Answered step by step

Verified Expert Solution

Question

1 Approved Answer

My Apps x D2L Grades - ACCT-201-2A-77 X D2L Grades - ACCT-201-2A-778 X CengageNOWv2 | Online t w.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSession Locator=&inprogress=false Translate < eBook Show Me

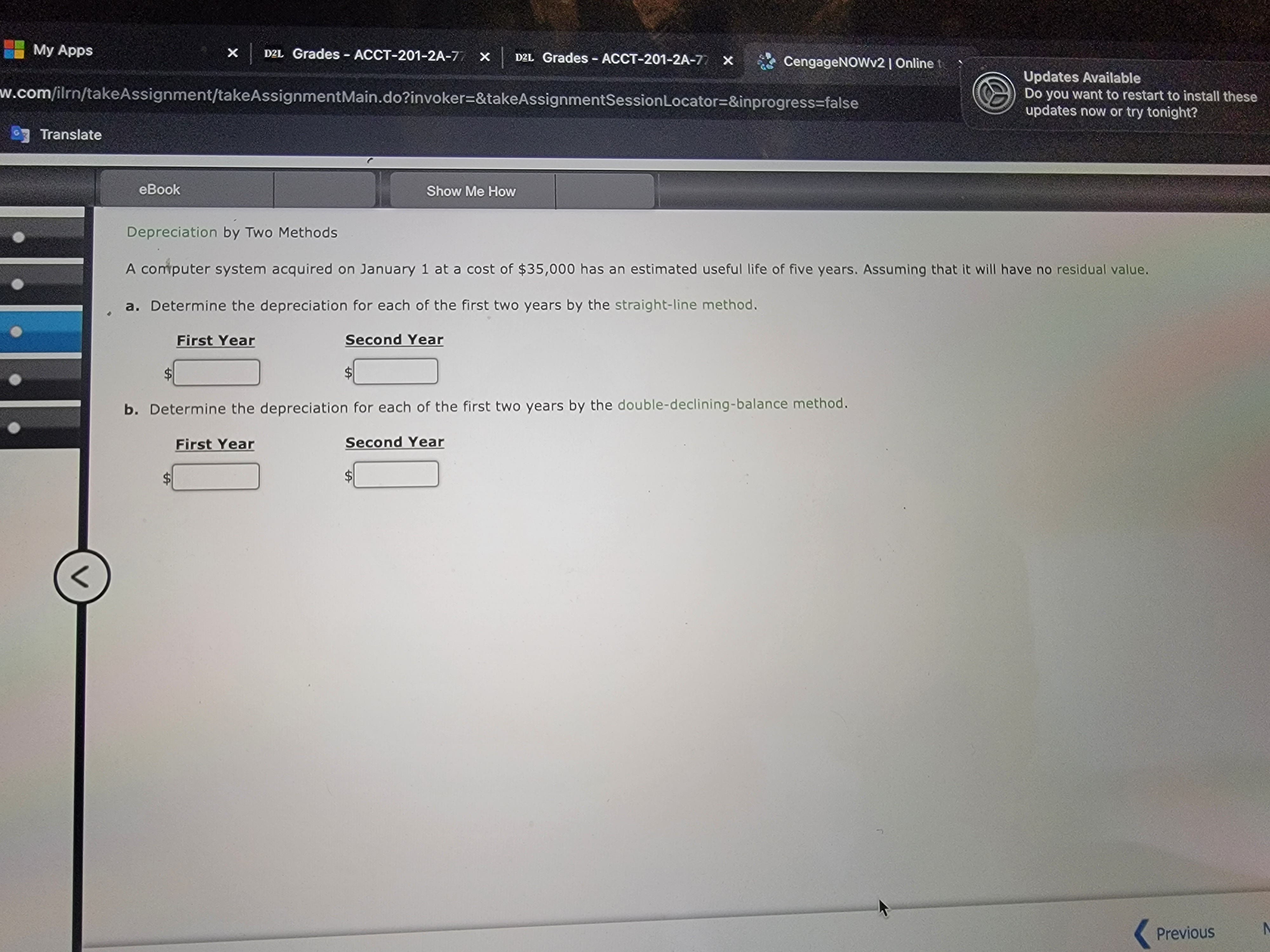

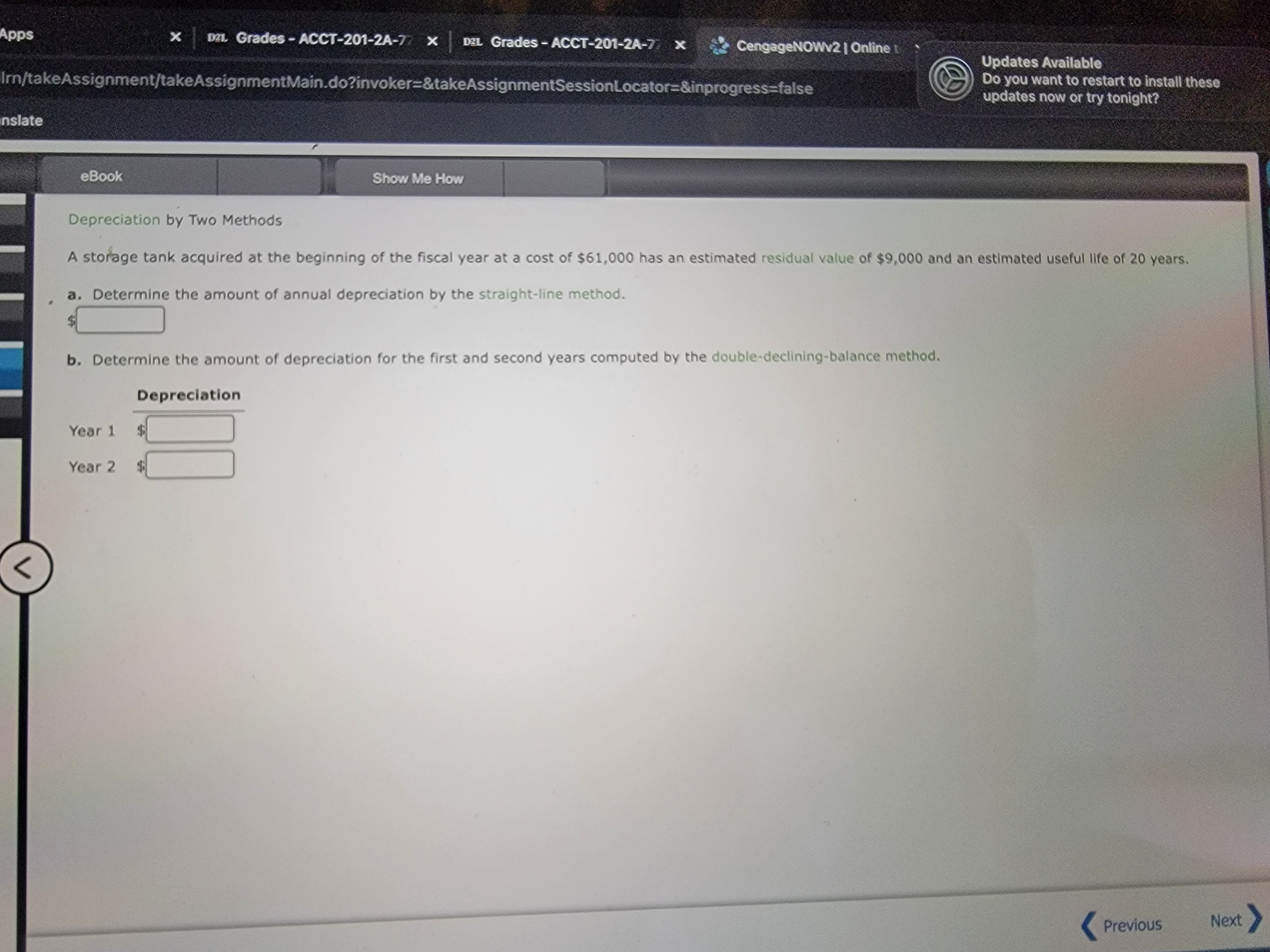

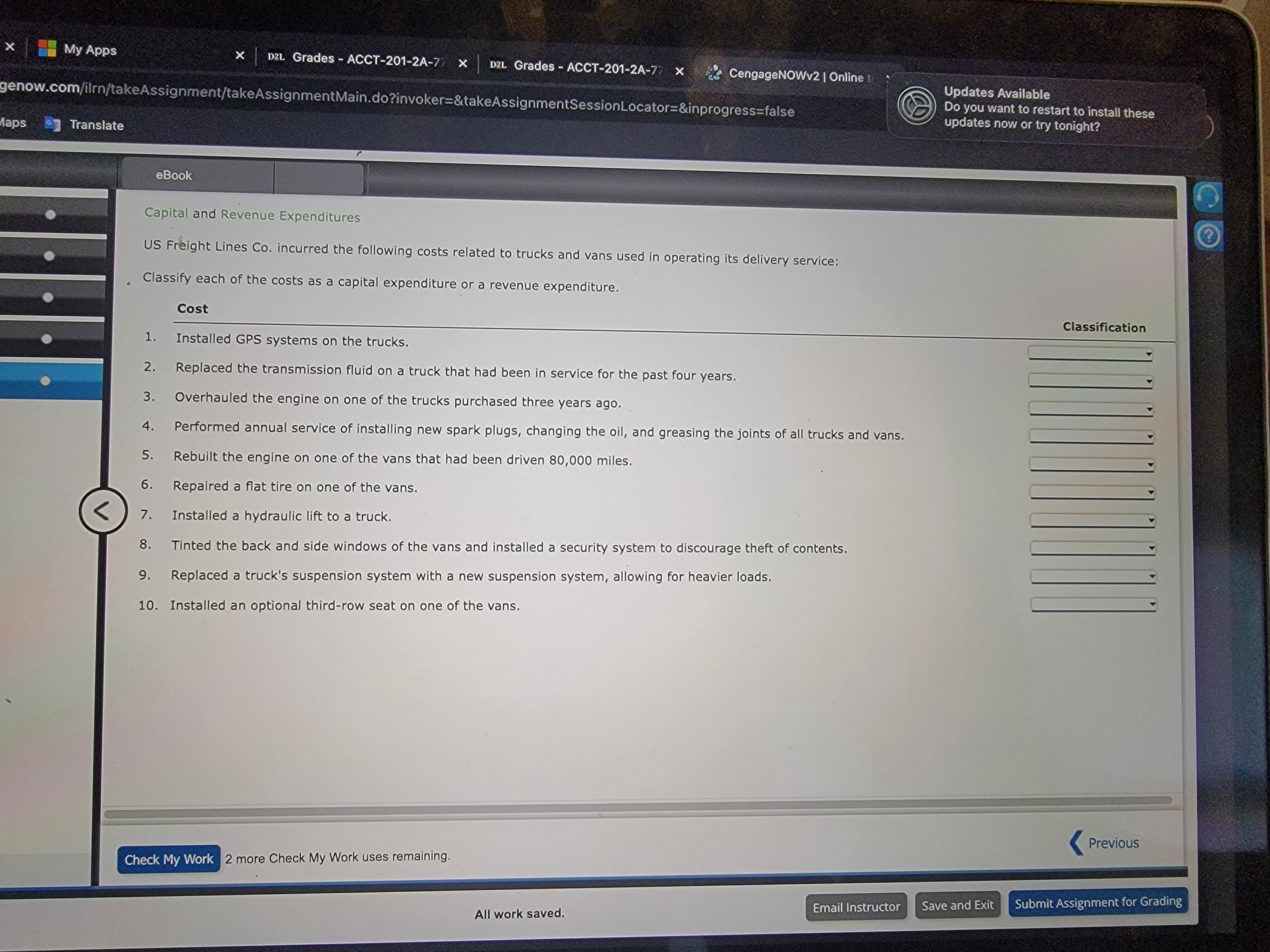

My Apps x D2L Grades - ACCT-201-2A-77 X D2L Grades - ACCT-201-2A-778 X CengageNOWv2 | Online t w.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSession Locator=&inprogress=false Translate < eBook Show Me How Updates Available Do you want to restart to install these updates now or try tonight? Depreciation by Two Methods A computer system acquired on January 1 at a cost of $35,000 has an estimated useful life of five years. Assuming that it will have no residual value. a. Determine the depreciation for each of the first two years by the straight-line method. First Year Second Year $ b. Determine the depreciation for each of the first two years by the double-declining-balance method. First Year Second Year Previous M Apps X DZI Grades - ACCT-201-2A-778X D2L Grades -ACCT-201-2A-77 x CengageNOWv2| Online t Irn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSession Locator=&inprogress=false nslate < eBook Show Me How Updates Available Do you want to restart to install these updates now or try tonight? Depreciation by Two Methods A storage tank acquired at the beginning of the fiscal year at a cost of $61,000 has an estimated residual value of $9,000 and an estimated useful life of 20 years. a. Determine the amount of annual depreciation by the straight-line method. b. Determine the amount of depreciation for the first and second years computed by the double-declining-balance method. Depreciation Year 1 $ Year 2 $ Previous Next X My Apps D2L Grades - ACCT-201-2A-77 X D2L Grades - ACCT-201-2A-77X CengageNOWv2 | Online t genow.com/ilrn/takeAssignment/takeAssignment Main.do?invoker=&takeAssignmentSession Locator=&inprogress=false Maps Translate < eBook Capital and Revenue Expenditures US Freight Lines Co. incurred the following costs related to trucks and vans used in operating its delivery service: Classify each of the costs as a capital expenditure or a revenue expenditure. Cost 1. Installed GPS systems on the trucks. 2. Replaced the transmission fluid on a truck that had been in service for the past four years. 3. Overhauled the engine on one of the trucks purchased three years ago. 4. Performed annual service of installing new spark plugs, changing the oil, and greasing the joints of all trucks and vans. 5. Rebuilt the engine on one of the vans that had been driven 80,000 miles. 6. Repaired a flat tire on one of the vans. Installed a hydraulic lift to a truck. 8. Tinted the back and side windows of the vans and installed a security system to discourage theft of contents. 9. Replaced a truck's suspension system with a new suspension system, allowing for heavier loads. 10. Installed an optional third-row seat on one of the vans. Check My Work 2 more Check My Work uses remaining. Updates Available Do you want to restart to install these updates now or try tonight? Classification Previous All work saved. Email Instructor Save and Exit Submit Assignment for Grading

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started