my last 4 digits are $8,242

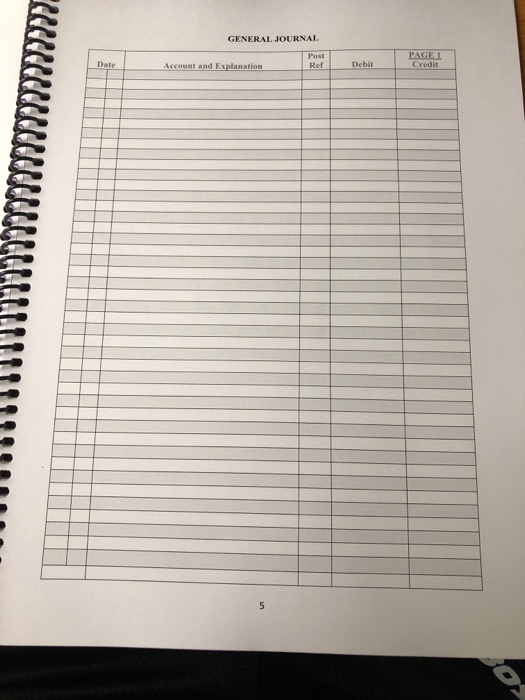

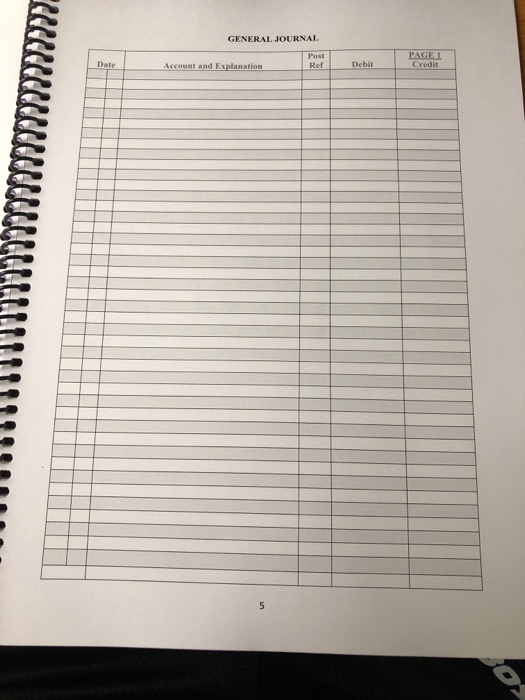

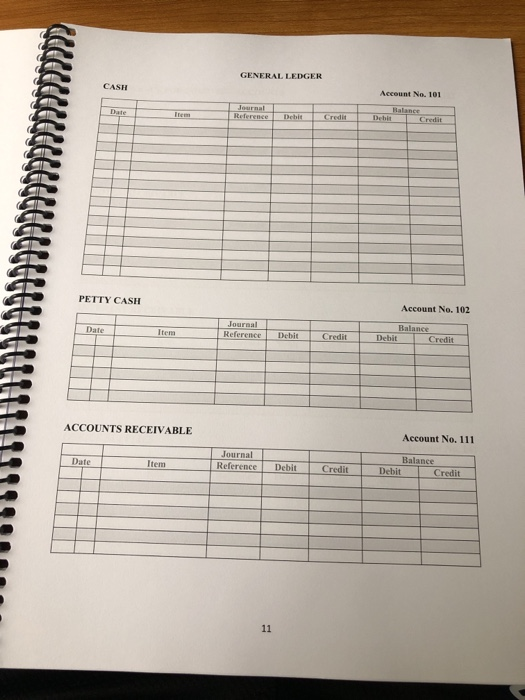

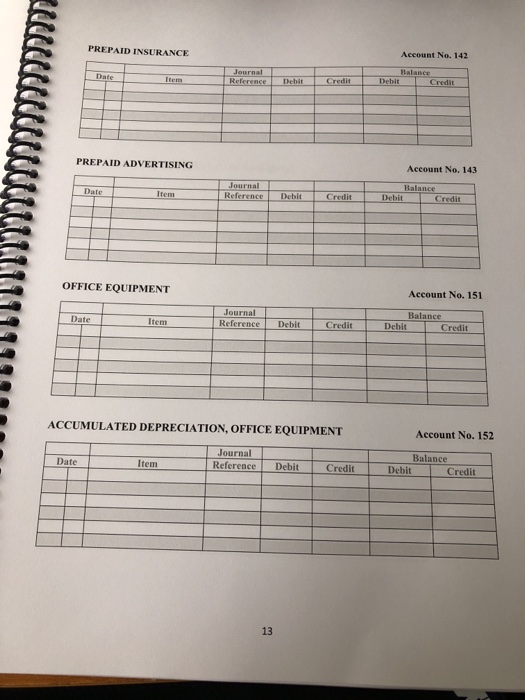

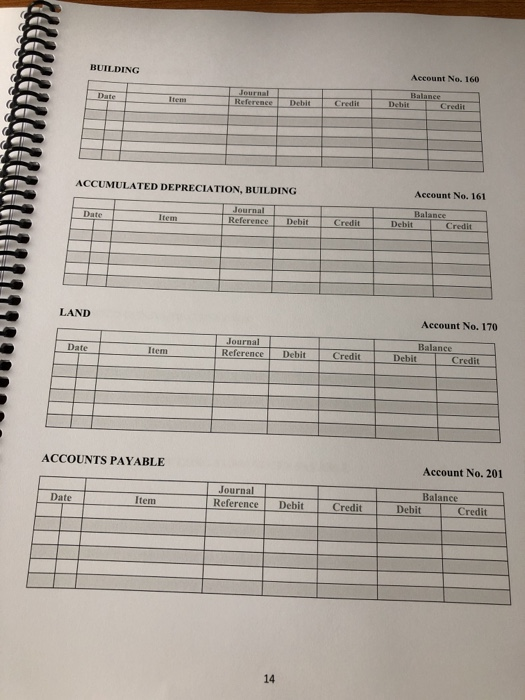

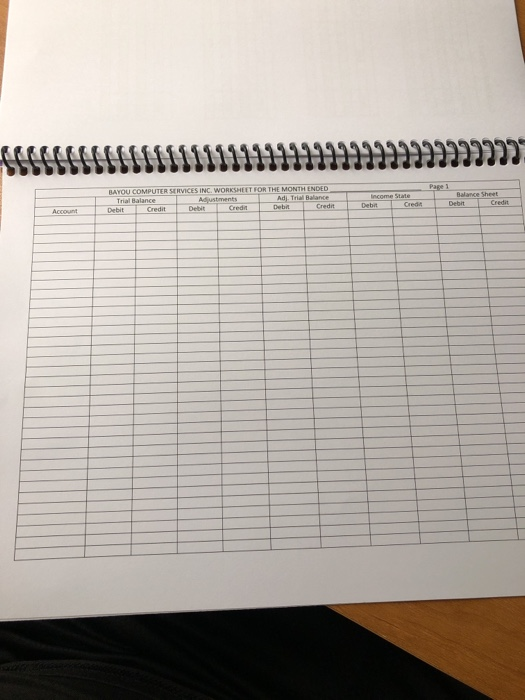

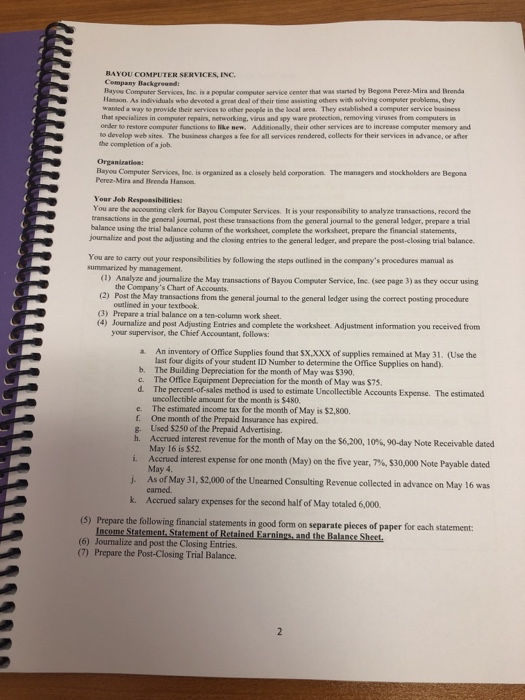

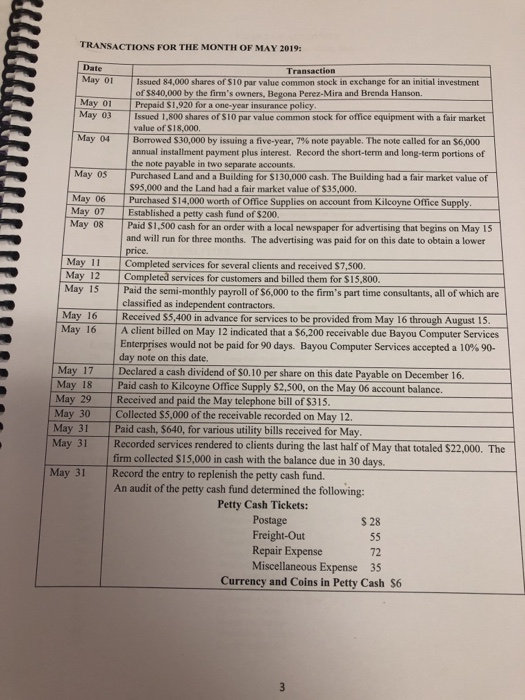

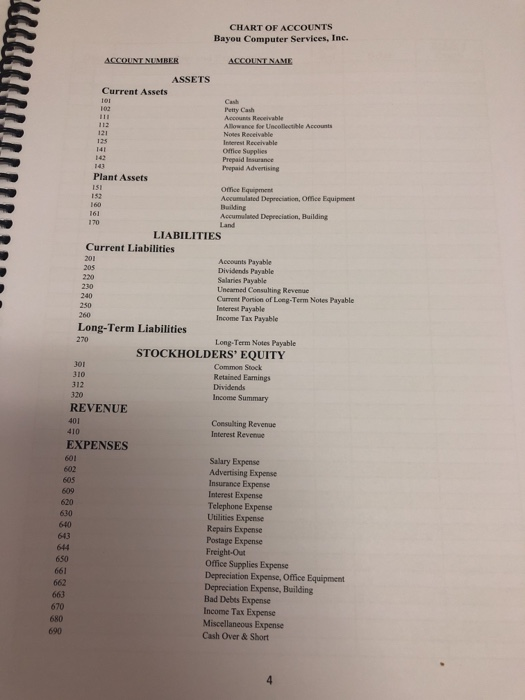

GENERAL JOURNAL Ref GENERAL LEDGER Account No. 101 CASH Account No. 102 PETTY CASH Balance Journal Reference Debit Credit Debit Dat Account No. 111 ACCOUNTS RECEIVABLE Balance Journal Reference Debit Credit DebitCredit Item Date Account No. 142 PREPAID INSURANCE Hal Date ference DebitCredit Debit Account No. 143 PREPAID ADVERTISING JournalCeedit Debit Reference Debit Balance DebitCredit Date Account No. 151 OFFICE EQUIPMENT Balance ournal Reference Debit Credit Debit Item ACCUMULATED DEPRECIATION, OFFICE EQUIPMENT Account No. 152 Journal Reference Debit Balance Credit Debit Date Item 13 Account No. 160 BUILDING Cr Account No. 161 ACCUMULATED DEPRECIATION, BUILDING Balance Journal Reference Debit Credit redit Date Account No. 170 LAND Balance Journal ReferenceDebit CreditDebit Credit Date Account No. 201 ACCOUNTS PAYABLE Balance Journal Reference Debit Debit. --Credit Cred t Item Date 14 LLuiiuum S INC. WORKSHEET FOR THE MONTH ENDED Ad Trial Balance BAYOU COMPUTER S Balance Sheet BAYOU COMPUTER SERVICES, INC. Company Background Bayou Computer Services, Inc, is a popular computer service center that was started by Begona Perez-Mira and Brenda Henson. As individuals who devoted a great deal of their time assisting others with solving computer problems, they wanted a way to provide their services to other people in the local area. They established a computer service business that specializes in computer repairs, networking, vinus and spy ware protection, removing viruses from computers in order to restore computer functions to like new. Additionally, their other services are to increase computer memory and no develop web sites The business charges a fee for all services rendered, collects for their services in advance, or after the complenion of a job Organizatiom: Bayou Computer Services, Inc. is organized as a closely held corporation. Perez-Mira and Brenda Hanson The managers and stockholders are Bepona Your Jeb Responsibilities You are the accounting clerk for Bayou Computer Services. It is your responsibility to analyze transactions, recond the transactions in the general journal, post these transactions from the general journal so the general ledger, prepare a trial balance using the trial balance column of the worksheet, complete the worksheet, prepare the financial statements joumalize and post the adjusting and the closing entries to the general ledger, and prepare the post-closing trial balance ou are to carry out your responsibilities by following the steps outlined in the company's procedures manual as summarizoed by management. (1) Analyze and joumalize the May transactions of Bayou Computer Service, Inc. (see page 3) as they occur using (2) Post the May transactions from the general journal to the general ledger using the correct posting procedare (3) Prepare a trial balance on a ten-column work sheet the Company's Chart of Accounts. outlined in your textbook (4) Journalize and post Adjusting Entries and complete the worksheet. Adjustment information you received from your supervisor, the Chief Accountant, follows: An inventory of Office Supplies found that SX.XXX of supplies remained at May 31. (Use the a. last four digits of your student ID Number to determine the Office Supplies on hand). b. The Building Depreciation for the moeth of May was $390. c. The Office Equipment Depreciation for the month of May was $75 d. The percent-of-sales method is used to estimate Uncollectible Accounts Expense. The estimated uncollectible amount for the month is $480. e. The estimated income tax for the month of May is $2,800 f. One month of the Prepaid Insurance has expired g. Used $250 of the Prepaid Advertising. h. Accrued interest revenue for the month of May on the S6200, 10%, 90-day Note Receivable dated May 16 is $52. Accrued interest expense for one month (May) on the five year, 7%, S30,000 Note Payable dated j" As of k. Accrued salary expenses for the second half of May totaled 6,000. the following financial statements in good form on separate pieces of paper for each statement i. May 4 May 31, $2,000 of the Unearned Consulting Revenue collected in advance on May 16 was earned (5) Prepare Income Statement, Statement of Retained Farnings, and the Balance Sheet (6) Journalize and post the Closing Entries (7) Prepare the Post-Closing Trial Balance. TRANSACTIONS FOR THE MONTH OF MAY 2019: Date Transaction May 01 Issued 84,000 shares of $10 par value common stock in exchange for an initial investment of $840,000 by the firm's owners, Begona Perez-Mira and Brenda Hanson. May 01 Prepaid $1.920 for a one-year insurance policy May 03 Issued 1,800 shares of S10 par value common stock for office equipment with a fair market value of $18,000 BorrowedS30,000byissungafive-year, 7% note payable. The note called for an $6,000 annual installment payment plus interest. Record the short-term and long-term portions of the note payable in two separate accounts. Purchased Land and a Building for $130,000 cash. The Building had a fair market value of $95,000 and the Land had a fair market value of $35,000 Purchased S14,000 worth of Office Supplies on account from Kilcoyne Office Supply May 04 May OS May 06 ay 07 Established a petty cash fund of $200 y 08 Paid $1,500 cash for an order with a local newspaper for advertising that begins on May 15 and will run for three months. The advertising was paid for on this date to obtain a lower price. May 11 Completed services for several clients and received $7,500 May 12 Completed services for customers and billed them for $15,800. May 15 Paid the semi-monthly payroll of $6,000 to the firm's part time consultants, all of which are classified as independent contractors May 16 Received $5,400 in advance for services to be provided from May 16 through August 15. May 16 A client billed on May 12 indicated that a $6,200 receivable due Bayou Computer Services Enterprises would not be paid for 90 days. Bayou Computer Services accepted a 10% 90- day note on this date. May 17 Declared a cash dividend of S0.10 per share on this date Payable on December 16 May 18 Paid cash to Kilcoyne Office Supply $2,500, on the May 06 account balance. May 29 Received and paid the May telephone bill of $315 May 30 Collected $5,000 of the receivable recorded on May 12 May 31Paid cash, $640, for various utility bills received for May May 31 Recorded services rendered to clients during the last half of May that totaled $22,000. The firm collected $15,000 in cash with the balance due in 30 days. May 31 Record the entry to replenish the petty cash fund An audit of the petty cash fund determined the following: Petty Cash Tickets: Postage Freight-Out Repair Expense Miscellaneous Expense S 28 72 35 Currency and Coins in Petty Cash S6 CHART OF ACCOUNTS Bayou Computer Services, Inc. ASSETS Current Assets Petty Cash 112 121 Allowance for Uncollectible Accounts Interest Receivable Office Supplies Prepaid Iesurance Prepaid Advertising Plant Assets Office Equipment Aecursulated Depreciation, Office Equipment 152 160 Accumalaned Depreciation, Building LIABILITIES Current Liabilities Accounts Payable Dividends Payable Salaries Payable Uncarned Consulting Revenue Current Portion of Loag-Term Notes Payable Ieterest Payable Income Tax Payable 250 260 Long-Term Liabilities 270 Long-Term Notes Payable STOCKHOLDERS' EQUITY 301 Common Stock Retained Earnings 310 312 320 REVENUE 401 410 EXPENSES 601 Income Summary Consulting Revenue Interest Revenae Salary Expense Advertising Expense Insurance Expense Interest Expense Telephone Expense Utilities Expense Repairs Expense Postage Expense Freight-Out Office Supplies Expense Depreciation Expense, Office Equipment Depreciation Expense, Building Bad Debes Expense Income Tax Expense Miscellaneous Expense 602 605 630 643 650 661 662 663 670 680 Cash Over & Short