my question is: Will he have to pay more taxes or he would get a taxes refund? if you could show your work that would be great

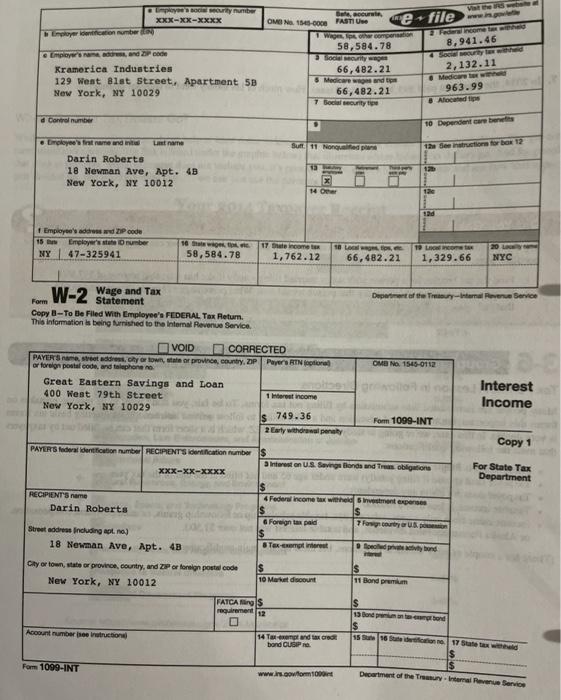

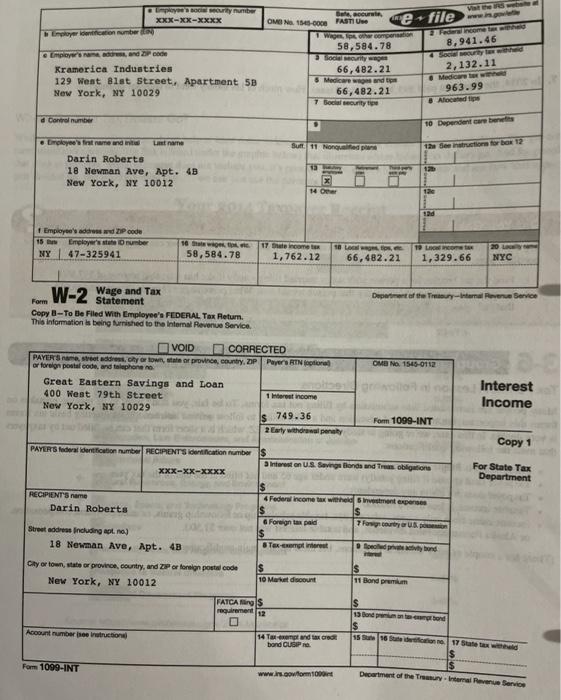

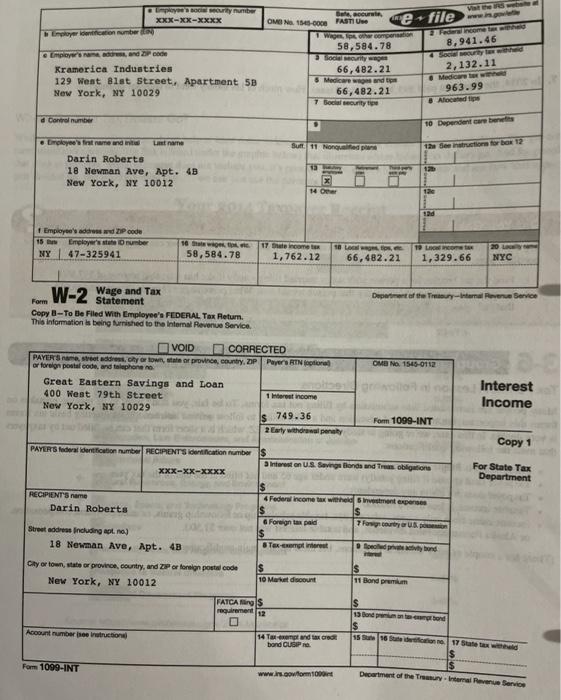

pley's Bumber XXX-XX-XXXX per conub mondor Code Kramerica Industries 129 Went Blat Street, Apartment 5B New York, NY 10029 O, CUIR OMG N10-000 PASTI we file War con 58,584.78 8,941.46 red 66,482.21 2,132.11 6 Medicare and Medicaret 66,482.21 963.99 7 Bocurity Alicante Control number 10 Dependent care benetes SUR 11 Monde the Senatructions for box 12 Employee's first name and tar Darin Roberts 18 Newman Ave, Apt. 48 New York, NY 10012 14 Omer Employees addPcode 15 Employer's trumber NY 47-325941 Lao 10 that 58,584.78 17 income 1,762.12 66,482.21 1,329.66 20 NYC Form W-2 Wage and Tax Department of the Truyamal Revenue Service Statement Copy B-To Be Filed With Employee's FEDERAL Tax Retur. This information is being furnished to the Internal Revenue Service OMO NO 1545-0112 VOID E CORRECTED PAYERS, retro, oy or town, or province, county ZP Payer RTN or foreign postal code and telephone Great Eastern Savings and Loan 400 West 79th Street 1 Interest income New York, NY 10029 749.36 2 Early withdrawal penal Interest Income Form 1099-INT Copy 1 PAYERS federal identification number RECIPIENTS identification sumber $ Interest on U.S. Savings Bonds and Tras obligations xxx-xx-xxxx For State Tax Department RECIPIENT'S name Darin Roberts Federal income tax with ment expenses Is Foreign tax paid 7 Forway USD $ Tex-centret edband Street address including at. ) 18 Newman Ave, Apt. 4B City or town, als or province, country, and ZIP or foreign postal code IS New York, NY 10012 10 Market discount FATCA ings IS 11 Blond premium regend 12 $ 19 Bonde bond Account number second 14 Tax-exempt dk cred bond CUP 15 16 17 Form 1099-INT www.coform1000 Dement of the Tyre Service pley's Bumber XXX-XX-XXXX per conub mondor Code Kramerica Industries 129 Went Blat Street, Apartment 5B New York, NY 10029 O, CUIR OMG N10-000 PASTI we file War con 58,584.78 8,941.46 red 66,482.21 2,132.11 6 Medicare and Medicaret 66,482.21 963.99 7 Bocurity Alicante Control number 10 Dependent care benetes SUR 11 Monde the Senatructions for box 12 Employee's first name and tar Darin Roberts 18 Newman Ave, Apt. 48 New York, NY 10012 14 Omer Employees addPcode 15 Employer's trumber NY 47-325941 Lao 10 that 58,584.78 17 income 1,762.12 66,482.21 1,329.66 20 NYC Form W-2 Wage and Tax Department of the Truyamal Revenue Service Statement Copy B-To Be Filed With Employee's FEDERAL Tax Retur. This information is being furnished to the Internal Revenue Service OMO NO 1545-0112 VOID E CORRECTED PAYERS, retro, oy or town, or province, county ZP Payer RTN or foreign postal code and telephone Great Eastern Savings and Loan 400 West 79th Street 1 Interest income New York, NY 10029 749.36 2 Early withdrawal penal Interest Income Form 1099-INT Copy 1 PAYERS federal identification number RECIPIENTS identification sumber $ Interest on U.S. Savings Bonds and Tras obligations xxx-xx-xxxx For State Tax Department RECIPIENT'S name Darin Roberts Federal income tax with ment expenses Is Foreign tax paid 7 Forway USD $ Tex-centret edband Street address including at. ) 18 Newman Ave, Apt. 4B City or town, als or province, country, and ZIP or foreign postal code IS New York, NY 10012 10 Market discount FATCA ings IS 11 Blond premium regend 12 $ 19 Bonde bond Account number second 14 Tax-exempt dk cred bond CUP 15 16 17 Form 1099-INT www.coform1000 Dement of the Tyre Service