Question

MVP, Inc., has produced rodeo supplies for over 20 years. The company currently has a debt-equity ratio of 55 percent and the tax rate is

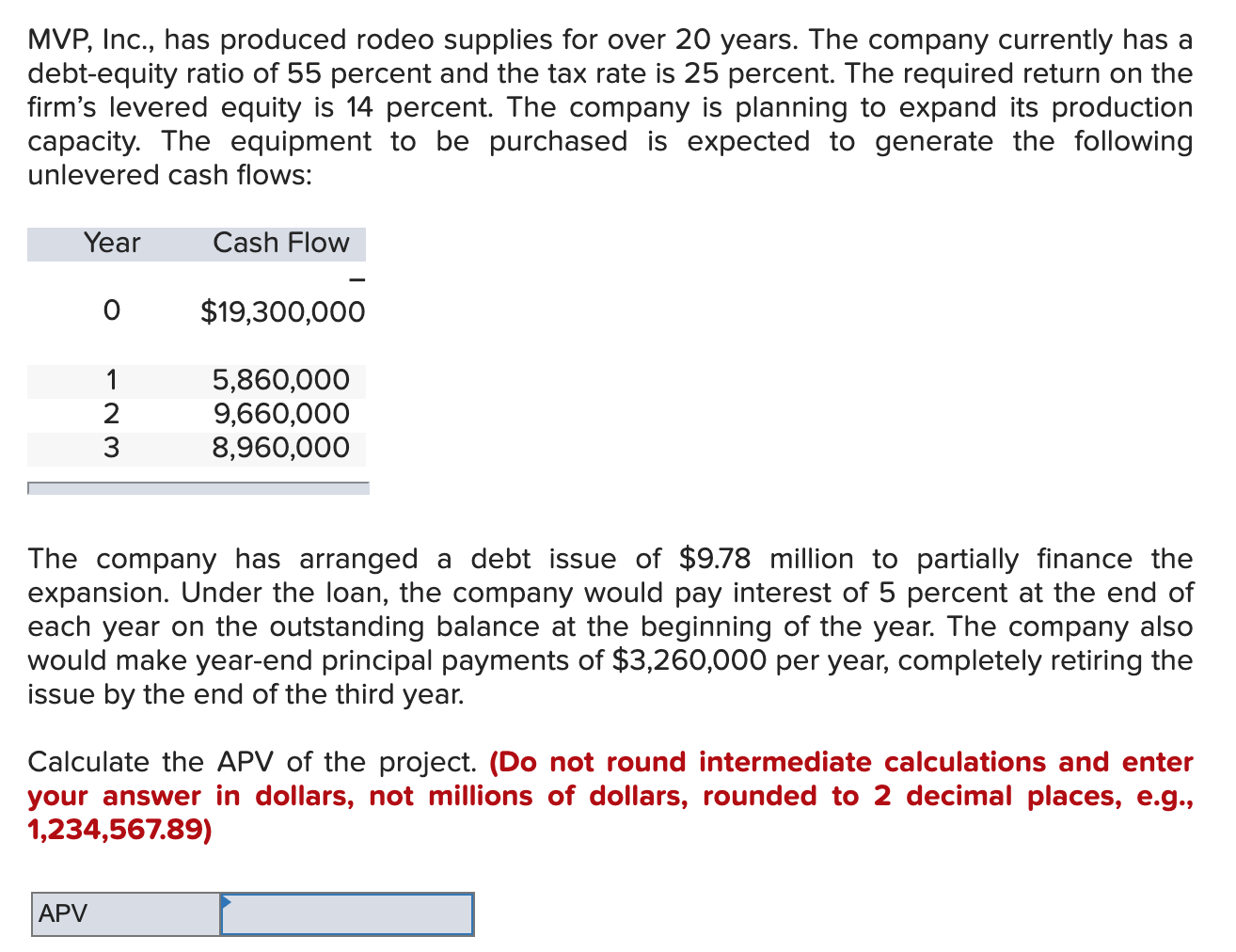

MVP, Inc., has produced rodeo supplies for over 20 years. The company currently has a debt-equity ratio of 55 percent and the tax rate is 25 percent. The required return on the firms levered equity is 14 percent. The company is planning to expand its production capacity. The equipment to be purchased is expected to generate the following unlevered cash flows: Year Cash Flow 0 $19,300,000 1 5,860,000 2 9,660,000 3 8,960,000 The company has arranged a debt issue of $9.78 million to partially finance the expansion. Under the loan, the company would pay interest of 5 percent at the end of each year on the outstanding balance at the beginning of the year. The company also would make year-end principal payments of $3,260,000 per year, completely retiring the issue by the end of the third year.

MVP, Inc., has produced rodeo supplies for over 20 years. The company currently has a debt-equity ratio of 55 percent and the tax rate is 25 percent. The required return on the firms levered equity is 14 percent. The company is planning to expand its production capacity. The equipment to be purchased is expected to generate the following unlevered cash flows: Year Cash Flow 0 $19,300,000 1 5,860,000 2 9,660,000 3 8,960,000 The company has arranged a debt issue of $9.78 million to partially finance the expansion. Under the loan, the company would pay interest of 5 percent at the end of each year on the outstanding balance at the beginning of the year. The company also would make year-end principal payments of $3,260,000 per year, completely retiring the issue by the end of the third year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started