Answered step by step

Verified Expert Solution

Question

1 Approved Answer

my question is Q 3 , systematic vs unsystematic risk. Thank you ! - B 8% + (16% -82B = 16%/8% = 2.0 AVAND CRITICAL

my question is Q 3 , systematic vs unsystematic risk. Thank you !

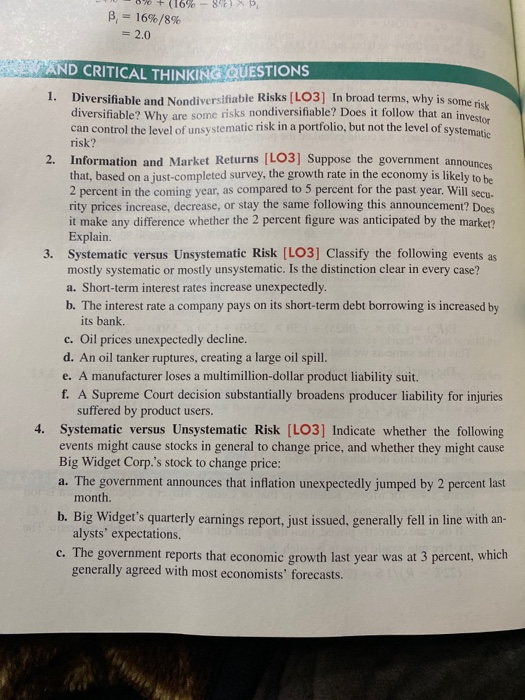

- B 8% + (16% -82B = 16%/8% = 2.0 AVAND CRITICAL THINKING QUESTIONS 1. Diversifiable and Nondiversifiable Risks (LO3] In broad terms, why is som diversifiable? Why are some risks nondiversifiable? Does it follow that an inye can control the level of unsystematic risk in a portfolio, but not the level of syster risk? 2. Information and Market Returns (L03) Suppose the government announce that, based on a just completed survey, the growth rate in the economy is likely to be 2 percent in the coming year, as compared to 5 percent for the past year. Will Secu. rity prices increase, decrease, or stay the same following this announcement? Does it make any difference whether the 2 percent figure was anticipated by the market? Explain. Systematic versus Unsystematic Risk (LO3] Classify the following events as mostly systematic or mostly unsystematic. Is the distinction clear in every case? a. Short-term interest rates increase unexpectedly. b. The interest rate a company pays on its short-term debt borrowing is increased by its bank. c. Oil prices unexpectedly decline. d. An oil tanker ruptures, creating a large oil spill. e. A manufacturer loses a multimillion-dollar product liability suit. f. A Supreme Court decision substantially broadens producer liability for injuries suffered by product users. Systematic versus Unsystematic Risk (LO3] Indicate whether the following events might cause stocks in general to change price, and whether they might cause Big Widget Corp.'s stock to change price: a. The government announces that inflation unexpectedly jumped by 2 percent last month. b. Big Widget's quarterly earnings report, just issued, generally fell in line with an alysts' expectations. c. The government reports that economic growth last year was at 3 percent, which generally agreed with most economists' forecasts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started