Question

My question must be answered by column 8 and I need help with how to get the formulas. For this project, you will prepare a

My question must be answered by column 8 and I need help with how to get the formulas.

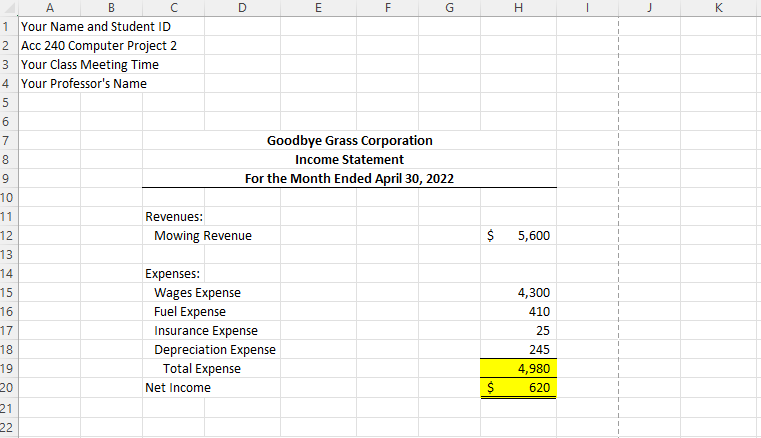

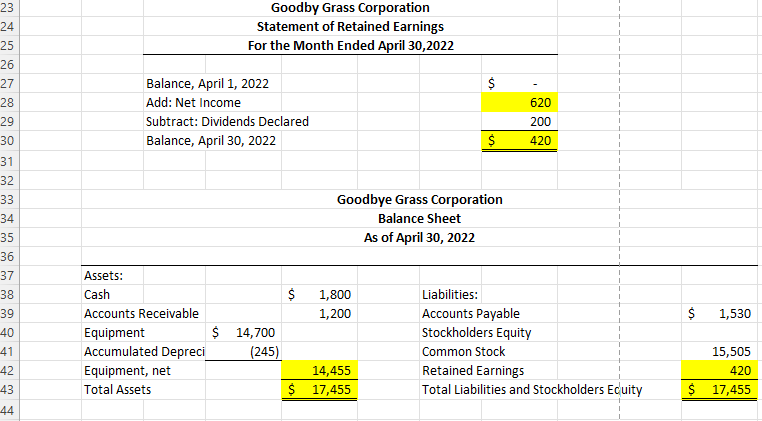

For this project, you will prepare a spreadsheet using MS Excel. Your spreadsheet will include an income statement, a statement of retained earnings, and a balance sheet.

Set up your spreadsheet like the one shown on the next page. For the cells shaded in yellow, you must use formulas to enter data. Do not type data in the shaded areas.

Save your work using the filename YourName ACC240 Computer Project 2. Remember, save and save often - every 15 minutes is a good guideline.

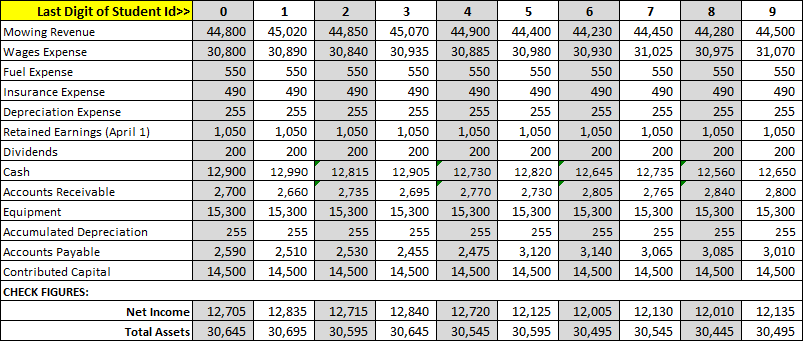

After you finish setting up your spreadsheet, change the numbers in your corresponding spreadsheet to the last digit of your student ID as shown below. Assume that all accounts have their normal debit/credit balance. Do not type in the check figures for net income or total assets. Those amounts are for you to check the accuracy of your formulas.

NOTE: Change Contributed Capital to Common Stock.

Set up your spreadsheet like the one on the next page. You must use formulas in the yellow cells. Do not type data directly into the yellow cells. Also, you do not need to put the yellow highlighting in the cells.

1

2

My question must be answered by column 8 and I need help with how to get the formulas.

\begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline Last Digit of Student Id & 0 & 1 & 2 & 3 & 4 & 5 & 6 & 7 & 8 & 9 \\ \hline Mowing Revenue & 44,800 & 45,020 & 44,850 & 45,070 & 44,900 & 44,400 & 44,230 & 44,450 & 44,280 & 44,500 \\ \hline Wages Expense & 30,800 & 30,890 & 30,840 & 30,935 & 30,885 & 30,980 & 30,930 & 31,025 & 30,975 & 31,070 \\ \hline Fuel Expense & 550 & 550 & 550 & 550 & 550 & 550 & 550 & 550 & 550 & 550 \\ \hline Insurance Expense & 490 & 490 & 490 & 490 & 490 & 490 & 490 & 490 & 490 & 490 \\ \hline Depreciation Expense & 255 & 255 & 255 & 255 & 255 & 255 & 255 & 255 & 255 & 255 \\ \hline Retained Earnings (April 1) & 1,050 & 1,050 & 1,050 & 1,050 & 1,050 & 1,050 & 1,050 & 1,050 & 1,050 & 1,050 \\ \hline Dividends & 200 & 200 & 200 & 200 & 200 & 200 & 200 & 200 & 200 & 200 \\ \hline Cash & 12,900 & 12,990 & 12,815 & 12,905 & 12,730 & 12,820 & 12,645 & 12,735 & 12,560 & 12,650 \\ \hline Accounts Receivable & 2,700 & 2,660 & 2,735 & 2,695 & 2,770 & 2,730 & 2,805 & 2,765 & 2,840 & 2,800 \\ \hline Equipment & 15,300 & 15,300 & 15,300 & 15,300 & 15,300 & 15,300 & 15,300 & 15,300 & 15,300 & 15,300 \\ \hline Accumulated Depreciation & 255 & 255 & 255 & 255 & 255 & 255 & 255 & 255 & 255 & 255 \\ \hline Accounts Payable & 2,590 & 2,510 & 2,530 & 2,455 & 2,475 & 3,120 & 3,140 & 3,065 & 3,085 & 3,010 \\ \hline Contributed Capital & 14,500 & 14,500 & 14,500 & 14,500 & 14,500 & 14,500 & 14,500 & 14,500 & 14,500 & 14,500 \\ \hline \end{tabular} CHECK FIGURES: \begin{tabular}{c|r|r|r|r|r|r|r|r|r|r} \hline Net Income & 12,705 & 12,835 & 12,715 & 12,840 & 12,720 & 12,125 & 12,005 & 12,130 & 12,010 & 12,135 \\ \hline Total Assets & 30,645 & 30,695 & 30,595 & 30,645 & 30,545 & 30,595 & 30,495 & 30,545 & 30,445 & 30,495 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started