Answered step by step

Verified Expert Solution

Question

1 Approved Answer

my question posted, i believe expert did it wrong. wouldn't it be to the power of ^6 not ^7 since we want stock price in

my question posted, i believe expert did it wrong. wouldn't it be to the power of ^6 not ^7 since we want stock price in year 6?

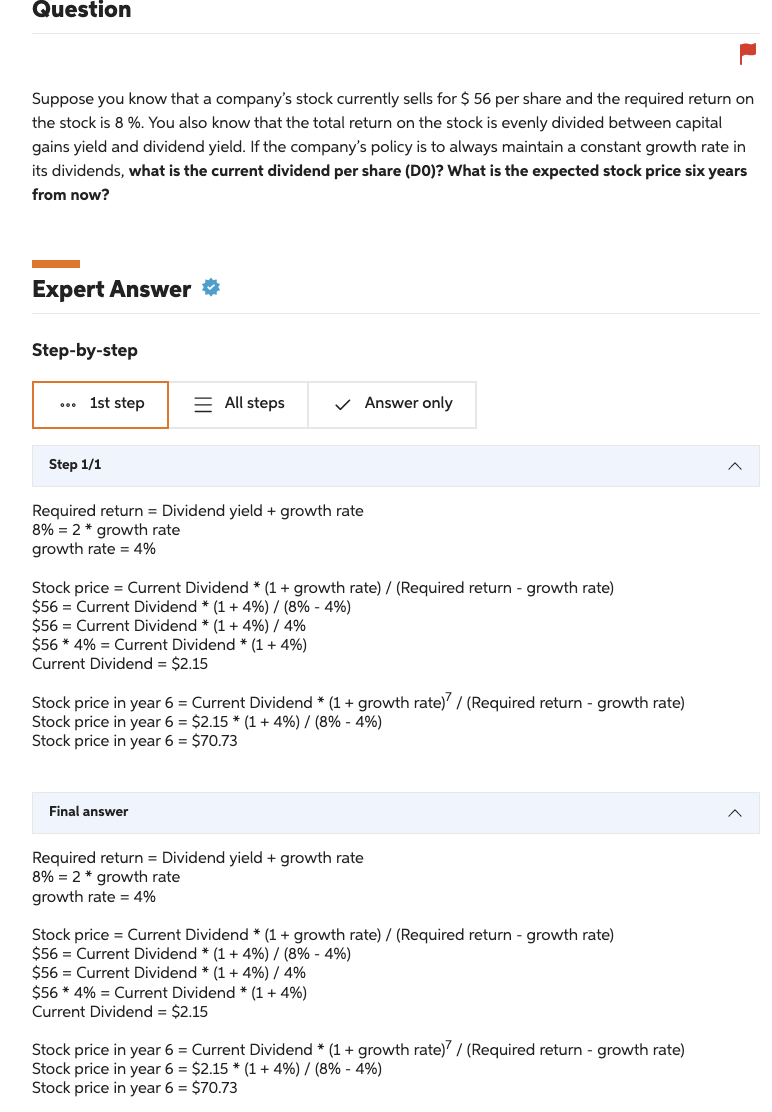

Suppose you know that a company's stock currently sells for $56 per share and the required return on the stock is 8%. You also know that the total return on the stock is evenly divided betwen gains yield and dividend yield. If the company's policy is to always maintain a constant growth rate in its dividends, what is the current dividend per share (DO)? What is the expected stock price six years from now? Expert Answer Step-by-step Step 1/1 Required return = Dividend yield + growth rate 8%=2 growth rate growth rate =4% Stock price = Current Dividend * (1+ growth rate )/ (Required return growth rate ) $56= Current Dividend * (1+4%)/(8%4%) $56= Current Dividend * (1+4%)/4% $564%= Current Dividend * (1+4%) Current Dividend =$2.15 Stock price in year 6= Current Dividend * (1+growthrate)7/ (Required return - growth rate) Stock price in year 6=$2.15(1+4%)/(8%4%) Stock price in year 6=$70.73 Final answer Required return = Dividend yield + growth rate 8%=2 growth rate growth rate =4% Stock price = Current Dividend (1+ growth rate )/( Required return growth rate ) $56= Current Dividend * (1+4%)/(8%4%) $56= Current Dividend * (1+4%)/4% $564%= Current Dividend * (1+4%) Current Dividend =$2.15 Stock price in year 6= Current Dividend * (1+growthrate)7/ ( Required return growth rate ) Stock price in year 6=$2.15(1+4%)/(8%4%) Stock price in year 6=$70.73Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started