Answered step by step

Verified Expert Solution

Question

1 Approved Answer

my slides on ReOI-based valuation, my slides on the Coca-Cola: Residual Income Case, and your own assumptions, value Coca- Cola's enterprise value (value of

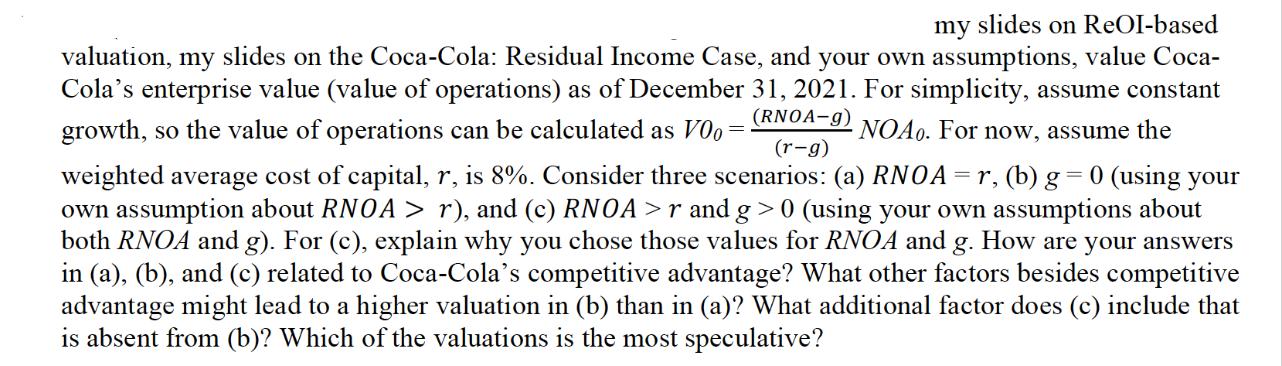

my slides on ReOI-based valuation, my slides on the Coca-Cola: Residual Income Case, and your own assumptions, value Coca- Cola's enterprise value (value of operations) as of December 31, 2021. For simplicity, assume constant (RNOA-g) growth, so the value of operations can be calculated as V00 NOAo. For now, assume the (r-g) weighted average cost of capital, r, is 8%. Consider three scenarios: (a) RNOA =r, (b) g = 0 (using your own assumption about RNOA > r), and (c) RNOA >r and g> 0 (using your own assumptions about both RNOA and g). For (c), explain why you chose those values for RNOA and g. How are your answers in (a), (b), and (c) related to Coca-Cola's competitive advantage? What other factors besides competitive advantage might lead to a higher valuation in (b) than in (a)? What additional factor does (c) include that is absent from (b)? Which of the valuations is the most speculative?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To value CocaColas enterprise value value of operations as of December 31 2021 using the Residual Income Model ROIbased valuation well consider three ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started