Answered step by step

Verified Expert Solution

Question

1 Approved Answer

My Bakery membeli sebuah mesin pada 1 April 2017 dengan harga RM160,000.00. Pada 1 Oktober 2018 sebuah lagi mesin telah dibeli dengan harga RM140,000.00.

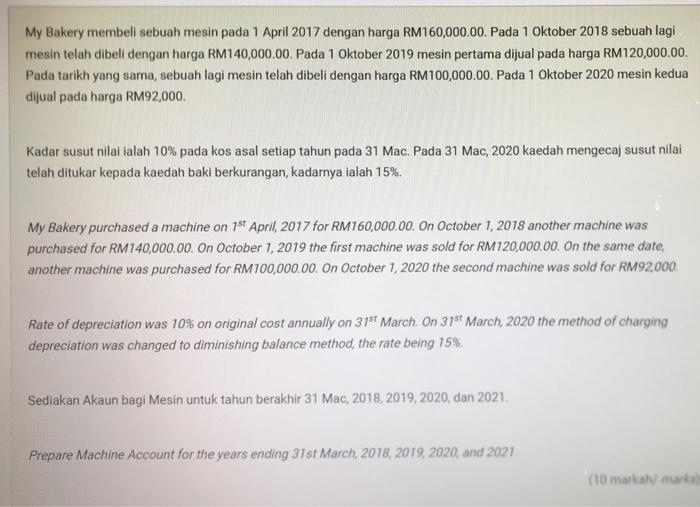

My Bakery membeli sebuah mesin pada 1 April 2017 dengan harga RM160,000.00. Pada 1 Oktober 2018 sebuah lagi mesin telah dibeli dengan harga RM140,000.00. Pada 1 Oktober 2019 mesin pertama dijual pada harga RM120,000.00. Pada tarikh yang sama, sebuah lagi mesin telah dibeli dengan harga RM100,000.00. Pada 1 Oktober 2020 mesin kedua dijual pada harga RM92,000. Kadar susut nilai ialah 10% pada kos asal setiap tahun pada 31 Mac. Pada 31 Mac, 2020 kaedah mengecaj susut nilai telah ditukar kepada kaedah baki berkurangan, kadarnya ialah 15%. My Bakery purchased a machine on 1t April, 2017 for RM160,000.00. On October 1, 2018 another machine was purchased for RM140,000.00. On October 1, 2019 the first machine was sold for RM120,000.00. On the same date, another machine was purchased for RM100,000.00. On October 1, 2020 the second machine was sold for RM92,000 Rate of depreciation was 10% on original cost annually on 31t March. On 31s March, 2020 the method of charging depreciation was changed to diminishing balance method, the rate being 15%. Sediakan Akaun bagi Mesin untuk tahun berakhir 31 Mac, 2018, 2019, 2020, dan 2021. Prepare Machine Account for the years ending 31st March, 2018, 2019, 2020, and 2021. (10 markah marks)

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Dr Cr Date Particulars Amount Date Particulars Amount Calculation of Depreciation 01...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started