Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mustang ( Pty ) Ltd is a fast - food company that specialises in selling extra - ordinarily large burgers and spicy fries. Since the

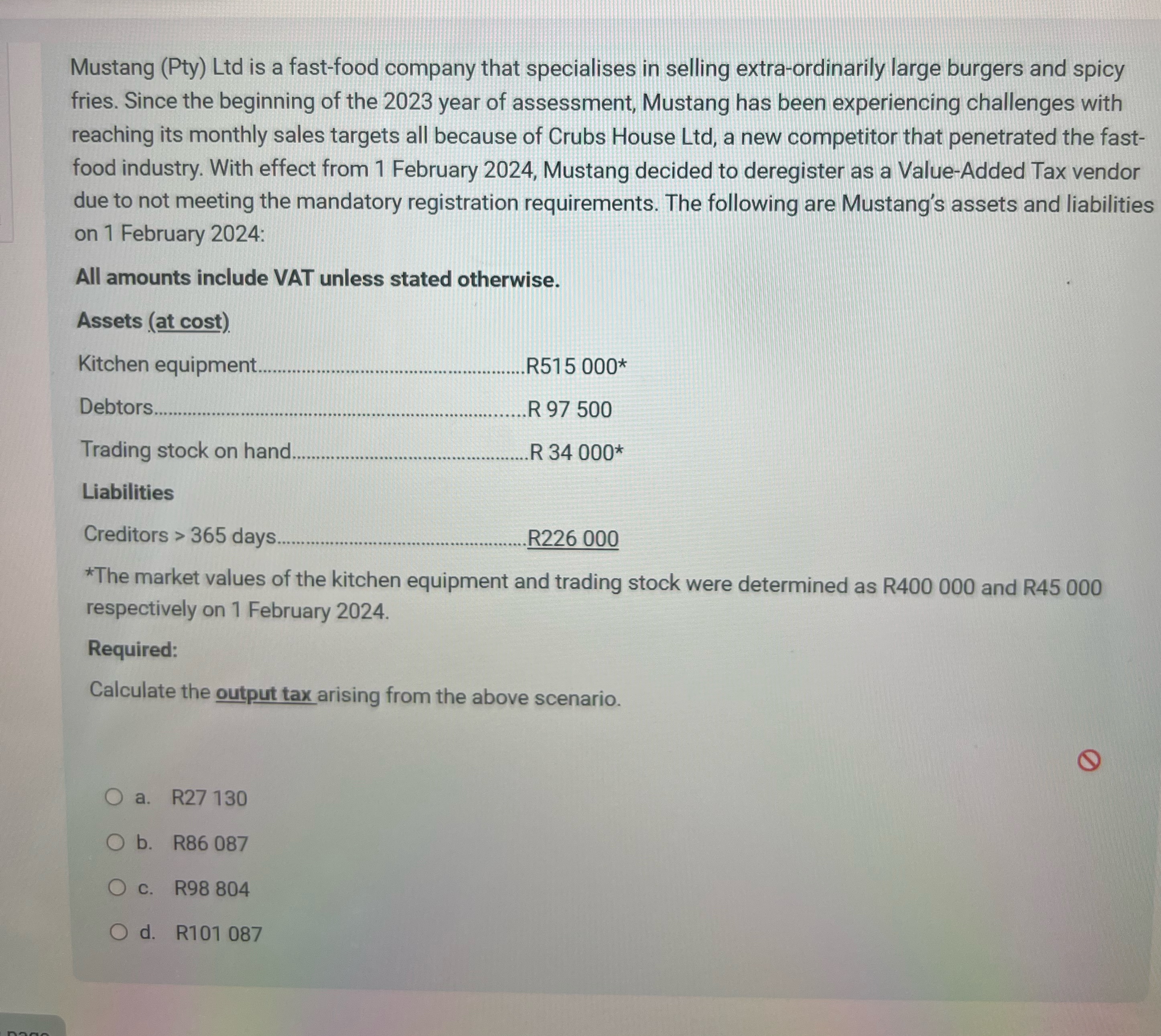

Mustang Pty Ltd is a fastfood company that specialises in selling extraordinarily large burgers and spicy fries. Since the beginning of the year of assessment, Mustang has been experiencing challenges with reaching its monthly sales targets all because of Crubs House Ltd a new competitor that penetrated the fastfood industry. With effect from February Mustang decided to deregister as a ValueAdded Tax vendor due to not meeting the mandatory registration requirements. The following are Mustang's assets and liabilities on February :

All amounts include VAT unless stated otherwise.

Assets at cost

Kitchen equipme!

R

Debtor

R

Trading stock on hand R

Liabilities

Creditors day:

The market values of the kitchen equipment and trading stock were determined as R and R respectively on February

Required:

Calculate the output tax arising from the above scenario.

a

b R

c R

d R

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started