Answered step by step

Verified Expert Solution

Question

1 Approved Answer

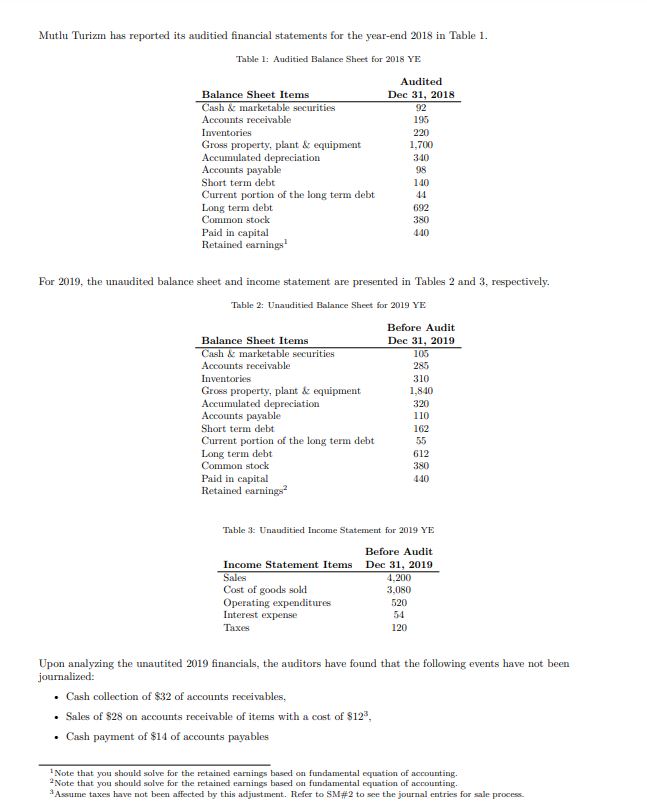

Mutlu Turizm has reported its auditied financial statements for the year-end 2018 in Table 1. Table 1: Auditied Balance Sheet for 2018 YE For 2019,

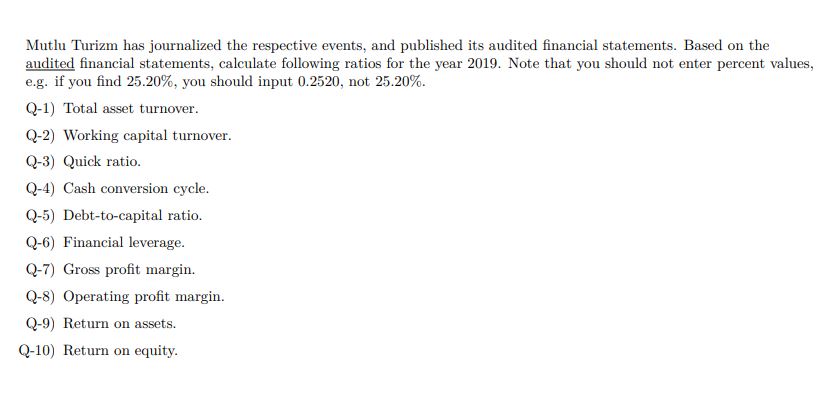

Mutlu Turizm has reported its auditied financial statements for the year-end 2018 in Table 1. Table 1: Auditied Balance Sheet for 2018 YE For 2019, the unandited balance sheet and income statement are presented in Tables 2 and 3 , respectively. Table 2: Unauditiod Balance Sheet for 2019 YE Table 3: Unauditied Income Statement for 2019 YE Upon analyzing the unautited 2019 financials, the auditors have found that the following events have not been journalized: - Cash collection of $32 of accounts receivables. - Sales of $28 on accounts receivable of items with a cost of $123, - Cash payment of $14 of accounts payables 1 Note that you should solve for the retained earnings based on fundamental equation of accounting. 2 Note that you should solve for the retained earnings based on fundamental equation of accourting. 3 Assume taxes have not been affected by this adjustment. Frefer to SM#2 to see the journal entries for sale process. Mutlu Turizm has journalized the respective events, and published its audited financial statements. Based on the audited financial statements, calculate following ratios for the year 2019. Note that you should not enter percent values, e.g. if you find 25.20%, you should input 0.2520 , not 25.20%. Q-1) Total asset turnover. Q-2) Working capital turnover. Q-3) Quick ratio. Q-4) Cash conversion cycle. Q-5) Debt-to-capital ratio. Q-6) Financial leverage. Q-7) Gross profit margin. Q-8) Operating profit margin. Q-9) Return on assets. Q-10) Return on equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started