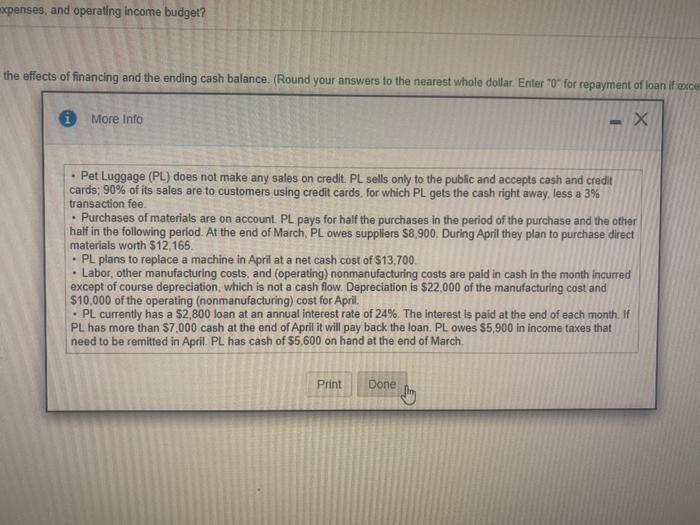

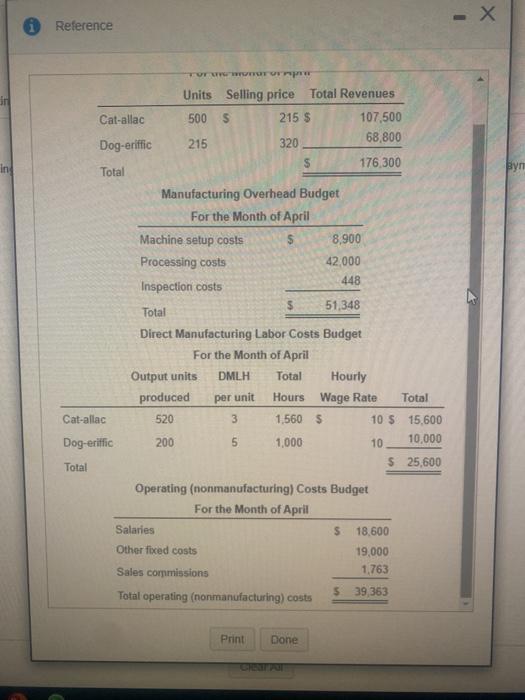

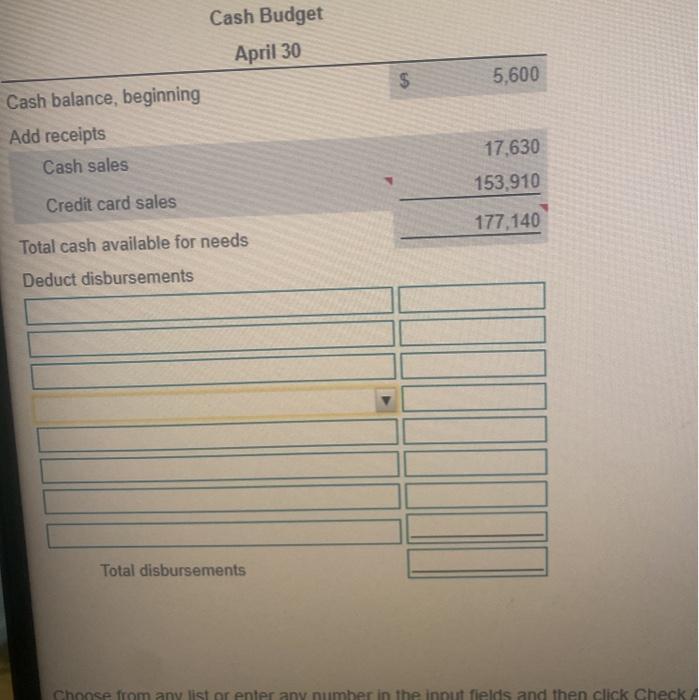

mxpenses, and operating income budget? the effects of financing and the ending cash balance. (Round your answers to the nearest whole dollar Enter"0" for repayment of loan if exce * More Info -X Pet Luggage (PL) does not make any sales on credit. PL sells only to the public and accepts cash and credit cards: 90% of its sales are to customers using credit cards for which PL gets the cash right away, less a 3% transaction fee. Purchases of materials are on account. PL pays for half the purchases in the period of the purchase and the other half the following period. At the end of March PL owes suppliers $8,900. During April they plan to purchase direct materials worth $12, 165 PL plans to replace a machine in April at a net cash cost of $13,700 Labor, other manufacturing costs, and (operating) nonmanufacturing costs are paid in cash in the month incurred except of course depreciation which is not a cash flow. Depreciation is $22,000 of the manufacturing cost and $10,000 of the operating (nonmanufacturing) cost for April. PL currently has a $2,800 loan at an annual interest rate of 24%. The interest is paid at the end of each month. If PL has more than $7,000 cash at the end of April it will pay back the loan. PL owes $5,900 in income taxes that need to be remitted in April. PL has cash of $5,600 on hand at the end of March Print Done - X Reference ing Byn or Wor Units Selling price Total Revenues Cat-allac 500 5 215 $ 107,500 Dog-eriffic 215 320 68,800 S 176,300 Total Manufacturing Overhead Budget For the Month of April Machine setup costs $ 8,900 Processing costs 42.000 448 Inspection costs $ 51,348 Total Direct Manufacturing Labor Costs Budget For the Month of April Output units DMLH Total Hourly produced Hours Wage Rate Total Cat-allac 520 3 1,560 5 10 S 15,600 Dog-eriffic 200 5 1,000 10 10,000 Total $ 25,600 Operating (nonmanufacturing) Costs Budget For the Month of April Salaries $ 18.600 Other fixed costs 19.000 Sales commissions 1,763 5 39 363 Total operating (nonmanufacturing) costs per unit Print Done Cash Budget April 30 $ 5,600 Cash balance, beginning Add receipts Cash sales 17,630 153,910 Credit card sales 177,140 Total cash available for needs Deduct disbursements Total disbursements Choose from any list or enter any number in the input fields and then click Check