Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Must use Extend Trial balance Must use Extend Trial balance Must use Extend Trial balance The following Trial Balance was extracted from the books of

Must use Extend Trial balance

Must use Extend Trial balance

Must use Extend Trial balance

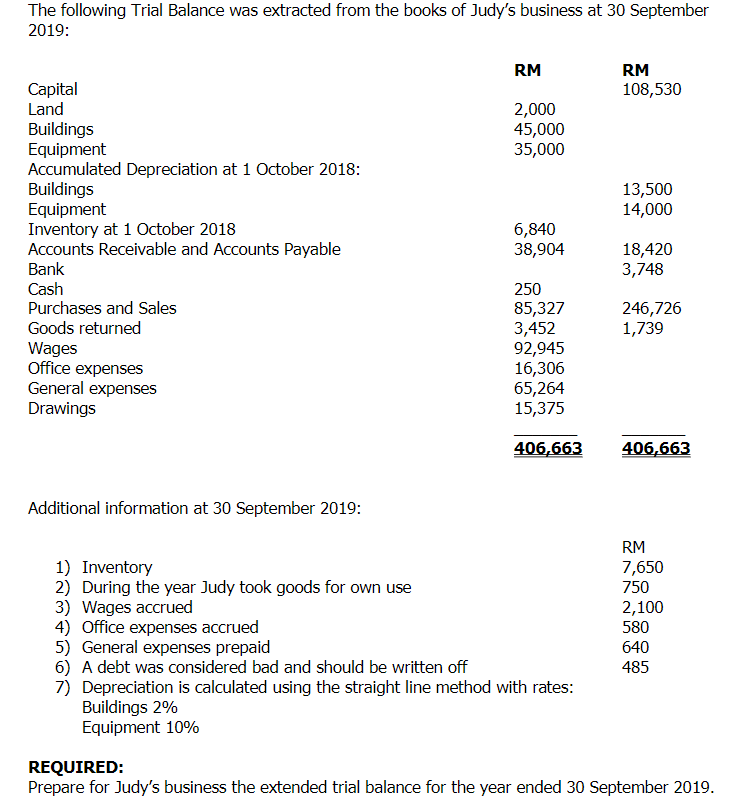

The following Trial Balance was extracted from the books of Judy's business at 30 September 2019: RM RM 108,530 2,000 45,000 35,000 13,500 14,000 Capital Land Buildings Equipment Accumulated Depreciation at 1 October 2018: Buildings Equipment Inventory at 1 October 2018 Accounts Receivable and Accounts Payable Bank Cash Purchases and Sales Goods returned Wages Office expenses General expenses Drawings 6,840 38,904 18,420 3,748 246,726 1,739 250 85,327 3,452 92,945 16,306 65,264 15,375 406,663 406,663 Additional information at 30 September 2019: 1) Inventory 2) During the year Judy took goods for own use 3) Wages accrued 4) Office expenses accrued 5) General expenses prepaid 6) A debt was considered bad and should be written off 7) Depreciation is calculated using the straight line method with rates: Buildings 2% Equipment 10% RM 7,650 750 2,100 580 640 485 REQUIRED: Prepare for Judy's business the extended trial balance for the year ended 30 September 2019Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started