Answered step by step

Verified Expert Solution

Question

1 Approved Answer

My firm's equity currently trades at $100/share. My estimate of the increase in the value of the firm due to our plan to recapitalize the

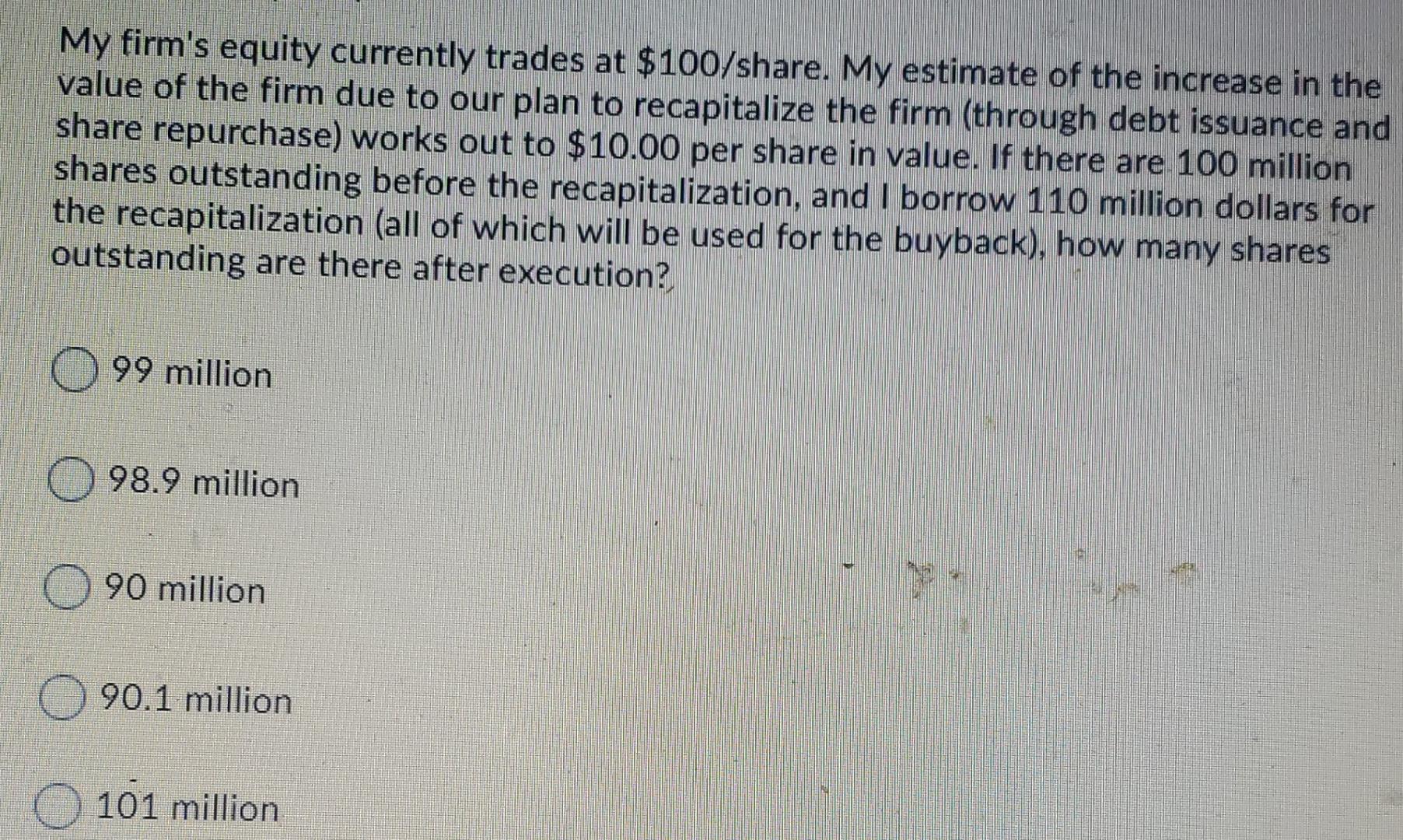

My firm's equity currently trades at $100/share. My estimate of the increase in the value of the firm due to our plan to recapitalize the firm (through debt issuance and share repurchase) works out to $10.00 per share in value. If there are 100 million shares outstanding before the recapitalization, and I borrow 110 million dollars for the recapitalization (all of which will be used for the buyback), how many shares outstanding are there after execution? 99 million 98.9 million 90 million 90.1 million 101 million

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started