Answered step by step

Verified Expert Solution

Question

1 Approved Answer

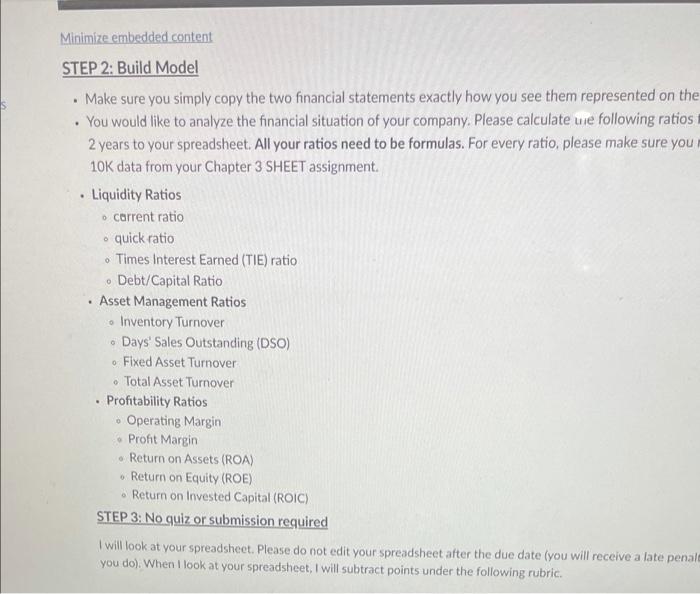

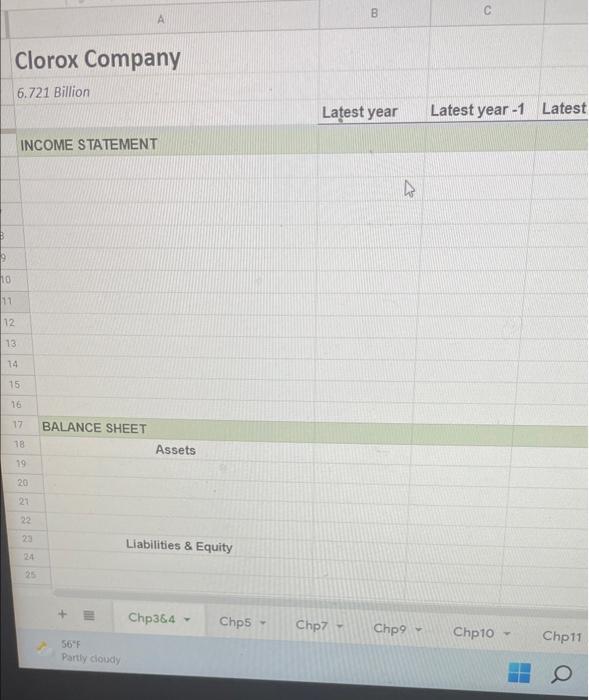

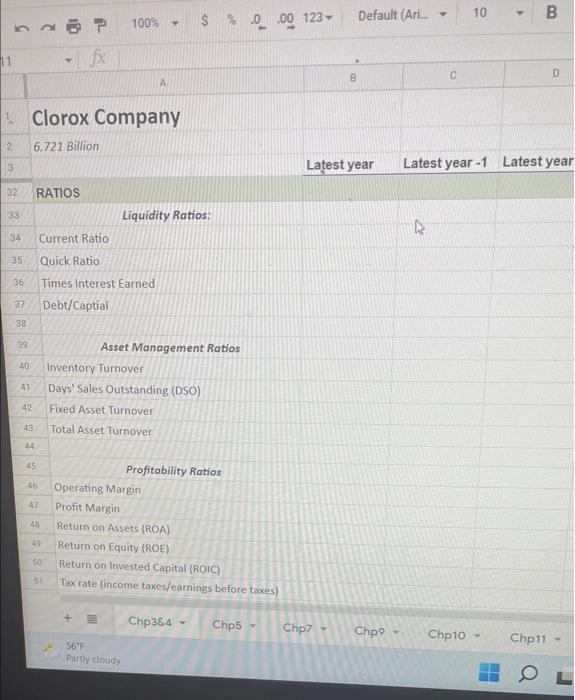

My company is the clorox company. The first picture is the instructions, and the next pictures are the spreadsheet data that i have to fill

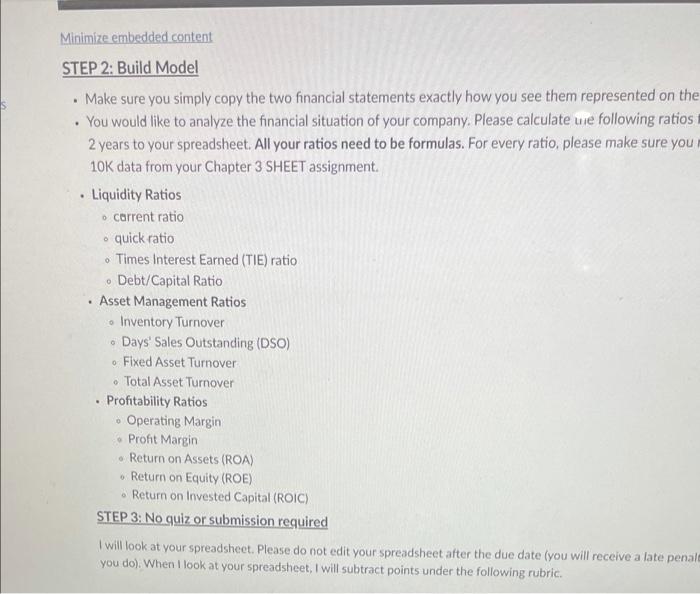

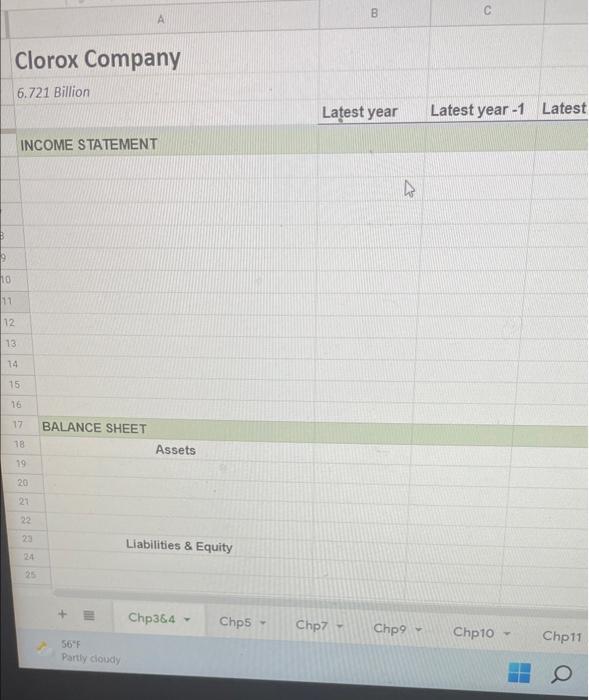

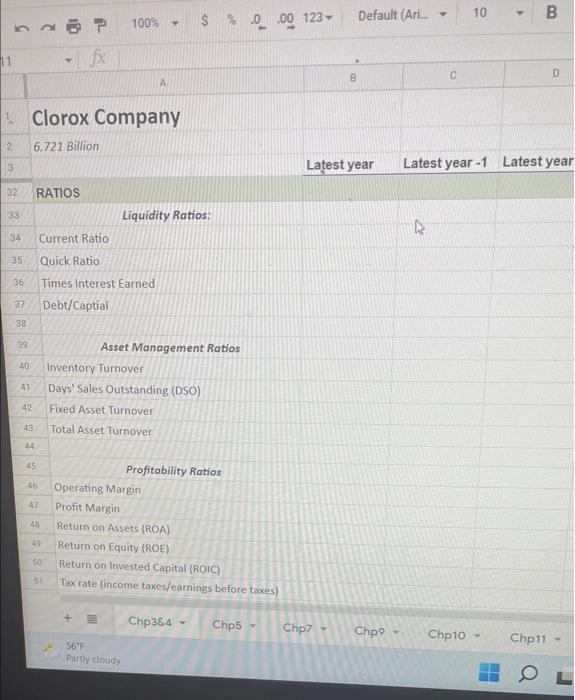

My company is the clorox company. The first picture is the instructions, and the next pictures are the spreadsheet data that i have to fill in.

Minimize embedded content STEP 2: Build Model . . Make sure you simply copy the two financial statements exactly how you see them represented on the You would like to analyze the financial situation of your company. Please calculate une following ratios 2 years to your spreadsheet. All your ratios need to be formulas. For every ratio, please make sure you 10K data from your Chapter 3 SHEET assignment. Liquidity Ratios carrent ratio O quick ratio Times Interest Earned (TIE) ratio 0 Debt/Capital Ratio Asset Management Ratios 0 Inventory Turnover Days' Sales Outstanding (DSO) Fixed Asset Turnover Total Asset Turnover Profitability Ratios Operating Margin Profit Margin Return on Assets (ROA) Return on Equity (ROE) Return on Invested Capital (ROIC) STEP 3: No quiz or submission required I will look at your spreadsheet. Please do not edit your spreadsheet after the due date (you will receive a late penale you do). When I look at your spreadsheet, I will subtract points under the following rubric. . B 10 11 12 A Clorox Company 6.721 Billion INCOME STATEMENT 13 14 15 67299 16 17 BALANCE SHEET 18 19 20 21 2232 24 25 56F Partly cloudy Assets Liabilities & Equity Chp3&4 Y Chp5- Y B Latest year Chp7 4 Chp9 V C Latest year-1 Latest Chp10 Chpl1 11 2 3 32 33 34 35 36 37 38 39 40 41 42 43 45 46 47 48 P fx Clorox Company 6.721 Billion RATIOS Current Ratio Quick Ratio Times Interest Earned Debt/Captial Inventory Turnover Days' Sales Outstanding (DSO) Fixed Asset Turnover Total Asset Turnover Profitability Ratios Operating Margin Profit Margin Return on Assets (ROA) Return on Equity (ROE) Return on Invested Capital (ROIC) Tax rate (income taxes/earnings before taxes) Chp3&4 Chp5 56 F Partly cloudy 49 50 100% - $% 0.00 123 Liquidity Ratios: Asset Management Ratios B Latest year Chp7 Y Default (Ari.... B C D Latest year -1 Latest year 4 Chp Chp10 10 Y Chp11 OL

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started