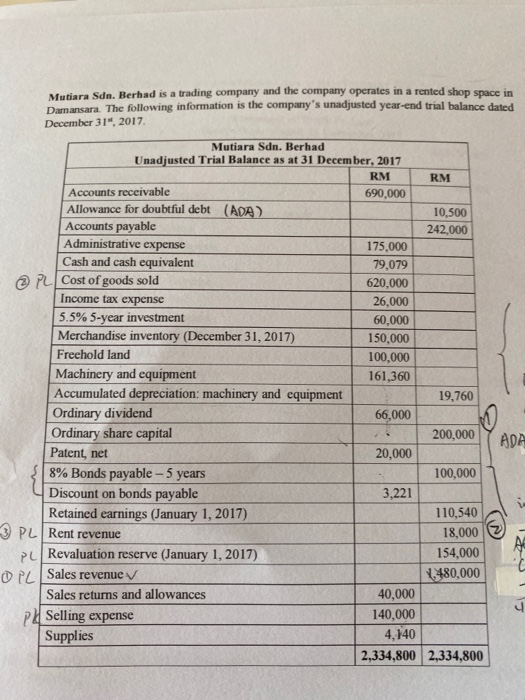

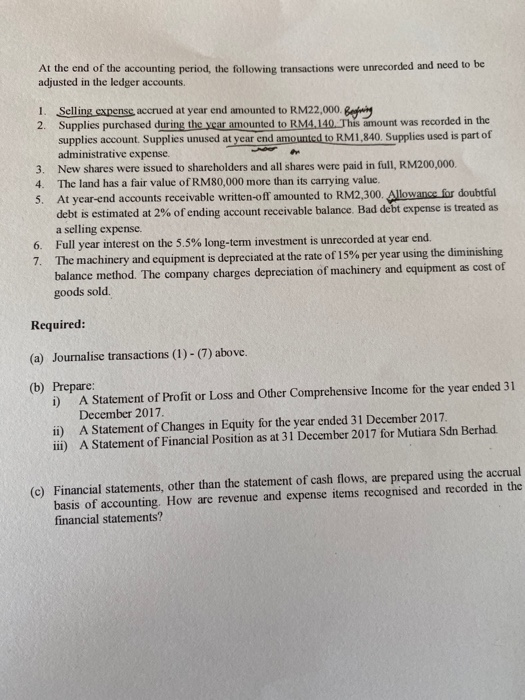

Mutiara Sdn. Berhad is a trading company and the company operates in a rented shop space in Darnansara. The following information is the company's unadjusted year-end trial balance dated December 31" 2017. RM 10,500 242,000 Mutiara Sdn. Berhad Unadjusted Trial Balance as at 31 December, 2017 RM Accounts receivable 690,000 Allowance for doubtful debt (ADA) Accounts payable Administrative expense 175,000 Cash and cash equivalent 79,079 PLCost of goods sold 620,000 Income tax expense 26,000 5.5% 5-year investment 60,000 Merchandise inventory (December 31, 2017) 150,000 Freehold land 100,000 Machinery and equipment 161,360 Accumulated depreciation: machinery and equipment Ordinary dividend 66,000 Ordinary share capital Patent, net 20.000 8% Bonds payable - 5 years Discount on bonds payable 3,221 Retained earnings (January 1, 2017) 3 PL Rent revenue PL Revaluation reserve (January 1, 2017) Dil Sales revenue v Sales returns and allowances 40,000 Selling expense 140,000 Supplies 4,140 2,334,800 19,760 200,000 ADA 100,000 110,540 18,000 154,000 1,480,000 2,334,800 At the end of the accounting period, the followine transactions were unrecorded and need to be adjusted in the ledger accounts. 1. Selling expense, accrued at year end amounted to RM22,000. Rewing 2. Supplies purchased during the year amounted to RM4.140. This amount was recorded in the supplies account Supplies unused at year end amounted to RM1,840. Supplies used is part of administrative expense. 3. New shares were issued to shareholders and all shares were paid in full, RM200,000. 4. The land has a fair value of RM80,000 more than its carrying value. At year-end accounts receivable written-off amounted to RM2,300. Allowance for doubtful debt is estimated at 2% of ending account receivable balance. Bad debt expense is treated as a selling expense. 6. Full year interest on the 5.5% long-term investment is unrecorded at year end. 7. The machinery and equipment is depreciated at the rate of 15% per year using the diminishing balance method. The company charges depreciation of machinery and equipment as cost of goods sold. Required: (a) Journalise transactions (1) - (7) above. (b) Prepare: i) A Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 December 2017. ii) A Statement of Changes in Equity for the year ended 31 December 2017. iii) A Statement of Financial Position as at 31 December 2017 for Mutiara Sdn Berhad. (c) Financial statements, other than the statement of cash flows, are prepared using the accrual basis of accounting. How are revenue and expense items recognised and recorded in the financial statements