Answered step by step

Verified Expert Solution

Question

1 Approved Answer

My questions are: 1. what are the recommendations for appendix 3 ? 2. write executive summary for the case. MGMT 8500: 23W -capstone -V69 CASE

My questions are:

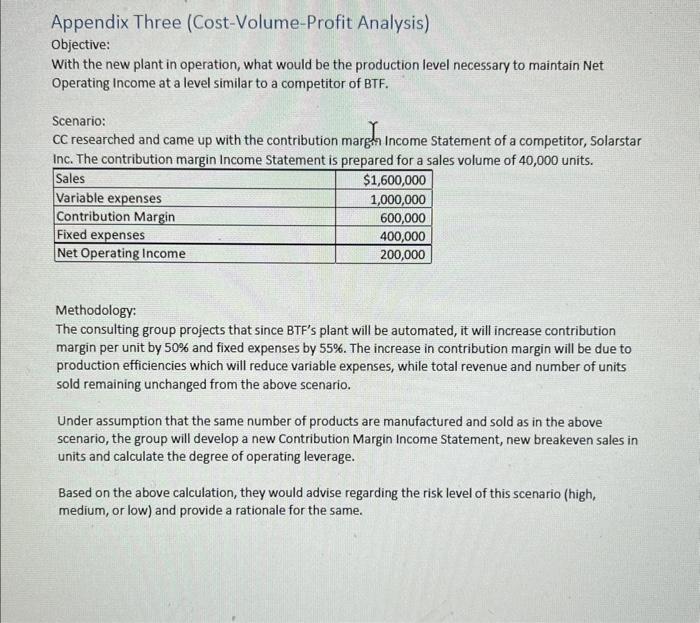

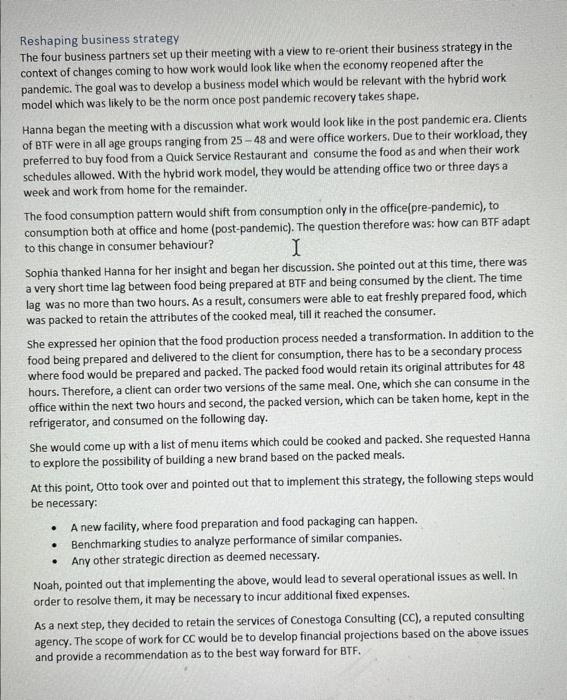

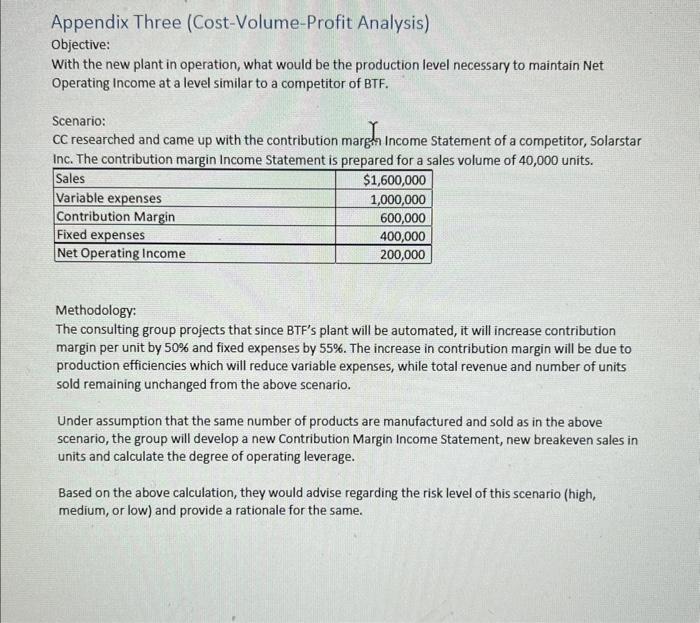

MGMT 8500: 23W -capstone -V69 CASE It was a regular working day in April'21, when four business partners gathered together for strategy session for their organization: Best Tasting Food (BTF). Background: BTF operated a chain of Quick Service Restaurants (QSR) in business localities in the GTA, Mississauga, Brampton, Oakville, Kitchener, Waterloo, and Cambridge. Their first outlet opened in 2007 in Vaughn and then continued to expand to other areas. BTF outlets offered food and beverages for takeout and delivery only. There was no dine-in option available. The rapid expansion of food delivery service Grovided a strong headwind for BTF. Since their outlets did not require a prominent location, the leasing costs were minimized. The above factors contributed to the success and growth of BTF until Covid struck in early 2020. Most of the revenue generated by BTF was from lunch items, afternoon snacks and early evening dinners consumed by clients working in their offices. With 90% of client working from home, the demand for such services almost disappeared overnight. BTF had to downsize its operations, close outlets, and lay off nearly 60% of its workforce. Positive news began to appear in April '21 with the arrival of vaccines in Canada. Both the Federal and Provincial governments expressed confidence of vaccinating a majority of the population by Fall'21 would allow restaurant businesses to function normally by November 21. About business partners Hannah Bauer (Hanna) is the Senior Vice President-Marketing. She spent over fifteen years with Fortune 500 companies in the Consumer-Packaged Goods sector. She developed multi-channel marketing strategies for BTF, which led to BTF being positioned as an agile, innovating enterprise. Sophia Jensen (Sophia) was the Corporate Chef of BTF. She spent nearly twenty years with leading hotel chains in Western Canada before taking on the current role in BTF. She displayed exemplary skills at developing new products which contributed to the profitability of BTF. Leon Schindler (Leon) was the Chief Financial Officer of BTF. He too came from a hospitality background, having worked with leading hotel chains in Toronto. His expertise was in Capital Budgeting and product costing, which worked well in conjunction with the culinary skills of Sophia when new products were being developed. Noah Schulz(Noah) was the Senior Vice President-Operations. His background was as a General Manager in Fast Food Outlets. With his exemplary people skills and ability to train new hires, BTF was able to hire operations staff with little or no experience and develop them to high performing team members. Reshaping business strategy The four business partners set up their meeting with a view to re-orient their business strategy in the context of changes coming to how work would look like when the economy reopened after the pandemic. The goal was to develop a business model which would be relevant with the hybrid work model which was likely to be the norm once post pandemic recovery takes shape. Hanna began the meeting with a discussion what work would look like in the post pandemic era. Clients of BTF were in all age groups ranging from 25 - 48 and were office workers. Due to their workload, they preferred to buy food from a Quick Service Restaurant and consume the food as and when their work schedules allowed. With the hybrid work model, they would be attending office two or three days a week and work from home for the remainder. The food consumption pattern would shift from consumption only in the office(pre-pandemic), to consumption both at office and home (post-pandemic). The question therefore was: how can BTF adapt to this change in consumer behaviour? Sophia thanked Hanna for her insight and began her discussion. She pointed out at this time, there was a very short time lag between food being prepared at BTF and being consumed by the client. The time lag was no more than two hours. As a result, consumers were able to eat freshly prepared food, which was packed to retain the attributes of the cooked meal, till it reached the consumer. She expressed her opinion that the food production process needed a transformation. In addition to the food being prepared and delivered to the client for consumption, there has to be a secondary process where food would be prepared and packed. The packed food would retain its original attributes for 48 hours. Therefore, a client can order two versions of the same meal. One, which she can consume in the office within the next two hours and second, the packed version, which can be taken home, kept in the refrigerator, and consumed on the following day. She would come up with a list of menu items which could be cooked and packed. She requested Hanna to explore the possibility of building a new brand based on the packed meals. At this point, Otto took over and pointed out that to implement this strategy, the following steps would be necessary: - A new facility, where food preparation and food packaging can happen. - Benchmarking studies to analyze performance of similar companies. - Any other strategic direction as deemed necessary. Noah, pointed out that implementing the above, would lead to several operational issues as well. In order to resolve them, it may be necessary to incur additional fixed expenses. As a next step, they decided to retain the services of Conestoga Consulting (CC), a reputed consulting agency. The scope of work for CC would be to develop financial projections based on the above issues and provide a recommendation as to the best way forward for BTF. Appendix Three (Cost-Volume-Profit Analysis) Objective: With the new plant in operation, what would be the production level necessary to maintain Net Operating Income at a level similar to a competitor of BTF. Scenario: cC researched and came up with the contribution margh Income Statement of a competitor, Solarstar Inc. The contribution margin Income Statement is prepared for a sales volume of 40,000 units. Methodology: The consulting group projects that since BTF's plant will be automated, it will increase contribution margin per unit by 50% and fixed expenses by 55%. The increase in contribution margin will be due to production efficiencies which will reduce variable expenses, while total revenue and number of units sold remaining unchanged from the above scenario. Under assumption that the same number of products are manufactured and sold as in the above scenario, the group will develop a new Contribution Margin Income Statement, new breakeven sales in units and calculate the degree of operating leverage. Based on the above calculation, they would advise regarding the risk level of this scenario (high, medium, or low) and provide a rationale for the same 1. what are the recommendations for appendix 3 ?

2. write executive summary for the case.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started