Answered step by step

Verified Expert Solution

Question

1 Approved Answer

My Unadjusted Trial Balance Credit total is off from the check figure. Why? My Adjusted TB Debit and Credits are off from the check figures.

My Unadjusted Trial Balance Credit total is off from the check figure. Why?

My Adjusted TB Debit and Credits are off from the check figures. Why?

My income statement Debits are off. Why?

My Balance Sheet Credits are off. Why?

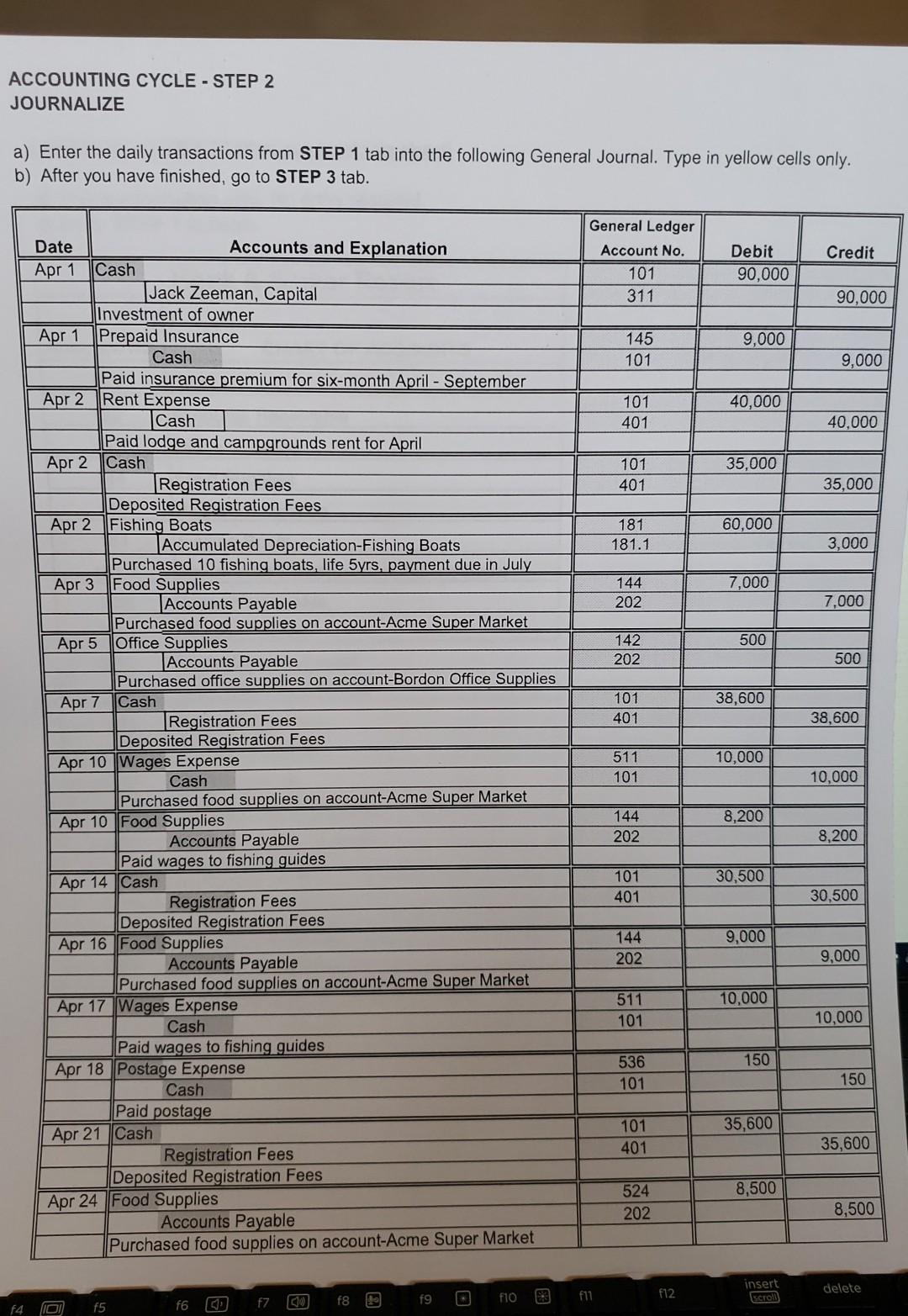

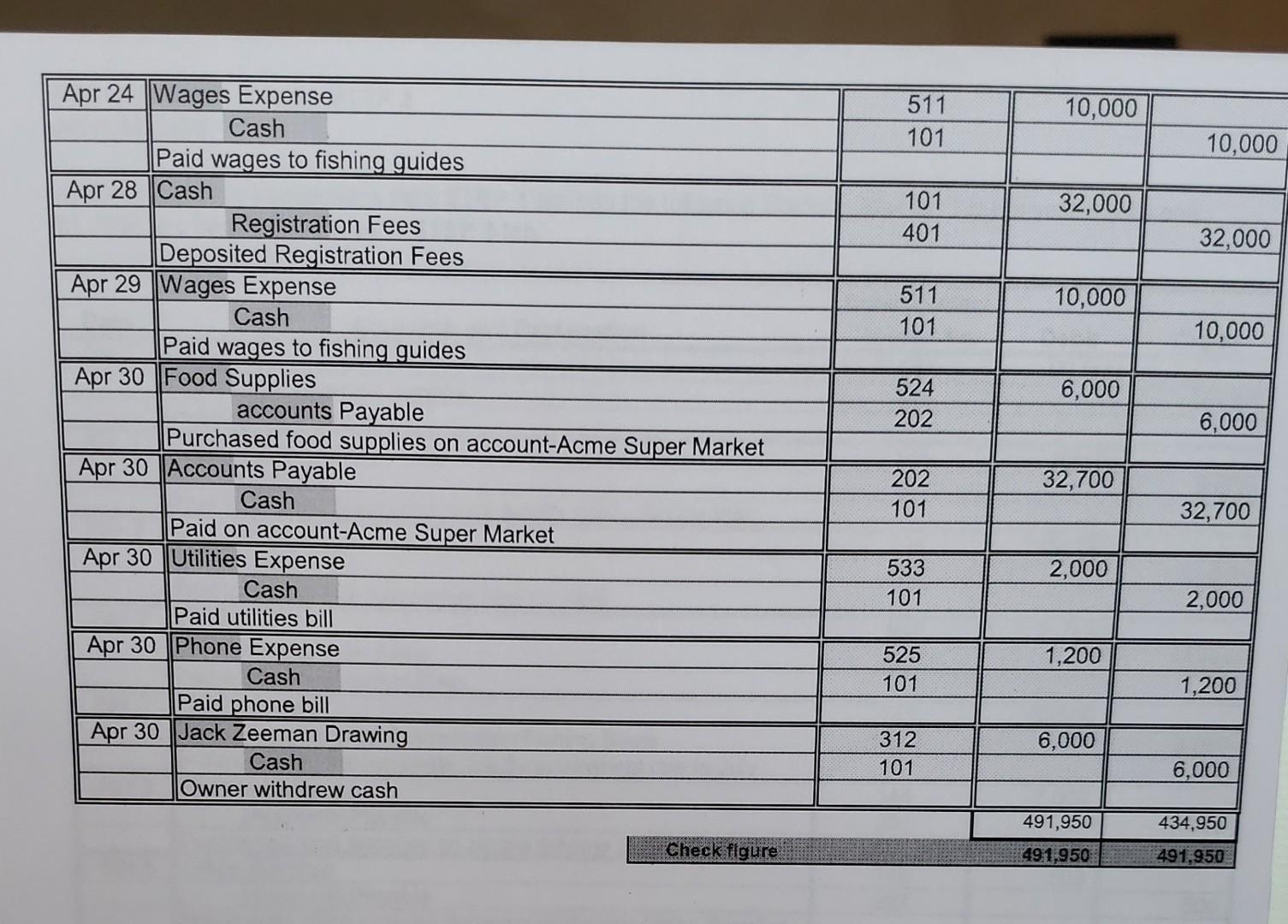

Journalizing Credits are off. Why?

My month ending adjustments do balance.

I know that I have asked several questions however, it has taken me 3 days to figure out (and with someone giving me an outline on how to submit) how to submit questions.

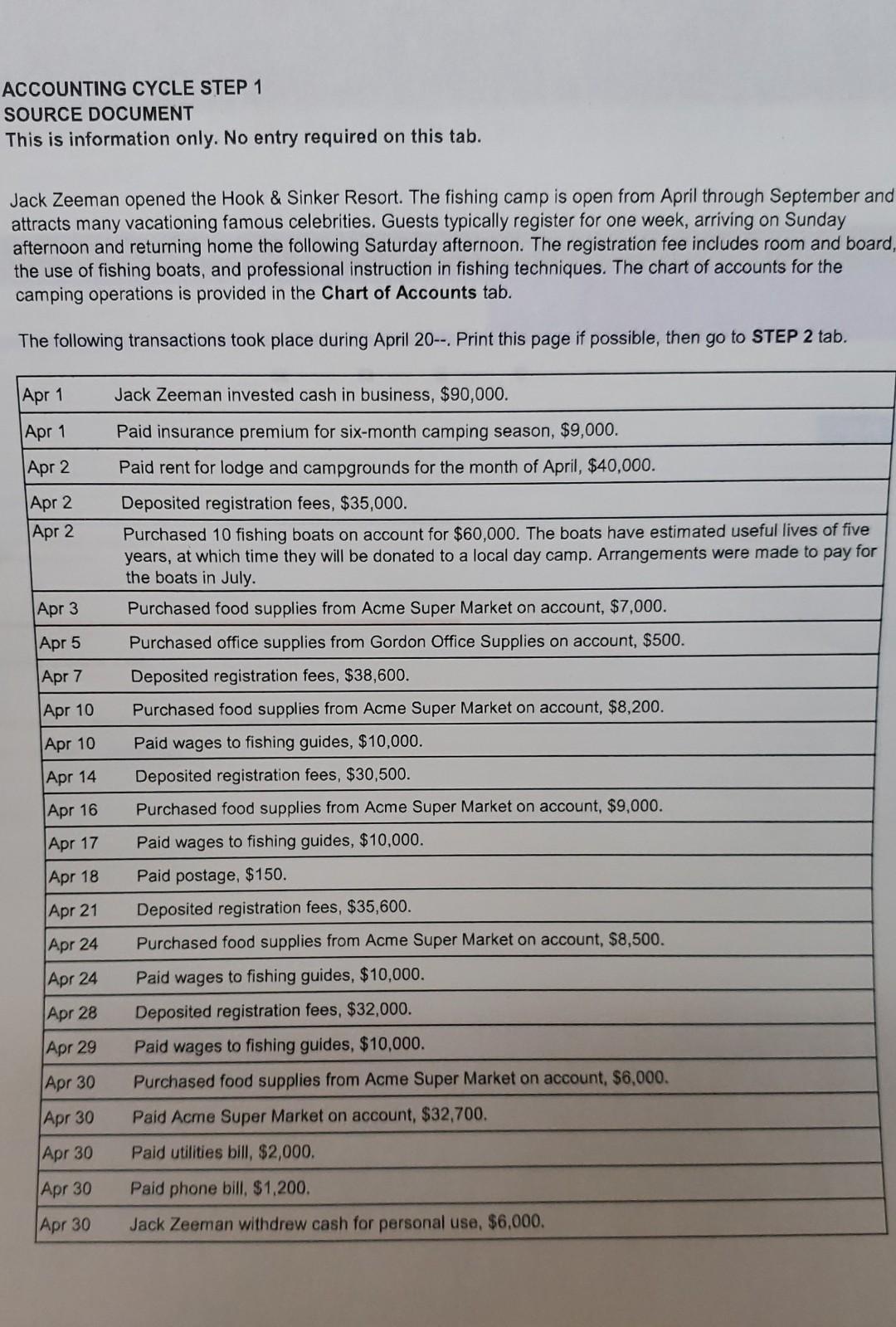

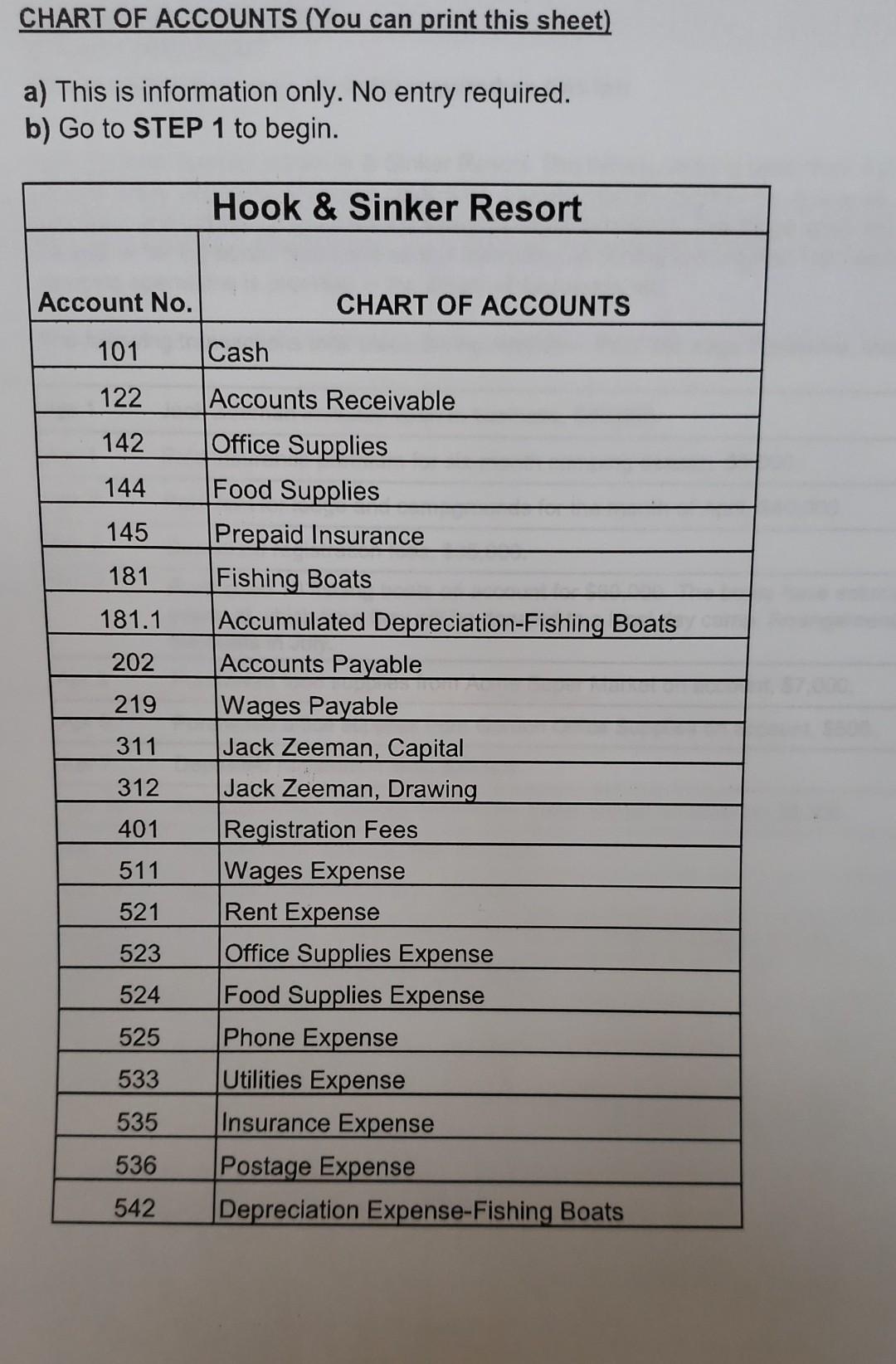

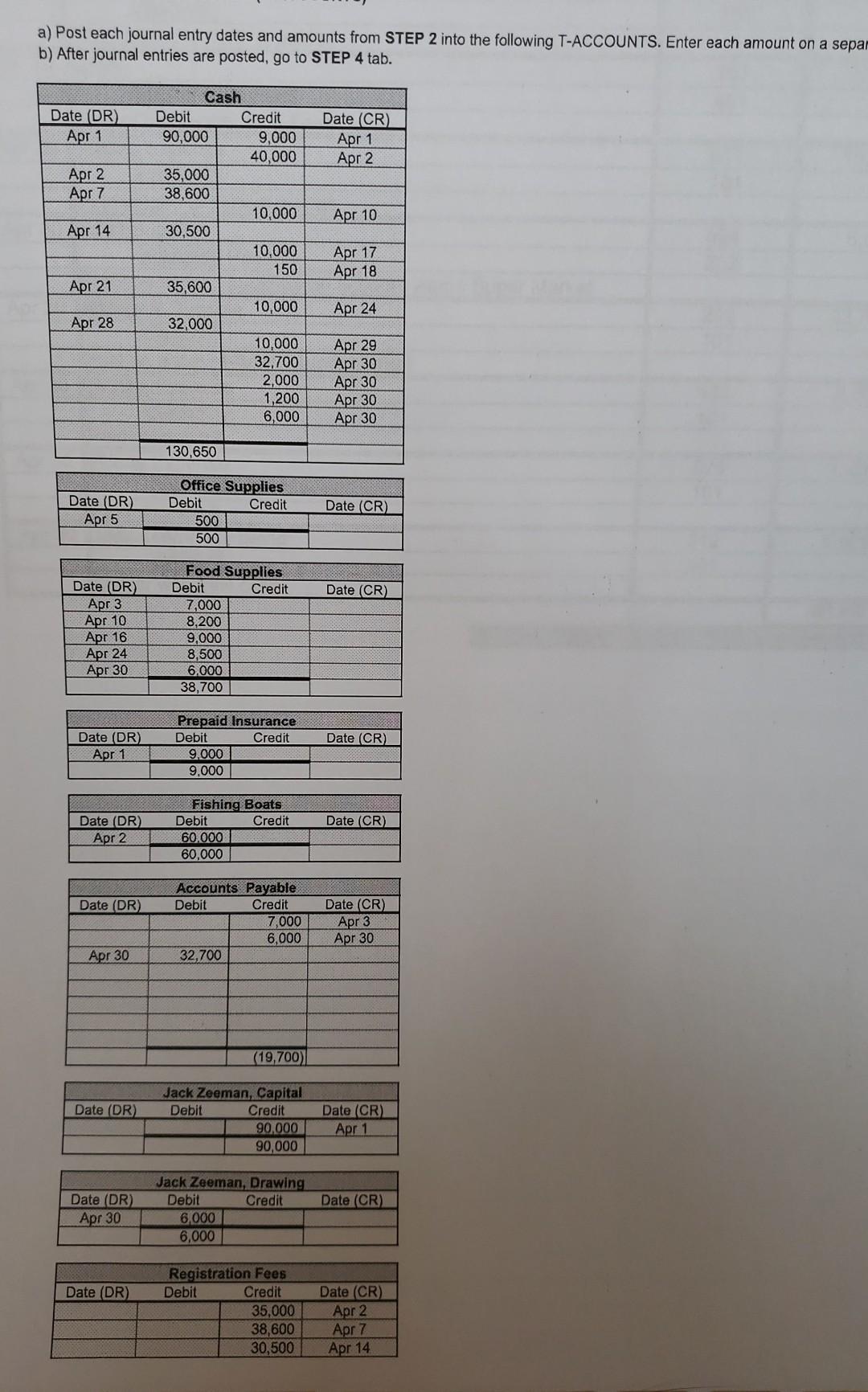

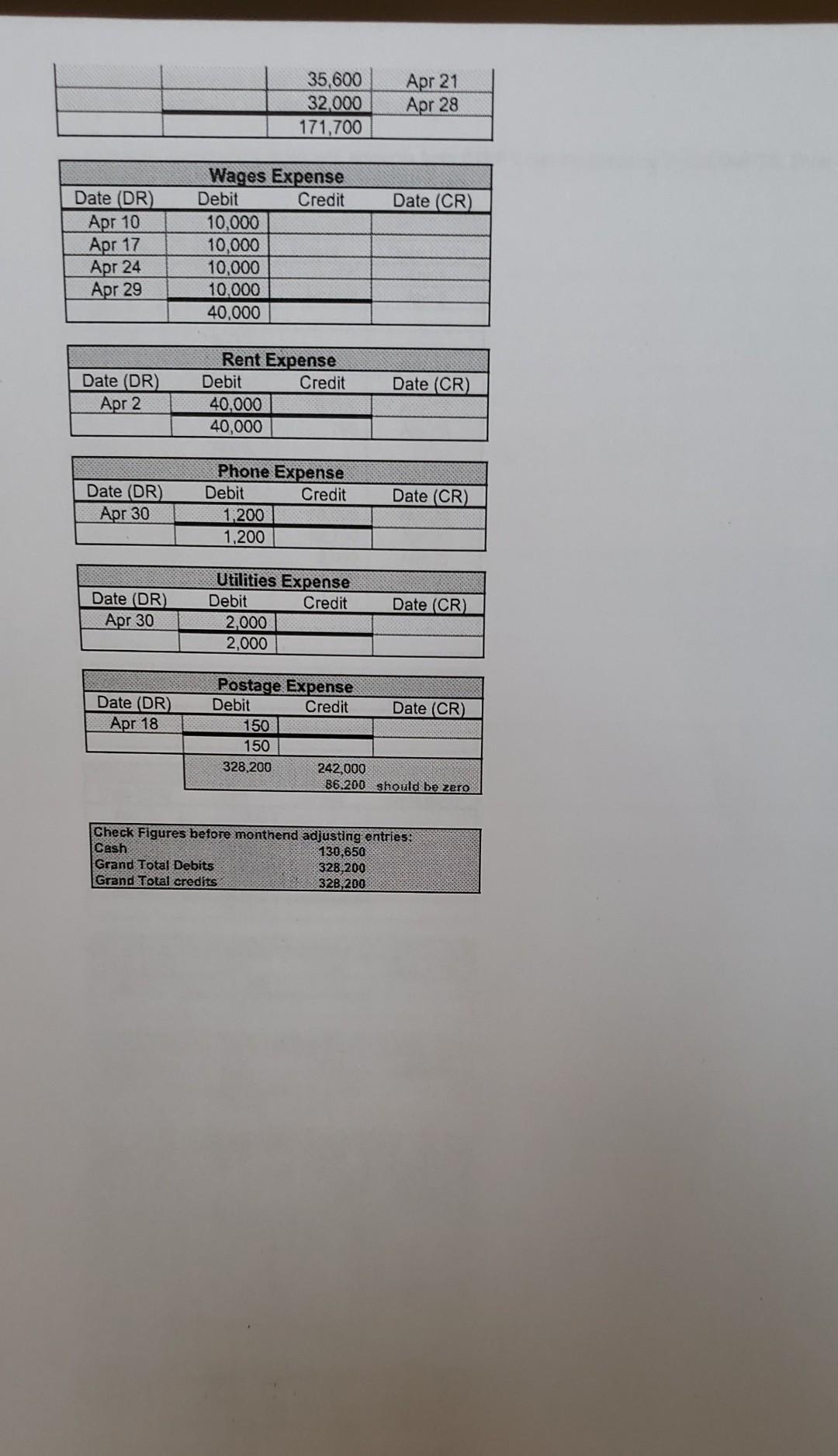

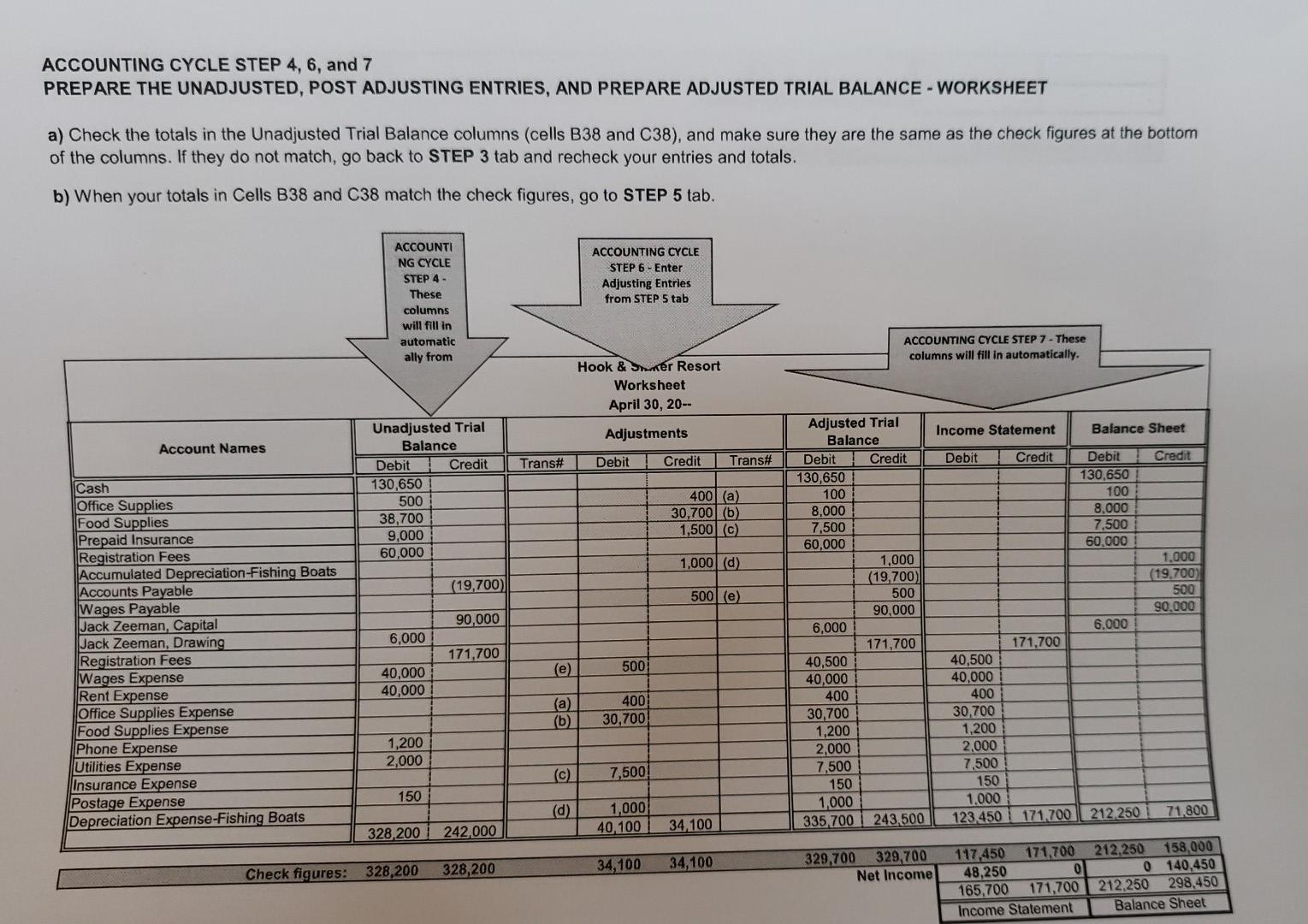

ACCOUNTING CYCLE STEP 1 SOURCE DOCUMENT This is information only. No entry required on this tab. Jack Zeeman opened the Hook & Sinker Resort. The fishing camp is open from April through September and attracts many vacationing famous celebrities. Guests typically register for one week, arriving on Sunday afternoon and returning home the following Saturday afternoon. The registration fee includes room and board, the use of fishing boats, and professional instruction in fishing techniques. The chart of accounts for the camping operations is provided in the Chart of Accounts tab. The following transactions took place during April 20-- Print this page if possible, then go to STEP 2 tab. |Apr 1 Jack Zeeman invested cash in business, $90,000. Apr 1 Paid insurance premium for six-month camping season, $9,000. Paid rent for lodge and campgrounds for the month of April, $40,000. Apr 2 Apr 2 \Apr 2 Deposited registration fees, $35,000. Purchased 10 fishing boats on account for $60,000. The boats have estimated useful lives of five years, at which time they will be donated to a local day camp. Arrangements were made to pay for the boats in July. Purchased food supplies from Acme Super Market on account, $7,000. Purchased office supplies from Gordon Office Supplies on account, $500. Apr 3 Apr 5 |Apr 7 Deposited registration fees, $38,600. Apr 10 Purchased food supplies from Acme Super Market on account, $8,200. Apr 10 Apr 14 Apr 16 Apr 17 Apr 18 Apr 21 Apr 24 Paid wages to fishing guides, $10,000. Deposited registration fees, $30,500. Purchased food supplies from Acme Super Market on account, $9,000. Paid wages to fishing guides, $10,000. Paid postage, $150. Deposited registration fees, $35,600. Purchased food supplies from Acme Super Market on account, $8,500. Paid wages to fishing guides, $10,000. Deposited registration fees, $32,000. Paid wages to fishing guides, $10,000. Purchased food supplies from Acme Super Market on account, $6,000. Paid Acme Super Market on account, $32,700. Paid utilities bill, $2,000. Paid phone bill, $1,200. Apr 24 Apr 28 Apr 29 Apr 30 Apr 30 |Apr 30 Apr 30 Apr 30 Jack Zeeman withdrew cash for personal use, $6,000, CHART OF ACCOUNTS (You can print this sheet) a) This is information only. No entry required. b) Go to STEP 1 to begin. Hook & Sinker Resort Account No. CHART OF ACCOUNTS 101 Cash 122 Accounts Receivable 142 144 145 181 181.1 202 219 311 312 401 Office Supplies Food Supplies Prepaid Insurance Fishing Boats Accumulated Depreciation-Fishing Boats Accounts Payable Wages Payable Jack Zeeman, Capital Jack Zeeman, Drawing Registration Fees Wages Expense Rent Expense Office Supplies Expense Food Supplies Expense Phone Expense Utilities Expense Insurance Expense Postage Expense Depreciation Expense-Fishing Boats 511 521 523 524 525 533 535 536 542 ACCOUNTING CYCLE - STEP 2 JOURNALIZE a) Enter the daily transactions from STEP 1 tab into the following General Journal. Type in yellow cells only. b) After you have finished, go to STEP 3 tab. General Ledger Account No. 101 311 Credit Debit 90,000 90,000 9,000 145 101 9,000 40,000 101 401 40,000 35,000 101 401 35,000 60,000 181 181.1 3,000 144 7,000 202 7,000 500 142 202 500 38,600 101 401 38,600 Date Accounts and Explanation Apr 1 Cash Jack Zeeman, Capital Investment of owner Apr 1 Prepaid Insurance Cash Paid insurance premium for six-month April - September Apr 2 Rent Expense Cash Paid lodge and campgrounds rent for April Apr 2 Cash Registration Fees Deposited Registration Fees Apr 2 Fishing Boats Accumulated Depreciation-Fishing Boats Purchased 10 fishing boats, life 5yrs, payment due in July Apr 3 Food Supplies Accounts Payable Purchased food supplies on account-Acme Super Market Apr 5 Office Supplies Accounts Payable Purchased office supplies on account-Bordon Office Supplies Apr 7 Cash Registration Fees Deposited Registration Fees Apr 10 Wages Expense Cash Purchased food supplies on account-Acme Super Market Apr 10 Food Supplies Accounts Payable Paid wages to fishing guides Apr 14 Cash Registration Fees Deposited Registration Fees Apr 16 Food Supplies Accounts Payable Purchased food supplies on account-Acme Super Market Apr 17 Wages Expense Cash Paid wages to fishing guides Apr 18 Postage Expense Cash Paid postage Apr 21 Cash Registration Fees Deposited Registration Fees Apr 24 Food Supplies Accounts Payable Purchased food supplies on account-Acme Super Market 10,000 511 101 10,000 8,200 144 202 8,200 30,500 101 401 30,500 9,000 144 202 9,000 10,000 511 101 10,000 150 536 101 150 35,600 101 401 35,600 8,500 524 202 8,500 insert scroll delete f12 f8 19 fio f11 f6 14 f5 10,000 511 101 10,000 32,000 101 401 32,000 511 10,000 101 10,000 524 202 6,000 6,000 Apr 24 Wages Expense Cash Paid wages to fishing guides Apr 28 Cash Registration Fees Deposited Registration Fees Apr 29 Wages Expense Cash Paid wages to fishing guides Apr 30 Food Supplies accounts Payable Purchased food supplies on account-Acme Super Market Apr 30 Accounts Payable Cash Paid on account-Acme Super Market Apr 30 Utilities Expense Cash Paid utilities bill Apr 30 Phone Expense Cash Paid phone bill Apr 30 Jack Zeeman Drawing Cash Owner withdrew cash 32,700 202 101 32,700 533 101 2,000 2,000 1,200 525 101 1,200 6,000 312 101 6,000 434,950 491,950 491,950 Check figure 491,950 a) Post each journal entry dates and amounts from STEP 2 into the following T-ACCOUNTS. Enter each amount on a separ b) After journal entries are posted, go to STEP 4 tab. Date (DR) Apr 1 Date (CR) Apr 1 Apr 2 Apr 2 Apr 7 Apr 10 Apr 14 Cash Debit Credit 90,000 9,000 40,000 35,000 38,600 10,000 30,500 10,000 150 35,600 10,000 32,000 10,000 32,700 2,000 1,200 6,000 Apr 17 Apr 18 Apr 21 Apr 24 Apr 28 Apr 29 Apr 30 Apr 30 Apr 30 Apr 30 130,650 Date (DR) Apr 5 Office Supplies Debit Credit 500 500 Date (CR) Date (CR) Date (DR. Apr 3 Apr 10 Apr 16 Apr 24 Apr 30 Food Supplies Debit Credit 7,000 8,200 9,000 8,500 6.000 38,700 Prepaid Insurance Debit Credit 9.000 9.000 Date (DR) Apr 1 Date (CR) Date (CR) Date (DR) Apr 2 Fishing Boats Debit Credit 60.000 60,000 Date (DR) Accounts Payable Debit Credit 7,000 6,000 32,700 Date (CR) Apr 3 Apr 30 Apr 30 (19,700) Date (DR) Jack Zeeman, Capital Debit Credit 90.000 90,000 Date (CR) Apr 1 Date (CR) Date (DR) Apr 30 Jack Zeeman, Drawing Debit Credit 6,000 6,000 Date (DR) Registration Fees Debit Credit 35,000 38,600 30,500 Date (CR) Apr 2 Apr 7 Apr 14 35,600 32,000 171,700 Apr 21 Apr 28 Date (DR) Date (CR) Apr 10 Apr 17 Apr 24 Apr 29 Wages Expense Debit Credit 10,000 10,000 10,000 10.000 40,000 Date (DR) Date (CR) Rent Expense Debit Credit 40,000 40,000 Apr 2 Date (DR) Phone Expense Debit Credit 1,200 1.200 Date (CR) Apr 30 Date (DR) Utilities Expense Debit Credit 2,000 2,000 Date (CR) Apr 30 Date (DR) Apr 18 Postage Expense Debit Credit Date (CR) 150 150 328,200 242,000 86.200 should be zero Check Figures before monthend adjusting entries: Cash 130.650 Grand Total Debits 328,200 Grand Total credits 32B,200 ACCOUNTING CYCLE STEP 4, 6, and 7 PREPARE THE UNADJUSTED, POST ADJUSTING ENTRIES, AND PREPARE ADJUSTED TRIAL BALANCE - WORKSHEET a) Check the totals in the Unadjusted Trial Balance columns (cells B38 and C38), and make sure they are the same as the check figures at the bottom of the columns. If they do not match, go back to STEP 3 tab and recheck your entries and totals. b) When your totals in Cells B38 and C38 match the check figures, go to STEP 5 tab. ACCOUNTI NG CYCLE STEP 4 These columns will fill in automatic ally from ACCOUNTING CYCLE STEP 6 - Enter Adjusting Entries from STEP 5 tab ACCOUNTING CYCLE STEP 7 - These columns will fill in automatically. Hook & Shmer Resort Worksheet April 30, 20- Adjustments Income Statement Balance Sheet Account Names Debit Credit Trans# Debit Trans# Credit Credit Unadjusted Trial Balance Debit Credit 130,650 500 38,700 9,000 60,000 400 (a) 30,7006) 1,500 (0) Debit 130,650 100 8.000 7.500 60.000 1,000 (d) (19,700) 1.000 (19,700) 500 90,000 500 (e) 90,000 Adjusted Trial Balance Debit Credit 130,650 100 8,000 7,500 60,000 1,000 (19,700) 500 90,000 6,000 171,700 40,500 40,000 400 30,700 1,200 2,000 7,500 150 1,000 335 700 243,500 6.000 6,000 Cash Office Supplies Food Supplies Prepaid Insurance Registration Fees Accumulated Depreciation-Fishing Boats Accounts Payable Wages Payable Jack Zeeman, Capital Jack Zeeman, Drawing Registration Fees Wages Expense Rent Expense Office Supplies Expense Food Supplies Expense Phone Expens Utilities Expense Insurance Expense Postage Expense Depreciation Expense-Fishing Boats 171,700 171,700 (e) 500 40,000 40,000 (a) (b) 400 30,700 40,500 40,000 400 30,700 1,200 2.000 7,500 1,200 2,000 C 7,500 150 150 (d) 1,000 40.100 1.000 123 450 171.700 212 250 71,800 34 100 328,200 242.000 34,100 328,200 34,100 Check figures: 328,200 329,700 329,700 Net Income 117,450 171,700 212,250 158,000 48,250 0 0 140,450 165,700 171,700 212,250 298,450 Income Statement Balance Sheet ACCOUNTING CYCLE STEP 1 SOURCE DOCUMENT This is information only. No entry required on this tab. Jack Zeeman opened the Hook & Sinker Resort. The fishing camp is open from April through September and attracts many vacationing famous celebrities. Guests typically register for one week, arriving on Sunday afternoon and returning home the following Saturday afternoon. The registration fee includes room and board, the use of fishing boats, and professional instruction in fishing techniques. The chart of accounts for the camping operations is provided in the Chart of Accounts tab. The following transactions took place during April 20-- Print this page if possible, then go to STEP 2 tab. |Apr 1 Jack Zeeman invested cash in business, $90,000. Apr 1 Paid insurance premium for six-month camping season, $9,000. Paid rent for lodge and campgrounds for the month of April, $40,000. Apr 2 Apr 2 \Apr 2 Deposited registration fees, $35,000. Purchased 10 fishing boats on account for $60,000. The boats have estimated useful lives of five years, at which time they will be donated to a local day camp. Arrangements were made to pay for the boats in July. Purchased food supplies from Acme Super Market on account, $7,000. Purchased office supplies from Gordon Office Supplies on account, $500. Apr 3 Apr 5 |Apr 7 Deposited registration fees, $38,600. Apr 10 Purchased food supplies from Acme Super Market on account, $8,200. Apr 10 Apr 14 Apr 16 Apr 17 Apr 18 Apr 21 Apr 24 Paid wages to fishing guides, $10,000. Deposited registration fees, $30,500. Purchased food supplies from Acme Super Market on account, $9,000. Paid wages to fishing guides, $10,000. Paid postage, $150. Deposited registration fees, $35,600. Purchased food supplies from Acme Super Market on account, $8,500. Paid wages to fishing guides, $10,000. Deposited registration fees, $32,000. Paid wages to fishing guides, $10,000. Purchased food supplies from Acme Super Market on account, $6,000. Paid Acme Super Market on account, $32,700. Paid utilities bill, $2,000. Paid phone bill, $1,200. Apr 24 Apr 28 Apr 29 Apr 30 Apr 30 |Apr 30 Apr 30 Apr 30 Jack Zeeman withdrew cash for personal use, $6,000, CHART OF ACCOUNTS (You can print this sheet) a) This is information only. No entry required. b) Go to STEP 1 to begin. Hook & Sinker Resort Account No. CHART OF ACCOUNTS 101 Cash 122 Accounts Receivable 142 144 145 181 181.1 202 219 311 312 401 Office Supplies Food Supplies Prepaid Insurance Fishing Boats Accumulated Depreciation-Fishing Boats Accounts Payable Wages Payable Jack Zeeman, Capital Jack Zeeman, Drawing Registration Fees Wages Expense Rent Expense Office Supplies Expense Food Supplies Expense Phone Expense Utilities Expense Insurance Expense Postage Expense Depreciation Expense-Fishing Boats 511 521 523 524 525 533 535 536 542 ACCOUNTING CYCLE - STEP 2 JOURNALIZE a) Enter the daily transactions from STEP 1 tab into the following General Journal. Type in yellow cells only. b) After you have finished, go to STEP 3 tab. General Ledger Account No. 101 311 Credit Debit 90,000 90,000 9,000 145 101 9,000 40,000 101 401 40,000 35,000 101 401 35,000 60,000 181 181.1 3,000 144 7,000 202 7,000 500 142 202 500 38,600 101 401 38,600 Date Accounts and Explanation Apr 1 Cash Jack Zeeman, Capital Investment of owner Apr 1 Prepaid Insurance Cash Paid insurance premium for six-month April - September Apr 2 Rent Expense Cash Paid lodge and campgrounds rent for April Apr 2 Cash Registration Fees Deposited Registration Fees Apr 2 Fishing Boats Accumulated Depreciation-Fishing Boats Purchased 10 fishing boats, life 5yrs, payment due in July Apr 3 Food Supplies Accounts Payable Purchased food supplies on account-Acme Super Market Apr 5 Office Supplies Accounts Payable Purchased office supplies on account-Bordon Office Supplies Apr 7 Cash Registration Fees Deposited Registration Fees Apr 10 Wages Expense Cash Purchased food supplies on account-Acme Super Market Apr 10 Food Supplies Accounts Payable Paid wages to fishing guides Apr 14 Cash Registration Fees Deposited Registration Fees Apr 16 Food Supplies Accounts Payable Purchased food supplies on account-Acme Super Market Apr 17 Wages Expense Cash Paid wages to fishing guides Apr 18 Postage Expense Cash Paid postage Apr 21 Cash Registration Fees Deposited Registration Fees Apr 24 Food Supplies Accounts Payable Purchased food supplies on account-Acme Super Market 10,000 511 101 10,000 8,200 144 202 8,200 30,500 101 401 30,500 9,000 144 202 9,000 10,000 511 101 10,000 150 536 101 150 35,600 101 401 35,600 8,500 524 202 8,500 insert scroll delete f12 f8 19 fio f11 f6 14 f5 10,000 511 101 10,000 32,000 101 401 32,000 511 10,000 101 10,000 524 202 6,000 6,000 Apr 24 Wages Expense Cash Paid wages to fishing guides Apr 28 Cash Registration Fees Deposited Registration Fees Apr 29 Wages Expense Cash Paid wages to fishing guides Apr 30 Food Supplies accounts Payable Purchased food supplies on account-Acme Super Market Apr 30 Accounts Payable Cash Paid on account-Acme Super Market Apr 30 Utilities Expense Cash Paid utilities bill Apr 30 Phone Expense Cash Paid phone bill Apr 30 Jack Zeeman Drawing Cash Owner withdrew cash 32,700 202 101 32,700 533 101 2,000 2,000 1,200 525 101 1,200 6,000 312 101 6,000 434,950 491,950 491,950 Check figure 491,950 a) Post each journal entry dates and amounts from STEP 2 into the following T-ACCOUNTS. Enter each amount on a separ b) After journal entries are posted, go to STEP 4 tab. Date (DR) Apr 1 Date (CR) Apr 1 Apr 2 Apr 2 Apr 7 Apr 10 Apr 14 Cash Debit Credit 90,000 9,000 40,000 35,000 38,600 10,000 30,500 10,000 150 35,600 10,000 32,000 10,000 32,700 2,000 1,200 6,000 Apr 17 Apr 18 Apr 21 Apr 24 Apr 28 Apr 29 Apr 30 Apr 30 Apr 30 Apr 30 130,650 Date (DR) Apr 5 Office Supplies Debit Credit 500 500 Date (CR) Date (CR) Date (DR. Apr 3 Apr 10 Apr 16 Apr 24 Apr 30 Food Supplies Debit Credit 7,000 8,200 9,000 8,500 6.000 38,700 Prepaid Insurance Debit Credit 9.000 9.000 Date (DR) Apr 1 Date (CR) Date (CR) Date (DR) Apr 2 Fishing Boats Debit Credit 60.000 60,000 Date (DR) Accounts Payable Debit Credit 7,000 6,000 32,700 Date (CR) Apr 3 Apr 30 Apr 30 (19,700) Date (DR) Jack Zeeman, Capital Debit Credit 90.000 90,000 Date (CR) Apr 1 Date (CR) Date (DR) Apr 30 Jack Zeeman, Drawing Debit Credit 6,000 6,000 Date (DR) Registration Fees Debit Credit 35,000 38,600 30,500 Date (CR) Apr 2 Apr 7 Apr 14 35,600 32,000 171,700 Apr 21 Apr 28 Date (DR) Date (CR) Apr 10 Apr 17 Apr 24 Apr 29 Wages Expense Debit Credit 10,000 10,000 10,000 10.000 40,000 Date (DR) Date (CR) Rent Expense Debit Credit 40,000 40,000 Apr 2 Date (DR) Phone Expense Debit Credit 1,200 1.200 Date (CR) Apr 30 Date (DR) Utilities Expense Debit Credit 2,000 2,000 Date (CR) Apr 30 Date (DR) Apr 18 Postage Expense Debit Credit Date (CR) 150 150 328,200 242,000 86.200 should be zero Check Figures before monthend adjusting entries: Cash 130.650 Grand Total Debits 328,200 Grand Total credits 32B,200 ACCOUNTING CYCLE STEP 4, 6, and 7 PREPARE THE UNADJUSTED, POST ADJUSTING ENTRIES, AND PREPARE ADJUSTED TRIAL BALANCE - WORKSHEET a) Check the totals in the Unadjusted Trial Balance columns (cells B38 and C38), and make sure they are the same as the check figures at the bottom of the columns. If they do not match, go back to STEP 3 tab and recheck your entries and totals. b) When your totals in Cells B38 and C38 match the check figures, go to STEP 5 tab. ACCOUNTI NG CYCLE STEP 4 These columns will fill in automatic ally from ACCOUNTING CYCLE STEP 6 - Enter Adjusting Entries from STEP 5 tab ACCOUNTING CYCLE STEP 7 - These columns will fill in automatically. Hook & Shmer Resort Worksheet April 30, 20- Adjustments Income Statement Balance Sheet Account Names Debit Credit Trans# Debit Trans# Credit Credit Unadjusted Trial Balance Debit Credit 130,650 500 38,700 9,000 60,000 400 (a) 30,7006) 1,500 (0) Debit 130,650 100 8.000 7.500 60.000 1,000 (d) (19,700) 1.000 (19,700) 500 90,000 500 (e) 90,000 Adjusted Trial Balance Debit Credit 130,650 100 8,000 7,500 60,000 1,000 (19,700) 500 90,000 6,000 171,700 40,500 40,000 400 30,700 1,200 2,000 7,500 150 1,000 335 700 243,500 6.000 6,000 Cash Office Supplies Food Supplies Prepaid Insurance Registration Fees Accumulated Depreciation-Fishing Boats Accounts Payable Wages Payable Jack Zeeman, Capital Jack Zeeman, Drawing Registration Fees Wages Expense Rent Expense Office Supplies Expense Food Supplies Expense Phone Expens Utilities Expense Insurance Expense Postage Expense Depreciation Expense-Fishing Boats 171,700 171,700 (e) 500 40,000 40,000 (a) (b) 400 30,700 40,500 40,000 400 30,700 1,200 2.000 7,500 1,200 2,000 C 7,500 150 150 (d) 1,000 40.100 1.000 123 450 171.700 212 250 71,800 34 100 328,200 242.000 34,100 328,200 34,100 Check figures: 328,200 329,700 329,700 Net Income 117,450 171,700 212,250 158,000 48,250 0 0 140,450 165,700 171,700 212,250 298,450 Income Statement Balance Sheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started