Question

MyBnB started a home rental company on January 1. As of November 30, MyBnB reported the following balances. The company does not yet have a

MyBnB started a home rental company on January 1. As of November 30, MyBnB reported the following balances. The company does not yet have a balance in Retained Earnings because this is its first year of operations so no net income has been reported in prior years.

| Accounts Payable | $ 900 | Equipment | $ 7,200 |

|---|---|---|---|

| Cash | 3,000 | Repairs Expense | 600 |

| Cleaning Expense | 2,700 | Service Revenue | 6,000 |

| Common Stock | 9,000 | Wages Expense | 2,400 |

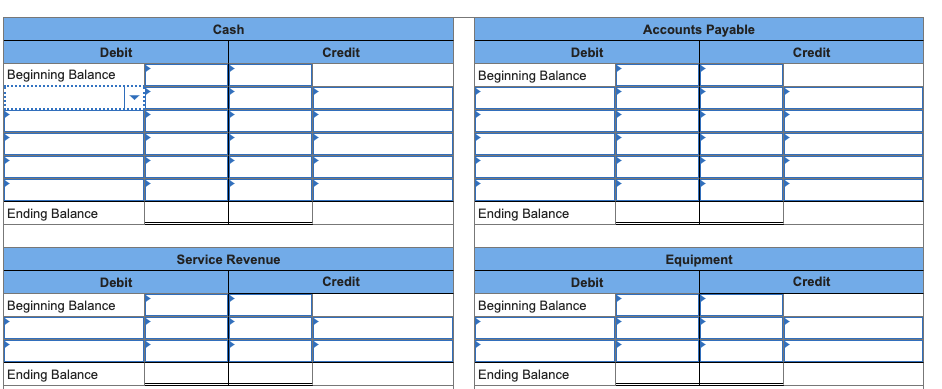

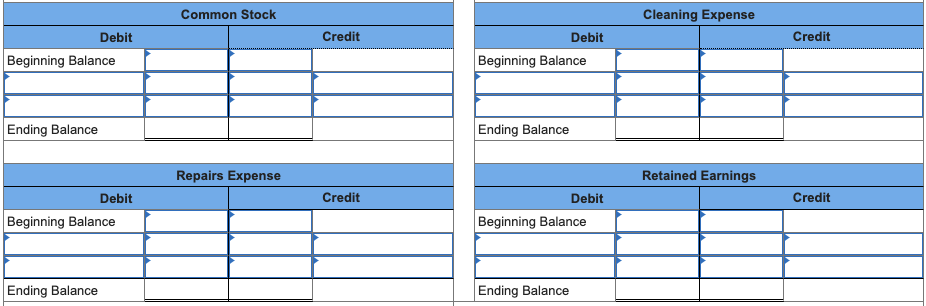

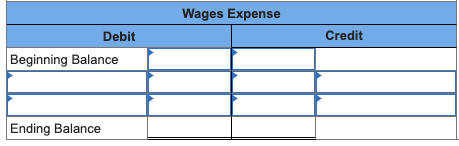

4. Prepare T-accounts that show the November 30 balances as December 1 beginning balances and then post the journal entries from your answer to requirement 3 to calculate updated December 31 balances. Retained Earnings has a beginning balance of $0.

(THIS IS THE ONLY INFORMATION I WAS GIVEN FOR THE QUESTION NEED HELP) LEFT COLUMNS CAN EITHER BE A, B, C, D, E )

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started