Question: Myriad Solutions, Inc. issued 12% bonds, dated January 1, with a face amount of $330 million on January 1, 2021, for $295,039,998. The bonds

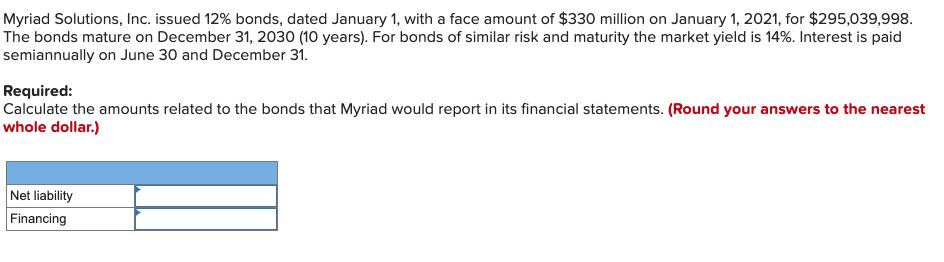

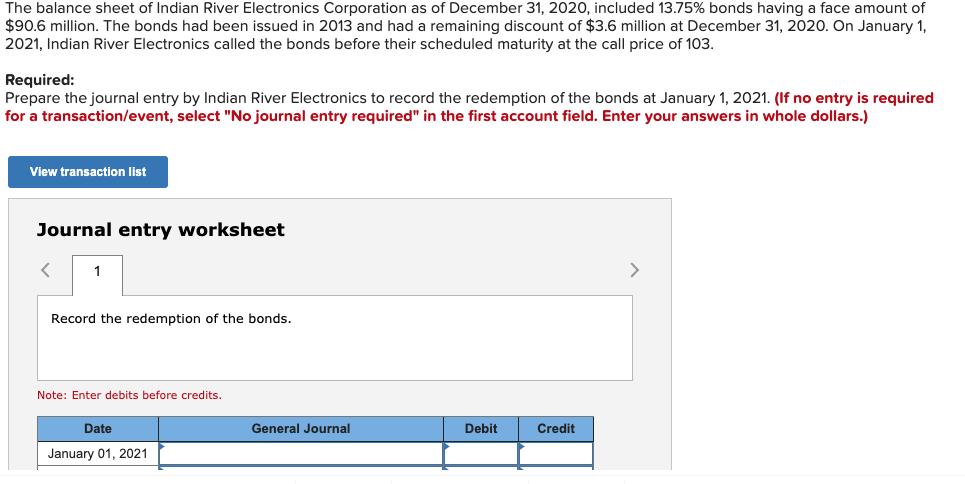

Myriad Solutions, Inc. issued 12% bonds, dated January 1, with a face amount of $330 million on January 1, 2021, for $295,039,998. The bonds mature on December 31, 2030 (10 years). For bonds of similar risk and maturity the market yield is 14%. Interest is paid semiannually on June 30 and December 31. Required: Calculate the amounts related to the bonds that Myriad would report in its financial statements. (Round your answers to the nearest whole dollar.) Net liability Financing The balance sheet of Indian River Electronics Corporation as of December 31, 2020, included 13.75% bonds having a face amount of $90.6 million. The bonds had been issued in 2013 and had a remaining discount of $3.6 million at December 31, 2020. On January 1, 2021, Indian River Electronics called the bonds before their scheduled maturity at the call price of 103. Required: Prepare the journal entry by Indian River Electronics to record the redemption of the bonds at January 1, 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in whole dollars.) View transaction list Journal entry worksheet 1 > Record the redemption of the bonds. Note: Enter debits before credits. Date General Journal Debit Credit January 01, 2021

Step by Step Solution

3.28 Rating (154 Votes )

There are 3 Steps involved in it

Answer Cash interest 33000000012 612 19800000 Part 1 ... View full answer

Get step-by-step solutions from verified subject matter experts