Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mutiyara Berhad is interested in measuring its overall cost of capital. Current investigation has gathered the following data. The firm is in the 40%

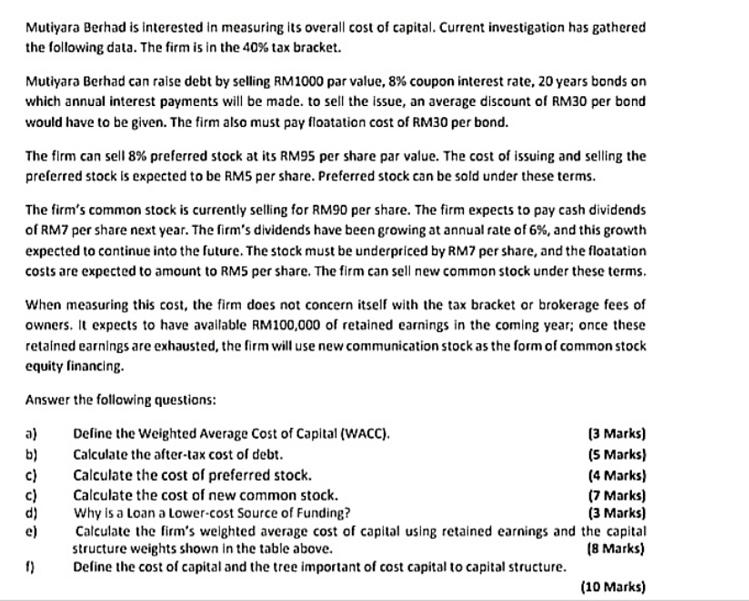

Mutiyara Berhad is interested in measuring its overall cost of capital. Current investigation has gathered the following data. The firm is in the 40% tax bracket. Mutiyara Berhad can raise debt by selling RM1000 par value, 8% coupon interest rate, 20 years bonds on which annual interest payments will be made. to sell the issue, an average discount of RM30 per bond would have to be given. The firm also must pay floatation cost of RM30 per bond. The firm can sell 8% preferred stock at its RM95 per share par value. The cost of issuing and selling the preferred stock is expected to be RMS per share. Preferred stock can be sold under these terms. The firm's common stock is currently selling for RM90 per share. The firm expects to pay cash dividends of RM7 per share next year. The firm's dividends have been growing at annual rate of 6%, and this growth expected to continue into the future. The stock must be underpriced by RM7 per share, and the floatation costs are expected to amount to RM5 per share. The firm can sell new common stock under these terms. When measuring this cost, the firm does not concern itself with the tax bracket or brokerage fees of owners. It expects to have available RM100,000 of retained earnings in the coming year; once these retained earnings are exhausted, the firm will use new communication stock as the form of common stock equity financing. Answer the following questions: a) b) c) T = f) Define the Weighted Average Cost of Capital (WACC). Calculate the after-tax cost of debt. Calculate the cost of preferred stock. Calculate the cost of new common stock. Why is a Loan a Lower-cost Source of Funding? Calculate the firm's weighted average cost of capital using retained earnings and structure weights shown in the table above. Define the cost of capital and the tree important of cost capital to capital structure. (3 Marks) (5 Marks) (4 Marks) (7 Marks) (3 Marks) the capital (8 Marks) (10 Marks) a) Compute the cash conversion cycle for the firm below. Income Statement Sales Cost of Goods Sold Balance Sheet Inventory Accounts Receivable Accounts Payable RM 20,500,600 16,000,000 2,000,500 1,500,800 1,200,000 (4 Marks) b) Pilah Pizzas uses 50,000 units of cheese per year. Each unit costs RM2.50. The ordering cost for the cheese is RM250 per order, and its carrying cost is RM0.50 per unit per year. Calculate the firm's economic order quantity (EOQ) for the cheese. Pilah Pizza operates 250 days per year and maintains a minimum inventory level of 2 days' worth of cheese as a safety stock. If the lead time to receive orders of cheese is 3 days, calculate the reorder point. (6 Marks) (10 Marks) c) Explain the role of the five C's of credit in the credit selection activity?

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a The Weight ed Average Cost of Capital W ACC is a calculation of a firm s cost of capital in which each category of capital is proportion ately weigh...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started