Must show all calculations

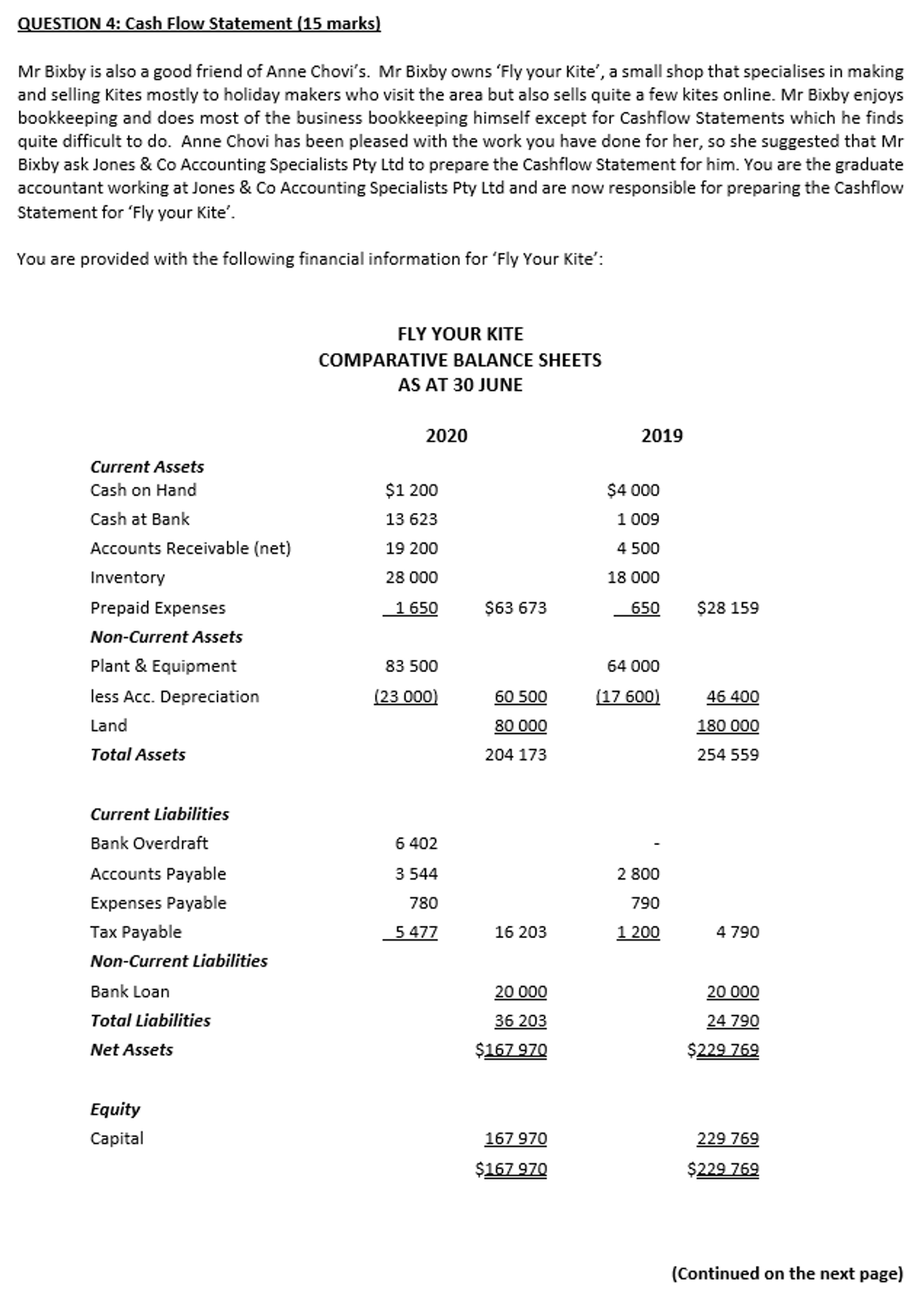

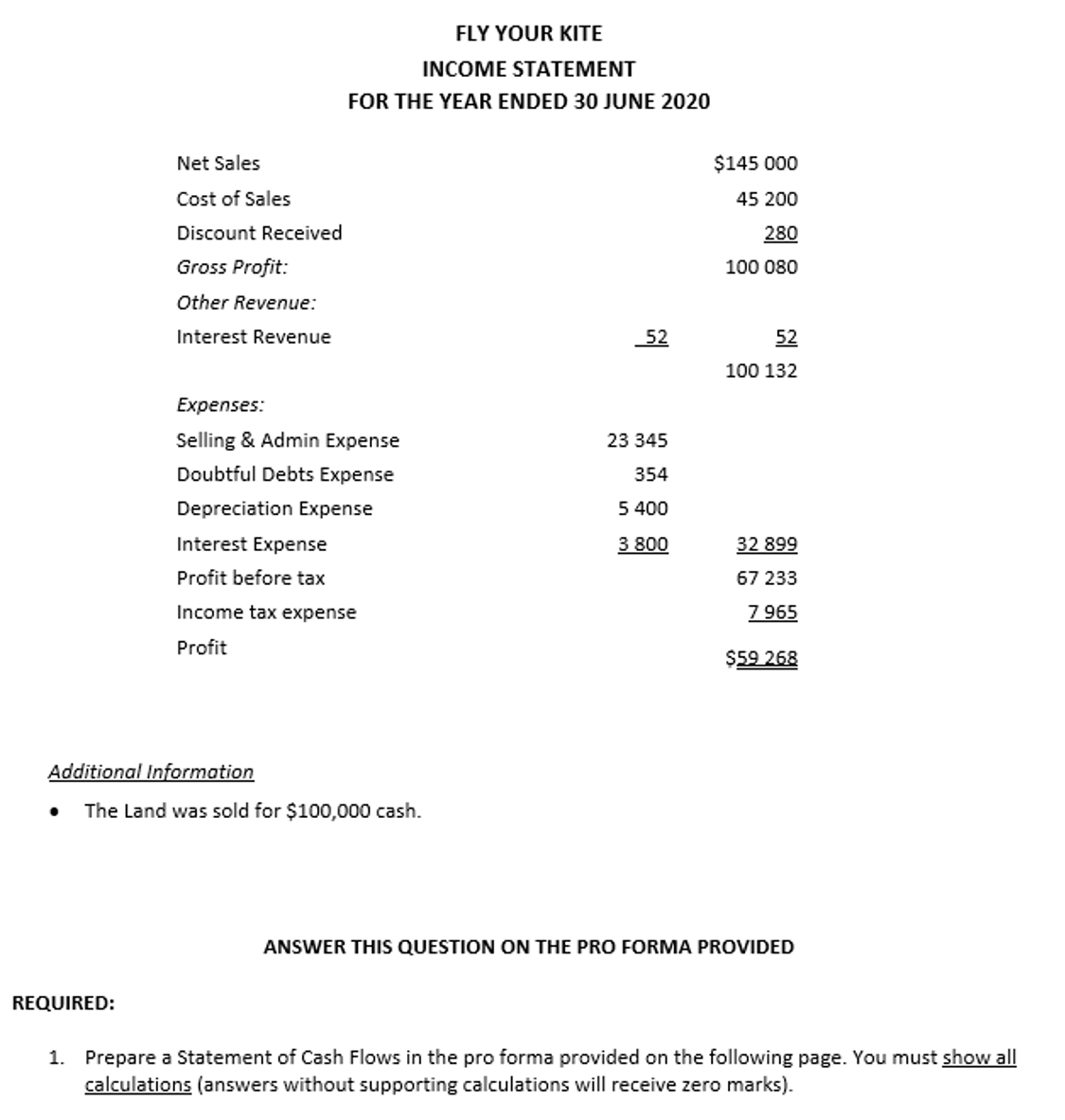

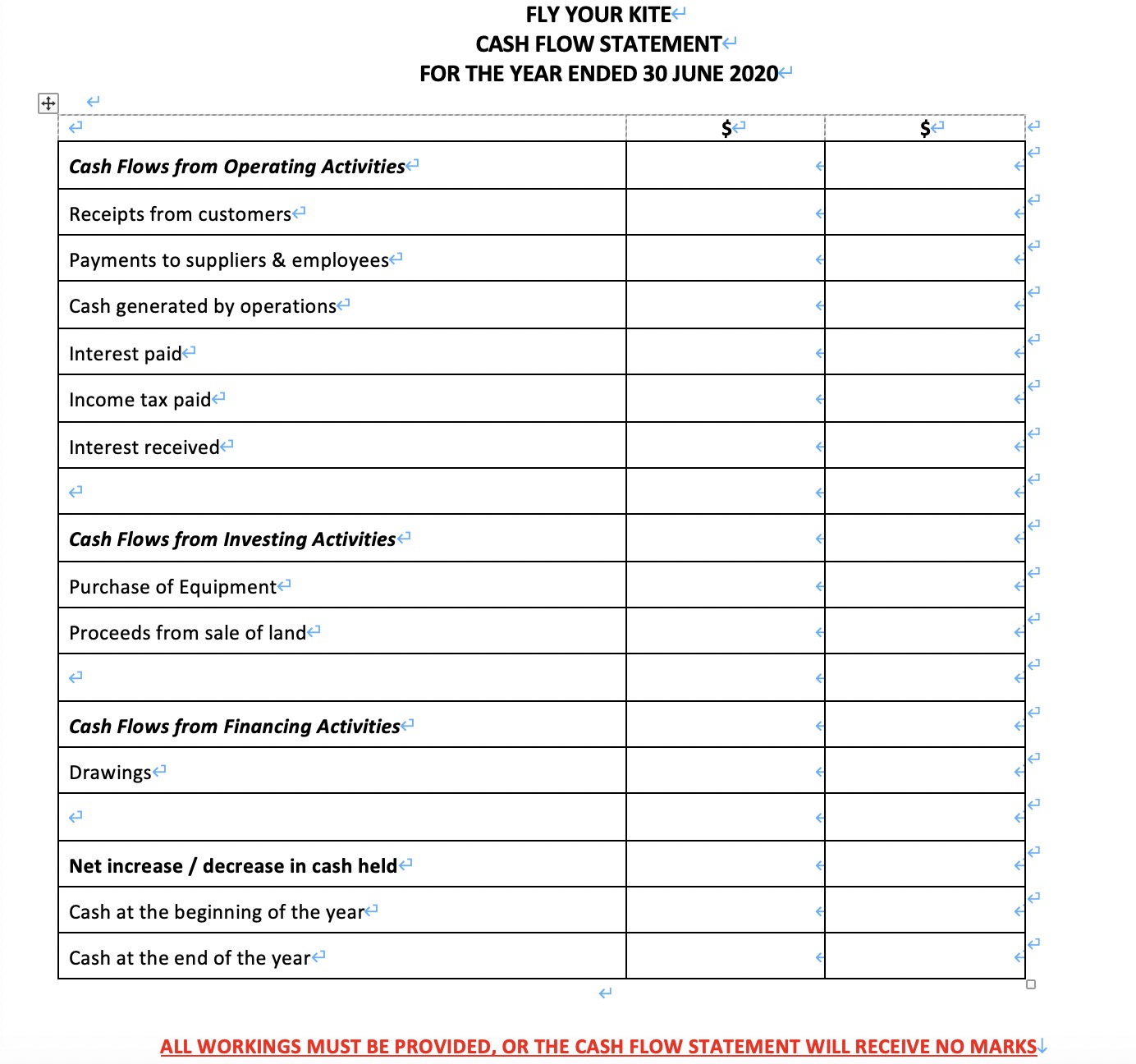

QUESTION 4: Cash Flow Statement (15 marks) Mr Bixby is also a good friend of Anne Chovi's. Mr Bixby owns 'Fly your Kite', a small shop that specialises in making and selling Kites mostly to holiday makers who visit the area but also sells quite a few kites online. Mr Bixby enjoys bookkeeping and does most of the business bookkeeping himself except for Cashflow Statements which he finds quite difficult to do. Anne Chovi has been pleased with the work you have done for her, so she suggested that Mr Bixby ask Jones & Co Accounting Specialists Pty Ltd to prepare the Cashflow Statement for him. You are the graduate accountant working at Jones & Co Accounting Specialists Pty Ltd and are now responsible for preparing the Cashflow Statement for 'Fly your Kite'. You are provided with the following financial information for 'Fly Your Kite': FLY YOUR KITE COMPARATIVE BALANCE SHEETS AS AT 30 JUNE 2020 2019 Current Assets Cash on Hand $1 200 $4 000 Cash at Bank 13 623 1 009 Accounts Receivable (net) 19 200 4 500 Inventory 28 000 18 000 Prepaid Expenses 1 650 $63 673 650 $28 159 Non-Current Assets Plant & Equipment 83 500 64 000 less Acc. Depreciation (23 000) 60 500 (17 600) 46 400 Land 80 000 180 000 Total Assets 204 173 254 559 Current Liabilities Bank Overdraft 6 402 Accounts Payable 3 544 2 800 Expenses Payable 780 790 Tax Payable 5 477 16 203 1 200 4 790 Non-Current Liabilities Bank Loan 20 000 20 000 Total Liabilities 36 203 24 790 Net Assets $167 970 $229 769 Equity Capital 167 970 229 769 $167 970 $229 769 (Continued on the next page)FLY YOUR KITE INCOME STATEMENT FOR THE YEAR ENDED 30 JUNE 2020 Net Sales $145 000 Cost of Sales 45 200 Discount Received gap Gross Prot: 100 080 Other Revenue: Interest Revenue 2 2 100 132 Expenses: Selling 8: Admin Expense 23 345 Doubtful Debts Expense 354 Depreciation Expense 5 400 Interest Expense m 32 399 Profit before tax 67 233 Income tax expense E Profit 559.253 Additional lnfgrmotfon o The Land was sold for $100,000 cash. ANSWER THIS QUESTION ON THE PRO FORMA PROVIDED REQUIRED: 1. Prepare a Statement of Cash Flows in the pro forma provided on the following page. You must show all calculations (answers without supporting calculations will receive zero marks]- FLY YOUR KITE CASH FLOW STATEMENT FOR THE YEAR ENDED 30 JUNE 2020- Cash Flows from Operating Activities Receipts from customers Payments to suppliers & employees Cash generated by operations Interest paid Income tax paid Interest received Cash Flows from Investing Activities Purchase of Equipment Proceeds from sale of land Cash Flows from Financing Activities Drawings Net increase / decrease in cash held Cash at the beginning of the year Cash at the end of the year ALL WORKINGS MUST BE PROVIDED, OR THE CASH FLOW STATEMENT WILL RECEIVE NO MARKS