Question

My question is, how do you solve for the Discounted Cash Flows (how do you get 4.55, 8.26, etc) for both projects. Also, how do

My question is, how do you solve for the Discounted Cash Flows (how do you get 4.55, 8.26, etc) for both projects. Also, how do you find those NPVs?

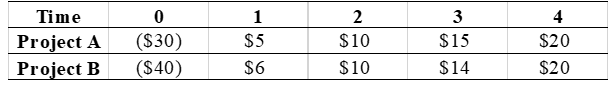

Your division is considering two projects. Your divisions WACC is 10%, and the projects' after-tax cash flows (in millions of dollars) would be as follows: (Time Period is in terms of years.)

Calculate the Discounted Payback Period of each project:

| Project A | |||||

| Time period: | 0 | 1 | 2 | 3 | 4 |

| Cash flow: | (30) | 5 | 10 | 15 | 20 |

| Discounted cash flow: | 4.55 | 8.26 | 11.27 | 13.66 | |

| Cumulative discounted cash flow: | -30 | -25.45 | -17.19 | -5.92 | -7.74 |

Discounted Payback Period of Project A = 3+5.9215/20 = 3.296 years

| Project B | |||||

| Time period: | 0 | 1 | 2 | 3 | 4 |

| Cash flow: | (40) | 6 | 10 | 14 | 20 |

| Discounted cash flow: | 5.45 | 8.26 | 10.52 | 13.66 | |

| Cumulative discounted cash flow: | -40 | -34.54 | -26.28 | -15.76 | -2.10 |

How should you interpret Project Bs cumulative discounted cash flow? (Hint: Remember the cumulative cash flow tells you how long time it takes for the project to recover the initial cost.)

After 4 years we are 2.10 million short, therefore project B cant recover

Using your financial calculator, calculate the NPV of each project:

NPVA = 7.74 NPVB =-2.10

0 Time Project A Project B $5 23 $10 $15 $10 $14 ($30) ($40) $20 $6 $20Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started