my question has not been answered yet

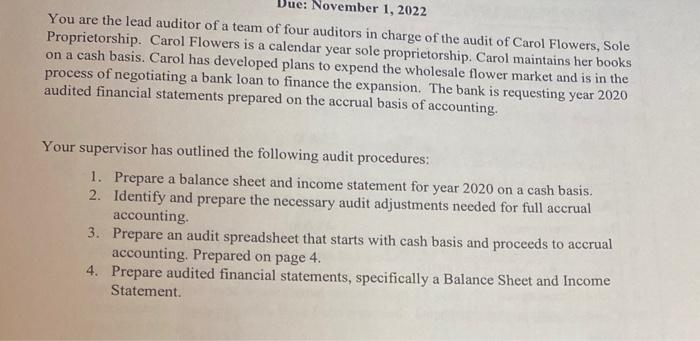

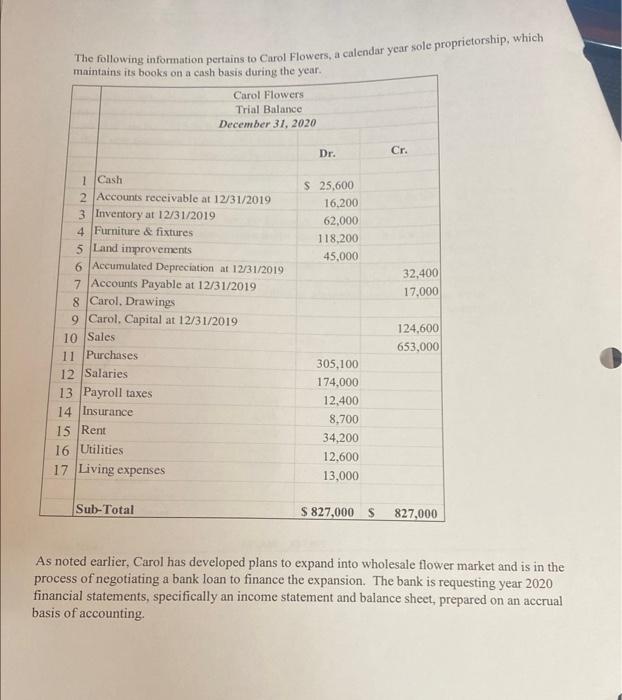

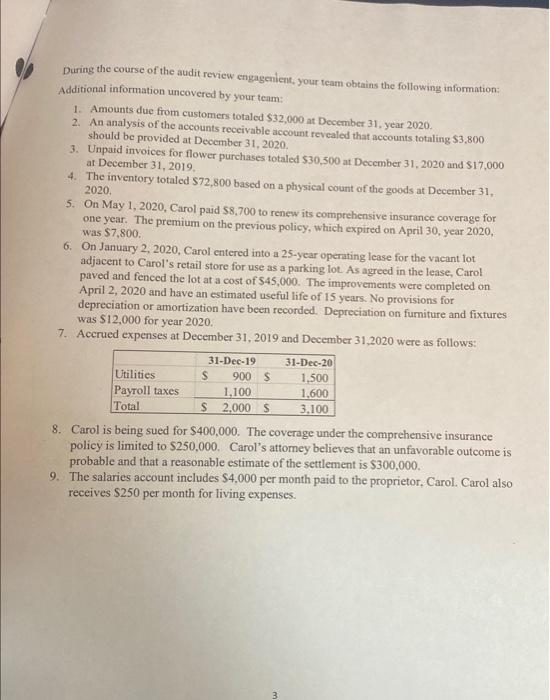

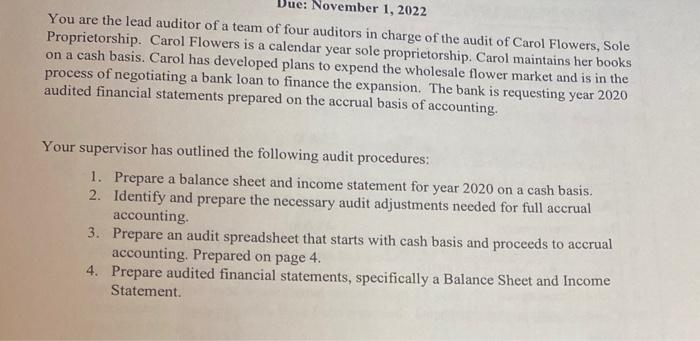

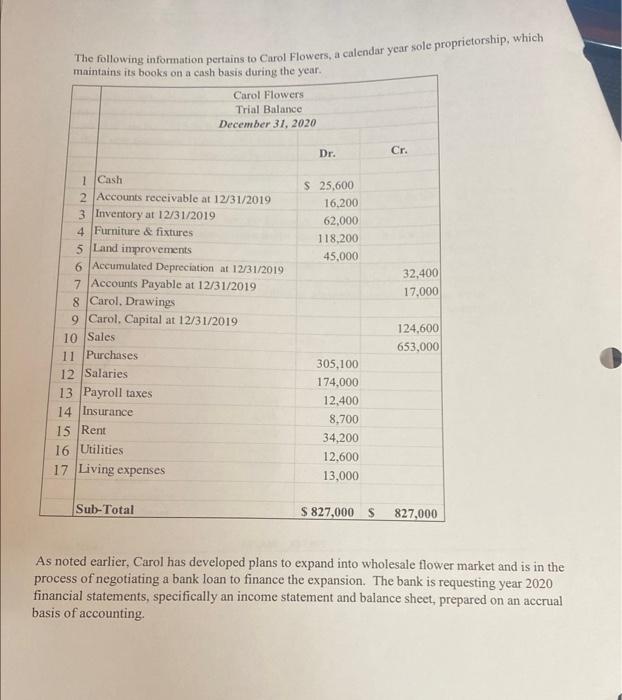

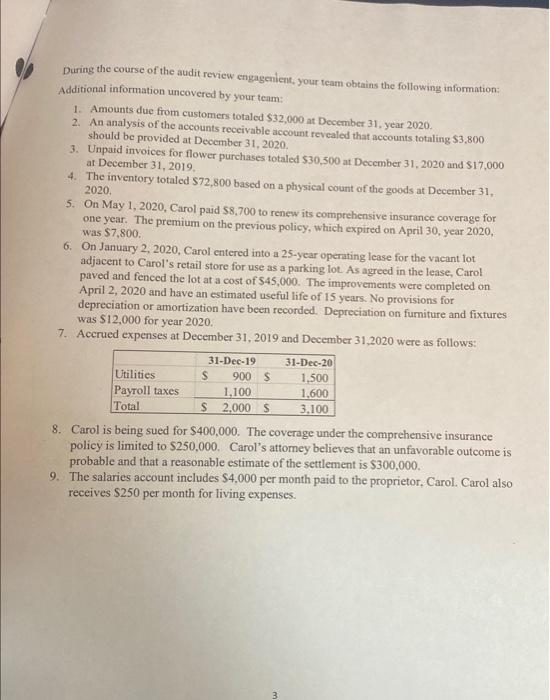

Dour auditors in charge of the audit of Carol Flowers, Sole You are the lead auditor of a team of four auditors in charge of the audit of Carol Flowers, Sole Proprietorship. Carol Flowers is a calcndar year sole proprictorship. Carol maintains her books process of negotiating a bank loan to finance the expansion. The bank is re tered the accounting. Your supervisor has outlined the following audit procedures: 1. Prepare a balance sheet and income statement for year 2020 on a cash basis. 2. Identify and prepare the necessary audit adjustments needed for full accrual accounting. 3. Prepare an audit spreadsheet that starts with cash basis and proceeds to accrual accounting. Prepared on page 4. 4. Prepare audited financial statements, specifically a Balance Sheet and Income Statement. The following information pertains to Carol Flowers, a calendar year sole proprietorship, which maintains its books on a cash basis during the year. As noted earlier, Carol has developed plans to expand into wholesale flower market and is in the process of negotiating a bank loan to finance the expansion. The bank is requesting year 2020 financial statements, specifically an income statement and balance sheet, prepared on an accrual basis of accounting. During the course of the audit review engagenient, your team obtains the following information: Additional information uncovered by your team: 1. Amounts due from customers totaled $32,000 at December 31 , year 2020 . 2. An analysis of the accounts receivable account revealed that accounts totaling $3,800 should be provided at December 31,2020 . 3. Unpaid invoices for flower purchases totaled $30,500 at December 31, 2020 and $17,000 at December 31, 2019. 4. The inventory totaled $72,800 based on a physical count of the goods at December 31 , 2020. 5. On May 1, 2020, Carol paid $8,700 to renew its comprehensive insurance coverage for one year. The premium on the previous policy, which expired on April 30, year 2020 , was $7,800. 6. On January 2, 2020, Carol entered into a 25-year operating lease for the vacant lot adjacent to Carol's retail store for use as a parking lot. As agreed in the lease, Carol paved and fenced the lot at a cost of $45,000. The improvements were completed on April 2, 2020 and have an estimated useful life of 15 years. No provisions for depreciation or amortization have been recorded. Depreciation on furniture and fixtures was $12,000 for year 2020 . 7. Acerued expenses at December 31, 2019 and December 31,2020 were as follows: 8. Carol is being sued for $400,000. The coverage under the comprehensive insurance policy is limited to $250,000. Carol's attomey believes that an unfavorable outcome is probable and that a reasonable estimate of the settlement is $300,000. 9. The salaries account includes $4,000 per month paid to the proprietor, Carol. Carol also receives $250 per month for living expenses. Dour auditors in charge of the audit of Carol Flowers, Sole You are the lead auditor of a team of four auditors in charge of the audit of Carol Flowers, Sole Proprietorship. Carol Flowers is a calcndar year sole proprictorship. Carol maintains her books process of negotiating a bank loan to finance the expansion. The bank is re tered the accounting. Your supervisor has outlined the following audit procedures: 1. Prepare a balance sheet and income statement for year 2020 on a cash basis. 2. Identify and prepare the necessary audit adjustments needed for full accrual accounting. 3. Prepare an audit spreadsheet that starts with cash basis and proceeds to accrual accounting. Prepared on page 4. 4. Prepare audited financial statements, specifically a Balance Sheet and Income Statement. The following information pertains to Carol Flowers, a calendar year sole proprietorship, which maintains its books on a cash basis during the year. As noted earlier, Carol has developed plans to expand into wholesale flower market and is in the process of negotiating a bank loan to finance the expansion. The bank is requesting year 2020 financial statements, specifically an income statement and balance sheet, prepared on an accrual basis of accounting. During the course of the audit review engagenient, your team obtains the following information: Additional information uncovered by your team: 1. Amounts due from customers totaled $32,000 at December 31 , year 2020 . 2. An analysis of the accounts receivable account revealed that accounts totaling $3,800 should be provided at December 31,2020 . 3. Unpaid invoices for flower purchases totaled $30,500 at December 31, 2020 and $17,000 at December 31, 2019. 4. The inventory totaled $72,800 based on a physical count of the goods at December 31 , 2020. 5. On May 1, 2020, Carol paid $8,700 to renew its comprehensive insurance coverage for one year. The premium on the previous policy, which expired on April 30, year 2020 , was $7,800. 6. On January 2, 2020, Carol entered into a 25-year operating lease for the vacant lot adjacent to Carol's retail store for use as a parking lot. As agreed in the lease, Carol paved and fenced the lot at a cost of $45,000. The improvements were completed on April 2, 2020 and have an estimated useful life of 15 years. No provisions for depreciation or amortization have been recorded. Depreciation on furniture and fixtures was $12,000 for year 2020 . 7. Acerued expenses at December 31, 2019 and December 31,2020 were as follows: 8. Carol is being sued for $400,000. The coverage under the comprehensive insurance policy is limited to $250,000. Carol's attomey believes that an unfavorable outcome is probable and that a reasonable estimate of the settlement is $300,000. 9. The salaries account includes $4,000 per month paid to the proprietor, Carol. Carol also receives $250 per month for living expenses