Answered step by step

Verified Expert Solution

Question

1 Approved Answer

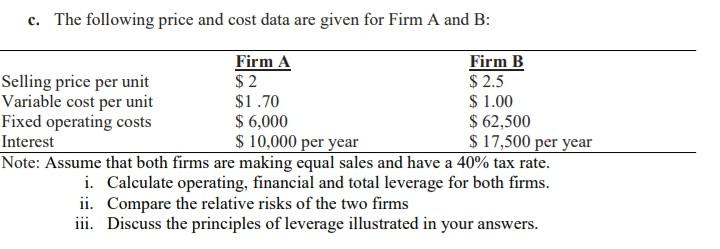

my subject is financial management c. The following price and cost data are given for Firm A and B: $ 2.5 Firm A Firm B

my subject is financial management

c. The following price and cost data are given for Firm A and B: $ 2.5 Firm A Firm B Selling price per unit $ 2 Variable cost per unit $1.70 $ 1.00 Fixed operating costs $ 6,000 $ 62,500 Interest $ 10,000 per year $ 17,500 per year Note: Assume that both firms are making equal sales and have a 40% tax rate. i. Calculate operating, financial and total leverage for both firms. ii. Compare the relative risks of the two firms iii. Discuss the principles of leverage illustrated in your answers. c. The following price and cost data are given for Firm A and B: $ 2.5 Firm A Firm B Selling price per unit $ 2 Variable cost per unit $1.70 $ 1.00 Fixed operating costs $ 6,000 $ 62,500 Interest $ 10,000 per year $ 17,500 per year Note: Assume that both firms are making equal sales and have a 40% tax rate. i. Calculate operating, financial and total leverage for both firms. ii. Compare the relative risks of the two firms iii. Discuss the principles of leverage illustrated in your answersStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started