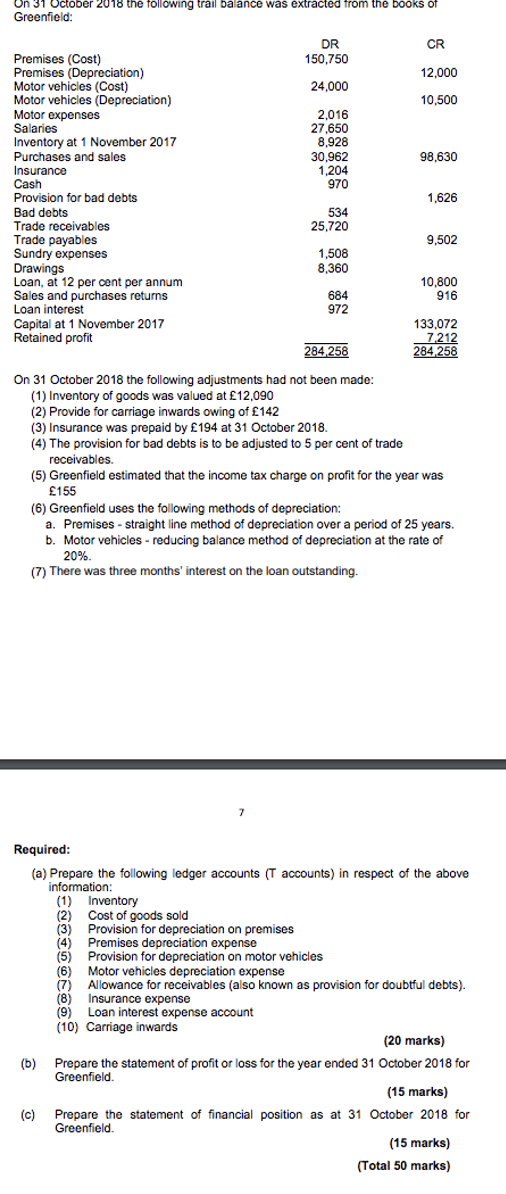

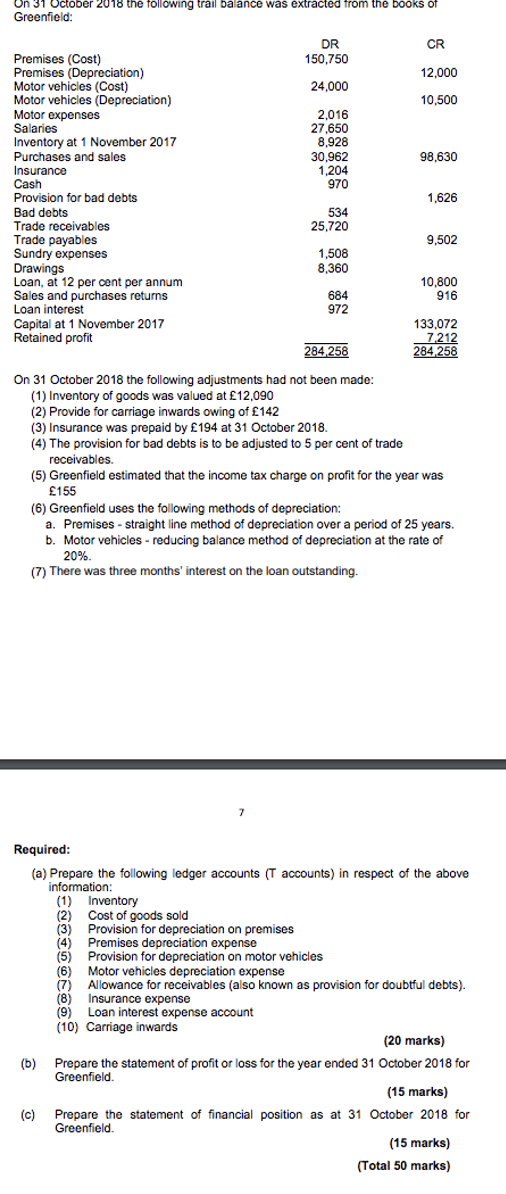

n 31 October 2018 the following trail balance was extracted from the books of Greenfield: CR DR 150,750 12,000 24,000 10,500 2,016 27,650 8,928 30,962 1,204 970 98,630 Premises (Cost) Premises (Depreciation) Motor vehicles (Cost) Motor vehicles (Depreciation) Motor expenses Salaries Inventory at 1 November 2017 Purchases and sales Insurance Cash Provision for bad debts Bad debts Trade receivables Trade payables Sundry expenses Drawings Loan, at 12 per cent per annum Sales and purchases returns Loan interest Capital at 1 November 2017 Retained profit 1,626 534 25,720 9,502 1,508 8,360 10.800 916 684 972 133,072 7.212 284,258 284258 On 31 October 2018 the following adjustments had not been made: (1) Inventory of goods was valued at 12,090 (2) Provide for carriage inwards owing of 142 (3) Insurance was prepaid by 194 at 31 October 2018 (4) The provision for bad debts is to be adjusted to 5 per cent of trade receivables. (5) Greenfield estimated that the income tax charge on profit for the year was 155 (6) Greenfield uses the following methods of depreciation: a. Premises - straight line method of depreciation over a period of 25 years. b. Motor vehicles - reducing balance method of depreciation at the rate of 20% (7) There was three months' interest on the loan outstanding. Required: (a) Prepare the following ledger account (T accounts) in respect of the above information: (1) Inventory (2) Cost of goods sold (3) Provision for depreciation on premises (4) Premises depreciation expense (5) Provision for depreciation on motor vehicles (6) Motor vehicles depreciation expense (7) Allowance for receivables (also known as provision for doubtful debts). (8) Insurance expense (9) Loan interest expense account (10) Carriage inwards (20 marks) (b) Prepare the statement of profit or loss for the year ended 31 October 2018 for Greenfield. (15 marks) (c) Prepare the statement of financial position as at 31 October 2018 for Greenfield. (15 marks) (Total 50 marks) n 31 October 2018 the following trail balance was extracted from the books of Greenfield: CR DR 150,750 12,000 24,000 10,500 2,016 27,650 8,928 30,962 1,204 970 98,630 Premises (Cost) Premises (Depreciation) Motor vehicles (Cost) Motor vehicles (Depreciation) Motor expenses Salaries Inventory at 1 November 2017 Purchases and sales Insurance Cash Provision for bad debts Bad debts Trade receivables Trade payables Sundry expenses Drawings Loan, at 12 per cent per annum Sales and purchases returns Loan interest Capital at 1 November 2017 Retained profit 1,626 534 25,720 9,502 1,508 8,360 10.800 916 684 972 133,072 7.212 284,258 284258 On 31 October 2018 the following adjustments had not been made: (1) Inventory of goods was valued at 12,090 (2) Provide for carriage inwards owing of 142 (3) Insurance was prepaid by 194 at 31 October 2018 (4) The provision for bad debts is to be adjusted to 5 per cent of trade receivables. (5) Greenfield estimated that the income tax charge on profit for the year was 155 (6) Greenfield uses the following methods of depreciation: a. Premises - straight line method of depreciation over a period of 25 years. b. Motor vehicles - reducing balance method of depreciation at the rate of 20% (7) There was three months' interest on the loan outstanding. Required: (a) Prepare the following ledger account (T accounts) in respect of the above information: (1) Inventory (2) Cost of goods sold (3) Provision for depreciation on premises (4) Premises depreciation expense (5) Provision for depreciation on motor vehicles (6) Motor vehicles depreciation expense (7) Allowance for receivables (also known as provision for doubtful debts). (8) Insurance expense (9) Loan interest expense account (10) Carriage inwards (20 marks) (b) Prepare the statement of profit or loss for the year ended 31 October 2018 for Greenfield. (15 marks) (c) Prepare the statement of financial position as at 31 October 2018 for Greenfield. (15 marks) (Total 50 marks)