Answered step by step

Verified Expert Solution

Question

1 Approved Answer

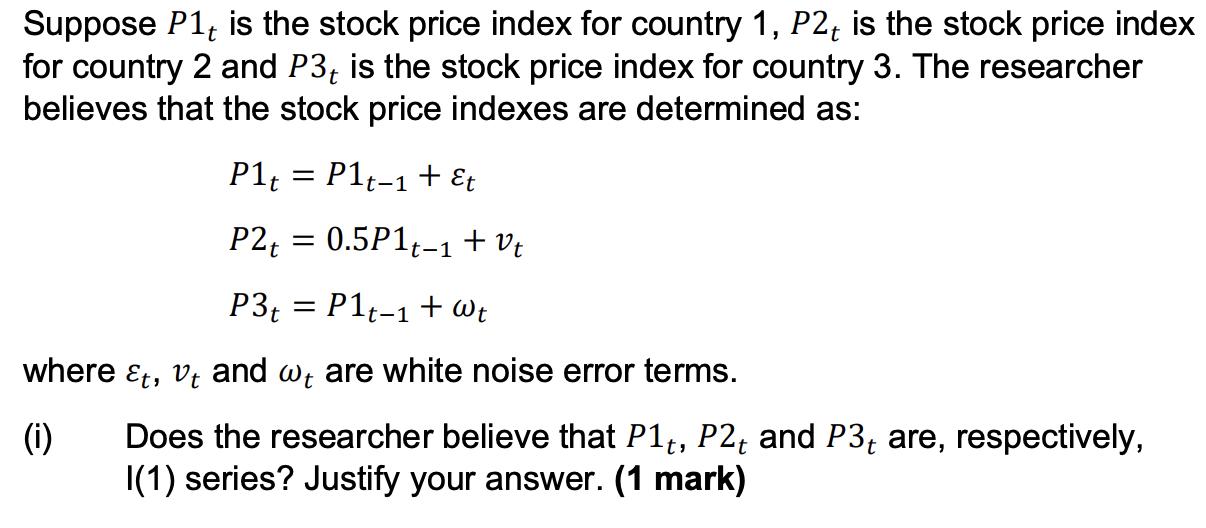

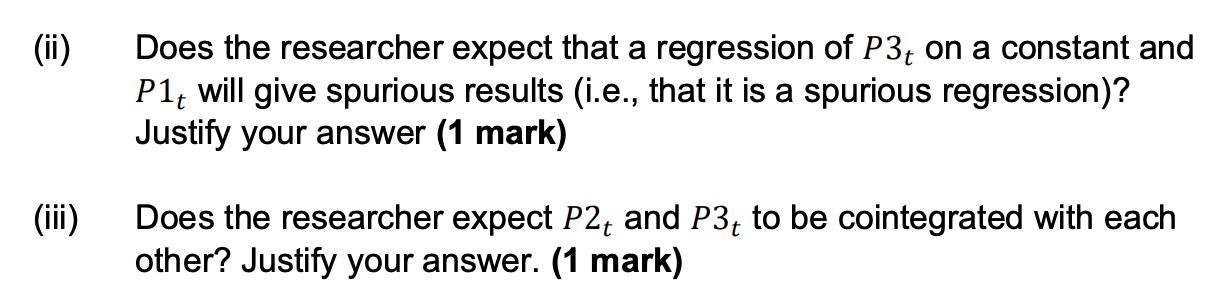

Suppose P1, is the stock price index for country 1, P2, is the stock price index for country 2 and P3, is the stock

Suppose P1, is the stock price index for country 1, P2, is the stock price index for country 2 and P3, is the stock price index for country 3. The researcher believes that the stock price indexes are determined as: P1t = P1t-1 + P2t = 0.5P1t-1 +Vt P3t = P1t-1 + Wt where &t, Vt and we are white noise error terms. (i) Does the researcher believe that P1, P2t and P3, are, respectively, I(1) series? Justify your answer. (1 mark) (ii) (iii) t Does the researcher expect that a regression of P3, on a constant and P1, will give spurious results (i.e., that it is a spurious regression)? Justify your answer (1 mark) t Does the researcher expect P2 and P3, to be cointegrated with each other? Justify your answer. (1 mark)

Step by Step Solution

★★★★★

3.54 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

i To determine if the series P1t P2t and P3t are I1 series integrated of order 1 we need to check if the series are stationary after differencing once ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started