Answered step by step

Verified Expert Solution

Question

1 Approved Answer

My question is: Using the information provided, compute book income before taxes for Coastline. Please help Accounting for Income Tax Assignment The Coastline Corporation is

My question is: Using the information provided, compute book income before taxes for Coastline. Please help

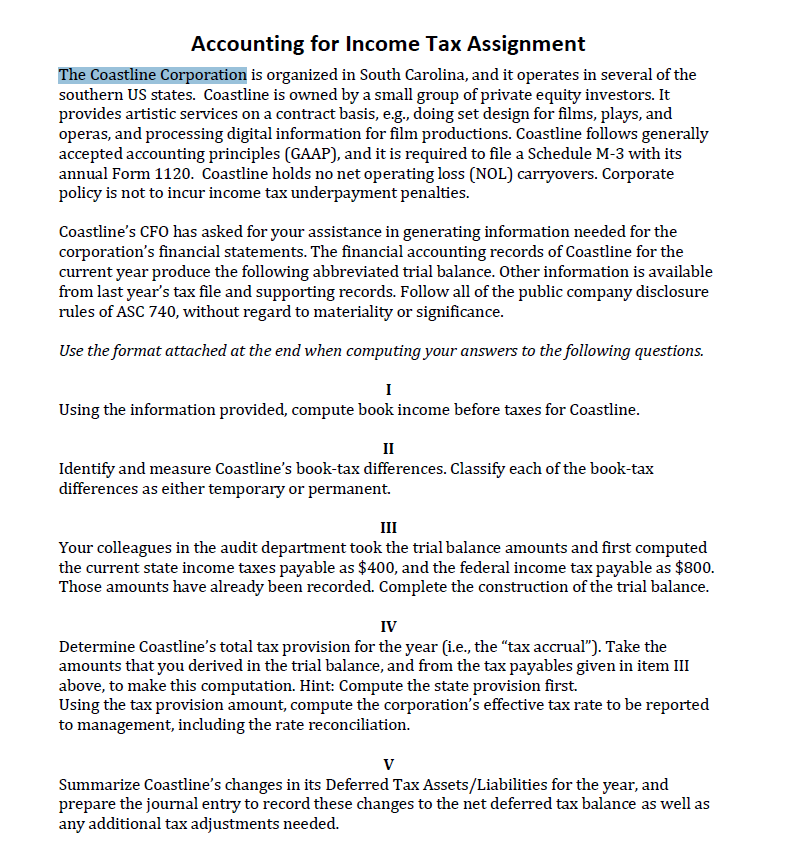

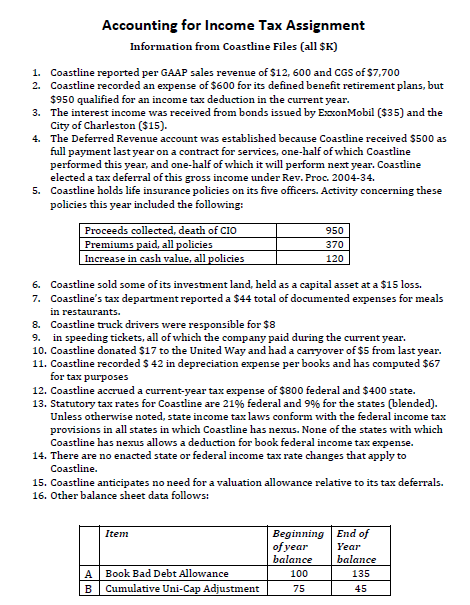

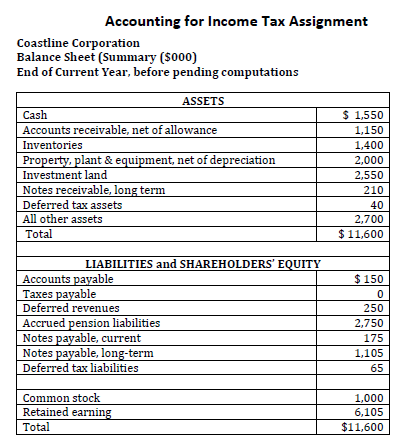

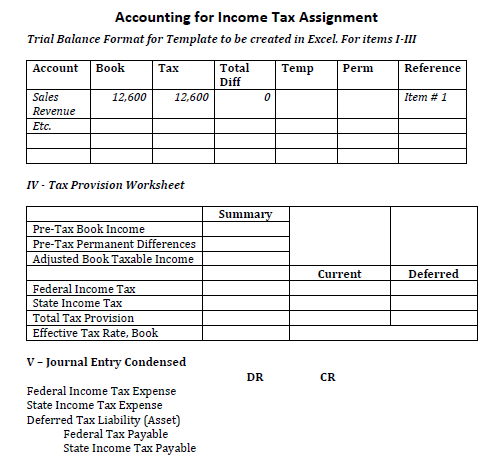

Accounting for Income Tax Assignment The Coastline Corporation is organized in South Carolina, and it operates in several of the southern US states. Coastline is owned by a small group of private equity investors. It provides artistic services on a contract basis, e.g., doing set design for films, plays, and operas, and processing digital information for film productions. Coastline follows generally accepted accounting principles (GAAP), and it is required to file a Schedule M-3 with its annual Form 1120. Coastline holds no net operating loss (NOL) carryovers. Corporate policy is not to incur income tax underpayment penalties. Coastline's CFO has asked for your assistance in generating information needed for the corporation's financial statements. The financial accounting records of Coastline for the current year produce the following abbreviated trial balance. Other information is available from last year's tax file and supporting records. Follow all of the public company disclosure rules of ASC 740, without regard to materiality or significance. Use the format attached at the end when computing your answers to the following questions. Using the information provided, compute book income before taxes for Coastline. Identify and measure Coastline's book-tax differences. Classify each of the book-tax differences as either temporary or permanent. III Your colleagues in the audit department took the trial balance amounts and first computed the current state income taxes payable as $400, and the federal income tax payable as $800. Those amounts have already been recorded. Complete the construction of the trial balance. IV Determine Coastline's total tax provision for the year (i.e., the "tax accrual"). Take the amounts that you derived in the trial balance, and from the tax payables given in item III above, to make this computation. Hint: Compute the state provision first. Using the tax provision amount, compute the corporation's effective tax rate to be reported to management, including the rate reconciliation. V Summarize Coastline's changes in its Deferred Tax Assets/Liabilities for the year, and prepare the journal entry to record these changes to the net deferred tax balance as well as any additional tax adjustments needed. Accounting for Income Tax Assignment Information from Coastline Files (all $K) 1. Coastline reported per GAAP sales revenue of $12,600 and CGS of $7,700 2. Coastline recorded an expense of $600 for its defined benefit retirement plans, but $950 qualified for an income tax deduction in the current year. 3. The interest income was received from bonds issued by ExxonMobil (\$35) and the City of Charleston ($15). 4. The Deferred Revenue account was established because Coastline received $500 as full payment last year on a contract for services, one-half of which Coastline performed this year, and one-half of which it will perform next year. Coastline elected a tax deferral of this gross income under Rev. Proc. 2004-34. 5. Coastline holds life insurance policies on its five officers. Activity concerning these policies this year included the following: 6. Coastline sold some of its investment land, held as a capital asset at a $15 loss. 7. Coastline's tax department reported a $44 total of documented expenses for meals in restaurants. 8. Coastline truck drivers were responsible for $8 9. in speeding tickets, all of which the company paid during the current year. 10. Coastline donated $17 to the United Way and had a carryover of $5 from last year. 11. Coastline recorded $42 in depreciation expense per books and has computed $67 for tax purposes 12. Coastline accrued a current-year tax expense of $800 federal and $400 state. 13. Statutory tax rates for Coastline are 21% federal and 9% for the states (blended). Unless otherwise noted, state income tax laws conform with the federal income tax provisions in all states in which Coastline has nexus. None of the states with which Coastline has nexus allows a deduction for book federal income tax expense. 14. There are no enacted state or federal income tax rate changes that apply to Coastline. 15. Coastline anticipates no need for a valuation allowance relative to its tax deferrals. 16. Other balance sheet data follows: Accounting for Income Tax Assignment Coastline Corporation Ralance Sheet (Summarv ($000) Accounting for Income Tax Assignment Trial Balance Format for Template to be created in Excel. For items I-III IV - Tax Provision Worksheet Accounting for Income Tax Assignment The Coastline Corporation is organized in South Carolina, and it operates in several of the southern US states. Coastline is owned by a small group of private equity investors. It provides artistic services on a contract basis, e.g., doing set design for films, plays, and operas, and processing digital information for film productions. Coastline follows generally accepted accounting principles (GAAP), and it is required to file a Schedule M-3 with its annual Form 1120. Coastline holds no net operating loss (NOL) carryovers. Corporate policy is not to incur income tax underpayment penalties. Coastline's CFO has asked for your assistance in generating information needed for the corporation's financial statements. The financial accounting records of Coastline for the current year produce the following abbreviated trial balance. Other information is available from last year's tax file and supporting records. Follow all of the public company disclosure rules of ASC 740, without regard to materiality or significance. Use the format attached at the end when computing your answers to the following questions. Using the information provided, compute book income before taxes for Coastline. Identify and measure Coastline's book-tax differences. Classify each of the book-tax differences as either temporary or permanent. III Your colleagues in the audit department took the trial balance amounts and first computed the current state income taxes payable as $400, and the federal income tax payable as $800. Those amounts have already been recorded. Complete the construction of the trial balance. IV Determine Coastline's total tax provision for the year (i.e., the "tax accrual"). Take the amounts that you derived in the trial balance, and from the tax payables given in item III above, to make this computation. Hint: Compute the state provision first. Using the tax provision amount, compute the corporation's effective tax rate to be reported to management, including the rate reconciliation. V Summarize Coastline's changes in its Deferred Tax Assets/Liabilities for the year, and prepare the journal entry to record these changes to the net deferred tax balance as well as any additional tax adjustments needed. Accounting for Income Tax Assignment Information from Coastline Files (all $K) 1. Coastline reported per GAAP sales revenue of $12,600 and CGS of $7,700 2. Coastline recorded an expense of $600 for its defined benefit retirement plans, but $950 qualified for an income tax deduction in the current year. 3. The interest income was received from bonds issued by ExxonMobil (\$35) and the City of Charleston ($15). 4. The Deferred Revenue account was established because Coastline received $500 as full payment last year on a contract for services, one-half of which Coastline performed this year, and one-half of which it will perform next year. Coastline elected a tax deferral of this gross income under Rev. Proc. 2004-34. 5. Coastline holds life insurance policies on its five officers. Activity concerning these policies this year included the following: 6. Coastline sold some of its investment land, held as a capital asset at a $15 loss. 7. Coastline's tax department reported a $44 total of documented expenses for meals in restaurants. 8. Coastline truck drivers were responsible for $8 9. in speeding tickets, all of which the company paid during the current year. 10. Coastline donated $17 to the United Way and had a carryover of $5 from last year. 11. Coastline recorded $42 in depreciation expense per books and has computed $67 for tax purposes 12. Coastline accrued a current-year tax expense of $800 federal and $400 state. 13. Statutory tax rates for Coastline are 21% federal and 9% for the states (blended). Unless otherwise noted, state income tax laws conform with the federal income tax provisions in all states in which Coastline has nexus. None of the states with which Coastline has nexus allows a deduction for book federal income tax expense. 14. There are no enacted state or federal income tax rate changes that apply to Coastline. 15. Coastline anticipates no need for a valuation allowance relative to its tax deferrals. 16. Other balance sheet data follows: Accounting for Income Tax Assignment Coastline Corporation Ralance Sheet (Summarv ($000) Accounting for Income Tax Assignment Trial Balance Format for Template to be created in Excel. For items I-III IV - Tax Provision WorksheetStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started