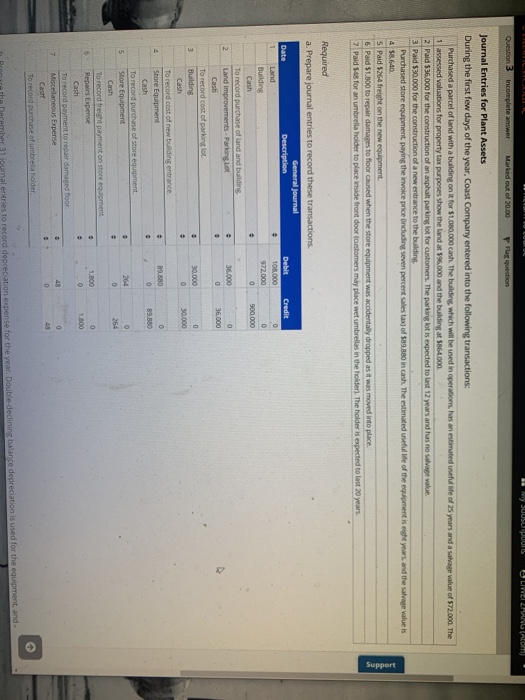

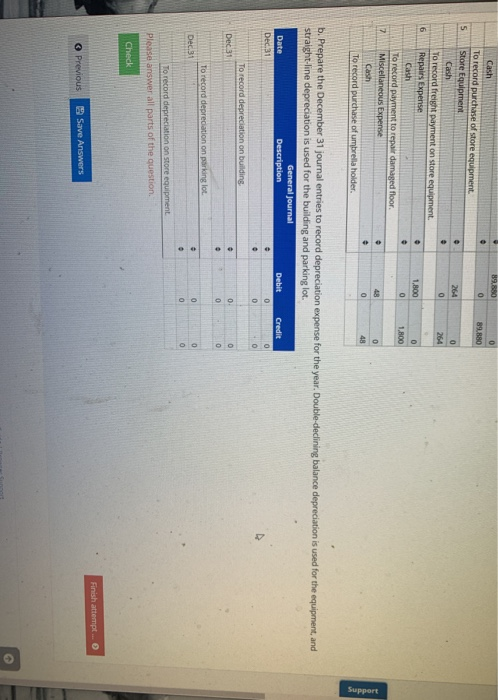

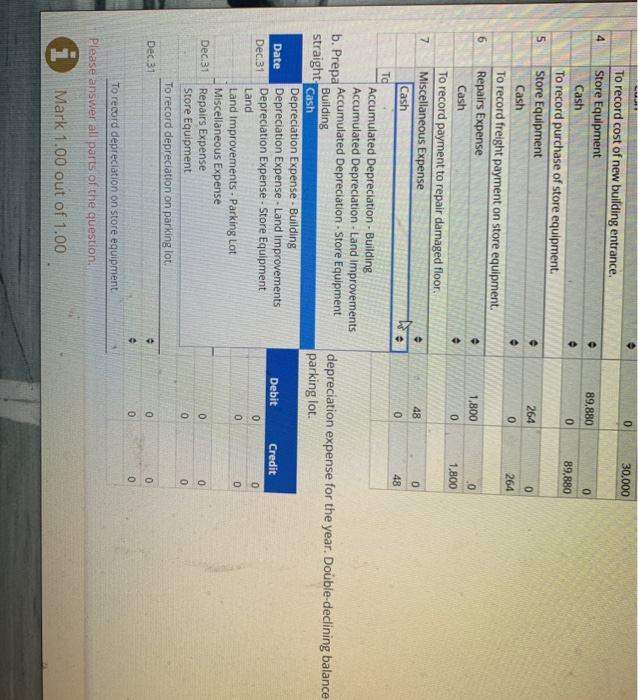

my s poons OLIWIERANDALOTI Question 3 Incomplete answer Marked out of 20.00 P Flag question Journal Entries for Plant Assets During the first few days of the year, Coast Company entered into the following transactions Purchased a parcel of land with a building on it for $1.050.000 cash. The building, which will be used in operations, has an estimated useful life of 25 years and a salvage value of $72.000. The 1 assessed valuations for property tax purposes show the land at 396.000 and the building at 5864.000 2 Paid $36.000 for the construction of an asphalt parking lot for customers. The parking lot is expected to last 12 years and has no Salvage value 3 Paid $30.000 for the construction of a new entrance to the building Purchased store equipment paying the invoice price including seven percent Sales tax of S in cash. The estimated us e of the equipment is eight years, and the Salvage value is 4 58.640. S Paid $264 freight on the new equipment 6 Paid $1.800 to repair damages to floor caused when the store equipment was accidentally dropped as it was moved into place 7 Paid 148 for an umbrella holder to place inside front door customers may place wel umbrellas in the holder. The holder is expected to last 20 years Support Debit Credit Required a. Prepare journal entries to record these transactions. General journal Date Description 1 Land Building Cash To record purchase of land and building Land improvements. Parking lot 972.000 0 900,000 36.000 To record cost of parking lol Building 89,880 To record cost of new building entrance Store Equipment Cash To record purchase of store equipment Store Equipment Cash to record freight went on store gume Repairs Expense To record payment to repair damaged Miscelaneous Expense TO cord purchase of unbrear older n Pron the Deremher 31 oumal entries to record depreciation expense for the year. Double-declining balance depreciation is used for the equipment and To record purchase of store equipment Store Equipment Cash To record freight payment on tore equipment NES Expense Cash To record payment to repair damaged for Miscellaneous Expense To record purchase of umbrella holder wedding b. Prepare the December 31 journal entries to record depreciation expense for the year. Double-declining balance depreciation is used for the equipment, and straight line depreciation is used for the building and parking lot. General journal Date Description Debit Credit Dec 31 To record depreciation on building to record deprecation on paring lot Dec.31 La record depreciation on store equipment Please answer all parts of the question Check Previous Save Answers Finish attempt 0 30.000 89,880 89,880 264 To record cost of new building entrance. Store Equipment Cash To record purchase of store equipment. Store Equipment Cash To record freight payment on store equipment. Repairs Expense Cash To record payment to repair damaged floor Miscellaneous Expense Cash 264 1,800 1.800 Accumulated Depreciation - Building Accumulated Depreciation. Land improvements b. Prepa Accumulated Depreciation - Store Equipment Building straight Cash depreciation expense for the year. Double-declining balance parking lot. Date Dec 31 Debit Credit Depreciation Expense - Building Depreciation Expense - Land improvements Depreciation Expense - Store Equipment Land Land Improvements - Parking Lot Miscellaneous Expense Repairs Expense Store Equipment To record depreciation on parking lot. Dec.31 Dec.31 To record depreciation on store equipment Please answer all parts of the question Mark 1.00 out of 1.00