Answered step by step

Verified Expert Solution

Question

1 Approved Answer

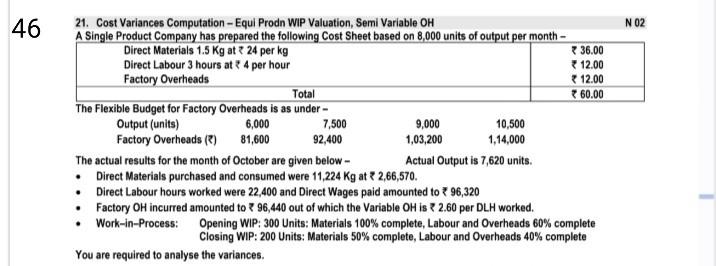

N 02 46 21. Cost Variances Computation - Equi Prodn WIP Valuation, Semi Variable OH A Single Product Company has prepared the following Cost Sheet

N 02 46 21. Cost Variances Computation - Equi Prodn WIP Valuation, Semi Variable OH A Single Product Company has prepared the following Cost Sheet based on 8,000 units of output per month Direct Materials 1.5 kg at 24 per kg 36.00 Direct Labour 3 hours at 4 per hour 12.00 Factory Overheads * 12.00 Total * 60.00 The Flexible Budget for Factory Overheads is as under- Output (units) 6,000 7,500 9,000 10,500 Factory Overheads() 81,600 92,400 1,03,200 1,14,000 The actual results for the month of October are given below- Actual Output is 7,620 units. Direct Materials purchased and consumed were 11,224 Kg at 2,66,570. Direct Labour hours worked were 22,400 and Direct Wages paid amounted to 96,320 Factory OH incurred amounted to 96,440 out of which the Variable OH is 2.60 per DLH worked. Work-in-Process: Opening WIP: 300 Units: Materials 100% complete, Labour and Overheads 60% complete Closing WIP: 200 Units: Materials 50% complete, Labour and Overheads 40% complete You are required to analyse the variances

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started