Must give a thumb like if answered all questions correctly. Many thanks!

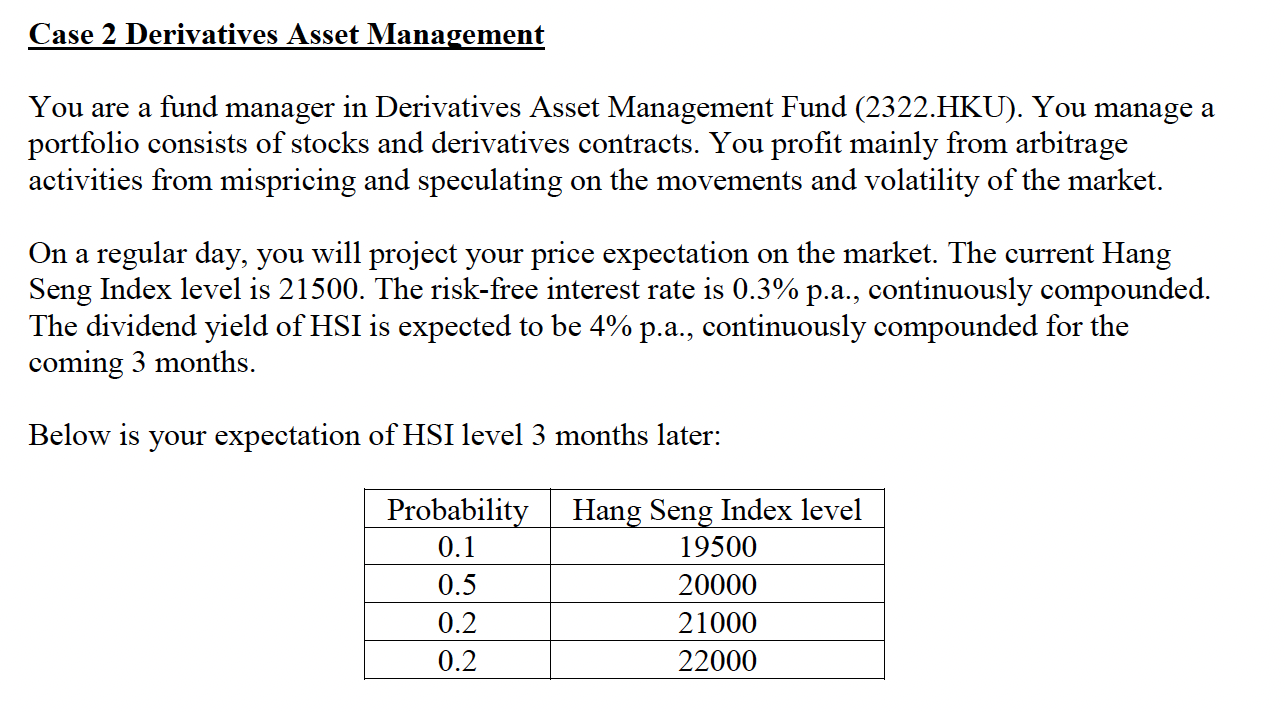

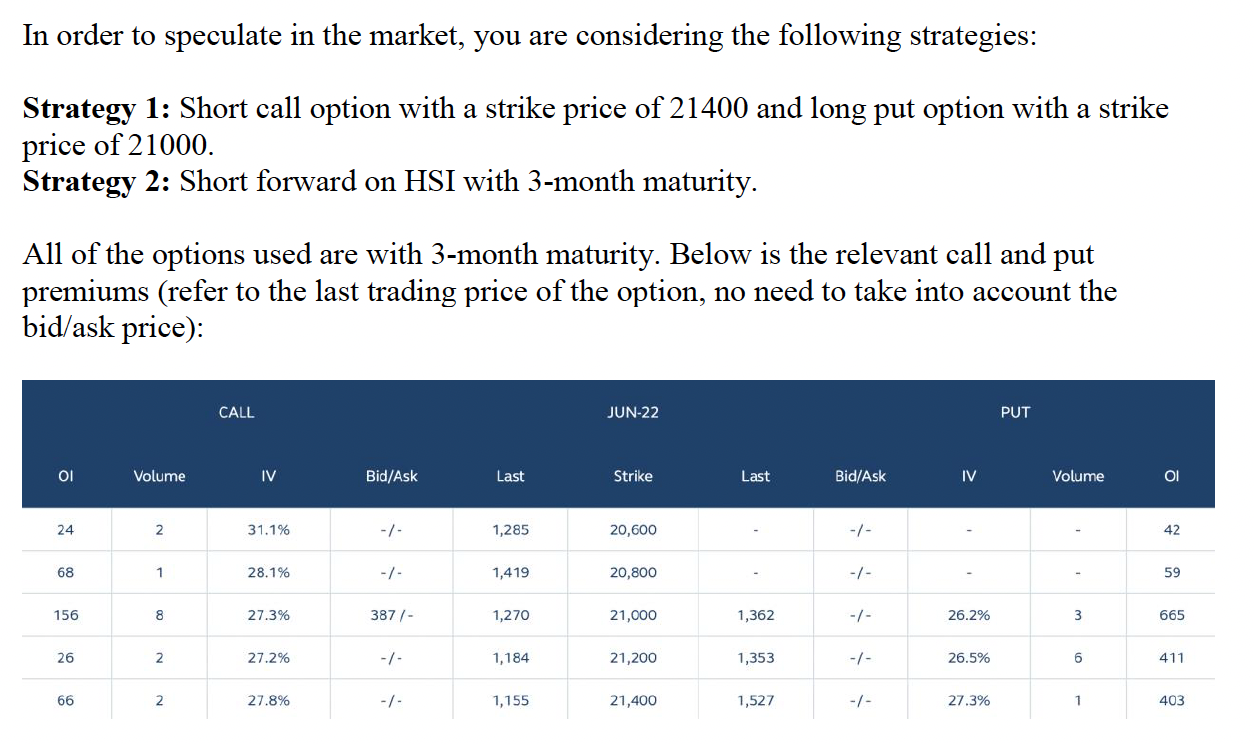

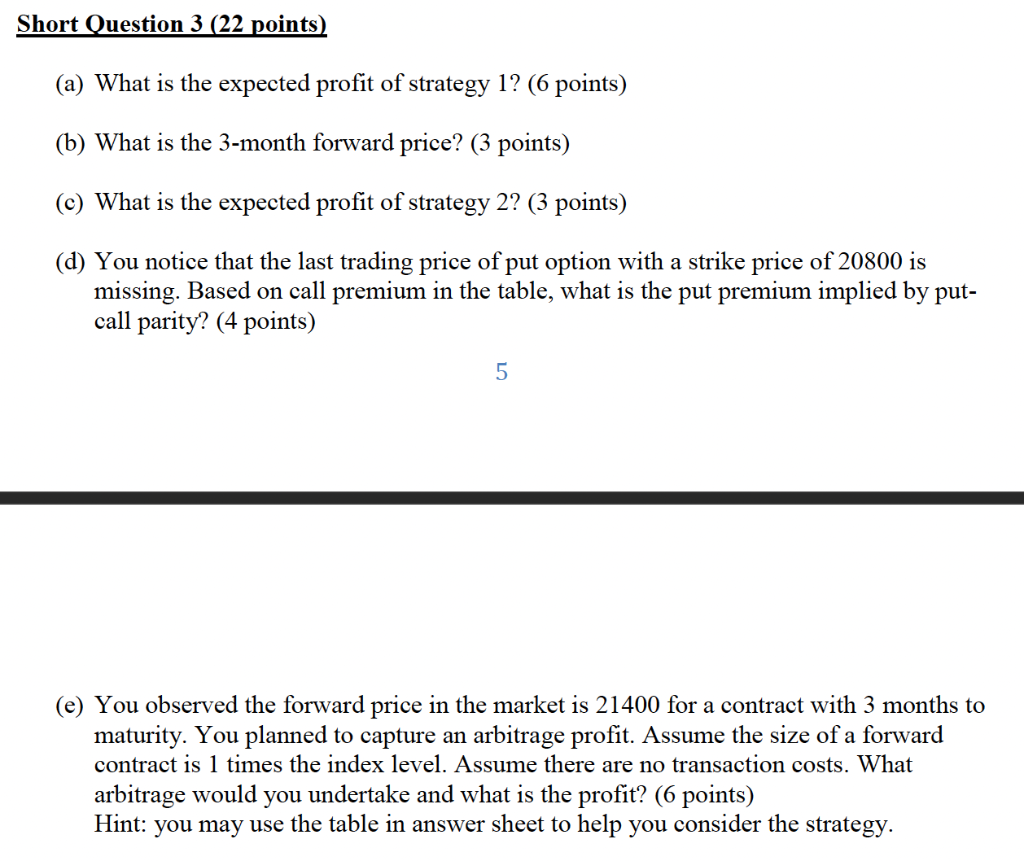

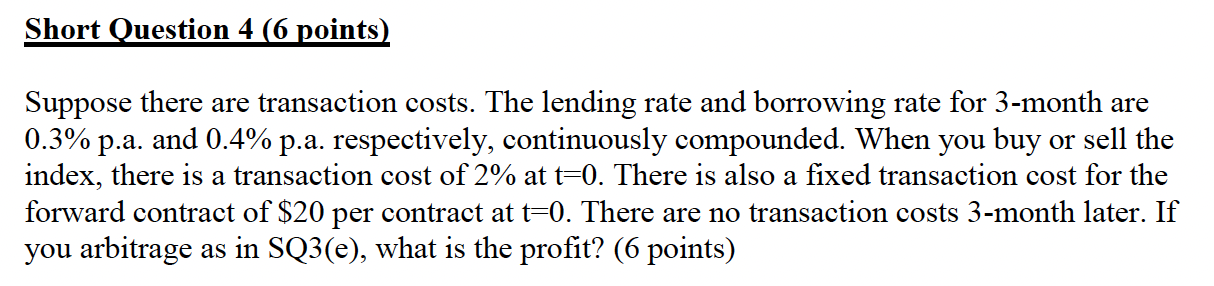

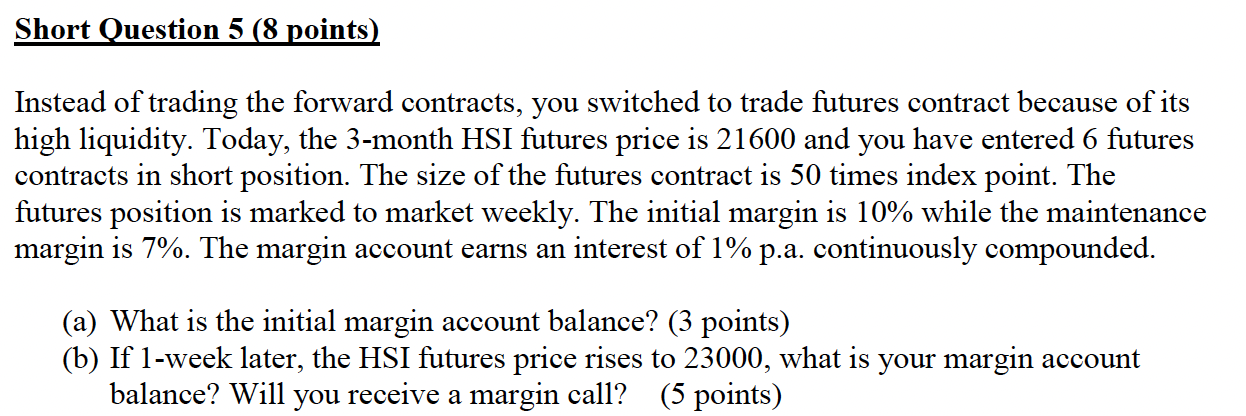

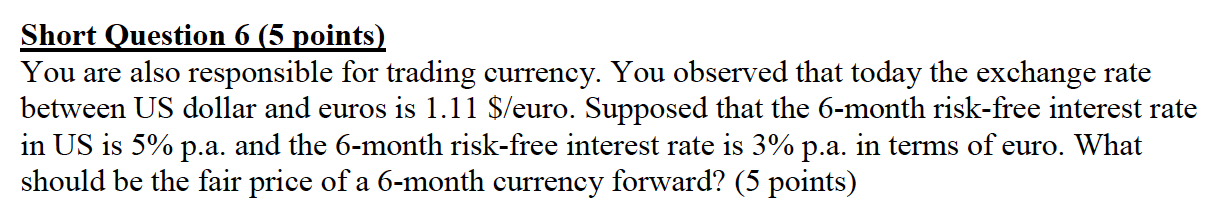

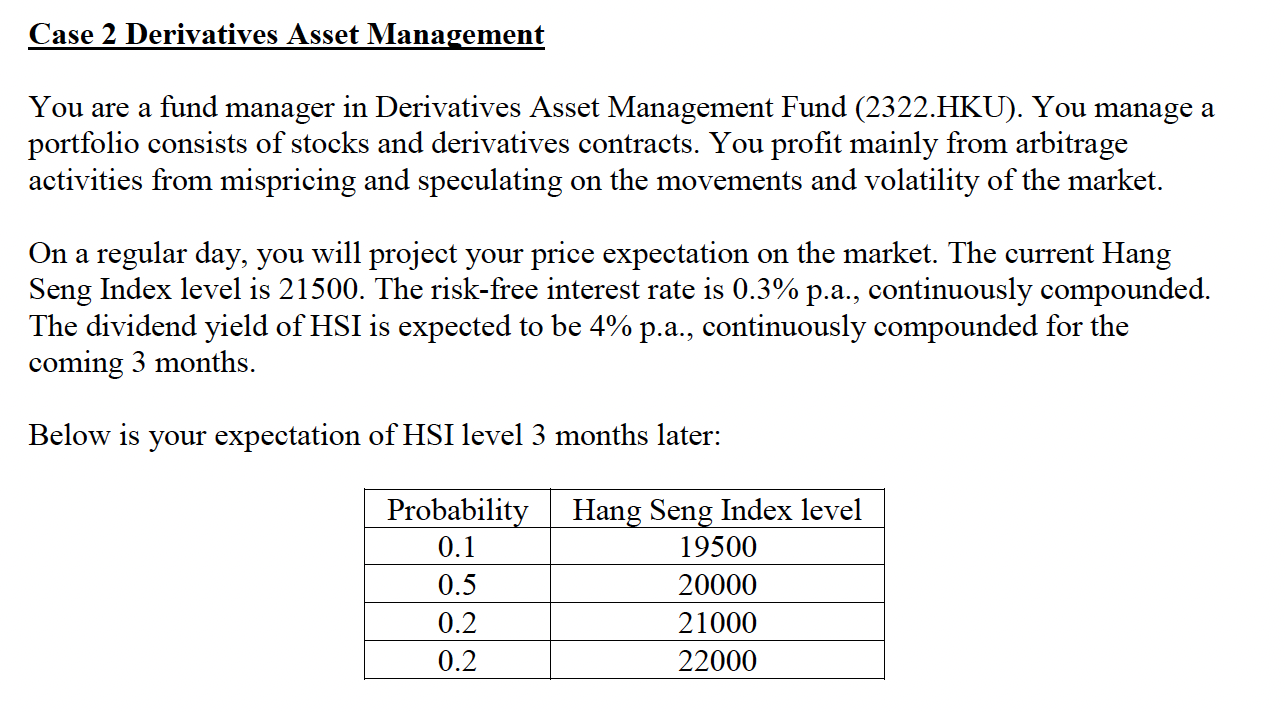

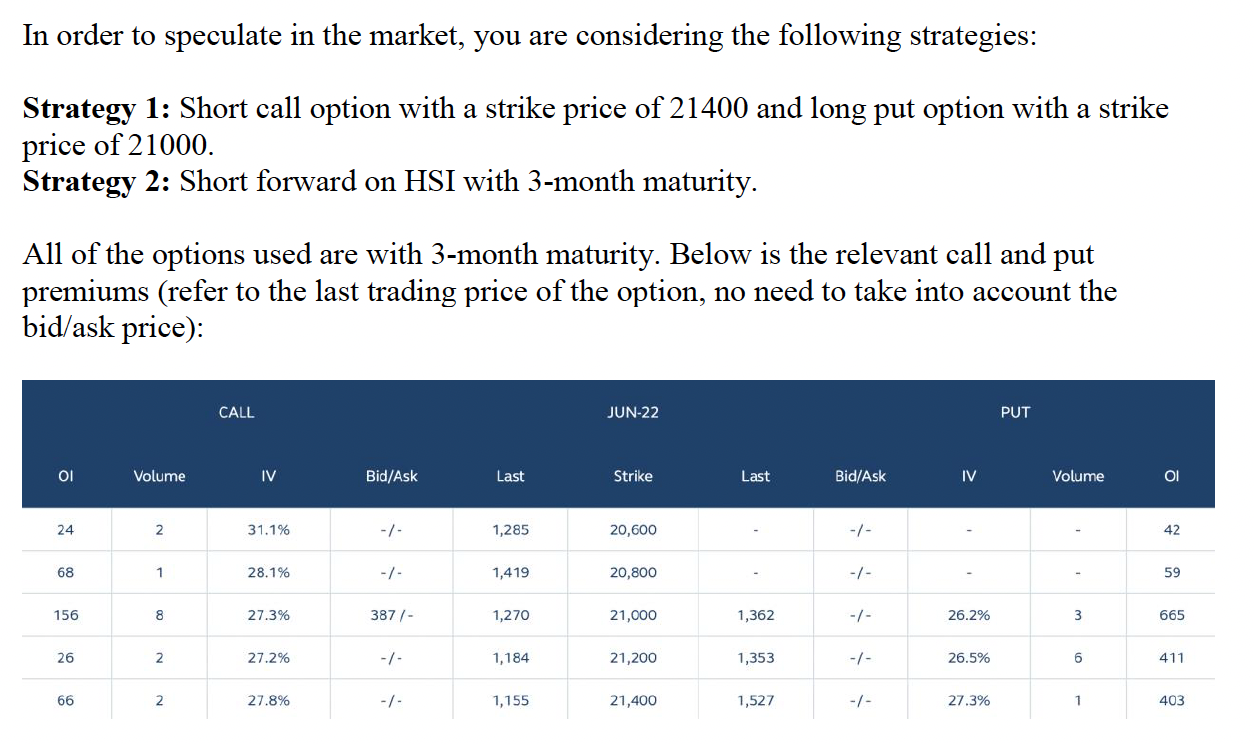

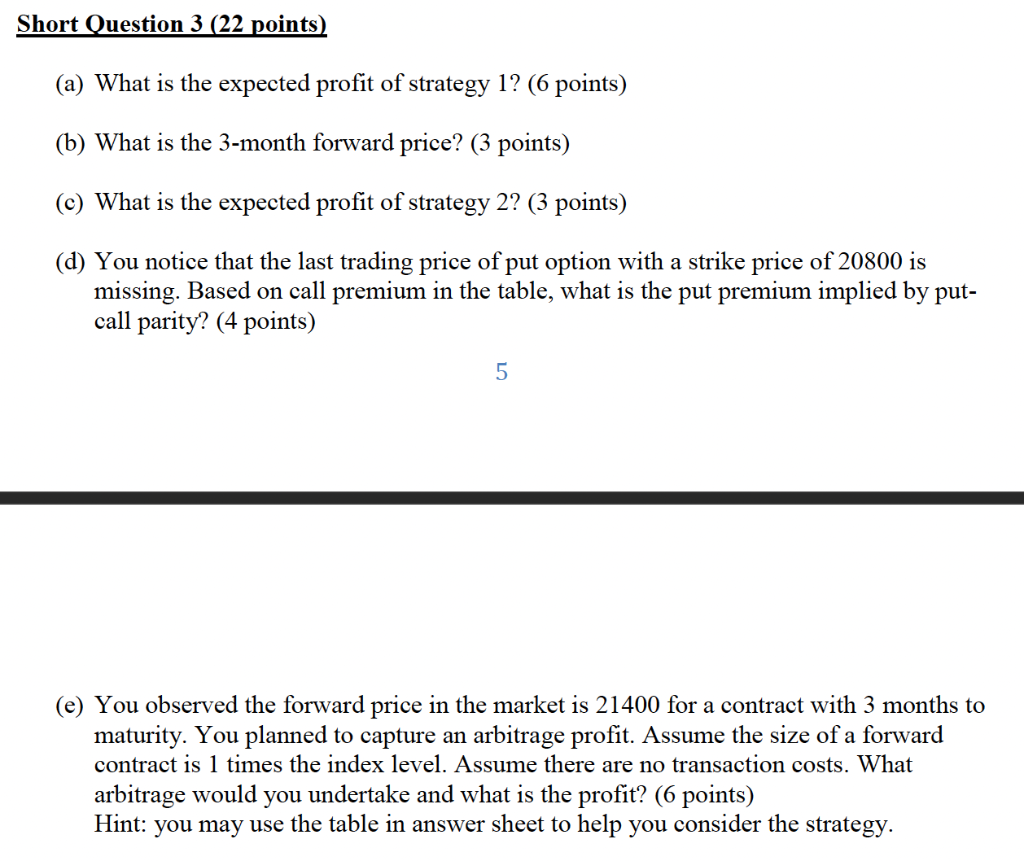

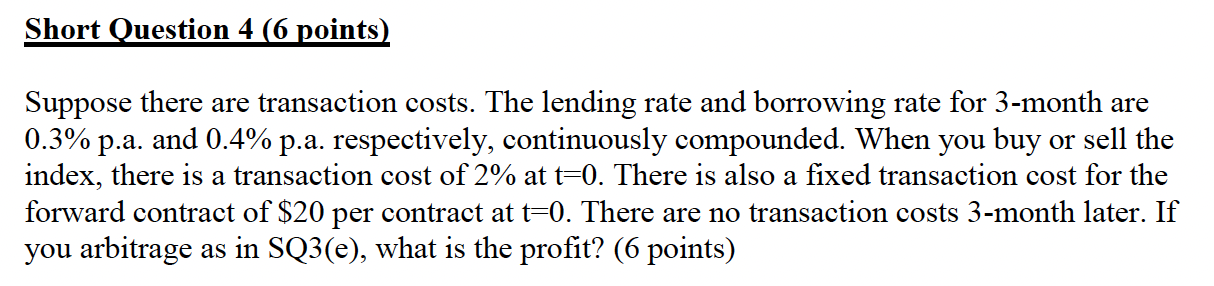

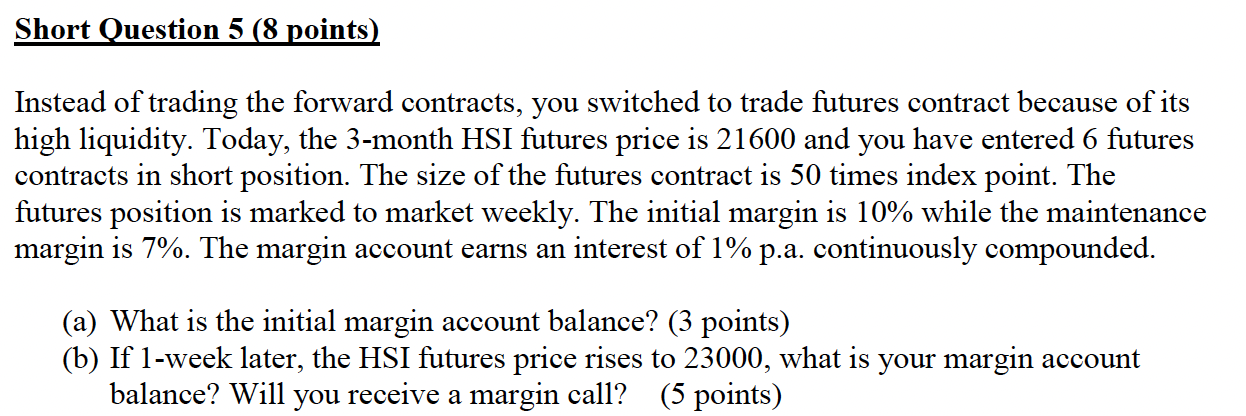

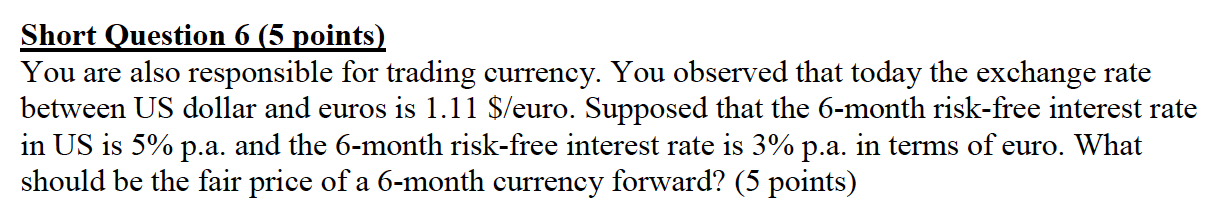

Case 2 Derivatives Asset Management You are a fund manager in Derivatives Asset Management Fund (2322.HKU). You manage a portfolio consists of stocks and derivatives contracts. You profit mainly from arbitrage activities from mispricing and speculating on the movements and volatility of the market. On a regular day, you will project your price expectation on the market. The current Hang Seng Index level is 21500. The risk-free interest rate is 0.3% p.a., continuously compounded. The dividend yield of HSI is expected to be 4% p.a., continuously compounded for the coming 3 months. Below is your expectation of HSI level 3 months later: Probability 0.1 0.5 0.2 0.2 Hang Seng Index level 19500 20000 21000 22000 In order to speculate in the market, you are considering the following strategies: Strategy 1: Short call option with a strike price of 21400 and long put option with a strike price of 21000. Strategy 2: Short forward on HSI with 3-month maturity. All of the options used are with 3-month maturity. Below is the relevant call and put premiums (refer to the last trading price of the option, no need to take into account the bid/ask price): CALL JUN-22 PUT OI Volume IV Bid/Ask Last Strike Last Bid/Ask IV Volume OI 24 2 31.1% -- 1,285 20,600 -- . 42 68 1 28.1% -- 1,419 20,800 -- 59 156 8 27.3% 387/- 1,270 21,000 1,362 -/- 26.2% 3 665 26 2 27.2% -- 1,184 21,200 1,353 -- 26.5% 6 411 66 2 2. 27.8% -- 1,155 21,400 1,527 1- 27.3% 1 403 Short Question 3 (22 points) (a) What is the expected profit of strategy 1? (6 points) (b) What is the 3-month forward price? (3 points) (c) What is the expected profit of strategy 2? (3 points) (d) You notice that the last trading price of put option with a strike price of 20800 is missing. Based on call premium in the table, what is the put premium implied by put- call parity? (4 points) 5 (e) You observed the forward price in the market is 21400 for a contract with 3 months to maturity. You planned to capture an arbitrage profit. Assume the size of a forward contract is 1 times the index level. Assume there are no transaction costs. What arbitrage would you undertake and what is the profit? (6 points) Hint: you may use the table in answer sheet to help you consider the strategy. Short Question 4 (6 points) Suppose there are transaction costs. The lending rate and borrowing rate for 3-month are 0.3% p.a. and 0.4%p.a. respectively, continuously compounded. When you buy or sell the index, there is a transaction cost of 2% at t=0. There is also a fixed transaction cost for the forward contract of $20 per contract at t=0. There are no transaction costs 3-month later. If you arbitrage as in SQ3(e), what is the profit? (6 points) a a Short Question 5 (8 points) Instead of trading the forward contracts, you switched to trade futures contract because of its high liquidity. Today, the 3-month HSI futures price is 21600 and you have entered 6 futures contracts in short position. The size of the futures contract is 50 times index point. The futures position is marked to market weekly. The initial margin is 10% while the maintenance margin is 7%. The margin account earns an interest of 1% p.a. continuously compounded. (a) What is the initial margin account balance? (3 points) (b) If 1-week later, the HSI futures price rises to 23000, what is your margin account balance? Will you receive a margin call? (5 points) Short Question 6 (5 points) You are also responsible for trading currency. You observed that today the exchange rate between US dollar and euros is 1.11 $/euro. Supposed that the 6-month risk-free interest rate in US is 5% p.a. and the 6-month risk-free interest rate is 3% p.a. in terms of euro. What should be the fair price of a 6-month currency forward? (5 points) Case 2 Derivatives Asset Management You are a fund manager in Derivatives Asset Management Fund (2322.HKU). You manage a portfolio consists of stocks and derivatives contracts. You profit mainly from arbitrage activities from mispricing and speculating on the movements and volatility of the market. On a regular day, you will project your price expectation on the market. The current Hang Seng Index level is 21500. The risk-free interest rate is 0.3% p.a., continuously compounded. The dividend yield of HSI is expected to be 4% p.a., continuously compounded for the coming 3 months. Below is your expectation of HSI level 3 months later: Probability 0.1 0.5 0.2 0.2 Hang Seng Index level 19500 20000 21000 22000 In order to speculate in the market, you are considering the following strategies: Strategy 1: Short call option with a strike price of 21400 and long put option with a strike price of 21000. Strategy 2: Short forward on HSI with 3-month maturity. All of the options used are with 3-month maturity. Below is the relevant call and put premiums (refer to the last trading price of the option, no need to take into account the bid/ask price): CALL JUN-22 PUT OI Volume IV Bid/Ask Last Strike Last Bid/Ask IV Volume OI 24 2 31.1% -- 1,285 20,600 -- . 42 68 1 28.1% -- 1,419 20,800 -- 59 156 8 27.3% 387/- 1,270 21,000 1,362 -/- 26.2% 3 665 26 2 27.2% -- 1,184 21,200 1,353 -- 26.5% 6 411 66 2 2. 27.8% -- 1,155 21,400 1,527 1- 27.3% 1 403 Short Question 3 (22 points) (a) What is the expected profit of strategy 1? (6 points) (b) What is the 3-month forward price? (3 points) (c) What is the expected profit of strategy 2? (3 points) (d) You notice that the last trading price of put option with a strike price of 20800 is missing. Based on call premium in the table, what is the put premium implied by put- call parity? (4 points) 5 (e) You observed the forward price in the market is 21400 for a contract with 3 months to maturity. You planned to capture an arbitrage profit. Assume the size of a forward contract is 1 times the index level. Assume there are no transaction costs. What arbitrage would you undertake and what is the profit? (6 points) Hint: you may use the table in answer sheet to help you consider the strategy. Short Question 4 (6 points) Suppose there are transaction costs. The lending rate and borrowing rate for 3-month are 0.3% p.a. and 0.4%p.a. respectively, continuously compounded. When you buy or sell the index, there is a transaction cost of 2% at t=0. There is also a fixed transaction cost for the forward contract of $20 per contract at t=0. There are no transaction costs 3-month later. If you arbitrage as in SQ3(e), what is the profit? (6 points) a a Short Question 5 (8 points) Instead of trading the forward contracts, you switched to trade futures contract because of its high liquidity. Today, the 3-month HSI futures price is 21600 and you have entered 6 futures contracts in short position. The size of the futures contract is 50 times index point. The futures position is marked to market weekly. The initial margin is 10% while the maintenance margin is 7%. The margin account earns an interest of 1% p.a. continuously compounded. (a) What is the initial margin account balance? (3 points) (b) If 1-week later, the HSI futures price rises to 23000, what is your margin account balance? Will you receive a margin call? (5 points) Short Question 6 (5 points) You are also responsible for trading currency. You observed that today the exchange rate between US dollar and euros is 1.11 $/euro. Supposed that the 6-month risk-free interest rate in US is 5% p.a. and the 6-month risk-free interest rate is 3% p.a. in terms of euro. What should be the fair price of a 6-month currency forward? (5 points)