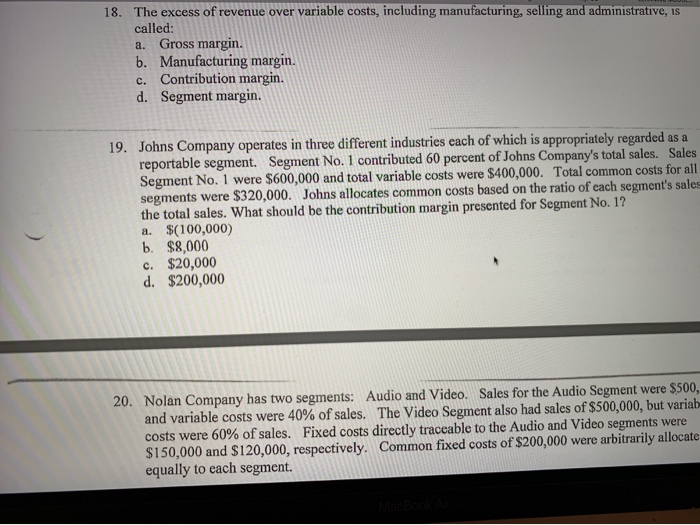

MYESC LEARNING MODUL 6. Which of the following is true about absorption costing? a. No fixed factory overhead is charged to production. b. It is also known as direct costing. c. The term used to designate the difference between sales and cost of goods sold is the "manufacturing margin." d. Over-applied factory overhead is reflected in the income statement as a reduction cost of goods sold. 7. Which of the following does not appear on an income statement prepared using variable costing? a. Gross margin/profit. b. Manufacturing margin c. Fixed production costs. d. Variable production costs. 8. On a variable costing income statement, the difference between sales and variable cost of goods sold is called: a. gross margin. b. contribution margin. c. profit margin. d. manufacturing margin. 9. What factor related to manufacturing costs causes the difference in net earnings computed using absorption costing and net earnings computed using variable costing? a. Absorption costing considers all costs in the determination of net earnings, whereas variable costing considers only direct costs. R u bindownsideredict costs 9. What factor related to manufacturing costs causes the difference in net earnings computed using absorption costing and net earnings computed using variable costing? a. Absorption costing considers all costs in the determination of net earnings, whereas variable costing considers only direct costs. b. Absorption costing "inventories" all direct costs, but variable costing considers direct costs to be period costs. c. Absorption costing "inventories" all fixed manufacturing costs for the period in ending finished goods inventory, but variable costing expenses all fixed costs. d. Absorption costing allocates fixed manufacturing costs between cost of goods sold and inventories, and variable costing considers all fixed costs to be period costs. 10. Net income reported under variable costing will exceed net income reported under absorption costing for a given period if: a. Production equals sales for that period. b. Production exceeds sales for that period. c. Sales exceed production for that period. d. The variable overhead exceeds the fixed overhead. 1. A manager can increase income under absorption costing by a. increasing variable costs. b. increasing production. c. increasing fixed costs. d. increasing leased assets. 12. The use of either absorption or variable costing will make little difference in companies a. with large inventories. b. using JIT. LEARNING MODUL mySC 12. The use of either absorption or variable costing will make little difference in companies a. with large inventories. b. using JIT. c. with high fixed costs. d. with high variable costs. 13. A basic tenet of variable costing is that fixed overhead costs should be currently expensed. What is the basic rationale behind this procedure? a. Fixed overhead costs will occur whether or not production occurs and so it presents a clearer picture of how changes in production volume affect costs and income. b. Fixed overhead costs are generally immaterial in amount and the cost of assigning the amounts to specific products would outweigh the benefits. c. Allocation of fixed overhead costs is arbitrary at best and could lead to erroneous decisions by management. d. Fixed overhead costs are uncontrollable and should not be charged to a specific product. 14. Absorption cost is required for: a. income tax purposes. b external financial 14. Absorption cost is required for: a. income tax purposes. b. external financial reporting but not income tax purposes. c. both external financial reporting and income tax purposes. d. neither external financial reporting nor income tax purposes. 15. Segment profitability analysis may be used to evaluate the profitability of: a. Divisions. b. Sales territories. c. Product lines. d. All of these are correct. 16. When evaluating profitability of a segment, costs that are directly identifiable with a specific segment are called: a. Direct costs. b. Common costs. c. Indirect costs. d. Fixed costs. 17. When evaluating profitability of a segment, costs that would disappear if the company eliminated the segment are called: a. Direct costs. b. Common costs. c. Indirect costs. d. Fixed costs. 18. The excess of revenue over variable costs, including manufacturing, selling and administrative, is called: a. Gross margin. b. Manufacturing margin. c. Contribution margin. d. Segment margin. 19. Johns Company operates in three different industries cach of which is appropriately regarded as a reportable segment. Segment No. 1 contributed 60 percent of Johns Company's total sales. Sales Segment No. I were $600,000 and total variable costs were $400,000. Total common costs for all segments were $320,000. Johns allocates common costs based on the ratio of each segment's sale the total sales. What should be the contribution margin presented for Segment No. 1? a. $(100,000) b. $8,000 c. $20,000 d. $200,000 20. Nolan Company has two segments: Audio and Video. Sales for the Audio Segment were $500, and variable costs were 40% of sales. The Video Segment also had sales of $500,000, but variah costs were 60% of sales. Fixed costs directly traceable to the Audio and Video segments were $150,000 and $120,000, respectively. Common fixed costs of $200,000 were arbitrarily allocate equally to each segment