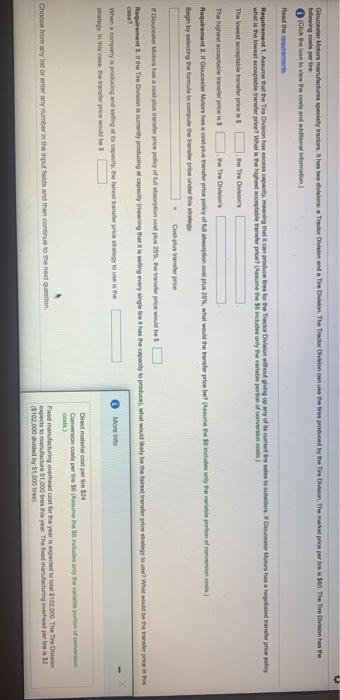

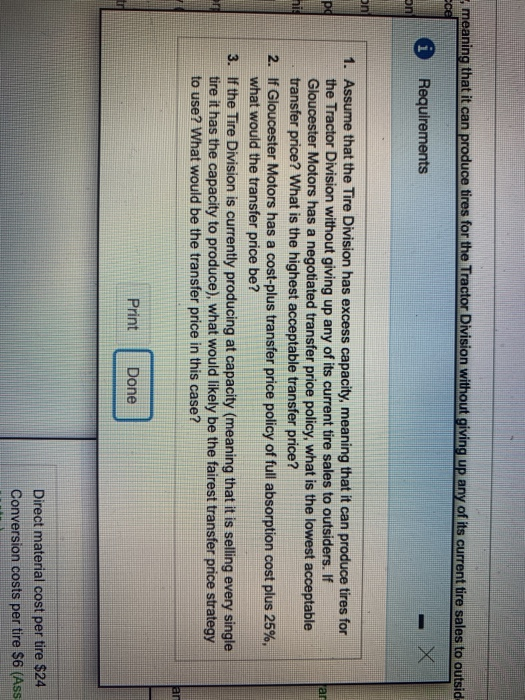

n a Tractor Division and a Tre Mision. The Tractor Whion con the tres produced by the The D on The market price per ris 100. The Time Division has the Gloucester Motors manufactures specialty tractors. It has bee following costs per tre Click the icon to view the costs and additional information) Read the recrets oles to unders, Gloucester Motors has negotiated transfer price policy Requirement 1. Assume that the Tire Division has excess capacity, meaning that can produce tires for the recorvision without ging up any of its current r what is the lowest acceptable transfer price? What is the highest acceptable transfer price? A m the includes only the variable portion of conversion costs) The lowest ceptable Vansfer price is . the Tire Division's The highest acceptable transfer price is the The Division's L Requirement 2. If Gloucester Motors has a costlus transfer price policy of Begin by selecting the formulate compute the transfer price under this tegy corption cont plus 25%, what would the transfer price be? Assume te $ includes only the variable portion of conversion cos Costplus transfer price If Gloucester Motor has a couples transfer price policy of absorption cost pus 25% e tramader price would be Requirement. If the Tire Division is current producing capacity (meaning that selling every single tire has the capacity to produce what would likely be the rest transfer prices on What would be the 1 More info When a company is producing and sing at its capacity, the first transfer price tagy to use is the strategy in this case, the transfer price would be Direct material cost per bir $24 Conversion coulis pertine 16 (Assume the includes only the variable portion of conversion Choose from any list or enter any number in the input fields and then continue to the next question Faced manufacturing overhead cost for the year is expected to total $102.000. The Tre Division expects to manufacture 51.000 tres this year. The feed manufacturing overhead per tire is $2 ($102.000 divided by 51,000 tres). meaning that it can produce tires for the Tractor Division without giving up any of its current tire sales to outsid i Requirements 1. Assume that the Tire Division has excess capacity, meaning that it can produce tires for the Tractor Division without giving up any of its current tire sales to outsiders. If Gloucester Motors has a negotiated transfer price policy, what is the lowest acceptable transfer price? What is the highest acceptable transfer price? 2. If Gloucester Motors has a cost-plus transfer price policy of full absorption cost plus 25%, what would the transfer price be? If the Tire Division is currently producing at capacity (meaning that it is selling every single tire it has the capacity to produce), what would likely be the fairest transfer price strategy to use? What would be the transfer price in this case? Print Done Direct material cost per tire $24 Conversion costs per tire $6 (Ass