Answered step by step

Verified Expert Solution

Question

1 Approved Answer

My project is due tonight!! can somebody please help me with this. I have no idea on how to do it. Cut At AY Copy

My project is due tonight!! can somebody please help me with this. I have no idea on how to do it.

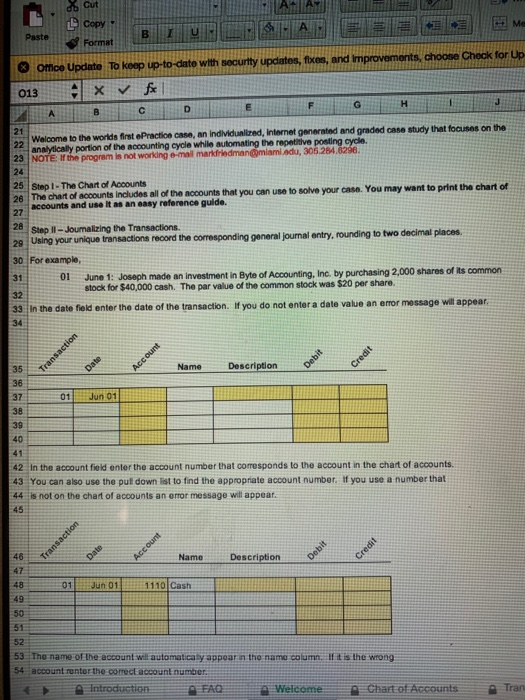

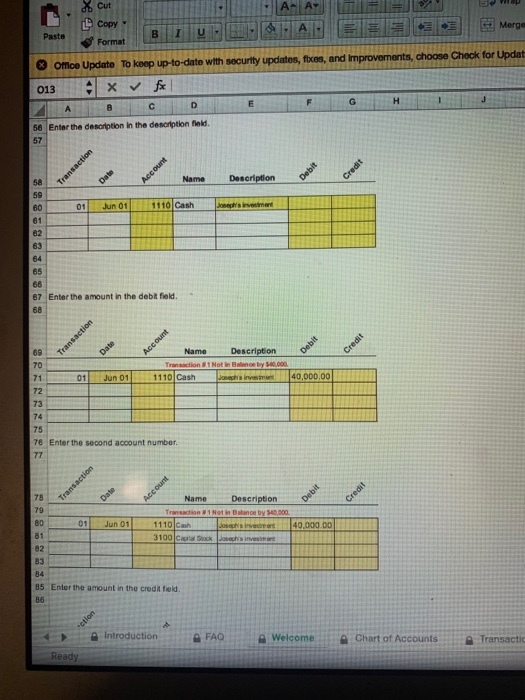

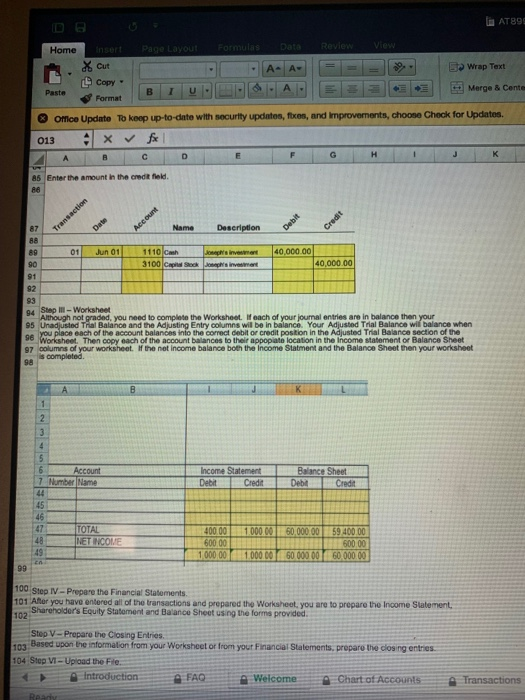

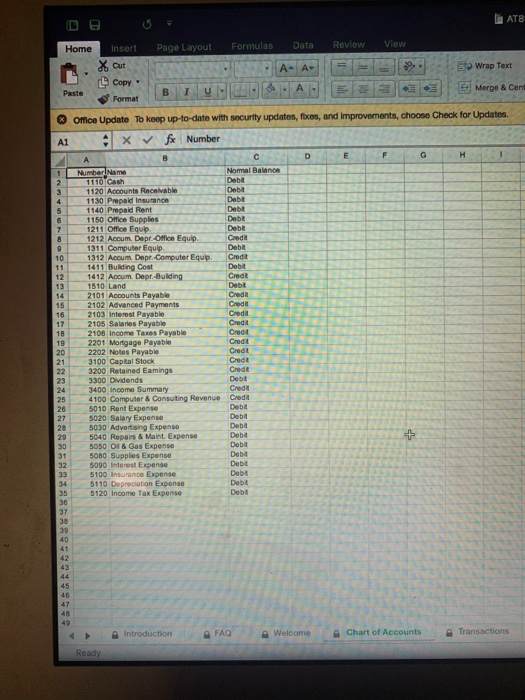

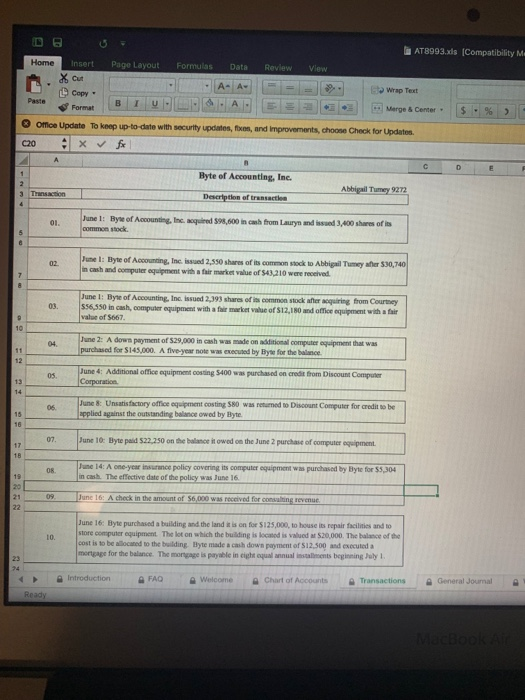

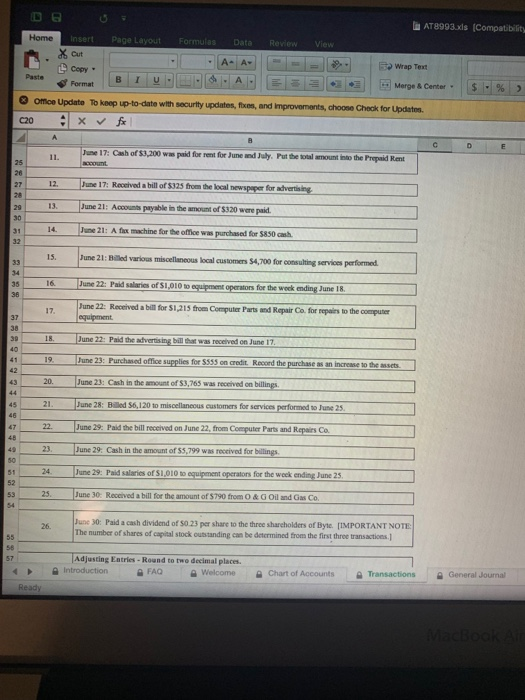

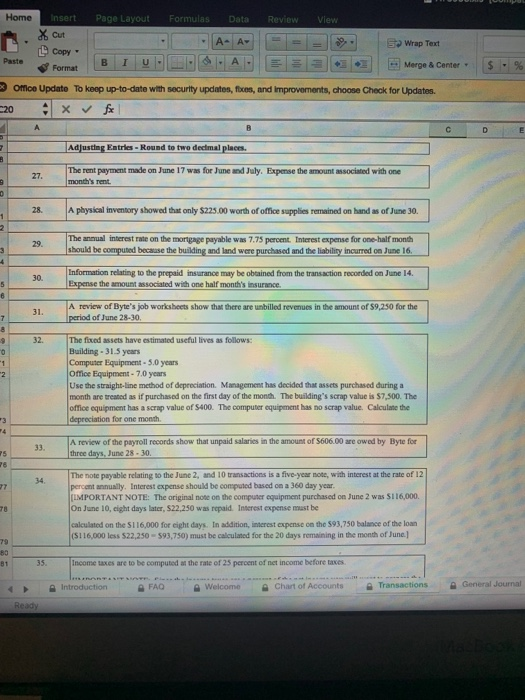

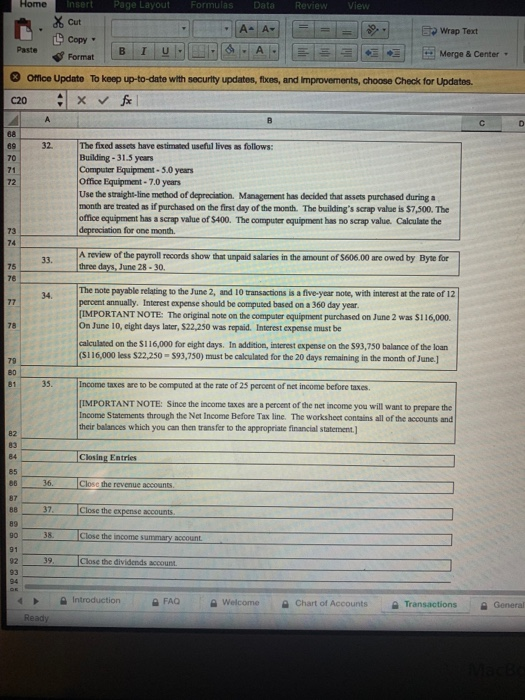

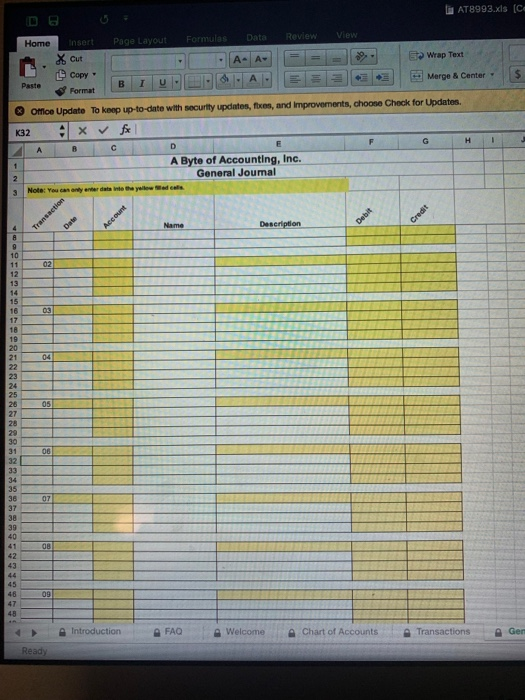

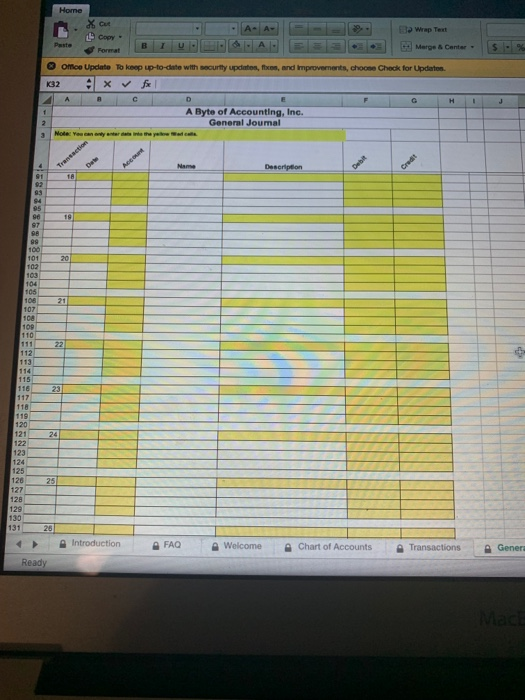

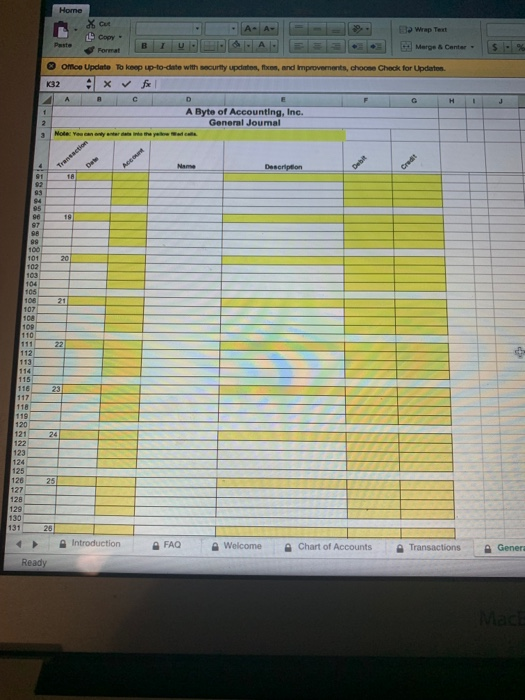

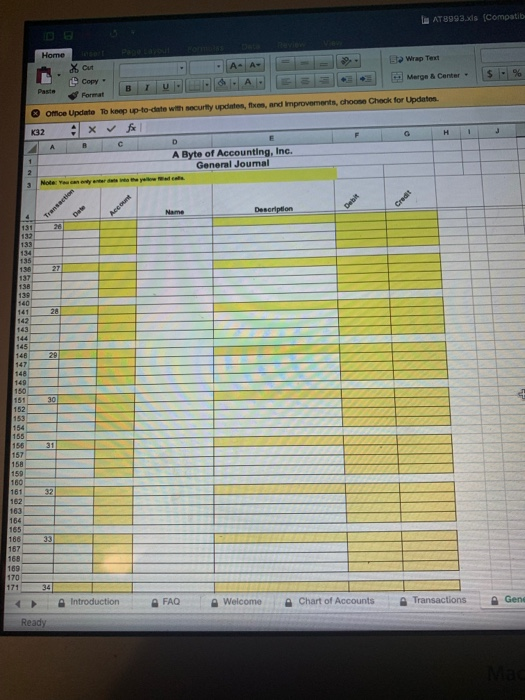

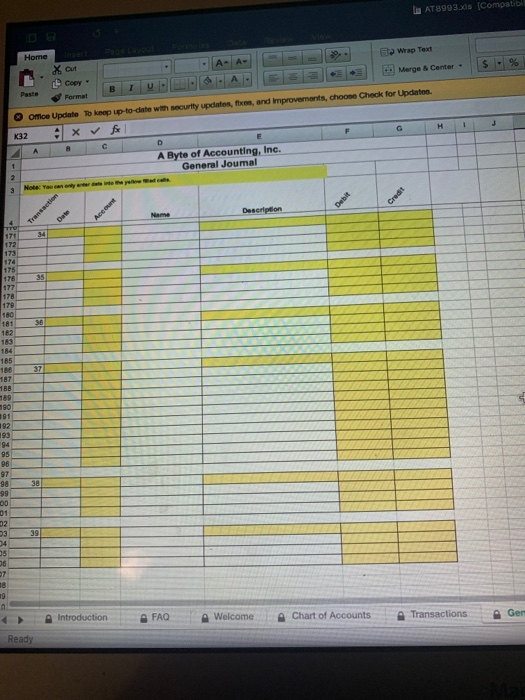

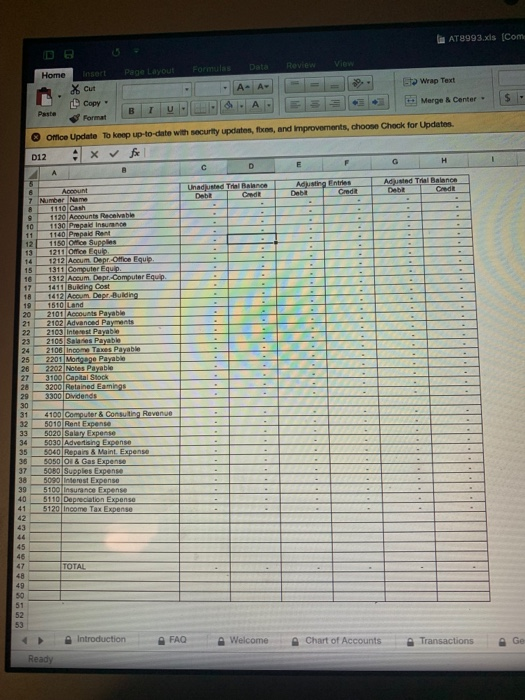

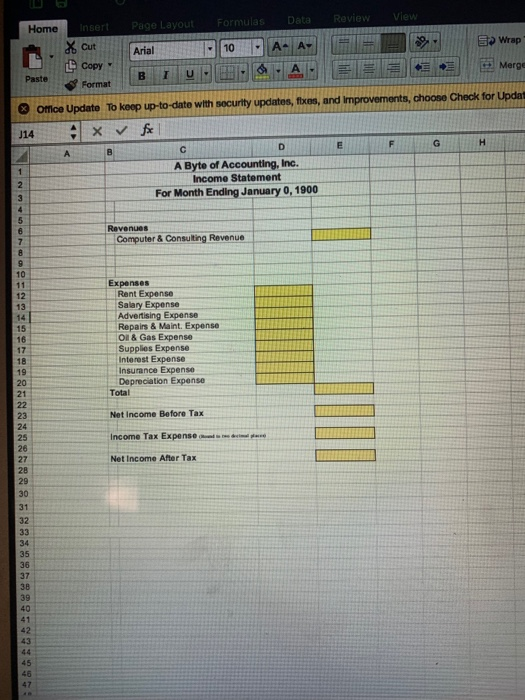

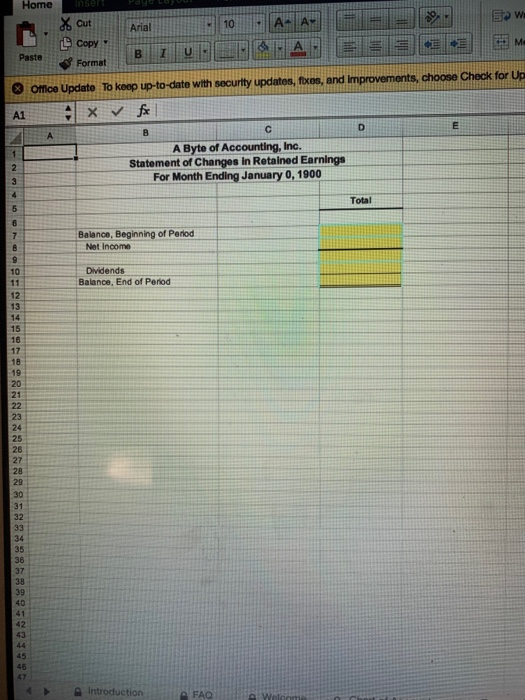

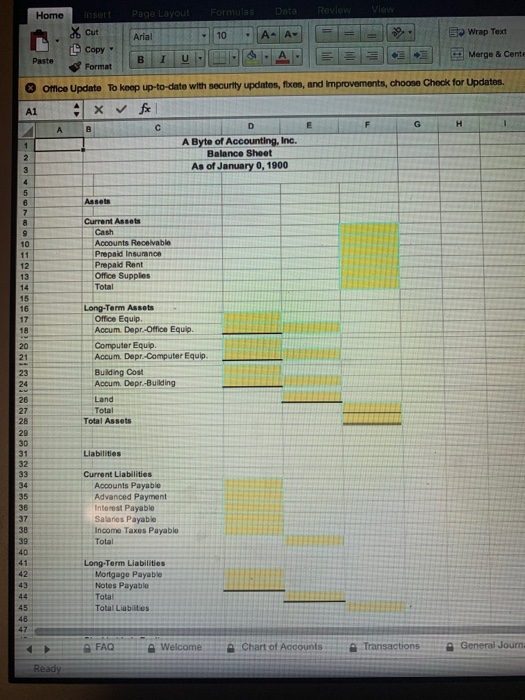

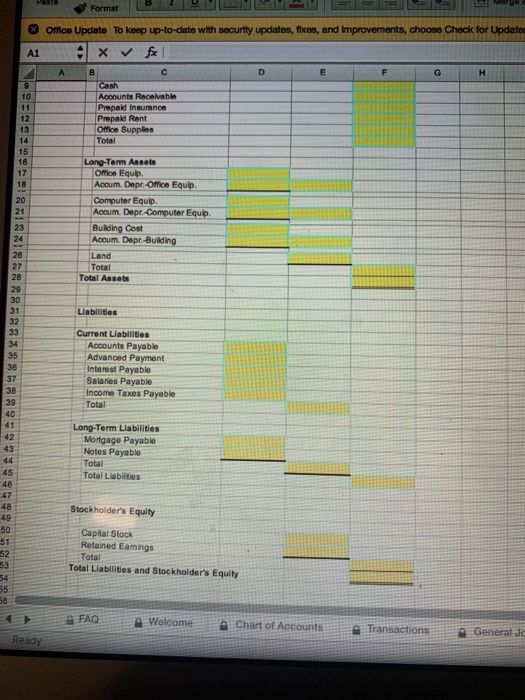

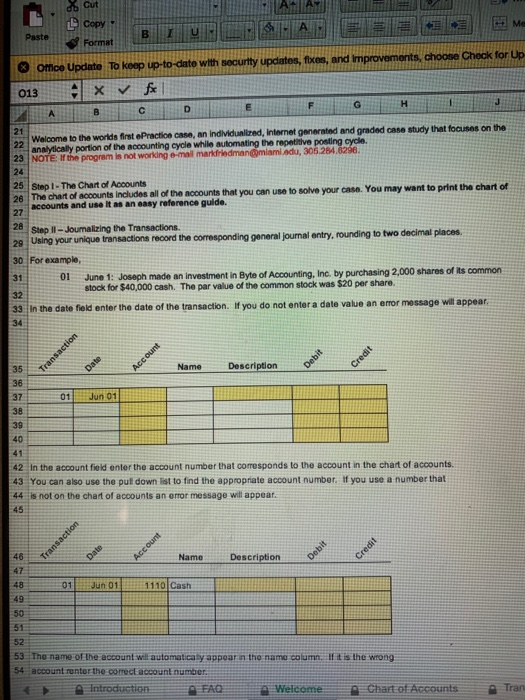

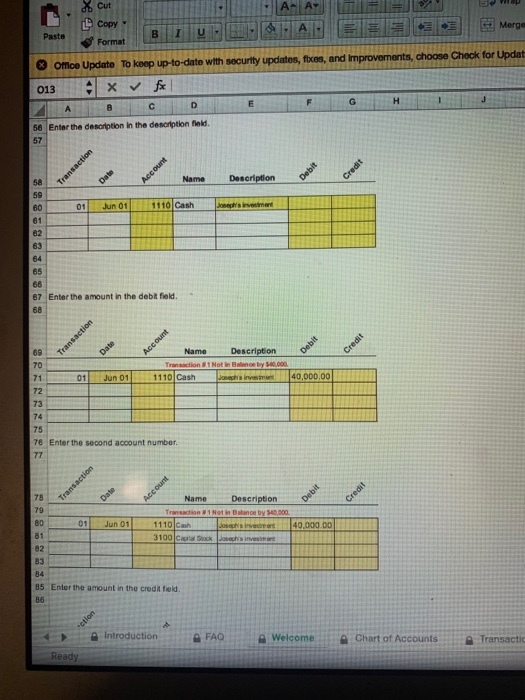

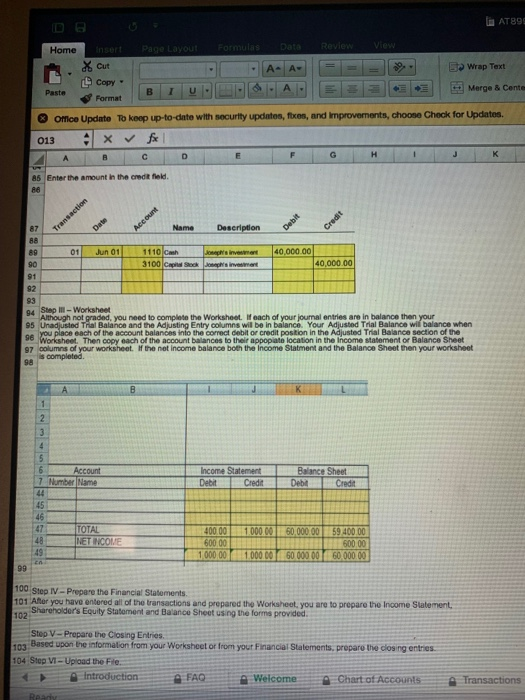

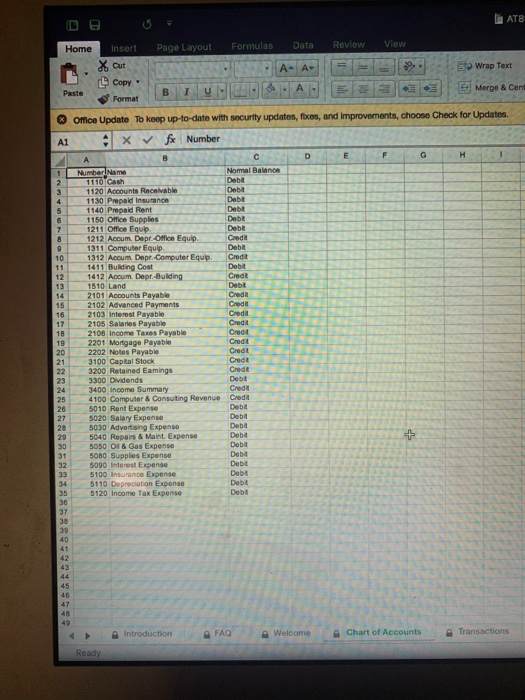

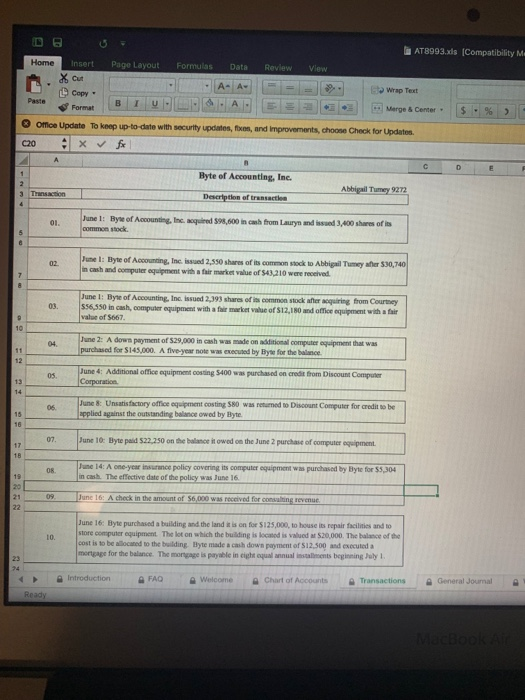

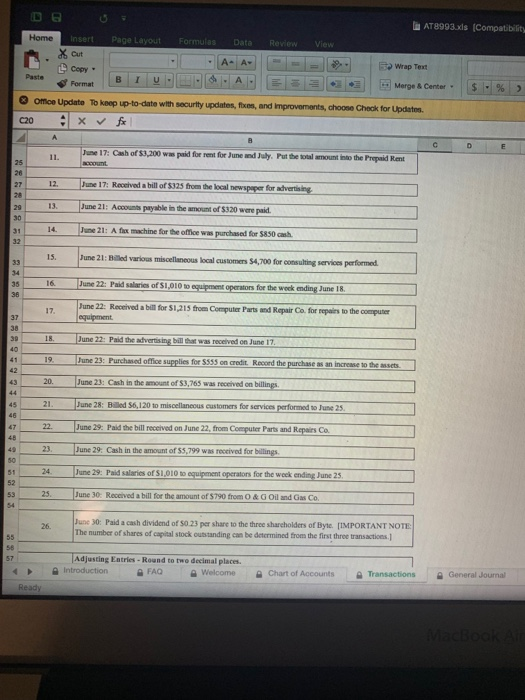

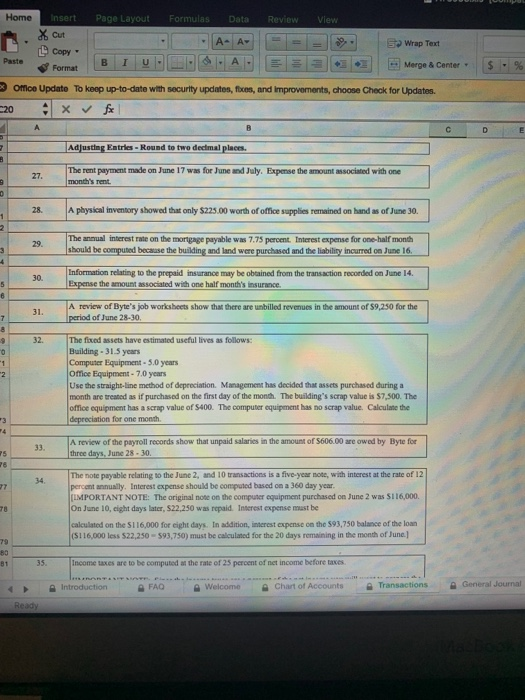

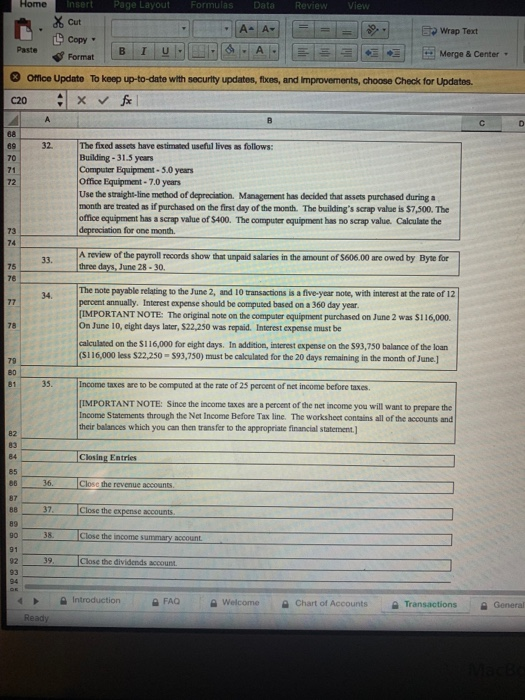

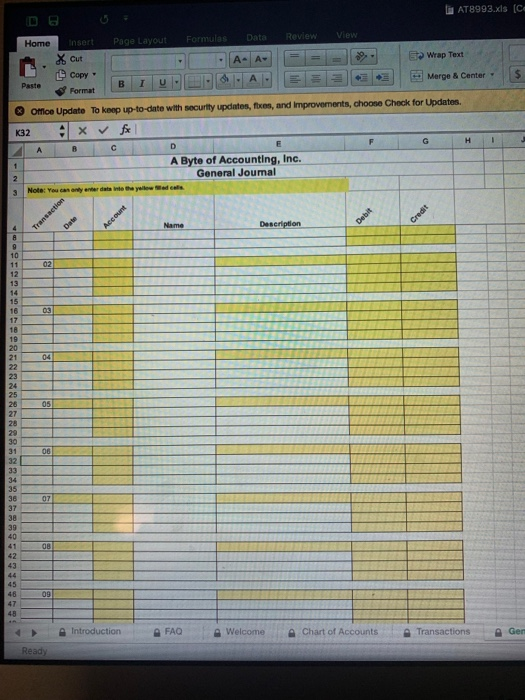

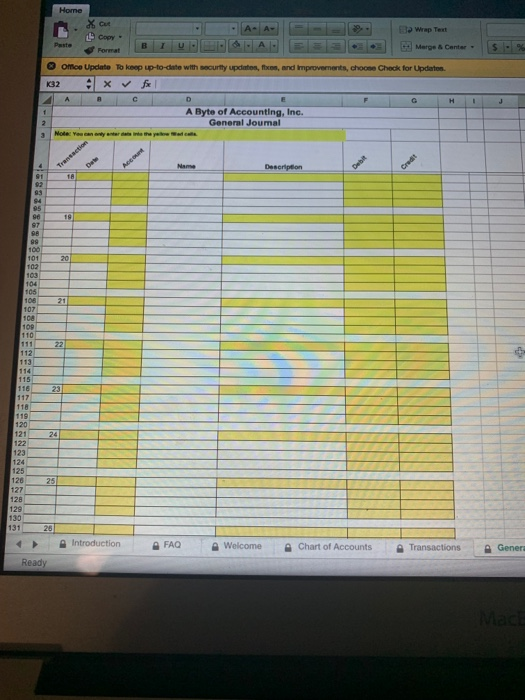

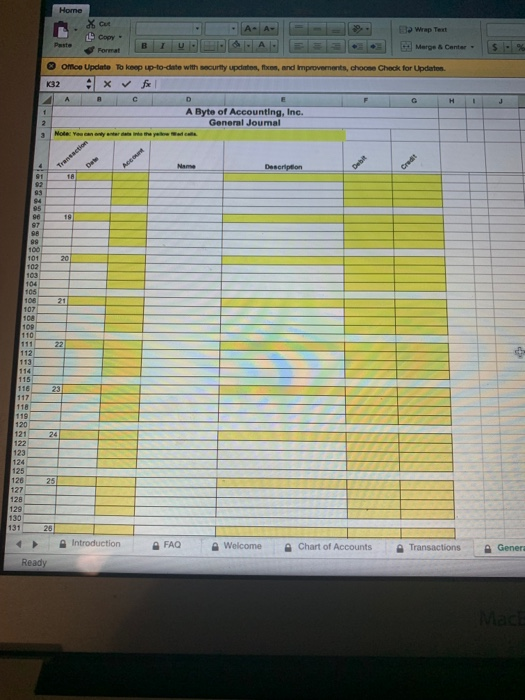

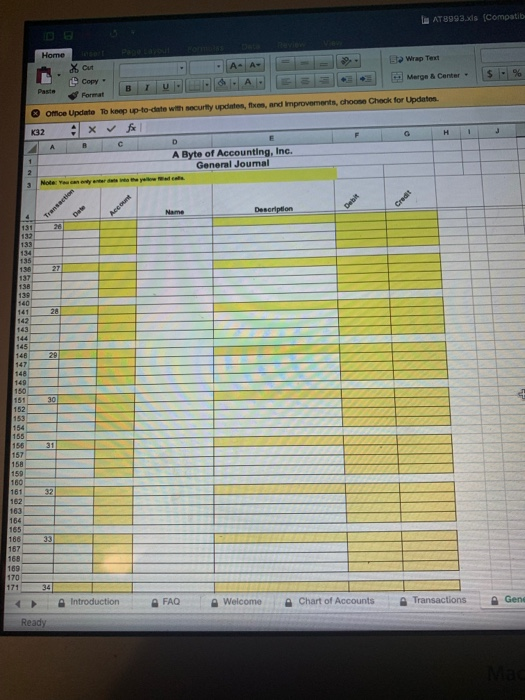

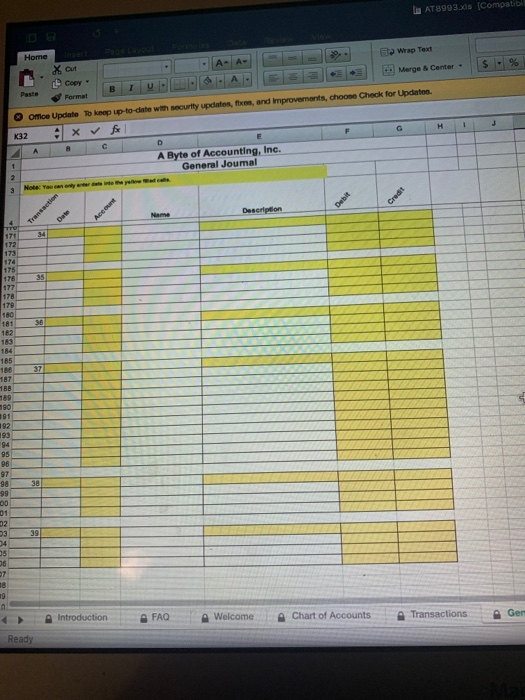

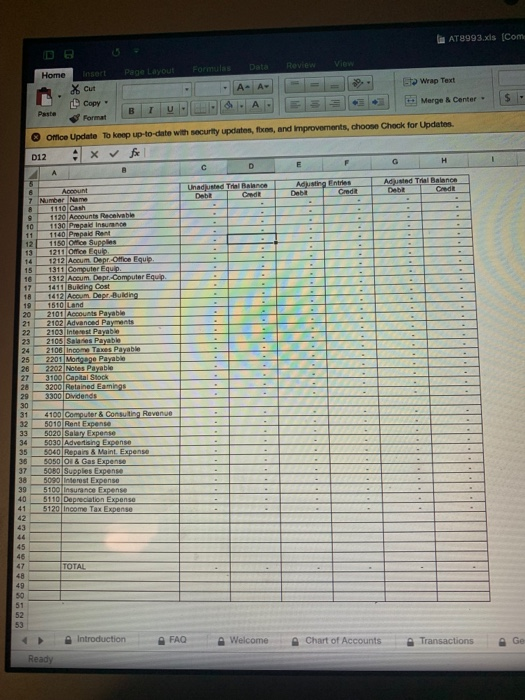

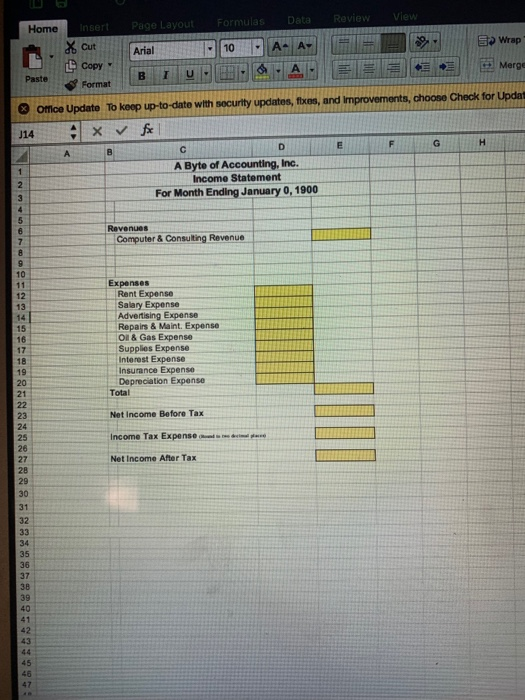

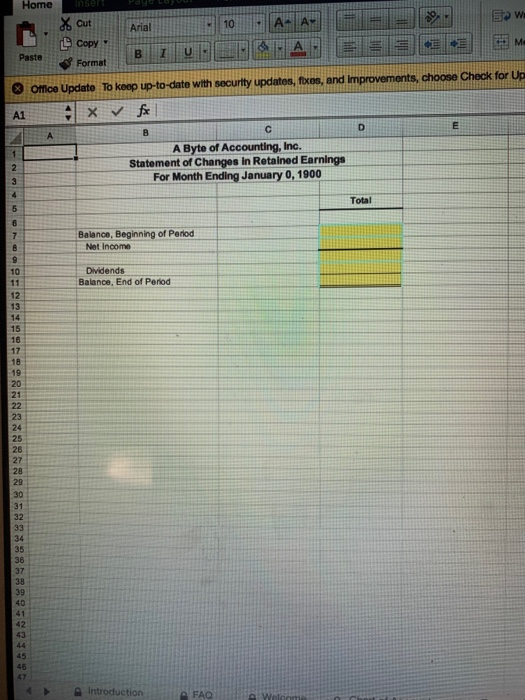

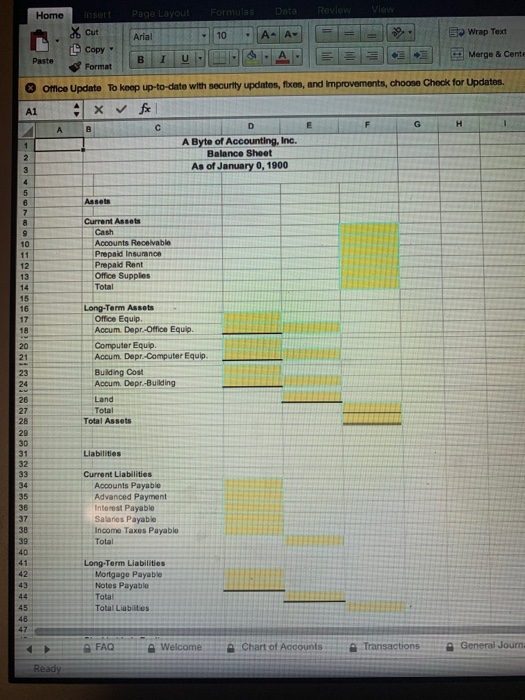

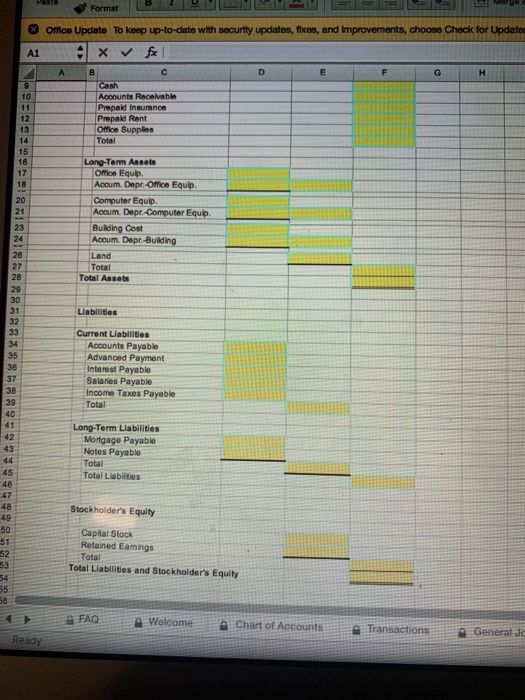

Cut At AY Copy A Paste Me I Format Office Update To keep up-to-date with security updates, fixes, and Improvements, choose Check for Up 013 AX B E A C F G H J 21 22 Welcome to the worlds first ePractice case, an individualized, internet generated and graded case study that focuses on the analytically portion of the accounting cycle while automating the repetitive posting cycle. 23 NOTE: If the program is not working e-mail markfriedman@miami.edu, 305.284.6296 24 25 Steo 1-The Chart of Ac0ounts 26 The chart of accounts includes all of the accounts that you can use to solve your case. You may want to print the chart of accounts and use It as an easy reference guide. 27 28 Step II-Joumalzing the Transactions. 29 Using your unique transactions record the coresponding general journal entry, rounding to two decimal places. 30 For example, 31 01 June 1: Joseph made an investment in Byte of Accounting, Inc. by purchasing 2,000 shares of its common stock for $40,000 cash. The par value of the common stock was $20 per share. 32 33 In the date field enter the date of the transaction. If you do not enter a date value an error message will appear 34 35 Name Description Date 36 37 01 Jun 01 38 39 40 41 42 In the account field enter the account number that coresponds to the account in the chart of accounts 43 You can also use the put down list to find the appropriate account number. If you use a number that 44 is not on the chart of accounts an error message will appear 45 46 Date Name Description Account 47 48 Jun 013 01 1110 Cash 49 50 51 52 53 The name of the apcount will automaticaly appear n tho nama column. If t is the wrong 54 account renter the comect account number Introduction FAC Welcome Chart of Accounts Tran Transaction Account Transaction Debit Credit Debit Credit Cut 9 Copy Paste A Format Merge Office Update To keep up-to-date with security updates, fbxes, and Improvements, choose Check for Updat: 013 A C D G H. 56 Enter the desoription in the desoription field. 57 58 Date Name Description Account Debit 59 60 01 Jun 01 1110 Cash Joneph's invemare 61 62 63 64 65 66 67 Enter the amount in the debit field. 68 69 Name Description 70 Transaction #1 Not in Balance by $40,000 71 01 Jun 01 1110 Cash Janechs invesiman 40,000.00 72 73 74 75 76 Enter the second account number. 77 78 Date Name Description 79 Transaction #1Not in Balance by $40,000 80 01 Jun 01 1110 Cah Josahs invesrean 3100 Cata Sock Jasephs inves 81 40,000.00 82 83 84 85 Enter the amount in the credit field. 86 sction Introduction FAQ Welcome Chart of Accounts Ready Transactic Transaction Transaction Date Account Credit Transaction Account Debit Credit Debit Credit AT899 Home insert Page Layout Formulas Data Review View Cut A- 5Wrap Text Copy Paste Format Merge & Cente Office Update To keep up-to-date with security updates, fxes, and Improvements, choose Check for Updates. 013 X A C E G H J K 85 Enter the amount in the credt fienid. 86 Transactions 87 Date Name Account Description 88 Debit Credit 89 01 Jun 01 1110 Cash Joseph's investment 3100 Cap Sock Josphs invesimant 40.000.00 90 40,000.00 91 92 93 94 Step Il-Worksheet Although not graded, you need to complete the Worksheet. If each of your jounal entries are in balance then your 95 Unadjusted Tral Balance and the Adjusting Entry columns will be in balance. Your Adjusted Trial Balance wil balance when you place each of the account balances into the corect debit or credit postion in the Adjusted Trial Balance section of the 96 Worksheet, Then cooy each of the account balances to their appopate location in the Income statement or Balance Sheet 97 0olumns of your worksheet. If the net income balance both the Income Statment and the Balance Sheet then your worksheet s completed. 98 A J K 2 4 5 Account Income Statement 7 Number Name 44 Balance Sheet Debit Debit Credit Credit 45 46 47 TOTAL NET INCOME 400 00 1000 00 60,000 00 48 59 400 00 600 00 49 600.00 60 000 00 1.000 00 1000 0060 000 00 cn 99 100 Step IV- Prepare the Financial Statements 101 Ater you have entered all of the transactions and prepared the Worksheet, you are to prepare the Income Statement, Shareholder's Equity Statement and Balance Sheet using the forms provided 102 w Step V-Prepare the Closing Entries. 101 Based upon the informalion from your Worksheet or from your Financial Statements, propare the clos ng entries 104 Step VI-Upioad the Fie Introduction FAO Welcome Chart of Accounts Transactions Readhe AT8 Review View Page Layout Data Formulas Home Insert Cut S Wrap Text A- A re Copy Merge & Cent E U Paste Format Office Update To keep up-to-date with security updates, fixes, and Improvements, choose Check for Updates. fx Number A1 H G E B A Nomal Balance Number Namer 1110 Cash 1120 Accounts Recelvabler 1130 Pepaid Insurancer 1140 Prepaid Rent 1150 Office Supples 1 Debit Debit Debit 2 3 Debi Debt Debib 5 1211 Office Equip. 1212 Accum. Depr.-Office Equip. 1311 Computer Equip. 1312 Accum. Depr-Computer Equip. 1411 Bulding Cost 1412 Accum. Depr.-Bulding 1510 Land 2101 Accounts Payable 2102 Advanced Payments 2103 Interest Payable 2105 Salaries Payable 2106 Income Taxes Payable 2201 Mortgage Payable 2202 Notes Payable Cndit Debit Credit Debit. Credit Debit Credt 10 11 12 13 14 Credit Credit Credit 15 16 17 Credit Credit 18 19 Credt Credt Credit 20 3100 Captal Stock 3200 Retained Eamings 21 22 Debit Credit Credit Debi 23 3300 Dividends 3400 Income Summary 4100 Computer & Consuting Revenue 5010 Rent Expense 5020 Salary Expense 5030 Advertising Expense 5040 Repairs & Maint. Expense 5050 Ol & Gas Expense 5080 Supplies Expense 5090 Interest Expenser 5100 Insurance Expenser 5110 Depreciation Expense 5120 Income Tax Expense 24 25 26 Debit 27 Debit Debit 28 29 Debit 30 Debi 31 Debit 32 Debit 33 34 35 Debit Debit 36 37 38 39 40 41 42 43 44 45 46 47 48 49 Welcome A Transactions A Chart of Accounts A Introduction A FAQ Ready AT8993.xls (Compatibility Me Home Insert Page Layout Formulas Data Review View X Cut o Wrap Text DCopy Paste U. E A Merge & Center Format Office Update To keep up-to-date with security updates, fixen, and Improvements, choose Check for Updates. C20 X A C E Byte of Accounting, Inc. Abbigail Tumey 9272 Transaction Description of transaction June 1: Byse of Accounting, Inc. acquired $98,600 in canh from Lauryn and issased 3,400 shares of its common stock 01. June 1: Byte of Accounting, Inc. issued 2,550 shares of its common stock to Abbigail Tumey afher 530,740 in cash and computer equipment with a fair market value of $43,210 wre received 02 7 June 1: Byte of Accounting, Inc. issued 2,393 shares of is common stock after acquiring from Courtney $56,550 in cash, computer equipment with a fair market value ofS12,180 and office equipment with a fair value of $667 03. 10 June 2: A down payment of $29,000 in cash was made on additional computer equipment that was 04 purchased for S145,000. A five-year note was executed by Byte for the balance 11 12 June 4: Additional office equipment costing $400 was purchased on credit from Discount Computer Corporation 05 13 14 June 8: Unsatisfactory office equipment costing 580 was returned to Discount Computer for credit to be 06 applied against the outstanding balance owed by Byte. 15 16 June 10: Byte paid 522,250 on the balance it owed on the June 2 purchase of computer equipment 07. 17 18 June 14: A one-year insurance policy covering its computer equipment was purchased by Byte for $5,304 in cash. The effective date of the policy was June 16. 08. 19 20 June 16: A check in the amount of $6,000 was received for consalting revenue. 21 09 22 June 16: Byte purchased a building and the land it is on for S125,000, to house its repair facilities and to- store computer equipment The lot on which the building is locased is valued at $20,000. The balance of the cost is to be allocated to the building. Byte made a cash down payment of S12.500 and executed a mortgage for the balance. The mortgage is payable in cight oqual annual installments beginning July 1 10. 23 4 A Introduction A FAQ A Welcome a Chart of Accounts A General Jounal A Transactions Ready acBook AT8993.xls (Compatibility Home Page Layout Insert Formulas Date Review View Cut A- A Wrap Text Copy Paste B U . Format Merge & Center- Ofce Update To keep up-to-date with securtty updates, fixes, and Improvements, choose Check for Updates. C20 f X Di P June 17: Cash of $3,200 was paid for rent for June and July, Put the total amount into the Prepaid Rent 11 25 accoumt 26 June 17: Received a bill of $325 from the local newspaper for advertising 12. 27 28 June 21: Accounts payable in the amount of $320 were paid 13 29 30 June 21: A fox machine for 14. 31 office was purchased for $850 cash. 32 15. June 21: Billed various miscellaneous local customers $4,700 for consulting services performed. 33 34 June 22: Paid salaries of $1,010 to equipment operators for the week ending June 18. 16. 35 36 June 22: Received a bill for S1,215 from Computer Parts and Repair Co. for repairs to the coputer equipment 17 37 38 June 22: Paid the advertising bill that was received on June 17 39 18. 40 June 23: Purchased office supplies for 5555 on credit. Record the purchase as an increase to the assets 19. 42 June 23: Cash in the amount of $3,765 was received on billings. 20. 43 44 June 28: Billed $6,120 to miscellaneous customers for services performed to June 25 21. 44 46 June 29: Paid the bill received on June 22, from Computer Parts and Repairs Co. 22 ET 48 June 29: Cash in the amount of $5,799 was received for billings 40 23. 50 June 29: Paid salaries of $1,010 to equipment operators for the week ending June 25. 24 55 June 30: 25. Received a bill for the amount of $790 from O & G Oil and Gas Co. 55 June 30: Paid a cash dividend of $0.23 per share to the three sharcholders of Byte. [IMPORTANT NOTE The number of shares of capital stock oustanding can be determined from the first three transactions. 26. 55 58 Adjusting Entries - Round to two decimal places. 57 Introduction Welcome FAQ Chart of Accounts A Transactions A General Journal Ready A Home Page Layout Insert Formulas Review Data View Cut Av Wrap Text Copy Paste B 1 U Merge & Center Format To keep up-to-date with security updates, fixes, and Improvements, choose Check for Updates Office Update 20 fe A C D Adjusting Entries- Round to two declmal places. The rent payment made on June 17 was for June and July. Expense the amount associated with one month's rent 27 A physical inventory showed that only $225.00 worth of office supplies remained on hand as of June 30. 28. 1 The annual interest rate on the mortgage payable was 7.75 percent. Interest expense for one-half month |should be computed because the building and land were purchased and the liability incurred on June 16. 29. Information relating to the prepaid insurance may be obtained from the transaction recorded on June 14. Expense the amount associated with one half month's insurance. 30. 5 6 A review of Byte's job worksheets show that there are unbilled revenues in the amount of $9,250 for the period of June 28-30, 31. 7 32 The fixed assets have estimated useful lives as follows: Building-31.5 years Computer Equipment-5.0 years Office Equipment-7.0 years Use the straight-line method of depreciation. Management has decided that assets purchased during a month are treated as if purchased on the first day of the month. The building's scrap value is $7,500. The office equipment has a scrap value of $400. The computer equipment has no scrap value. Calculate the depreciation for one month. 1 2 73 4 A review of the payroll records show that unpaid salaries in the amount of $606.00 are owed by Byte for three days, June 28-30. 33 5 The note payable relating to the June 2, and 10 transactions is a five-year note, with interest at the rate of 12 percent annually. Interest expense should be computed based on a 360 day year IMPORTANT NOTE: The original note on the computer equipment purchased on June 2 was SI16,000. On June 10, eight days later, $22,250 was repaid. Inserest expense must be 34 77 78 calculated on the S116,000 for eight days. In addition, interest expense on the 593,750 balance of the loan (S116,000 less $22,250- $93,750) must be calculated for the 20 days remaining in the month of June.] 79 Income taxes are to be computed at the rate of 25 percent of net income before taxes. 81 35 A Transactions A General Journal A FAQ A Chart of Accounts A Introduction A Welcome Ready fn AT8993.xls (Ce Home nsert Page Layout Formulas Data Review View Cut A- A- 5Wrap Text Copy Paste B L A Merge & Center - Format Office Update To keep up-to-date with security updates, flxes, and Improvements, choose Check for Updates. fx K32 XV A E H 1 A Byte of Accounting, Inc. General Joumal 2 Note: You can anly enter dats Inte the yellew ed cals Transaction Date Account Name Description Debit Credit 10 11 02 12 13 14 15 16 17 03 16 19 20 21 04 22 23 24 25 26 05 27 28 29 30 31 06 32 33 34 35 36 07 37 36 30 40 41 08 47 43 44 45 46 09 47 48 Introduction A FAQ A Welcome A Chart of Accounts Ready Transactions Ger Home B Copy BWrap Text Paster U Format Merge & Center Ofce Updlate To keep up-to-date with securtty updates, fbxes, and Improvenents, choose Check for Updates. K32 A C D H A Byte of Accounting, Inc. General Joumal Note: You can anly anter das inte the yeow d call 3 Transaction Dee Accout Name Description 81 Debit Credit 92 93 19 97 99 100 101 102 20 103 104 106 106 107 108 108 110 111 2 22 112 113 114 115 116 117 23 118 119 120 121 122 24 123 124 125 126 127 128 129 130 131 25 28 Introduction A FAQ A Welcome A Chart of Accounts Transactions Ready Genera Mac Home B Copy BWrap Text Paster U Format Merge & Center Ofce Updlate To keep up-to-date with securtty updates, fbxes, and Improvenents, choose Check for Updates. K32 A C D H A Byte of Accounting, Inc. General Joumal Note: You can anly anter das inte the yeow d call 3 Transaction Dee Accout Name Description 81 Debit Credit 92 93 19 97 99 100 101 102 20 103 104 106 106 107 108 108 110 111 2 22 112 113 114 115 116 117 23 118 119 120 121 122 24 123 124 125 126 127 128 129 130 131 25 28 Introduction A FAQ A Welcome A Chart of Accounts Transactions Ready Genera Mac AT8993xis (Compatib Review insert Pape ayout Home X Cut A- Ba Wrap Text 9 Copy - Merge & Center. Paste Format Office Update To keep up-to-date with securty updates, fxes, and Improvements, choose Check for Updateon f K32 E H A Byte of Accounting, Inc. General Joumal Note: Yau can enty enter dte into the yaow d calls. Transaction Date Deseriptions Account Name Debit Credit 131 132 133 134 135 136 137 138 139 140 27 141 28 142 143 144 145 146 29 147 148 149 150 151 30 152 153 154 155 156 157 158 159 160 161 31 32 162 163 164 165 166 167 168 169 170 171 33 34 A Introduction A FAQ A Welcome A Chart of Accounts A Transactions Gen Ready AT8993.xs (Compatibl Home o Wrap Text X Cut A- Copy Merge & Center - U. Paste Format Check for Updates. To keop up-to-date wth security updates, fixen, and Improvements, choose Ofce Update K32 D C A A Byte of Accounting, Inc. General Joumal Note: Yau gen enty eer dele into me vee ed cal Transaction Date- Namer Descripton Debit 171 172 34 173 174 175 35 176 177 178 179 180 181 36 182 183 184 185 186 37 187 188 190l 91 192 193 94 95 96 97 98 99 00 01 38 02 03 04 39 06 07 19 A Introduction A FAQ A Welcome Chart of Accounts Transactions Gen Ready Account Credit nAT8993.xds (Coms View Review Data Formulas Page Layout Insert Home Eo Wrap Text Av X Cut Merge & Center B Copy e A U Paste Format Office Update To keep up-to-date with security updates, fxos, and improvements, choose Chock for Updates. x f D12 G H. E C A Adjusted Trhal Balance Debil Adjusting Entries Deb Unadjusted Trial Baiance Debil Credt Account Number Name 1110 Cash 1120 Accounts Recevable 1130 Prepaid Insurance 1140 Prepaid Rent 1150 Office Supples 1211 Office Equip 1212 Accum Depr Office Equip 1311 Computer Equip. 1312 Accum. Depr.-Computer Equip. 1411 Bulding Cost 1412 Acoum Depr-Bulding 1510 Land 2101 Accounts Payable 2102 Advanced Payments. 2103 Interest Payable 2105 Salanes Payable- 2106 Income Taxes Payable 2201 Mortgage Payable 2202 Notes Payable 3100 Capital Stock 3200 Retained Eamings Credt Credt 10 11 12 13 14 15 16 17 18 10 20 21 22 23 2- 25 26 27 28 29 3300 Dividends 30 4100 Computer & Consulting Revenue 31 32 5010 Rent Expenser 5020 Salary Expenser 5030 Advertising Expense 5040 Repairs & Maint. Expense 5050 O & Gas Expense 5080 Supplies Expense 5090 Interest Expense 5100 Insurance Expenser 5110 Depreciation Expense 5120 Income Tax Expense 33 34 35 36 37 38 30 40 41 42 43 44 45 46 41 TOTAL 48 45 50 51 52 53 Introduction A FAQ A Welcome Chart of ACCounts A Transactions Ge Ready View Review Data Formulas Page Layout Insert Home So Wrap A- Av Cut 10 Arial Copy Merge A B Paste Format To keep up-to-date with security updates, fixes, and Improvements, choose Check for Updat Office Update f J14 G H Fi E D A A Byte of Accounting, Inc. Income Statement For Month Ending January 0, 1900 1 4 5 Revenues Computer & Consulting Revenue 7 10 Expenses Rent Expense Salary Expense Advertising Expense Repairs & Maint. Expense Ol& Gas Expense Supplies Expense 11 12 13 14 15 16 17 Interest Expense 18 Insurance Expense Depreciation Expense 19 20 Total 21 22 Net Income Before Tax 23 24 Income Tax Expense 25 26 Net Income After Tax 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 Home nser Wi A A Cut 10 Arial Copy Me A Paste Format To keep up-to-date with securty updates, foxes, and improvements, choose Check for Up Office Update fr X A1 F C B A A Byte of Accounting, Inc. Statement of Changes in Retained Earnings For Month Ending January 0, 1900 1 2 Total 5 Balance, Beginning of Period 7 Net Income 9 Dividends Balance, End of Period 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 Introduction FAO A Welcome View Revlew Page Layout Formulas Data Insert Home Wrap Text Cut A- A- Arial 10 B Copy . Merge & Cente R U Paste Format Ofice Update To keep up-to-date with security updates, fixes, and Improvements, choose Check for Updates. fr X A1 F G H D E C B A A Byte of Accounting, Inc. Balance Sheet 2 As of January 0, 1900 3 5 Assets Current Assets Cash Accounts Recelvable 10 Prepaid Insurance Prepaid Rent Office Supples Total 11 12 13 14 15 16 Long-Term Assets Office Equip. Accum. Depr-Office Equip. 17 18 Computer Equip. Accum. Depr.-Computer Equip. 20 21 Building Cost Accum. Depr-Building 23 24 Land 26 Total 27 28 Total Assets 29 30 31 Liabilities 32 33 Current Liabilities 34 Accounts Payable 35 Advanced Payment Interest Payable Salaries Payable Income Taxes Payable Total 36 37 38 39 40 41 Long-Term Liabilities Mortgage Payable Notes Payable Totat 42 43 44 45 Total Liabiltes 46 47 Transactions A General Journa A Welcome A Chart of Accounts FAO Ready Paste Bnd Marge Format Ofice Update To keep up-to-date with securty updates, fixes, and Improvements, choose Check for Updates X A1 B E A D G H Cash Accounts Recelvable Prepaid Insurance Prepaid Rent Office Supplies 10 11 12 13 Total 14. 15 16 Long-Term Assets Office Equip. Accum. Depr.-Office Equip. Computer Equip. Accum. Depr-Computer Equip. Building Cost Accum. Depr.-Building 17 18 20 21 23 24 26 Land Total 27 28 Total Assets 29 30 31 Liabilities 32 33 Current Liabllities Accounts Payable Advanced Payment Interest Payable Salaries Payable 34 35 36 37 38 Income Taxes Payable 39 Total 40 41 Long-Term Liabilities Mortgage Payable Notes Payable 42 43 44 Total 45 Total Liabilties 46 47 48 Stockholder's Equity 49 50 Capital Stock Retained Eamings 51 52 Total 53 Total Liabilities and Stockholder's Equity 54 55 6 FAQ A Welcome Chart of Accounts Transactions General Jc Ready

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started