my numbers were incorrect looking for correct one!

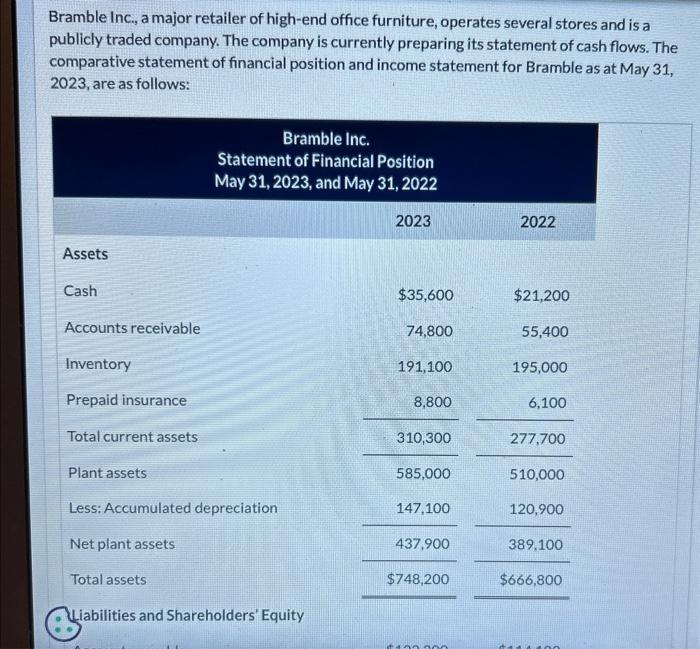

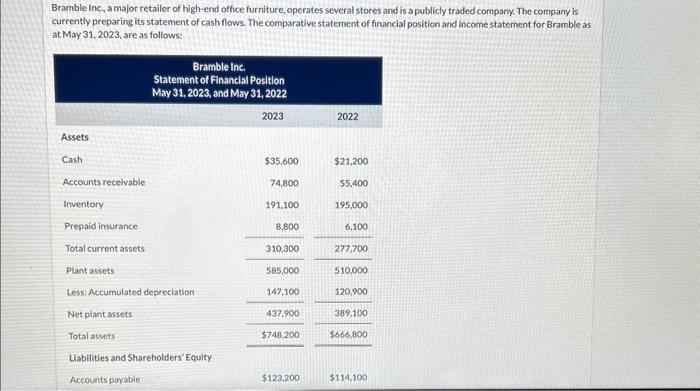

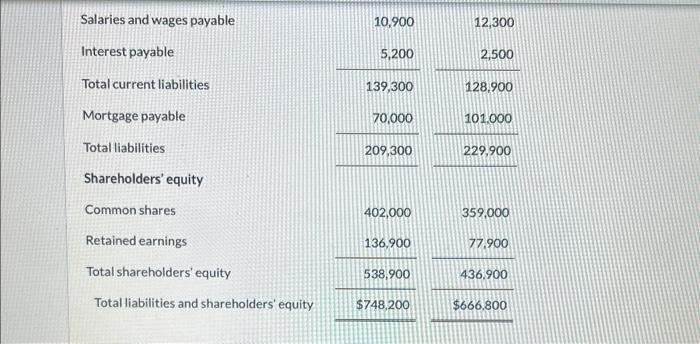

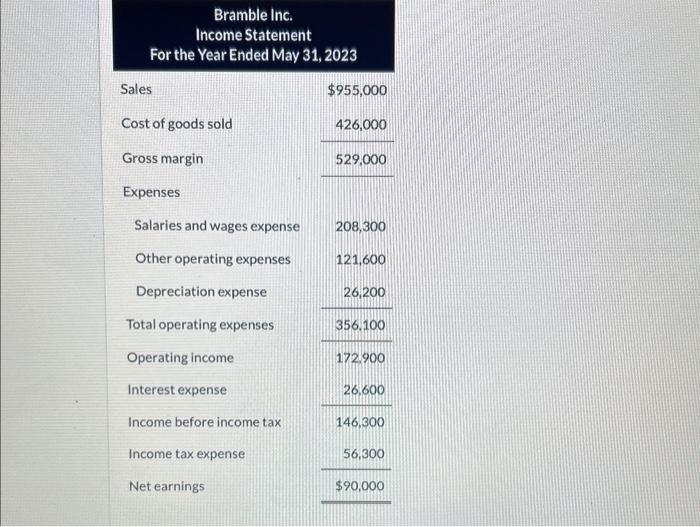

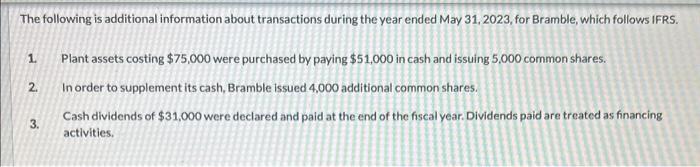

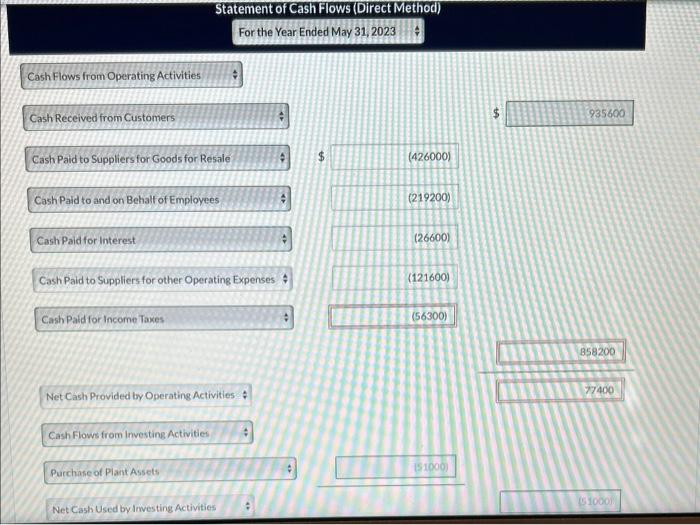

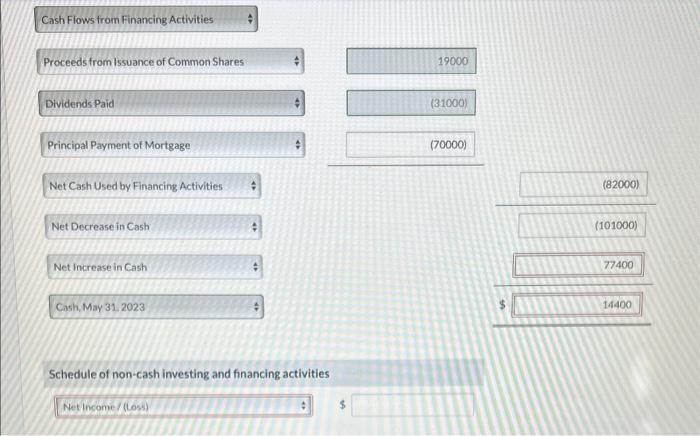

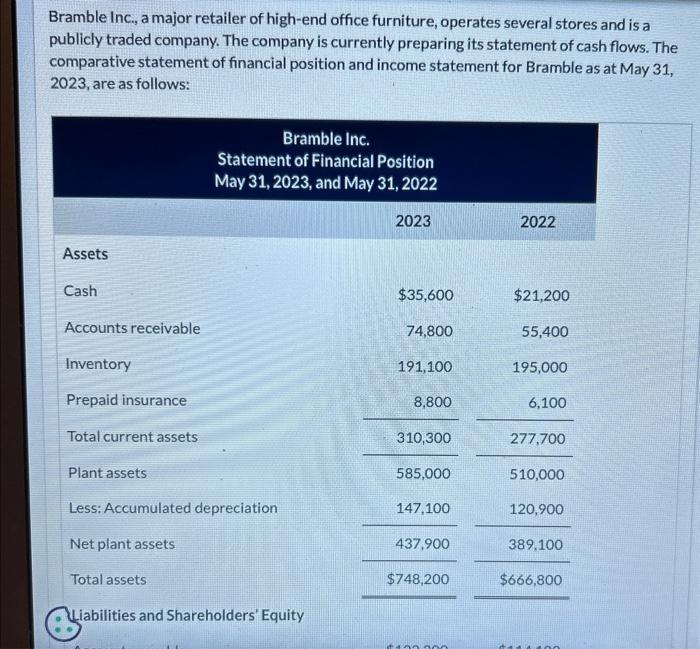

Bramble Inc., a major retailer of high-end office furniture, operates several stores and is a publicly traded company. The company is currently preparing its statement of cash flows. The comparative statement of financial position and income statement for Bramble as at May 31 , 2023, are as follows: Bramble Inc., a major retailer of high-end office furniture, operates several stores and is a publicly traded company. The company is currently preparing its statement of cash flows. The comparative statement of financial position and income statement for Bramble as at May 31, 2023, are as follows: Bramble Inc. Income Statement For the Year Ended May 31, 2023 Sales $955,000 Cost of goods sold Gross margin Expenses 426,000529,000 Salaries and wages expense 208,300 \begin{tabular}{l|l} Other operating expenses 121,600 \end{tabular} Depreciation expense Total operating expenses Operating income 172.900356.10026,200 Interest expense Income before income tax 26,600 Income tax expense Net earnings 146,300 56,300$90,000 The following is additional information about transactions during the year ended May 31, 2023, for Bramble, which follows IFRS. 1. Plant assets costing $75,000 were purchased by paying $51,000 in cash and issuing 5,000 common shares. 2. In order to supplement its cash, Bramble issued 4,000 additional common shares. 3. Cash dividends of $31,000 were declared and paid at the end of the fiscal year. Dividends paid are treated as financing activities. Statement of Cash Flows (Direct Method) For the Year Ended May 31, 2023 Cash Flows from Operating Activities Cash Received from Customers Cash Paid to Suppliers for Goods for Resale Cash Paid to and on Behalf of Emplovees Cash Paid for Interest Cash Paid to Suppliers for other Operating Expenses Cash Paid for Income Taxes Net Cash Provided by Operating Activities : Cash Flows from Investing Activities Purchase of Piant Asset Net Cash Used by Imvesting Activities $ 935600 $ (426000) (219200) (26600) (121600) (56300) (1810) 77400 Cash Flows from Financing Activities Proceeds from Issuance of Common Shares Dividends Paid Principal Payment of Mortgage Net Cash Used by Financing Activities Net increase in Cash Cash. May 31.2023 Schedule of non-cash investing and financing activities Net Income/(Loss) 3