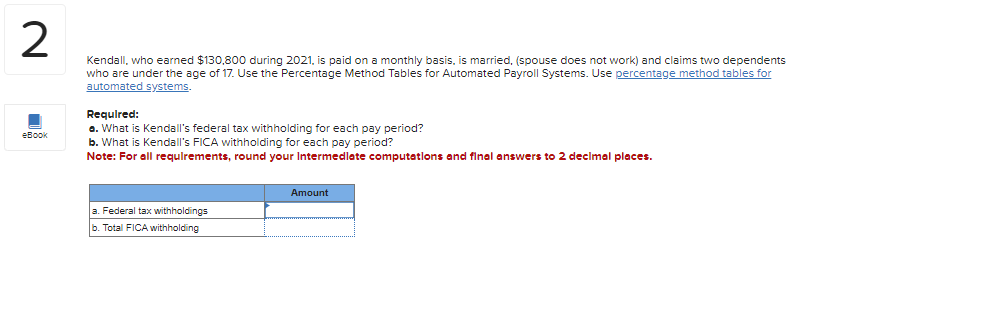

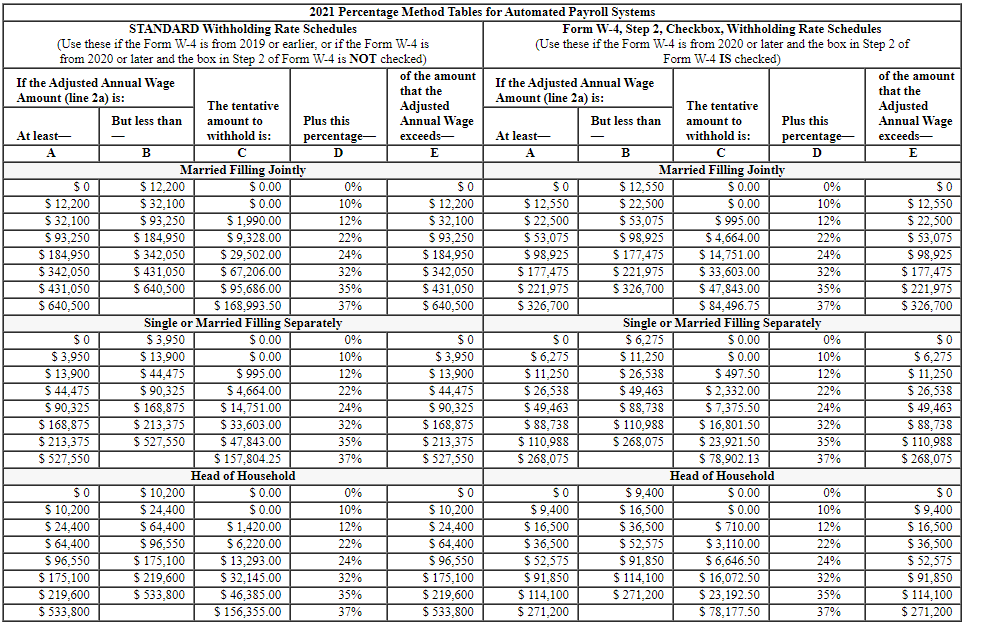

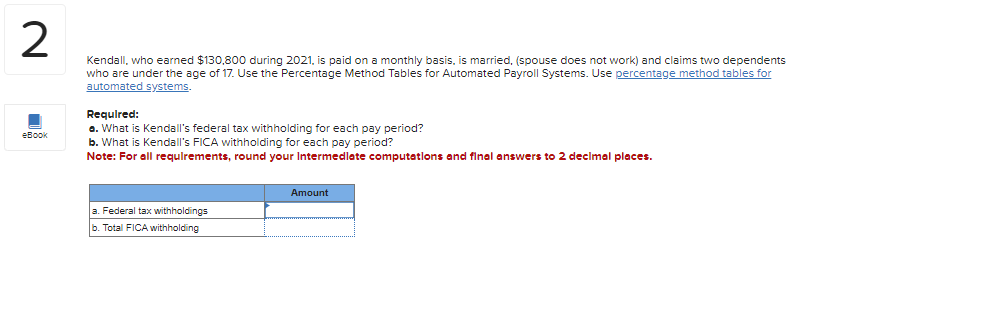

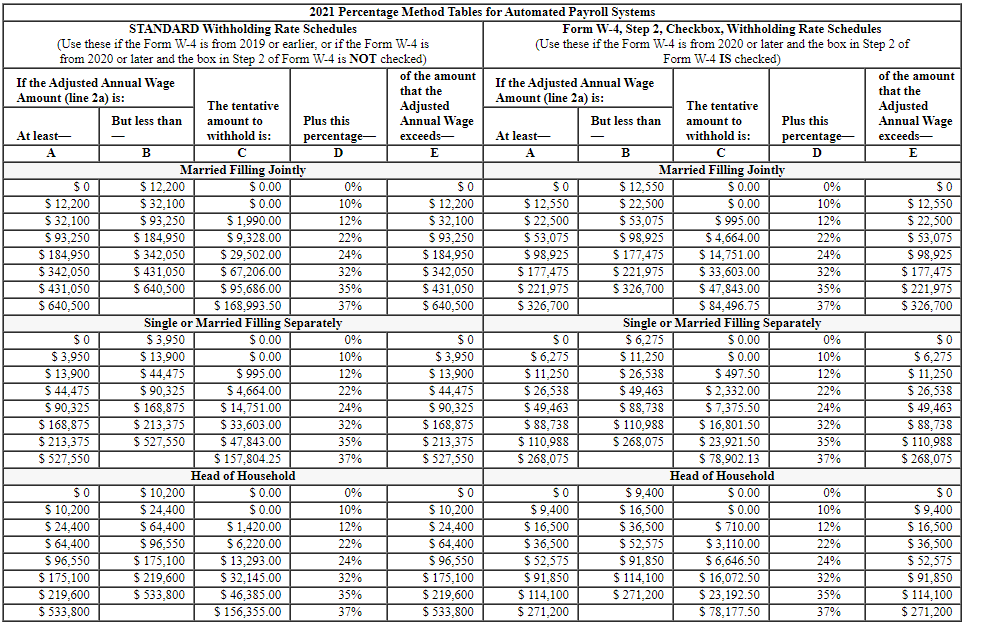

N Kendall, who earned $130.800 during 2021, is paid on a monthly basis, is married, (spouse does not work) and claims two dependents who are under the age of 17. Use the Percentage Method Tables for Automated Payroll Systems. Use percentage method tables for automated systems eBook Requlred: .. What is Kendall's federal tax withholding for each pay period? b. What is Kendall's FICA withholding for each pay period? Note: For all requlrements, round your Intermediate computations and final answers to 2 decimal places. Amount a. Federal tax withholdings b. Total FICA withholding 2021 Percentage Method Tables for Automated Payroll Systems STANDARD Withholding Rate Schedules Form W-4, Step 2, Checkbox, Withholding Rate Schedules (Use these if the Form W-4 is from 2019 or earlier, or if the Form W-4 is (Use these if the Form W-4 is from 2020 or later and the box in Step 2 of from 2020 or later and the box in Step 2 of Form W-4 is NOT checked) Form W-4 IS checked) of the amount of the amount If the Adjusted Annual Wage that the If the Adjusted Annual Wage Amount (line 2a) is: Amount (line 2a) is: that the The tentative Adjusted The tentative Adjusted But less than amount to Plus this Annual Wage But less than amount to Plus this Annual Wage At least- withhold is: percentage- exceeds At least- withhold is: percentage exceeds- A B c D E A B D E Married Filling Jointly Married Filling Jointly SO $ 12,200 $ 0.00 0% SO $0 $ 12,550 $ 0.00 0% SO $ 12,200 $ 32,100 $ 0.00 10% $ 12,200 $ 12,550 $ 22,500 $ 0.00 10% $ 12,550 $ 32,100 $ 93,250 $ 1.990.00 12% $ 32,100 $ 22.500 $ 53,075 $ 995.00 12% $ 22,500 $ 93,250 $184,950 S 9,328.00 22% $ 93,250 $ 53,075 $ 98.925 $ 4,664.00 22% $ 53,075 $184.950 $ 342,050 $ 29,502.00 24% S 184,950 $98,925 S 177,475 $ 14,751.00 24% $ 98.925 $ 342,050 $ 431,050 $ 67,206.00 32% $ 342,050 $ 177,475 $ 221,975 $ 33,603.00 32% $ 177,475 S431,050 $ 640,500 $ 95,686.00 35% S 431,050 $ 221,975 $ 326,700 $ 47,843.00 35% $ 221,975 $ 640,500 $ 168,993,50 37% $ 640,500 $ 326,700 $ 84.496.75 37% $ 326,700 Single or Married Filling Separately Single or Married Filling Separately $0 $ 3,950 $ 0.00 0% SO SO $ 6,275 $ 0.00 0% SO $ 3,950 $ 13.900 $ 0.00 10% $ 3,950 $6,275 $ 11,250 $ 0.00 10% $ 6,275 $ 13,900 $ 44,475 $ 995.00 12% $ 13,900 S 11.250 $ 26,538 $ 497.50 12% $ 11,250 $ 44,475 $ 90,325 $ 4.664.00 22% $ 44,475 $ 26,538 $ 49,463 $2.332.00 22% $ 26,538 $ 90,325 $ 168,875 $ 14,751.00 24% $ 90,325 $ 49,463 $ 88,738 $ 7.375.50 24% $ 49,463 $ 168,875 $ 213,375 $ 33,603.00 32% $ 168,875 $ 88,738 $ 110,988 $ 16.801.50 32 $ 88,738 $ 213,375 $ 527,550 $ 47,843.00 35% $ 213,375 $ 110,988 $ 268,075 $ 23,921.50 35% $ 110,988 $ 527,550 $ 157,804.25 37% $ 527,550 $ 268,075 $ 78,902.13 37% $ 268,075 Head of Household Head of Household SO $ 10.200 $ 0.00 0% SO SO $ 9,400 $ 0.00 0% $0 S 10,200 $ 24,400 $ 0.00 10% S 10,200 $ 9,400 $16.500 $ 0.00 10% $ 9,400 $ 24,400 $ 64,400 S 1.420.00 12% $ 24,400 $ 16,500 $36,500 $ 710.00 12% $ 16,500 $ 64,400 $ 96,550 $ 6,220.00 22% $ 64,400 $36,500 $ 52.575 $3,110.00 22% S 36.500 $ 96,550 S 175,100 $ 13,293.00 24% $ 96,550 $ 52.575 $ 91,850 $ 6,646.50 24% $ 52.575 S 175,100 $ 219,600 $ 32.145.00 32% $ 175, 100 $ 91,850 $ 114,100 $ 16,072.50 32% $ 91,850 $ 219,600 $ 533,800 $ 46,385.00 35% $ 219,600 $ 114,100 $ 271,200 $ 23,192.50 35% $ 114,100 $ 533,800 $ 156,355.00 37% $ 533,800 $ 271,200 $ 78.177.50 37% $ 271,200