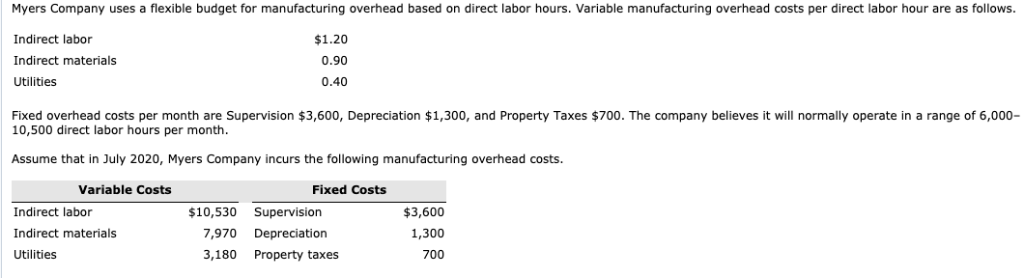

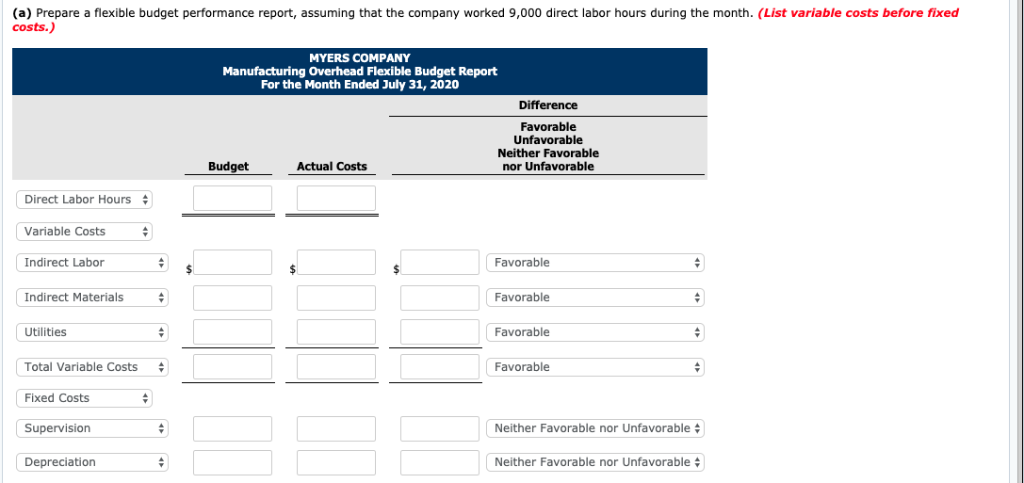

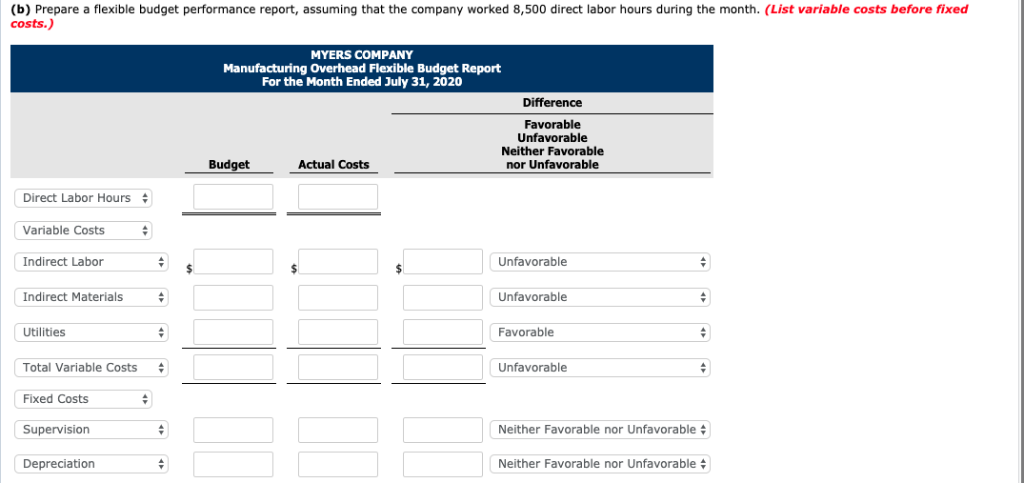

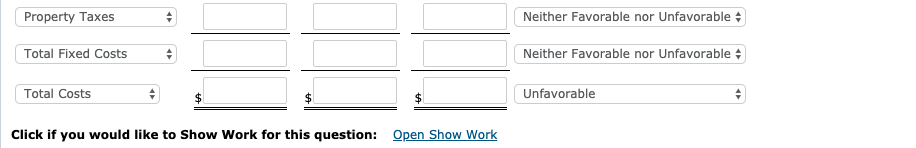

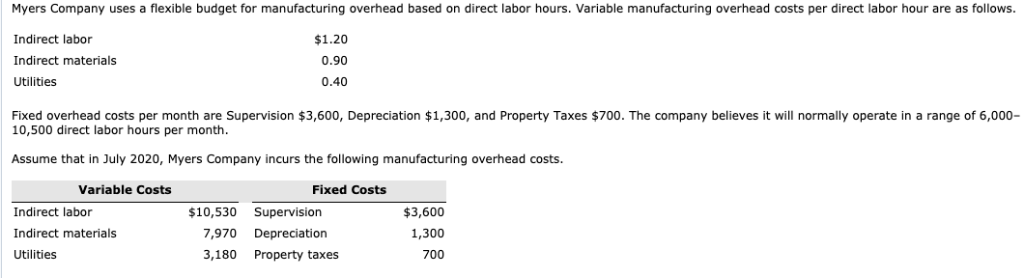

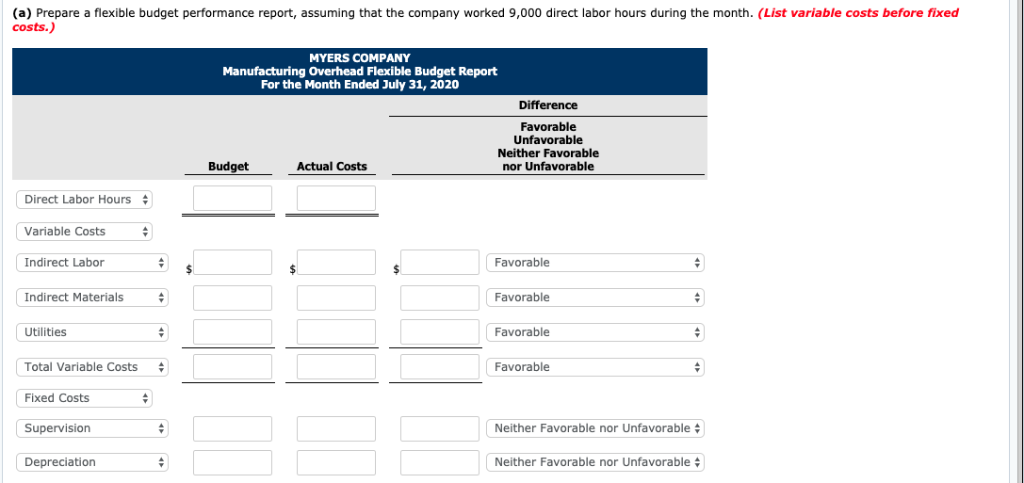

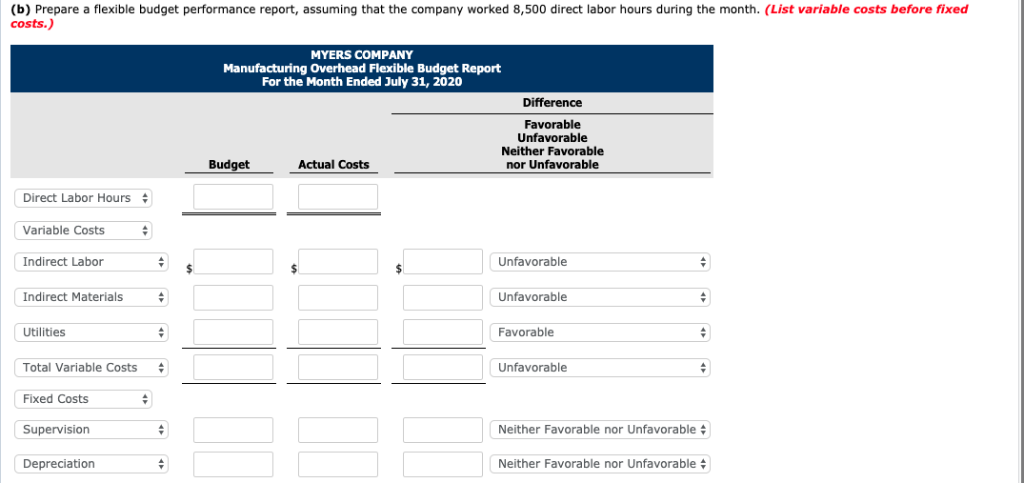

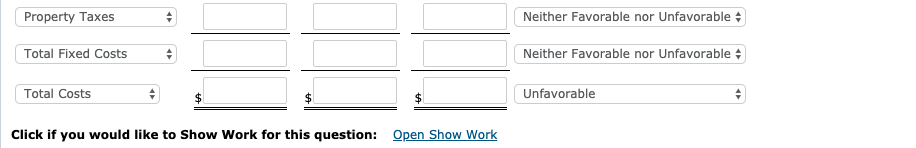

Myers Company uses a flexible budget for manufacturing overhead based on direct labor hours. Variable manufacturing overhead costs per direct labor hour are as follows Indirect labor Indirect materials Utilities $1.20 0.90 0.40 Fixed overhead costs per month are Supervision $3,600, Depreciation $1,300, and Property Taxes $700. The company believes it will normally operate in a range of 6,000 10,500 direct labor hours per month Assume that in July 2020, Myers Company incurs the following manufacturing overhead costs. Variable Costs Fixed Costs Indirect labor Indirect materials Utilities 10,530 Supervision $3,600 1,300 700 7,970 Depreciation 3,180 Property taxes (a) Prepare a flexible budget performance report, assuming that the company worked 9,000 direct labor hours during the month. (List variable costs before fixed costs.) MYERS COMPANY Manufacturing Overhead Flexible Budget Report For the Month Ended July 31, 2020 Difference Favorable Unfavorable Neither Favorable nor Unfavorable Budget Actual Costs Direct Labor Hours Variable Costs Indirect Labor Favorable Indirect Materials Favorable Utilities Favorable Total Variable Costs Favorable Fixed Costs Supervision Depreciation Neither Favorable nor Unfavorable # Neither Favorable nor Unfavorable # Neither Favorable nor Unfavorable Property Taxes Total Fixed Costs | Neither Favorable nor Unfavorable # Total Costs Favorable (b) Prepare a flexible budget performance report, assuming that the company worked 8,500 direct labor hours during the month. (List variable costs before fixed costs.) MYERS COMPANY Manufacturing Overhead Flexible Budget Report For the Month Ended July 31, 2020 Difference Favorable Unfavorable Neither Favorable nor Unfavorable Budget Actual Costs Direct Labor Hours Variable Costs Indirect Labor Unfavorable Indirect Materials Unfavorable Utilities Favorable Total Variable Costs Fixed Costs Supervision Depreciation Unfavorable Neither Favorable nor Unfavorable Neither Favorable nor Unfavorable Property Taxes Neither Favorable nor Unfavorable Neither Favorable nor Unfavorable Total Fixed Costs Total Costs Unfavorable Click if you would like to Show Work for this question: Open Show Work