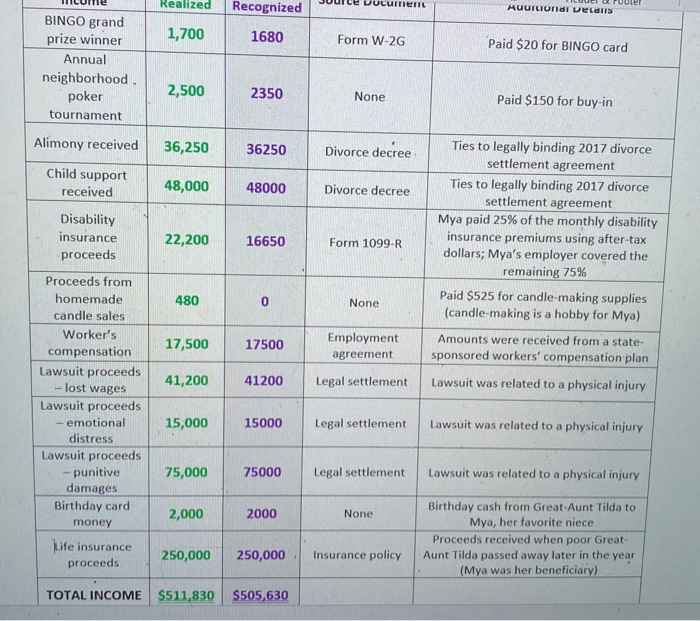

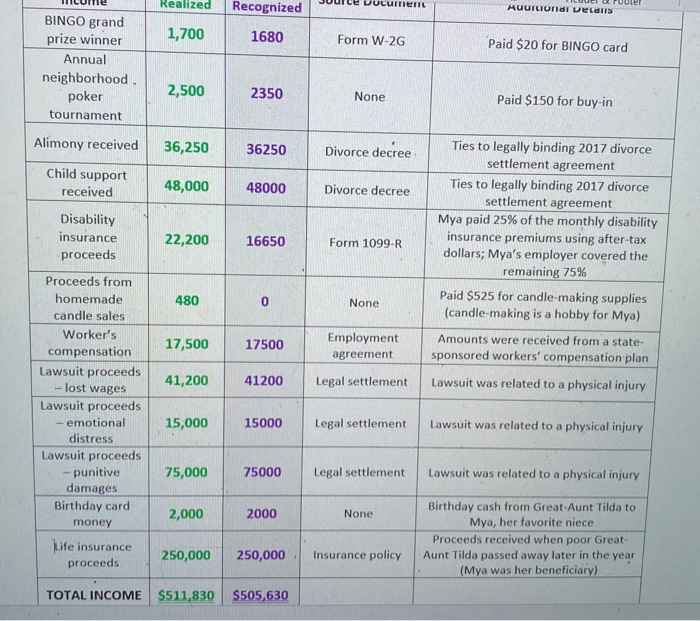

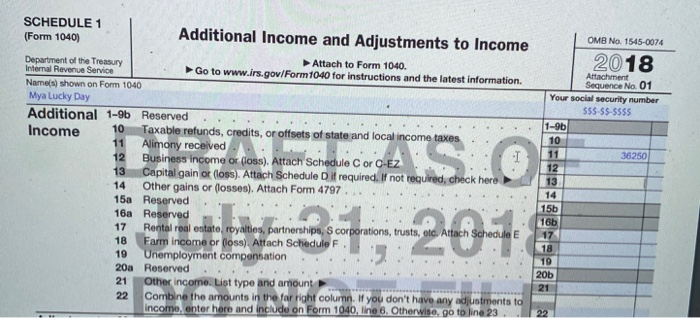

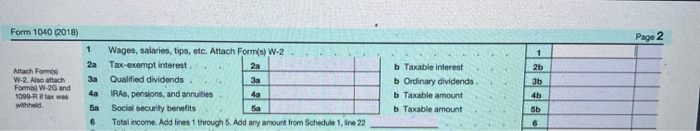

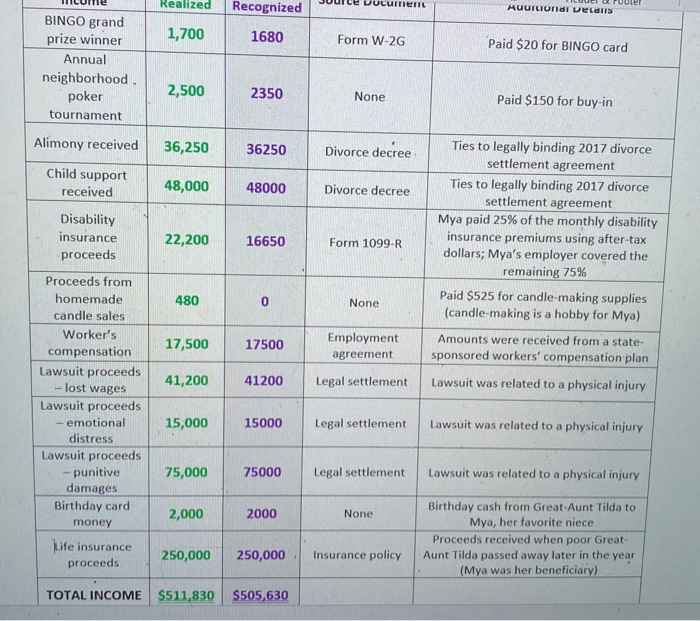

Mya has asked for assistance in determining how much of the $511,830 gross income she realized in 2018 must be recognized as taxable income on her 2018 individual tax return. also on her Form 1040 and Schedule 1. Schedule 1, Lines 10-22, Form 1040 Lines 1-6.

Realized Recognized urrier HUUiLiundi velalls 1,700 1680 Form W-2G Paid $20 for BINGO card BINGO grand prize winner Annual neighborhood. poker tournament 2,500 2350 None Paid $150 for buy-in Alimony received 36,250 36250 Divorce decree Child support received 48,000 48000 Divorce decree Disability insurance proceeds 22,200 16650 Form 1099-R Ties to legally binding 2017 divorce settlement agreement Ties to legally binding 2017 divorce settlement agreement Mya paid 25% of the monthly disability insurance premiums using after-tax dollars; Mya's employer covered the remaining 75% Paid $525 for candle-making supplies (candle-making is a hobby for Mya) Amounts were received from a state- sponsored workers' compensation plan 480 0 None 17,500 17500 Employment agreement 41,200 41200 Legal settlement Lawsuit was related to a physical injury Proceeds from homemade candle sales Worker's compensation Lawsuit proceeds - lost wages Lawsuit proceeds - emotional distress Lawsuit proceeds -punitive damages Birthday card money Life insurance proceeds 15,000 15000 Legal settlement Lawsuit was related to a physical injury 75,000 75000 Legal settlement Lawsuit was related to a physical injury 2,000 2000 None Birthday cash from Great-Aunt Tilda to Mya, her favorite niece Proceeds received when poor Great Aunt Tilda passed away later in the year (Mya was her beneficiary) 250,000 250,000 Insurance policy TOTAL INCOME $511,830 $505,630 SCHEDULE 1 (Form 1040) Additional Income and Adjustments to Income OMB No 1545-0074 2018 10 Department of the Treasury Attach to Form 1040. Internal Revenue Service Go to www.irs.gov/Form 1040 for instructions and the latest information. Name(s) shown on Form 1040 Mya Lucky Day Additional 1-9b Reserved Income Taxable refunds, credits, or offsets of state and local income taxes 11 Alimony received 12 Business income or loss). Attach Schedule C or O-EZ 13 Capital gain or loss). Attach Schedule Dif required. If not required, check here 14 Other gains or losses). Attach Form 4797 15a Reserved 16a Reserved 17 Rental real estate, royalties, partnerships, Scorporations, trusts, etc. E 18 Farm income or loss) Attach Schedule F 19 Unemployment compensation 20a Reserved 21 Other income. List type and amount 22 Combine the amounts in the far right column. If you don't have any adjustments to income, enter here and include on Form 1040, line 6. Otherwise, go to line 23 Attachment Sequence No. 01 Your social security number 556-SS-SSSS 1-96 10 11 36250 12 13 14 15b 16b 17 18 19 20b 21 3+, 22 Form 1040 (2018) Page 2 1 1 2a 2b 3a Attach Forms W-2. Also attach Formis) W-2G and 1099-R tax was Wages, salaries, tips, etc. Attach Form(s) W-2 Tax-exempt interest 2a Qualified dividends 3a IRAS, pensions, and annuities Social Security benefits Ba Total income. Add lines through 5. Add any amount from Schedule 1, line 22 b Taxable interest b Ordinary dividends b Taxable amount b Taxable amount 4a 3b 4b 5a 6 6 Realized Recognized urrier HUUiLiundi velalls 1,700 1680 Form W-2G Paid $20 for BINGO card BINGO grand prize winner Annual neighborhood. poker tournament 2,500 2350 None Paid $150 for buy-in Alimony received 36,250 36250 Divorce decree Child support received 48,000 48000 Divorce decree Disability insurance proceeds 22,200 16650 Form 1099-R Ties to legally binding 2017 divorce settlement agreement Ties to legally binding 2017 divorce settlement agreement Mya paid 25% of the monthly disability insurance premiums using after-tax dollars; Mya's employer covered the remaining 75% Paid $525 for candle-making supplies (candle-making is a hobby for Mya) Amounts were received from a state- sponsored workers' compensation plan 480 0 None 17,500 17500 Employment agreement 41,200 41200 Legal settlement Lawsuit was related to a physical injury Proceeds from homemade candle sales Worker's compensation Lawsuit proceeds - lost wages Lawsuit proceeds - emotional distress Lawsuit proceeds -punitive damages Birthday card money Life insurance proceeds 15,000 15000 Legal settlement Lawsuit was related to a physical injury 75,000 75000 Legal settlement Lawsuit was related to a physical injury 2,000 2000 None Birthday cash from Great-Aunt Tilda to Mya, her favorite niece Proceeds received when poor Great Aunt Tilda passed away later in the year (Mya was her beneficiary) 250,000 250,000 Insurance policy TOTAL INCOME $511,830 $505,630 SCHEDULE 1 (Form 1040) Additional Income and Adjustments to Income OMB No 1545-0074 2018 10 Department of the Treasury Attach to Form 1040. Internal Revenue Service Go to www.irs.gov/Form 1040 for instructions and the latest information. Name(s) shown on Form 1040 Mya Lucky Day Additional 1-9b Reserved Income Taxable refunds, credits, or offsets of state and local income taxes 11 Alimony received 12 Business income or loss). Attach Schedule C or O-EZ 13 Capital gain or loss). Attach Schedule Dif required. If not required, check here 14 Other gains or losses). Attach Form 4797 15a Reserved 16a Reserved 17 Rental real estate, royalties, partnerships, Scorporations, trusts, etc. E 18 Farm income or loss) Attach Schedule F 19 Unemployment compensation 20a Reserved 21 Other income. List type and amount 22 Combine the amounts in the far right column. If you don't have any adjustments to income, enter here and include on Form 1040, line 6. Otherwise, go to line 23 Attachment Sequence No. 01 Your social security number 556-SS-SSSS 1-96 10 11 36250 12 13 14 15b 16b 17 18 19 20b 21 3+, 22 Form 1040 (2018) Page 2 1 1 2a 2b 3a Attach Forms W-2. Also attach Formis) W-2G and 1099-R tax was Wages, salaries, tips, etc. Attach Form(s) W-2 Tax-exempt interest 2a Qualified dividends 3a IRAS, pensions, and annuities Social Security benefits Ba Total income. Add lines through 5. Add any amount from Schedule 1, line 22 b Taxable interest b Ordinary dividends b Taxable amount b Taxable amount 4a 3b 4b 5a 6 6