Answered step by step

Verified Expert Solution

Question

1 Approved Answer

my student id ends with a 49 Question C2 On March 23, 2021, Pfizer announced that it aims to expand its vaccine business by becoming

my student id ends with a 49

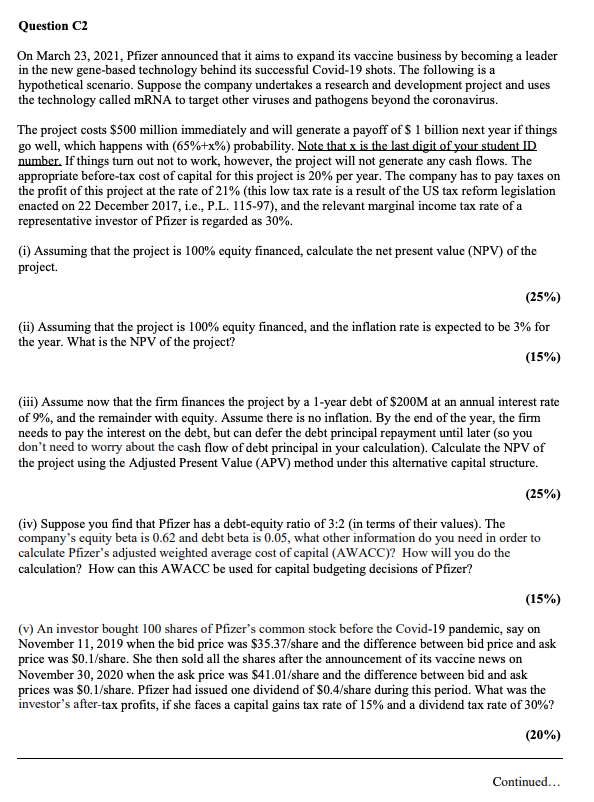

Question C2 On March 23, 2021, Pfizer announced that it aims to expand its vaccine business by becoming a leader in the new gene-based technology behind its successful Covid-19 shots. The following is a hypothetical scenario. Suppose the company undertakes a research and development project and uses the technology called mRNA to target other viruses and pathogens beyond the coronavirus. The project costs $500 million immediately and will generate a payoff of $ 1 billion next year if things go well, which happens with (65%+x%) probability. Note that x is the last digit of your student ID number. If things turn out not to work, however, the project will not generate any cash flows. The appropriate before-tax cost of capital for this project is 20% per year. The company has to pay taxes on the profit of this project at the rate of 21% (this low tax rate is a result of the US tax reform legislation enacted on 22 December 2017, i.e., P.L. 115-97), and the relevant marginal income tax rate of a representative investor of Pfizer is regarded as 30%. (1) Assuming that the project is 100% equity financed, calculate the net present value (NPV) of the project (25%) (ii) Assuming that the project is 100% equity financed, and the inflation rate is expected to be 3% for the year. What is the NPV of the project? (15%) (iii) Assume now that the firm finances the project by a 1-year debt of $200M at an annual interest rate of 9%, and the remainder with equity. Assume there is no inflation. By the end of the year, the firm needs to pay the interest on the debt, but can defer the debt principal repayment until later (so you don't need to worry about the cash flow of debt principal in your calculation). Calculate the NPV of the project using the Adjusted Present Value (APV) method under this alternative capital structure. (25%) (iv) Suppose you find that Pfizer has a debt-equity ratio of 3:2 (in terms of their values). The company's equity beta is 0.62 and debt beta is 0.05, what other information do you need in order to calculate Pfizer's adjusted weighted average cost of capital (AWACC)? How will you do the calculation? How can this AWACC be used for capital budgeting decisions of Pfizer? (15%) (v) An investor bought 100 shares of Pfizer's common stock before the Covid-19 pandemic, say on November 11, 2019 when the bid price was $35.37/share and the difference between bid price and ask price was $0.1/share. She then sold all the shares after the announcement of its vaccine news on November 30, 2020 when the ask price was $41.01/share and the difference between bid and ask prices was $0.1/share. Pfizer had issued one dividend of $0.4/share during this period. What was the investor's after-tax profits, if she faces a capital gains tax rate of 15% and a dividend tax rate of 30%? (20%) Continued... Question C2 On March 23, 2021, Pfizer announced that it aims to expand its vaccine business by becoming a leader in the new gene-based technology behind its successful Covid-19 shots. The following is a hypothetical scenario. Suppose the company undertakes a research and development project and uses the technology called mRNA to target other viruses and pathogens beyond the coronavirus. The project costs $500 million immediately and will generate a payoff of $ 1 billion next year if things go well, which happens with (65%+x%) probability. Note that x is the last digit of your student ID number. If things turn out not to work, however, the project will not generate any cash flows. The appropriate before-tax cost of capital for this project is 20% per year. The company has to pay taxes on the profit of this project at the rate of 21% (this low tax rate is a result of the US tax reform legislation enacted on 22 December 2017, i.e., P.L. 115-97), and the relevant marginal income tax rate of a representative investor of Pfizer is regarded as 30%. (1) Assuming that the project is 100% equity financed, calculate the net present value (NPV) of the project (25%) (ii) Assuming that the project is 100% equity financed, and the inflation rate is expected to be 3% for the year. What is the NPV of the project? (15%) (iii) Assume now that the firm finances the project by a 1-year debt of $200M at an annual interest rate of 9%, and the remainder with equity. Assume there is no inflation. By the end of the year, the firm needs to pay the interest on the debt, but can defer the debt principal repayment until later (so you don't need to worry about the cash flow of debt principal in your calculation). Calculate the NPV of the project using the Adjusted Present Value (APV) method under this alternative capital structure. (25%) (iv) Suppose you find that Pfizer has a debt-equity ratio of 3:2 (in terms of their values). The company's equity beta is 0.62 and debt beta is 0.05, what other information do you need in order to calculate Pfizer's adjusted weighted average cost of capital (AWACC)? How will you do the calculation? How can this AWACC be used for capital budgeting decisions of Pfizer? (15%) (v) An investor bought 100 shares of Pfizer's common stock before the Covid-19 pandemic, say on November 11, 2019 when the bid price was $35.37/share and the difference between bid price and ask price was $0.1/share. She then sold all the shares after the announcement of its vaccine news on November 30, 2020 when the ask price was $41.01/share and the difference between bid and ask prices was $0.1/share. Pfizer had issued one dividend of $0.4/share during this period. What was the investor's after-tax profits, if she faces a capital gains tax rate of 15% and a dividend tax rate of 30%? (20%) ContinuedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started