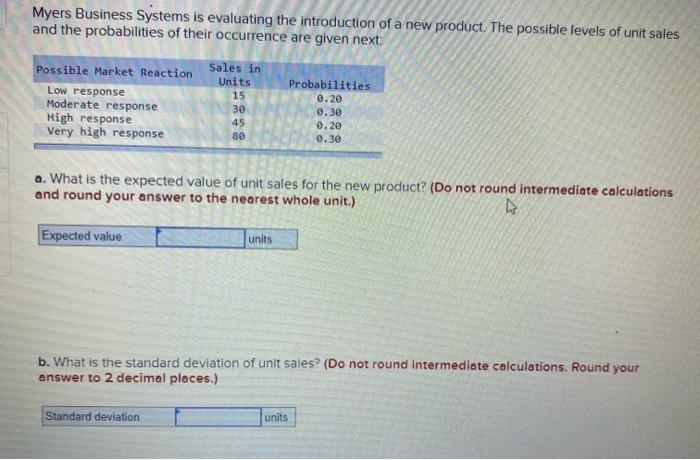

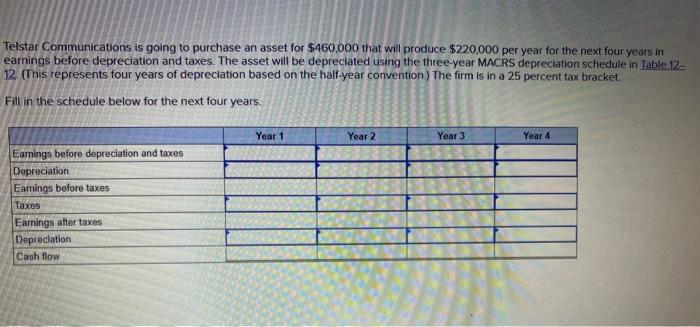

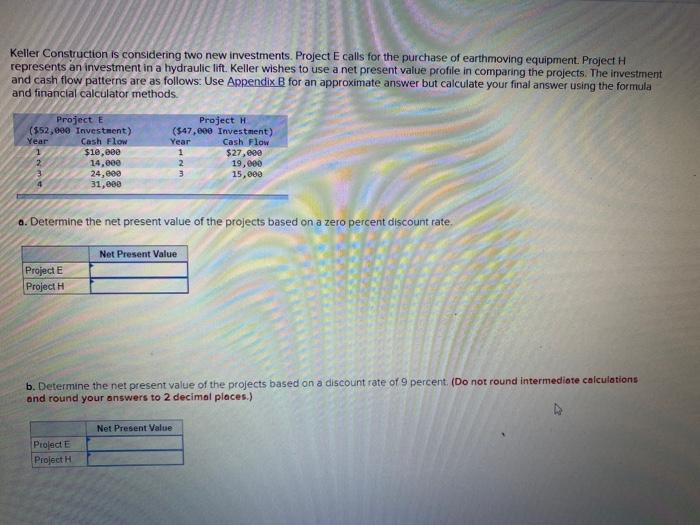

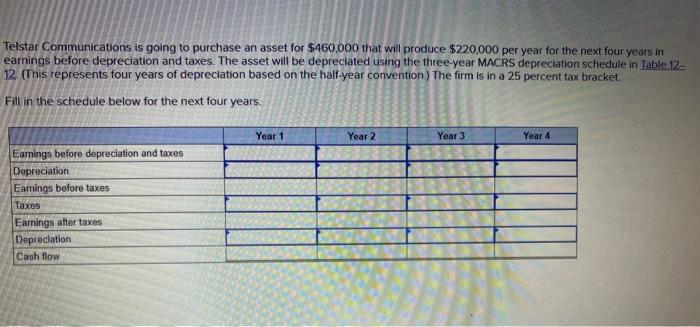

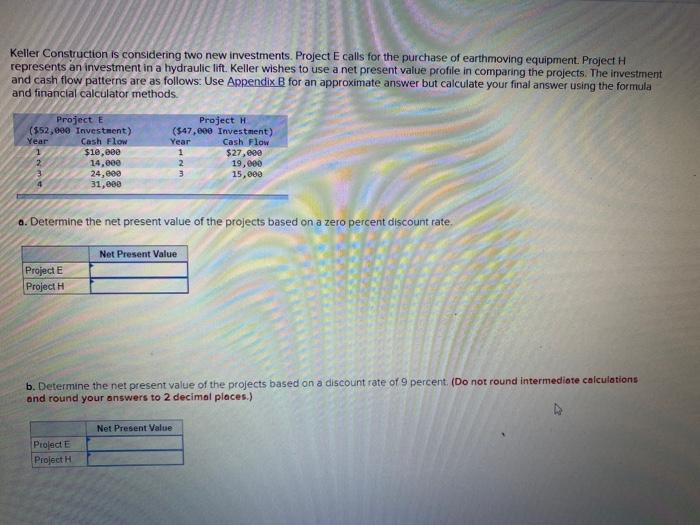

Myers Business Systems is evaluating the introduction of a new product. The possible levels of unit sales and the probabilities of their occurrence are given next Possible Market Reaction Sales in Units Low response 15 Moderate response 3e High response 45 Very high response 80 Probabilities 0.20 8.30 0.20 0.30 a. What is the expected value of unit sales for the new product? (Do not round intermediate calculations and round your answer to the nearest whole unit.) Expected value units b. What is the standard deviation of unit sales? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Standard deviation units Telstar Communications is going to purchase an asset for $460,000 that will produce $220,000 per year for the next four years in earnings before depreciation and taxes. The asset will be depreciated using the three-year MACRS depreciation schedule in Table 12 12. (This represents four years of depreciation based on the half-year convention) The firm is in a 25 percent tax bracket Fill in the schedule below for the next four years. Year 1 Year 2 Year 3 Year 4 Earnings before depreciation and taxes Depreciation Earnings before taxes Taxes Earnings after taxes Depreciation Cash flow Keller Construction is considering two new investments. Project E calls for the purchase of earthmoving equipment. Project H represents an investment in a hydraulic lift. Keller wishes to use a net present value profile in comparing the projects. The investment and cash flow patterns are as follows: Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods. Project E ($52,090 Investment) Year Cash Flow $10,888 2 14.000 24,000 31,600 Project (547,600 Investment) Year Cash Flow 1 $27,000 2 19,000 3 15,000 a. Determine the net present value of the projects based on a zero percent discount rate. Net Present Value Projecte Project H b. Determine the net present value of the projects based on a discount rate of 9 percent. (Do not round intermediate calculations and round your answers to 2 decimal places.) Net Present Value Project E Project H