Answered step by step

Verified Expert Solution

Question

1 Approved Answer

My answer is wrong I was wondering if you could explain what is the right answer A manufacturing firm determines that its payout schedule for

My answer is wrong I was wondering if you could explain what is the right answer

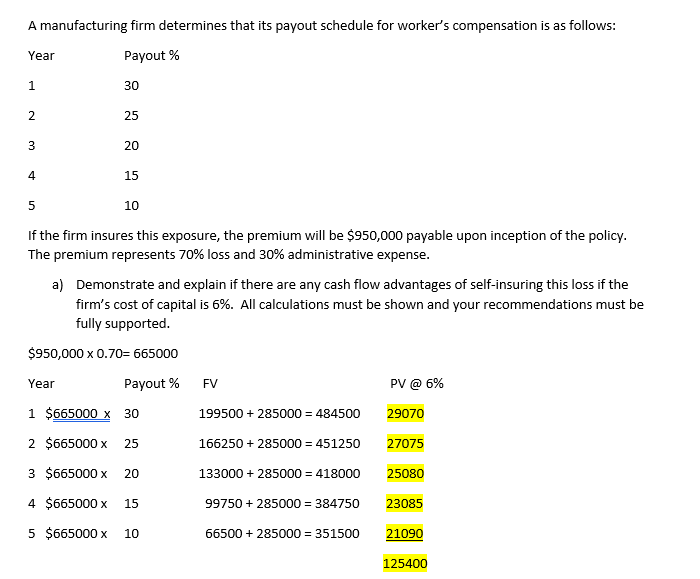

A manufacturing firm determines that its payout schedule for worker's compensation is as follows: Payout % Year 1 30 2 25 3 20 4 15 5 10 If the firm insures this exposure, the premium will be $950,000 payable upon inception of the policy. The premium represents 70% loss and 30% administrative expense. a) Demonstrate and explain if there are any cash flow advantages of self-insuring this loss if the firm's cost of capital is 5%. All calculations must be shown and your recommendations must be fully supported. $950,000 x 0.70= 665000 Year Payout % FV PV @ 6% 1 $665000 x 30 199500 + 285000 = 484500 29070 2 $665000 x 25 166250 + 285000 = 451250 27075 3 $665000 x 20 133000 + 285000 = 418000 25080 4 $665000 x 15 99750 + 285000 = 384750 23085 5 $665000 x 10 66500 + 285000 = 351500 21090 125400Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started