My question is Q 8 , cost of capital , parts b and c go on to another page , thank you !

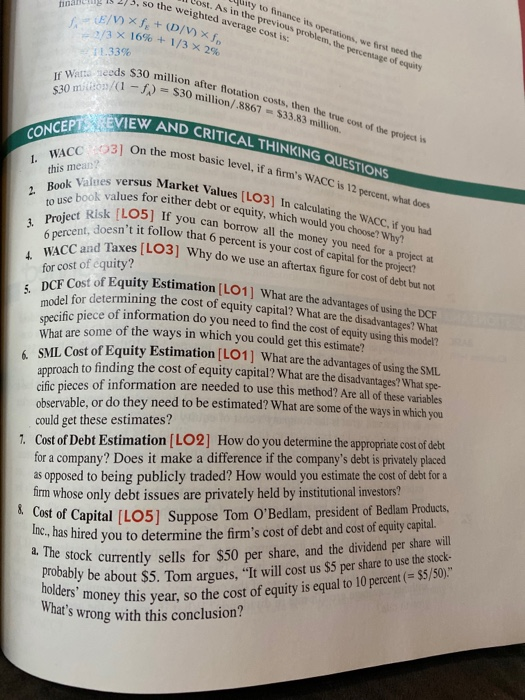

final 12) 5. so the weighted average cost is Luty lo tance is perw we vrst need the Dost. As in the previous problem, the percentage of equity 15 20 3. so EN XS+ (Din. 1/3 X 16% + 1/3 x 20 anxo L33% If War leeds $30. $30 miton/(1- 20 million after flotation costs, then the true cost of the rest is 11-f) 530 million/8867 - $33.83 million VIEW AND CRITICAL THINKING QUESTIONS CONCEPT EVIEW A 1. WACCO3] On the this mean? On the most basic level, if a firm's WACC is 12 percent, what does Book Values versus Market Vol. to use book values for either debt Market Values ILO3) In calculating the WACC, if you had for either debt or equity, which would you choose? Why? ILO5] If you can borrow all the money you need for a project at it follow that 6 percent is your cost of capital for the project! Taxes (LO3] Why do we use an aftertax figure for cost of debt but not 3. Project Risk (L05) 6 percent, doesn't it follow the 4 WACC and Taxes (LO31 for cost of equity? 5. DCF Cost of Equity Est model for determini fFquity Estimation (LO1] What are the advantages of using the DCF determining the cost of equity capital? What are the disadvantages? What ecific piece of information do you need to find the cost of equity What are some of the ways in which you could get this estimate? Cast of Equity Estimation [LO1] What are the advantages of usine the SML approach to finding the cost of equity capital? What are the disadvantage cific pieces of information are needed to use this method? Are all of these variables observable, or do they need to be estimated? What are some of the ways in which you 6 SML Cost of Equity Estimatie could get these estimates? 1. Cost of Debt Estimation (LO2] How do you determine the appropriate cost of debt for a company? Does it make a difference if the company's debt is privately placed as opposed to being publicly traded? How would you estimate the cost of debt for a firm whose only debt issues are privately held by institutional investors? Cost of Capital (LO5] Suppose Tom O'Bedlam, president of Bedlam Products, has hired you to determine the firm's cost of debt and cost of equity capital. ck currently sells for $50 per share, and the dividend per share will be about $5. Tom argues. "It will cost us $5 per share to use the stock- a. The stock currently sells probably be about $5. Tom holders' money this ye vey this year, so the cost of equity is equal to 10 percent (= $5/50)." What's wrong with this conclusion? PART 6 Cost of Capital and long-Term Financial Policy D. Based on the most recent financial statements, Bedlam Products total liability are 8 million. Total interest expense for the coming year will be about si mills Tom therefore reasons, "We owe $8 million, and we will pay $1 million interes Therefore, our cost of debt is obviously $1 million/8 million = 12.5%." What's wrong with this conclusion? c. Based on his own analysis, Tom is recommending that the company increase its use of equity financing because "Debt costs 12.5 percent, but equity costs only 10 percent; thus equity is cheaper." Ignoring all the other issues, what do you think about the conclusion that the cost of equity is less than the cost of debt? Company Risk versus Project Risk [LO5] Both Dow Chemical Company, a large natural gas user, and Superior Oil, a major natural gas producer, are thinking of in- vesting in natural gas wells near Houston. Both companies are all equity financed. Dow and Superior are looking at identical projects. They've analyzed their respective investments, which would involve a negative cash flow now and positive expected cash flows in the future. These cash flows would be the same for both firms. No debt would be used to finance the projects. Both companies estimate that their projects would have a net present value of $1 million at an 18 percent discount rate and a -$1.1 million NPV at a 22 percent discount rate. Dow has a beta of 1.25, whereas Superior has a beta of .75. The expected risk premium on the market is 8 percent and risk-free bonds are yielding 12 percent. Should either company proceed? Should both? Explain. Divisional Cost of Capital (LO5] Under what circumstances would it be appro priate for a firm to use different costs of capital for its different operating divisions? If the overall firm WACC were used as the hurdle rate for all divisions, would the riskier divisions or the more conservative divisions tend to get most of the investment projects? Why? If you were to try to estimate the appropriate cost of capital for dil ferent divisions, what problems might you encounter? What are two techniques you could use to develop a rough estimate for each division's cost of capital? 10. ROBLEMS connect FINANCE 1. Calculating Cost of Equity (LO1] The Absolute Zero Co. just issued a dividend of $3.40 per share on its common stock. The company is expected to maintain a con stant 4.5 percent growth rate in its dividende indefinitely If she can calle for $530