Answered step by step

Verified Expert Solution

Question

1 Approved Answer

My firm has FCF = 1000 and is unlevered. The required return as an unlevered firm is ru = 10%. Shareholders have been clamoring

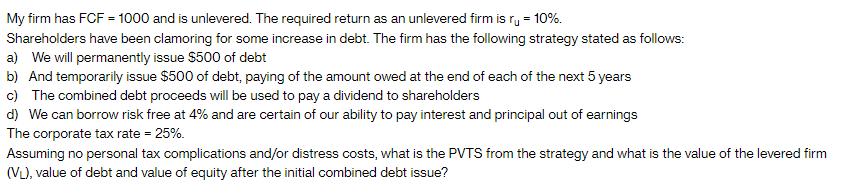

My firm has FCF = 1000 and is unlevered. The required return as an unlevered firm is ru = 10%. Shareholders have been clamoring for some increase in debt. The firm has the following strategy stated as follows: a) We will permanently issue $500 of debt b) And temporarily issue $500 of debt, paying of the amount owed at the end of each of the next 5 years c) The combined debt proceeds will be used to pay a dividend to shareholders d) We can borrow risk free at 4% and are certain of our ability to pay interest and principal out of earnings The corporate tax rate = 25%. Assuming no personal tax complications and/or distress costs, what is the PVTS from the strategy and what is the value of the levered firm (VL), value of debt and value of equity after the initial combined debt issue?

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the Present Value of Tax Shields PVTS and the value of the levered firm VL value of deb...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started