Answered step by step

Verified Expert Solution

Question

1 Approved Answer

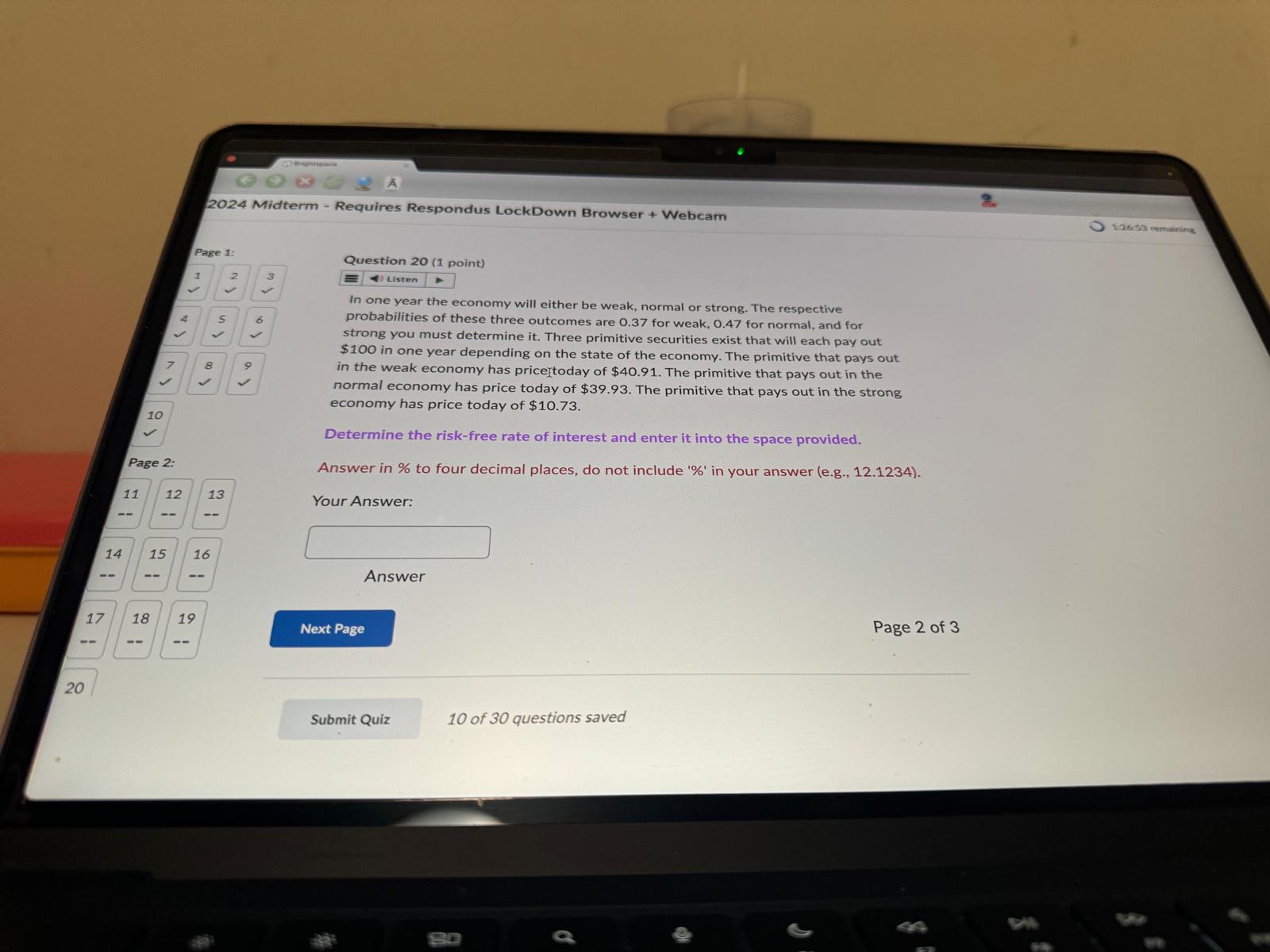

n one year the economy will either be weak, normal or strong. The respective probabilities of these three outcomes are 0 . 3 7 for

n one year the economy will either be weak, normal or strong. The respective probabilities of these three outcomes are for weak, for normal, and for strong you must determine it Three primitive securities exist that will each pay out $ in one year depending on the state of the economy. The primitive that pays out in the weak economy has pricetoday of $ The primitive that pays out in the normal economy has price today of $ The primitive that pays out in the strong economy has price today of $

Determine the riskfree rate of interest and enter it into the space provided.

Answer in to four decimal places, do not include in your answer eg

Your Answer:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started