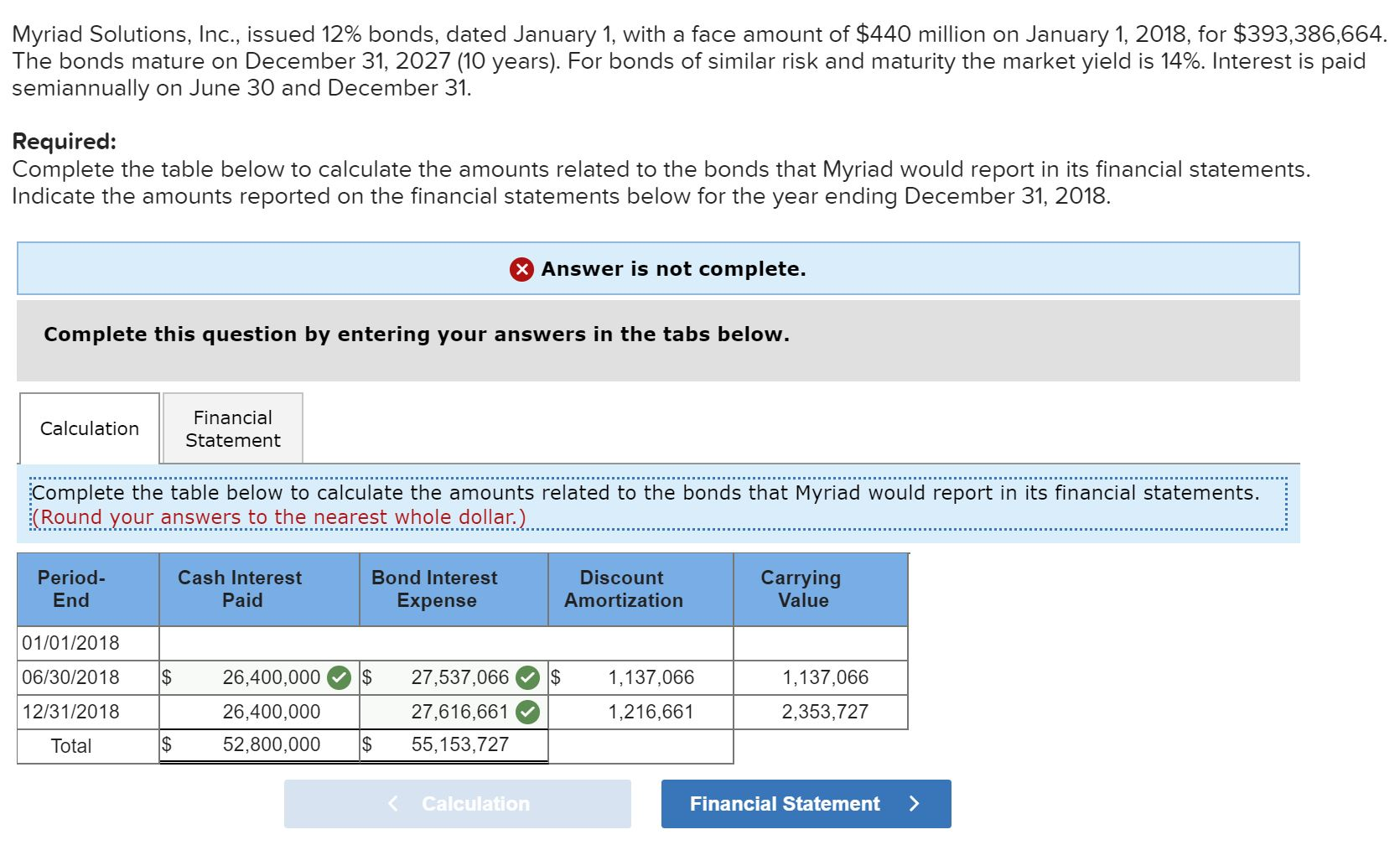

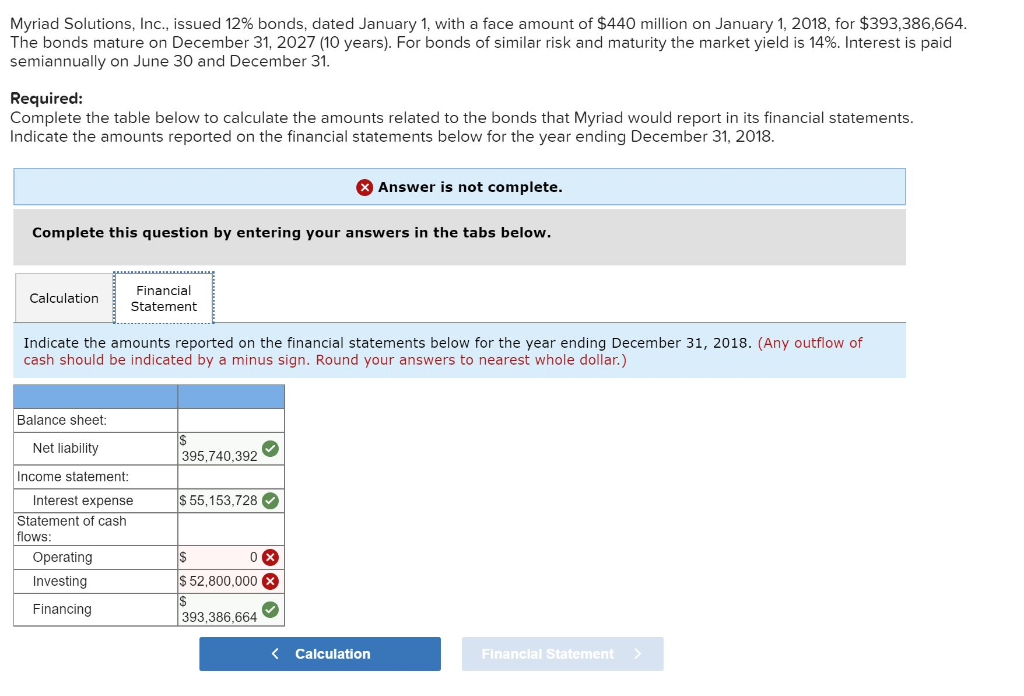

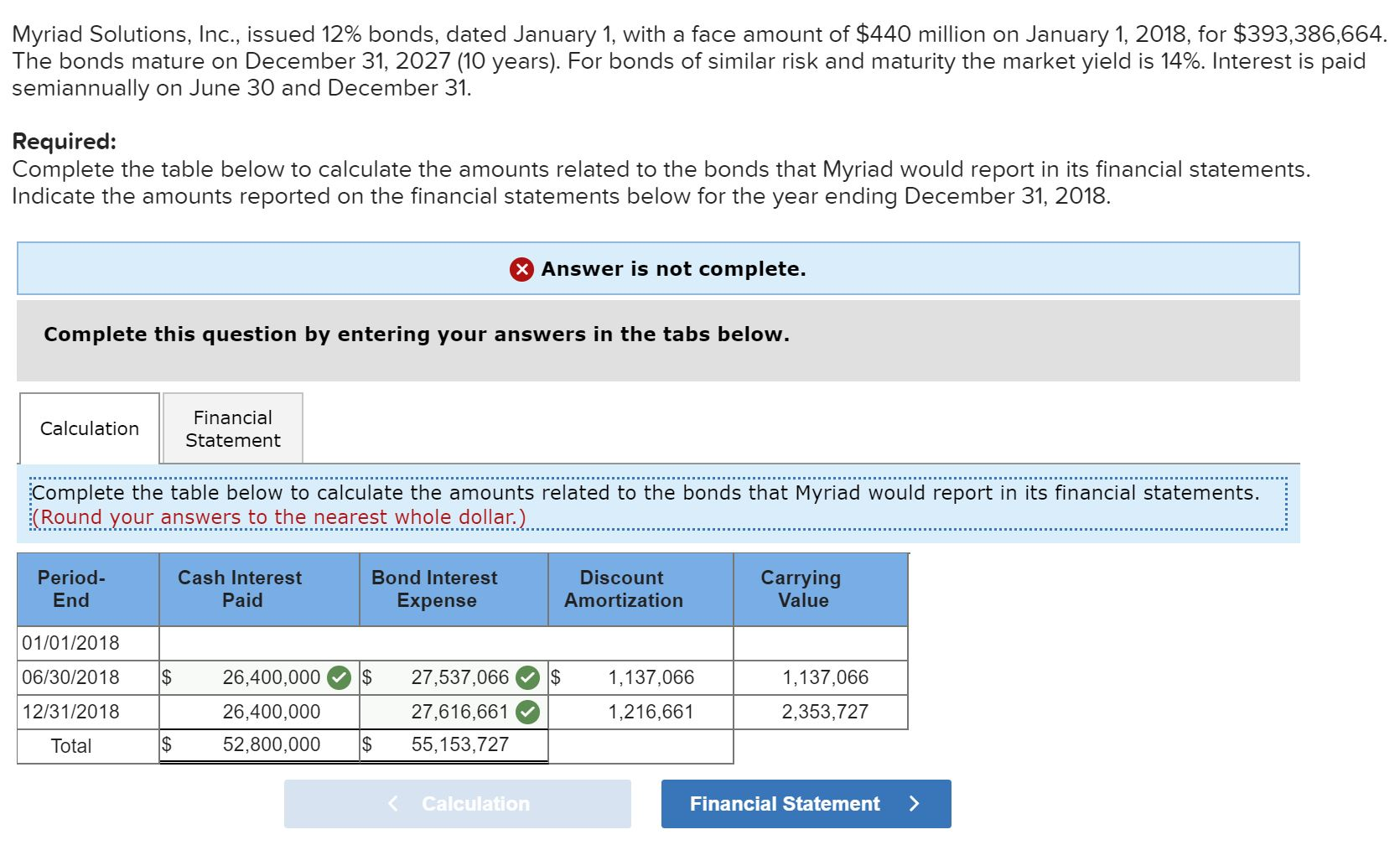

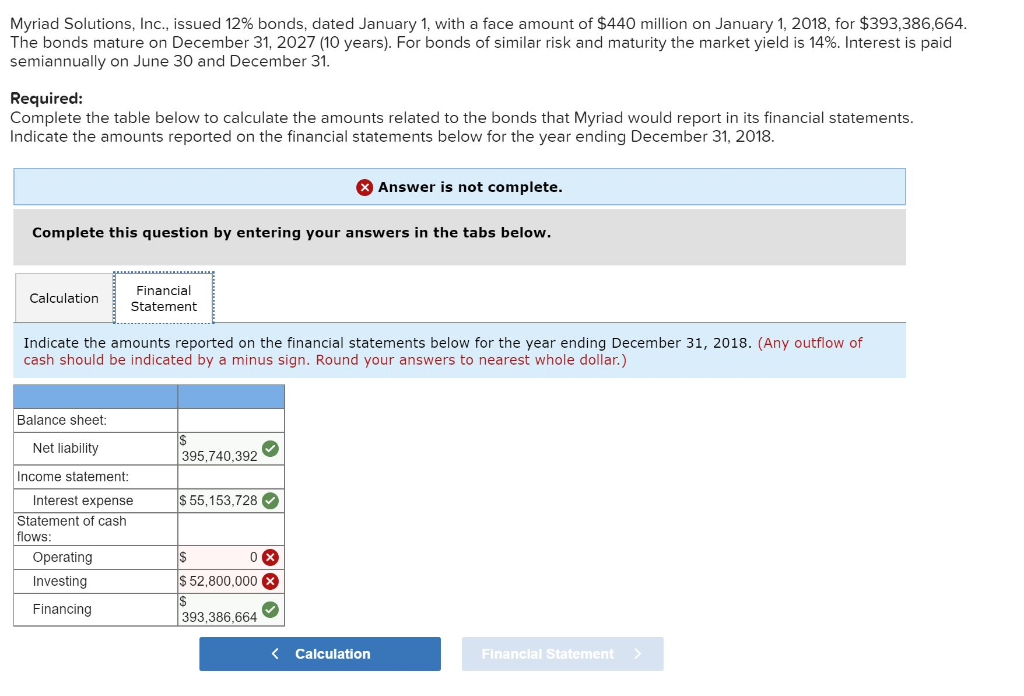

Myriad Solutions, Inc., issued 12 % bonds, dated January 1, with a face amount of $440 million on January 1, 2018, for $393,386,664 The bonds mature on December 31, 2027 (10 years). For bonds of similar risk and maturity the market yield is 14%. Interest is paid semiannually on June 30 and December 31. Required: Complete the table below to calculate the amounts related to the bonds that Myriad would report in its financial statements. Indicate the amounts reported on the financial statements below for the year ending December 31, 2018. Answer is not complete. Complete this question by entering your answers in the tabs below. Financial Calculation Statement Complete the table below to calculate the amounts related to the bonds that Myriad would report in its financial statements. (Round your answers to the nearest whole dollar.) Period- Cash Interest Bond Interest Discount Carrying Value End Paid Expense Amortization 01/01/2018 $ 26,400,000 $ $ 06/30/2018 27,537,066 1,137,066 1,137,066 12/31/2018 27,616,661 2,353,727 26,400,000 1,216,661 $ Total $ 52,800,000 55,153,727 KCalculation Financial Statement Myriad Solutions, Inc., issued 12% bonds, dated January 1, with a face amount of $440 million on January 1, 2018, for $393,386,664 The bonds mature on December 31, 2027 (10 years). For bonds of similar risk and maturity the market yield is 14%. Interest is paid semiannually on June 30 and December 31 Required: Complete the table below to calculate the amounts related to the bonds that Myriad would report in its financial statements Indicate the amounts reported on the financial statements below for the year ending December 31, 2018 Answer is not complete. Complete this question by entering your answers in the tabs below. Financial Calculation Statement Indicate the amounts reported on the financial statements below for the year ending December 31, 2018. (Any outflow of cash should be indicated by a minus sign. Round your answers to nearest whole dollar.) Balance sheet Net liability 395,740,392 Income statement: $55,153,728 Interest expense Statement of cash flows Operating 0 X $52,800,000X Investing Financing 393,386,664 Financial Statement> Calculation