Answered step by step

Verified Expert Solution

Question

1 Approved Answer

My calculations are way off with this, idk what I am missing. I keep getting $2,060.70... Ebony earned $86,760 during 2020. She is single, paid

My calculations are way off with this, idk what I am missing. I keep getting $2,060.70...

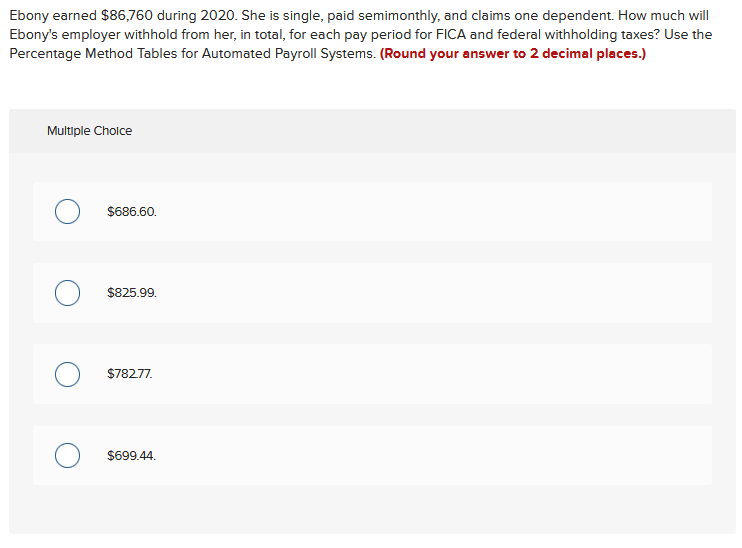

Ebony earned $86,760 during 2020. She is single, paid semimonthly, and claims one dependent. How much will Ebony's employer withhold from her, in total, for each pay period for FICA and federal withholding taxes? Use the Percentage Method Tables for Automated Payroll Systems. (Round your answer to 2 decimal places.) Multiple Choice $686.60. $825.99. $782.77 $699.44Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started