Answered step by step

Verified Expert Solution

Question

1 Approved Answer

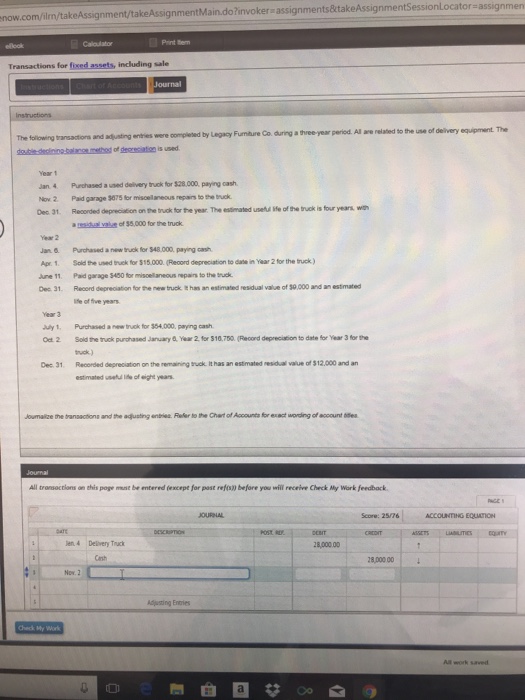

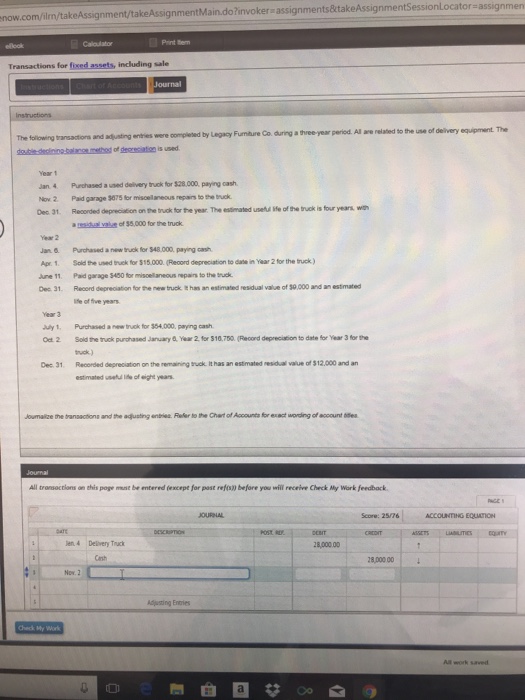

Must journalize each of these. now.com/ilm/takeAssignment/takeAssignmentMain.do?invoker- assignments&takeAssignmentSessionLocator-as Print tem Transactions for fixed assets, including sale Journal All are related to the use of delivery equipment

Must journalize each of these.

now.com/ilm/takeAssignment/takeAssignmentMain.do?invoker- assignments&takeAssignmentSessionLocator-as Print tem Transactions for fixed assets, including sale Journal All are related to the use of delivery equipment The The following transactiors and adjusting entries were completed by Legacy Funture Co. during a three-year period. Year 1 Jan. 4 Purchased a used delivery truck for $28.000, paying cash Nov 2 Paid garage 3075 for miscellaneous repains to the bruck Dec 31 Recorded depreciation on the truck for the year The estmated usetul life of the truck is four years wh Year 2 Jan & Purchased a new truck for 548,000. paying cash Apr. 1. Sold the used truck for $15.000 (Reoord depreciation to dase in Year 2 for the truck) June 11. Paid garage 35430 for misoellaneous repains to the tuck Dec 31 Record depreoiation for the new truck it has an estimated residual value of $9,000 and an estmated ife of ive yeas Year 3 July 1. Purchased a new truck for 354,000, paying cash Ot 2 Sold the tuck purchased January& Year 2 for 310.750(Reoond depreciation to date for Year 3 for the tuck) Dec 31. Recorded depreciation on the remaining truck It has an estimated residual value of $12.000 and arn estimated useful ife of eight yean Joumalize the transactions and the adjusting entries. Refer to the Chat of Aacounta or exact wording of account es All transoctions on this poge munt be entered (except for past refo)) before you will receive Check My Work feedback OURNAL ACCOUNTING EQUATION CMT 28,000.00 en 4 Delivery Truck Cash 8,00000 Now. 2 Adjusting Enaries

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started