Answered step by step

Verified Expert Solution

Question

1 Approved Answer

My balance sheet is incorrect as assets don't equal liabilities and equity, and I don't know what I did wrong from the previous questions. Can

My balance sheet is incorrect as assets don't equal liabilities and equity, and I don't know what I did wrong from the previous questions. Can someone double check my work and correct me?

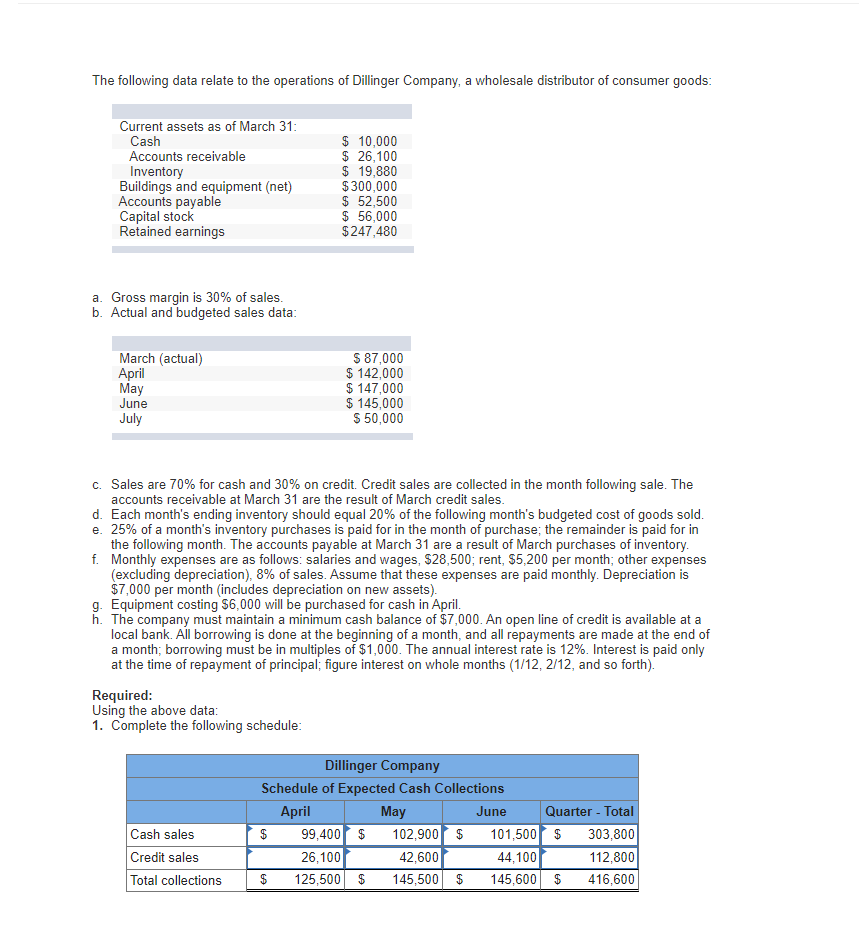

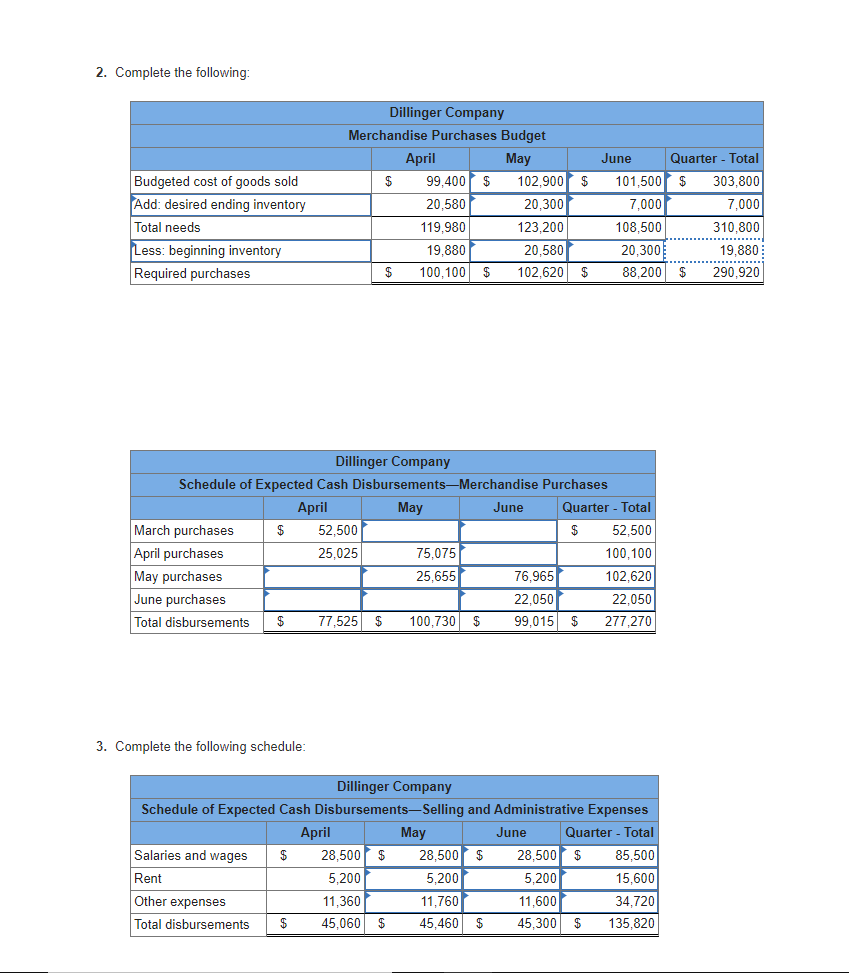

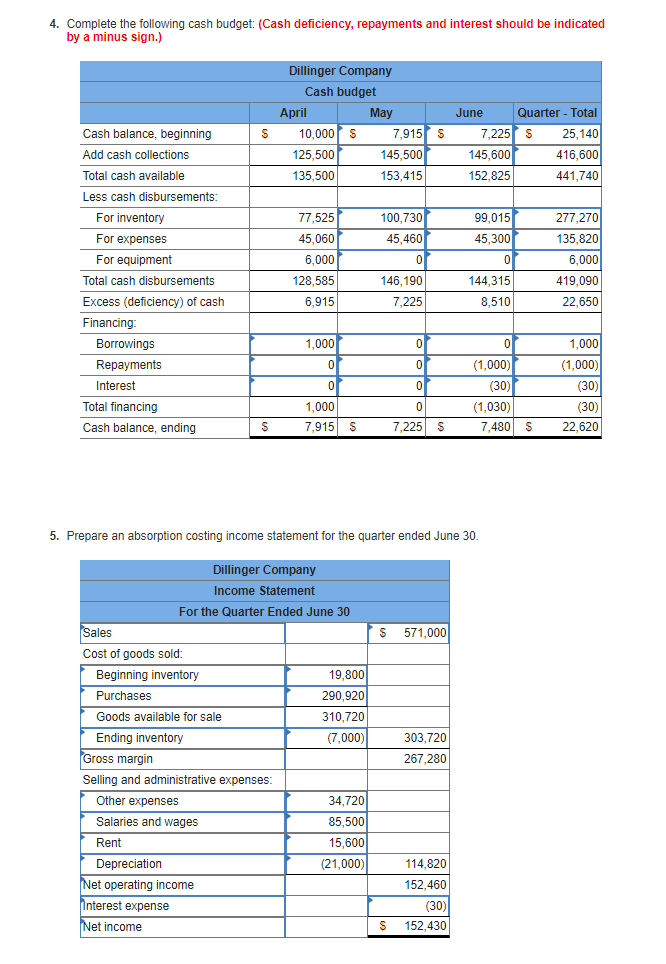

The following data relate to the operations of Dillinger Company, a wholesale distributor of consumer goods: Current assets as of March 31: Cash Accounts receivable Inventory Buildings and equipment (net) Accounts payable Capital stock Retained earnings $ 10,000 $ 26,100 $ 19,880 $300,000 $ 52,500 $ 56,000 $247,480 a. Gross margin is 30% of sales. b. Actual and budgeted sales data: March (actual) April May June July $ 87,000 $ 142,000 $ 147,000 $ 145,000 $ 50,000 C. Sales are 70% for cash and 30% on credit. Credit sales are collected in the month following sale. The accounts receivable at March 31 are the result of March credit sales. d. Each month's ending inventory should equal 20% of the following month's budgeted cost of goods sold. e. 25% of a month's inventory purchases is paid for in the month of purchase; the remainder is paid for in the following month. The accounts payable at March 31 are a result of March purchases of inventory. f. Monthly expenses are as follows: salaries and wages, $28,500; rent, $5,200 per month; other expenses (excluding depreciation), 8% of sales. Assume that these expenses are paid monthly. Depreciation is $7,000 per month (includes depreciation on new assets). g. Equipment costing $6,000 will be purchased for cash in April. h. The company must maintain a minimum cash balance of $7,000. An open line of credit is available at a local bank. All borrowing is done at the beginning of a month, and all repayments are made at the end of a month; borrowing must be in multiples of $1,000. The annual interest rate is 12%. Interest is paid only at the time of repayment of principal; figure interest on whole months (1/12, 2/12, and so forth) Required: Using the above data: 1. Complete the following schedule: Dillinger Company Schedule of Expected Cash Collections April May June 1 $ 99,400 $ 102,900 $ 101,500 26,100 42,600 44,100 | $ 125,500 $ 145,500 $ 145,600 Cash sales Credit sales | Total collections Quarter - Total $ 303,800 112,800 $ 416 6001 2. Complete the following: $ Budgeted cost of goods sold Add: desired ending inventory Total needs Less: beginning inventory Required purchases Dillinger Company Merchandise Purchases Budget April May $ 99,400 $ 102,900 20,580 20,300 119.980 123,200 19,880 20,580 | $ 100,100 $ 102,620 June 101,500 7,000 108,500 20,300 88,200 Quarter - Total $ 303,800 7,000 310,800 19,880 $ 290,920 $ Dillinger Company Schedule of Expected Cash Disbursements-Merchandise Purchases April May June Quarter - Total March purchases $ 52,500 $ 52,500 April purchases 25,025 75,075 100,100 May purchases 25,655 76,965 102,620 June purchases 22,0507 22,050 Total disbursements $ 77,525 $ 100,730 $ 99,015 $ 277,270 3. Complete the following schedule: Dillinger Company Schedule of Expected Cash DisbursementsSelling and Administrative Expenses April May June Quarter - Total Salaries and wages $ 28,500 $ 28,500 $ 28,500 $ 85,500 Rent 5,2005 ,2005 ,200 15,600 Other expenses 11,360 11,760 11,600 34,720 Total disbursements $ 45,060 $ 45,460 $ 45,300 $ 135,820 4. Complete the following cash budget: (Cash deficiency, repayments and interest should be indicated by a minus sign.) $ Dillinger Company Cash budget April May 10,000 $ 7,915 125,500 145,500 135,500 153,415 Cash balance, beginning Add cash collections Total cash available S June Quarter - Total 7,225 5 25,140 145,600 416,600 152,825 441,740 Less cash disbursements: 100,730 45,460 99,015 45,300 For inventory For expenses For equipment Total cash disbursements Excess (deficiency) of cash Financing 77,525 45,060 6,000 128,585 6,915 or 277,270 135,820 6,000 419,090 22,650 146,190 7,225 144,315 8,510 1,000 or Borrowings Repayments Interest 01 1,000 7,915 (1,000) (30) (1,030) 7,480 0 0 7,225 Total financing Cash balance, ending 1,000 (1,000) (30) (30) 22,620 $ S $ S 5. Prepare an absorption costing income statement for the quarter ended June 30. Dillinger Company Income Statement For the Quarter Ended June 30 Sales PS 571,000 Cost of goods sold: Beginning inventory 19,800 Purchases 290,920 Goods available for sale 310,720 Ending inventory (7,000) 303,720 Gross margin 267,280 Selling and administrative expenses: Other expenses 34,720 Salaries and wages 85,500 Rent 15,600 Depreciation (21,000) 114,820 Net operating income 152,460 Interest expense (30) (Net income S 152,430Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started