Question

Must show financial calculator steps. Do not use the formula method. A person buys a townhouse for $350,000. She makes a 20% down payment with

Must show financial calculator steps. Do not use the formula method. A person buys a townhouse for $350,000. She makes a 20% down payment with the balance financed by a mortgage at a Bank. The mortgage bears a stated rate of interest of 6.5% per annum, compounded semi-annually, has a 3-year term, and is repayable over 15 years. Payments are made monthly and rounded up to the next higher dollar.

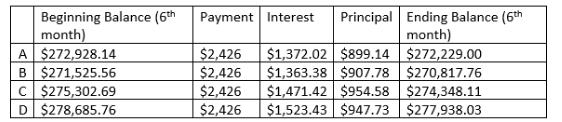

In the following excerpts from an amortization schedule, which line represents the outstanding balance for the mortgage at the end of 6 months?

Beginning Balance (6th month) A $272,928.14 B $271,525.56 C $275,302.69 D $278,685.76 Principal Ending Balance (6th month) $1,372.02 $899.14 $272,229.00 $1,363.38 $907.78 $270,817.76 $1,471.42 $954.58 $274,348.11 $1,523.43 $947.73 $277,938.03 Payment Interest $2,426 $2,426 $2,426 $2,426

Step by Step Solution

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started