Must Show All Work With Calculations

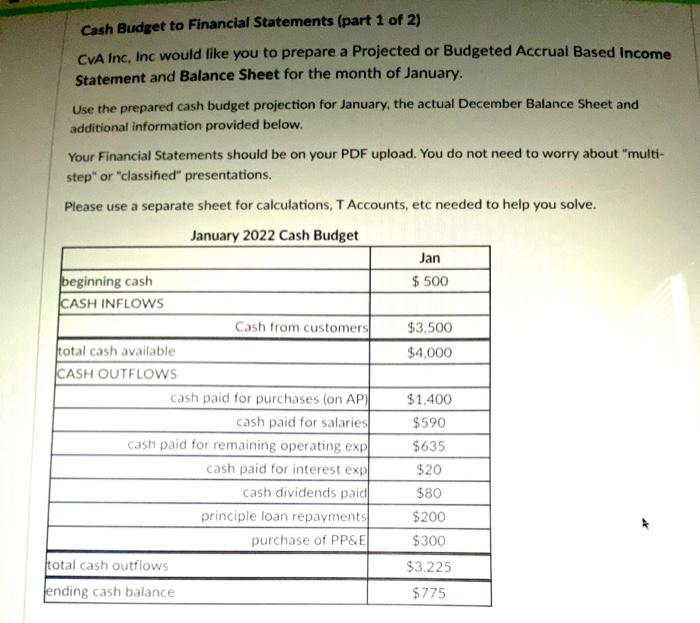

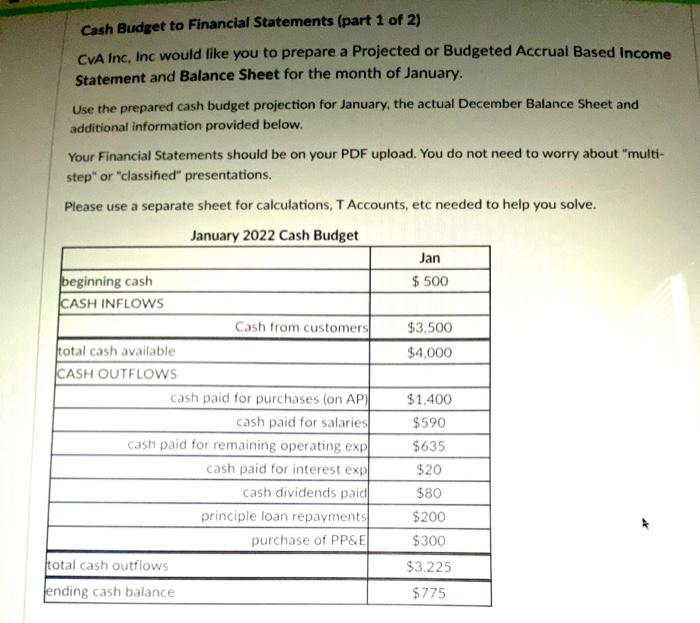

Cash Budget to Financial Statements (part 1 of 2) CVA Inc, Inc would like you to prepare a Projected or Budgeted Accrual Based Income Statement and Balance Sheet for the month of January Use the prepared cash budget projection for January, the actual December Balance Sheet and additional information provided below. Your Financial Statements should be on your PDF upload. You do not need to worry about "multi- step" or "classified" presentations. Please use a separate sheet for calculations, T Accounts, etc needed to help you solve. January 2022 Cash Budget Jan beginning cash $ 500 CASH INFLOWS Cash from customers $3,500 total cash available $4,000 CASH OUTFLOWS cash paid for purchases (on AP) $1,400 cash paid for salaries $590 cash paid for remaining operating expl $635 cash paid for interest expl $20 cash dividends paid $80 principle loan repayments $200 purchase of PP&EL $300 total cash outflows $3.225 ending cash balance $775 Balance Sheet as of Dec 31, 2021 ASSETS Kashi $500 WR $750 Inventory 5600 Prepaid Insurance $480 PPSE 5900 Accum Depr. - $100 Total Assets $3,130 Liabilities A/P for purchases) 5680 Salaries Payable $200 Loan payable $5.500 Total Liabilities $2,380 Equity Common Stock 3700 Retained Earnings $50 Total Liabilities & Equity $3.130 Additional Information Needed: A) Cash from customers on the budget is related to previous sales (AR) B) January sales are all on account and budgeted to be $3,000 C) COGS is 50% of Sales D) All Inventory purchases are on account and total $1,800 for January E) Cash payments made towards A/P are reflected on the cash budget shown F) The Insurance policy was paid in Dec and will cover a 1 year (12 me) period of Jan-Dec 2022. G) New PP&E (fixed asset) purchases were on Jan 1. Depreciation expense is $30 for the month and includes the new and previous PP&E. H) Cash paid for interest is the same as interest expense. U Salaries expense for January will be $480. Cash paid towards salaries is shown on the cash budget 1) Income taxes are estimated at 20% and recorded as a payable ** For preliminary grading you may enter the Net Income (after tax) for January. Your PDF will be reviewed. Correct Canvas answers with no work do not get credit